You'll find many of the features you know and love from the Moneyhub app, but with so much more. Project your finances up to 60 years into the future with our powerful cashflow forecasting engine. Track your financial journey with unlimited custom dashboards. Gain clarity with spending trends, income and expense statements, calendar budgeting, net worth reports, and support for multiple currencies.

With PocketSmith, you can safely store essential documents like insurance policies, warranties, receipts, and photos. Rest easy, knowing all your household records are accessible when you need them.

We’re a team of hardworking people who are committed to looking after all Moneyhub users. Come try us out and take your money journey to the next level!

Our dedicated Moneyhub importer helps you make the switch with ease. Seamlessly transfer data from your accounts, transactions, budgets and categories, and set it up in PocketSmith within minutes.

We've partnered with data provider Salt Edge to connect you with PSD2-compliant open banking feeds for all major institutions across England, Scotland, Wales, Northern Ireland and the EU.

Some free personal finance apps in the UK advertise to you, making you their product. The PocketSmith experience is about you and your money. You will not be sold other products along the way.

Since 2008, we've been working on creating the world's best personal finance tool. We pride ourselves on constant improvement and iteration. You won't see any stagnation around here. Check out our product history.

We're highly responsive and care about helping you be in control of your money. If you need a little help or just want to learn more, please get in touch — we’ll get right back to you.

PocketSmith is privately owned and funded only by customer subscriptions so you are the centre of our world. PocketSmith is stable, profitable and here to stay. Here’s a bit more about us.

“I have far more insight with in-depth reports than I did with MoneyHub, and I personally find it much more intuitive when managing transactions, categories, assets, etc. I've barely touched the surface, really.” Read more reviews.

Only financial tool I've come across in the past four years that gives you the ability to accurately forecast your accounts in a way that makes sense: graph, calendar and cash flow views in any scenario.

Austen Haines

USA

I've been using PocketSmith properly for over a year now and must say it has been an absolutely FANTASTIC tool for taking control of my finances and getting a better awareness of my money.

Teddy Dereje

New Zealand

PocketSmith has all the features you adored in Moneyhub, but it also takes your financial planning to new heights.

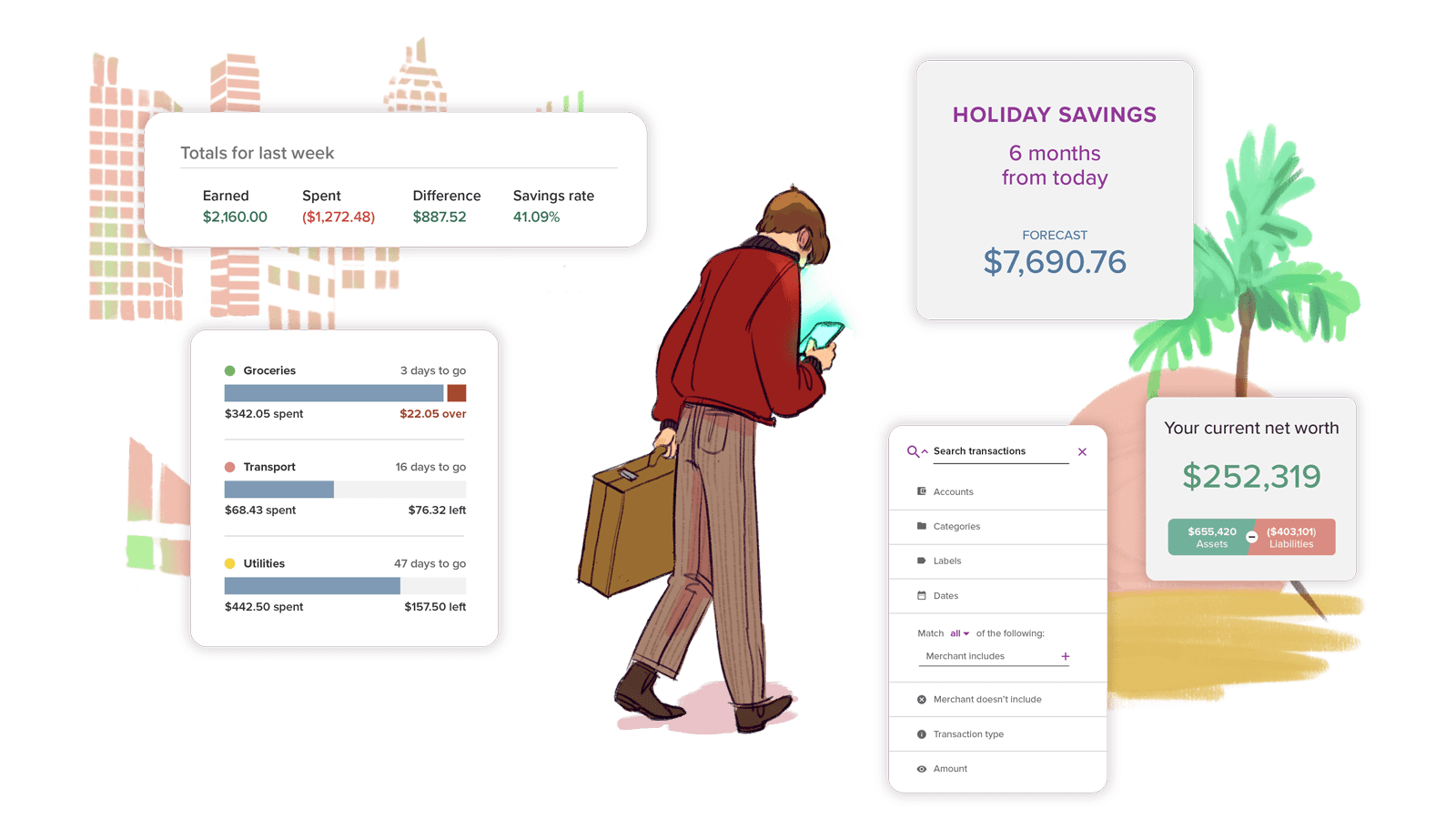

Visualisation: Craft custom dashboards tailored to your financial journey, from versatile graphs to calendar-based planning. See the insights that matter to you and block out the noise.

Reporting: Get a snapshot of your finances with your personal income and expense statement. Keep track of your net worth, and monitor international accounts with real-time currency conversions.

Transactions: Organise transactions intuitively, with custom nestable categories, labels, notes and attachments. Finding and filtering have never been easier with the Transactions page's super powerful Search bar.

Budgeting: Exercise the control you want with flexible budgeting periods and activating rollover budgeting. Share your journey with a family member or financial advisor with Advisor Access.

PocketSmith has been an innovator in the fintech world since 2008 and is still proudly independent and self-funded. Our only source of revenue is our customer subscriptions, and we are a stable, profitable company with no investors telling us what to do — our customers are at the centre of everything we do.

At PocketSmith, we make money from your subscription, not your data. We will never sell your data or advertise to you.

How do I transfer my data from Moneyhub to PocketSmith?

Transferring your Moneyhub data to PocketSmith is straightforward. First, export your data from Moneyhub (unless you want to start afresh). Then, in PocketSmith, use our dedicated importer to upload and seamlessly integrate your financial data. Choose ‘Move from another app’ then select ‘Moneyhub’.

What sets PocketSmith apart as the best alternative to Moneyhub?

Don’t take it from us, hear what our lovely user community has to say. See how diverse households around the world use PocketSmith to get financial peace of mind. From self-employed expat mental health nurse Nicole, who uses PocketSmith to conquer her taxes, to London-based Kevin, who uses our app to track his everyday expenses and pay off his debts, and to Jimmy, a Kiwi who fast-tracked his way to a house deposit with PocketSmith.

What banks are supported by PocketSmith compared to Moneyhub?

PocketSmith provides extensive support for banks globally, covering major financial institutions in the UK, EU and beyond. While Moneyhub focused primarily on UK banks, PocketSmith's reach is broader, catering to international users. Check out our complete list of supported banks to see if your specific bank is included.

What other tools and features does PocketSmith offer that Moneyhub doesn't?

While Moneyhub provides a comprehensive view of your finances, PocketSmith takes it a step further with a suite of advanced features.

Here are a few examples:

Cash Flow Forecasting up to 60 Years: You can plan for big life changes, retirement, home ownership, or anything else and instantly see how decisions today affect your financial future.

Flexible Budgeting: Choose from various budget periods, from daily to annually, and even use rollover budgeting for an envelope system approach.

Multi-Currency Support: Monitor international accounts with live currency conversions.

Net Worth Tracking: See all your assets and liabilities in one place to monitor your overall wealth.

Advanced Transaction Tools: Beyond simple categorisation, use custom labels, notes, attachments, and even set up smart rules for future transactions.

Why doesn’t PocketSmith offer a trial?

We prioritise our customers' needs and the sustainability of PocketSmith. With the significant costs associated with bank feeds, our resources are dedicated to supporting our paying users. Rather than courting potential users with short-term trials, we concentrate on delivering consistent value to our committed user base. This approach ensures the longevity and quality of our services.

Is PocketSmith a blend of web and mobile applications?

Absolutely! PocketSmith is primarily cloud-based desktop household financial software complemented by a mobile companion app. Our iOS and Android versions ensure your financial insights are always a tap away.

Can I share PocketSmith with my financial advisor or family member?

Yes, PocketSmith has a shared access feature where you can choose to share access to your PocketSmith account with a trusted partner, financial advisor, or other financial services of your choice, such as a mortgage broker.

Offer available exclusively to new PocketSmith users.

Money Under 30 | Advice On Credit Cards, Investing, Student Loans, Mortgages & More