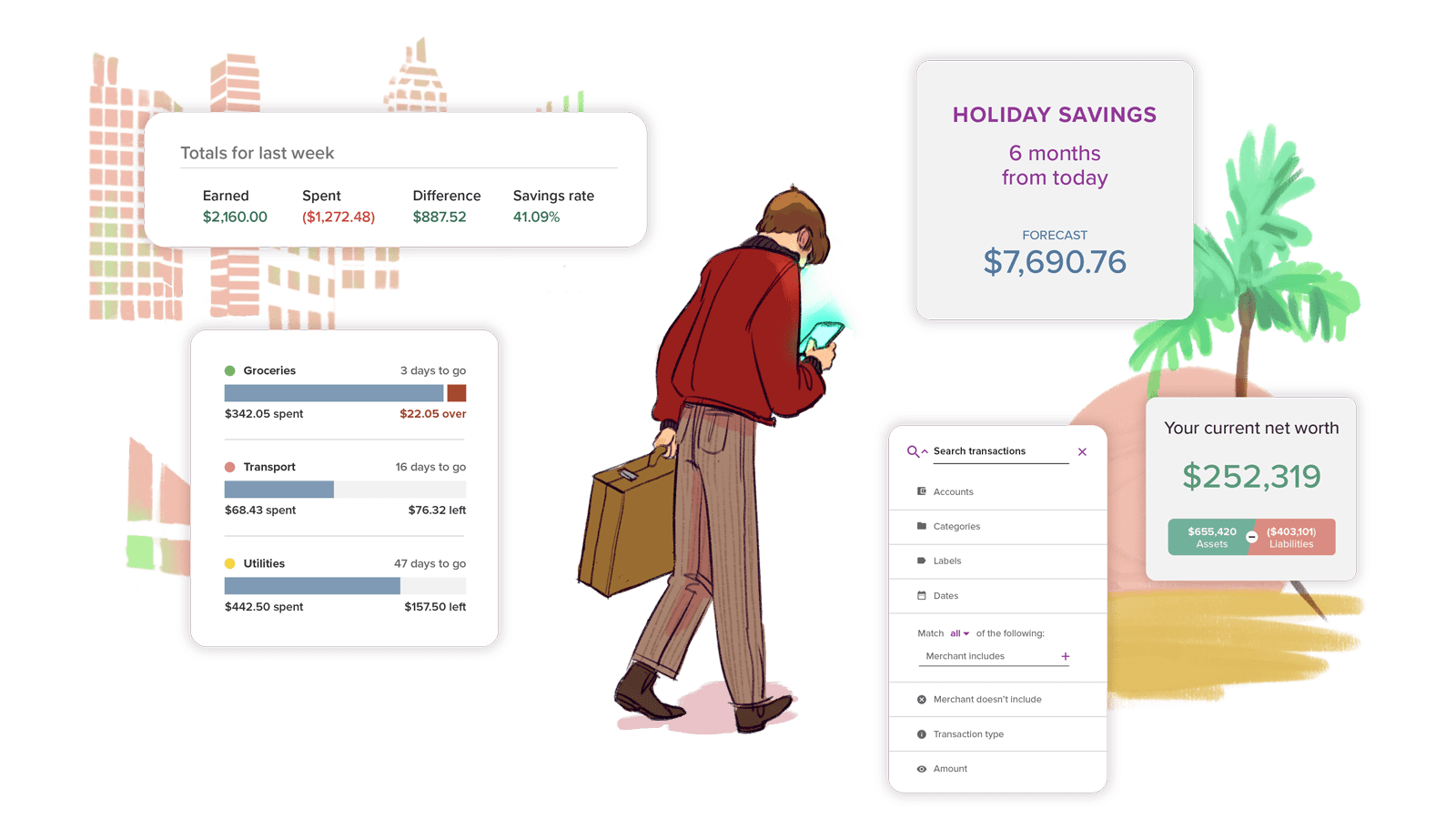

PocketSmith offers unparalleled flexibility with multiple custom dashboards and reporting options. Get the insights you want with spending trends, income and expense statements, calendar budgeting, net worth tracking, and multi-currency support.

Record your finances just the way you want and plan for the future up to 30 years ahead with our powerful cashflow forecasting engine.

You can even store important files like insurance documents, warranties, receipts and photos in PocketSmith, and have peace of mind knowing you have a copy of all your household administration in one place when you need it.

PocketSmith is not just the best of all the YNAB alternatives, it's an upgrade!

Our dedicated importer for YNAB transactions makes PocketSmith your easy YNAB replacement. You'll soon see your financial future in a completely new light.

PocketSmith has the best forecasting features of all the YNAB alternatives in the market. See your future in a detailed report of your choice or on any given day in your budget calendar.

Weekly groceries, biweekly paychecks, quarterly bills. Tuesday to Tuesday, or every 15th. You can also apply rollover budgeting to some categories but not others. We know that You Need a flexible Budget!

We're highly responsive and care about getting you in control of your money. If you need a little help or just want to learn more, please get in touch - we’ll get right back to you.

We’re a diverse and enthusiastic crew of makers in New Zealand serving a global userbase in 191 countries. Here’s a bit more about us and our values.

Your data is safe with us. It's encrypted in transit and at rest, and you're not required to share personally-identifying information with us. Read more about our security practices.

Everything you love about YNAB, plus all of the things you’ve wished it could do.

| YNAB | PocketSmith | |

|---|---|---|

| Bank account aggregation | ||

| Multi-currency (currency for each account) | ||

| Currency conversion | ||

| View sets of accounts together | ||

| Bank feeds | ||

| Connect to banks outside North America | ||

| Auto-categorization | ||

| Auto-categorization can be turned off | ||

| Mortgage, loan and investment accounts | ||

| Transaction management | ||

| Notes | ||

| Labels and tagging | ||

| Attach images and files | ||

| File imports (CSV, OFX, QIF, QFX) | ||

| Saved searches | ||

| Multi-criteria rules (by merchant, partial text match, amount, date, and more) | ||

| Reporting | ||

| Customizable dashboards | ||

| Historical spending trends | ||

| Income and Expense (P&L) statement | ||

| Cashflow statement | ||

| Daily projected future balances | ||

| Customizable date ranges | ||

| Categorize and track spending | ||

| Split expenses into different categories | ||

| Customisable main and sub-categories | ||

| Roll-up (overall) reporting | ||

| Budgeting | ||

| Rollover budgeting | ||

| Flexible budgets (e.g. daily, weekly, quarterly, yearly) | ||

| Budget on a calendar | ||

| Schedule future budgets | ||

| Daily historic and future closing balances | ||

| What-if scenario modelling. Test your budget's future outcomes! | ||

| Forecasting | ||

| Cashflow projection | ||

| Daily projected future bank balances | ||

| What-if scenario modelling | ||

| Net worth | ||

| Track assets and liabilities | ||

| Automatically updated by feed accounts | ||

| Multiple loan accounts for an asset | ||

| Send expenses to Xero | ||

| Cash flow reporting | ||

| Calendar | ||

| Schedule future budgets | ||

| Daily historic and future closing balances | ||

| Platforms | ||

| iOS | ||

| Android | ||

| Web | ||

| Linux | ||

| macOS | ||

| Windows | ||

| Security | ||

| Two-factor authentication (2FA) | ||

| Advisor Access | ||

| Better personalization |

I was a YNAB user for almost 3 years. It was a cool budgeting tool but trying to get a snapshot of my family’s overall financial situation was not very intuitive! Fortunately, I found PocketSmith. Its easy-to-use financial dashboard gave me all the info I needed for my family’s finances. I could finally have fun doing my family accounts!

Sam Harith, The Comic Accountant, New Zealand

PocketSmith is the only product that forecasts each and any of your daily account balances up to 30 years into the future. We designed this feature to give you the clearest foresight into your finances, so you can plan in comfort and know the future impact of your current decisions. It is the fun alternative to YNAB.

PocketSmith gives you the ability to customize your reports in multiple ways so you don’t miss important information. Some of the unique features you will only find here are multiple dashboards and custom widgets for financial metrics important to you, saved searches for frequently sought-after transactions, and an Income and Expense report with customizable categories. Our transaction search engine is also the best in the market, hands-down.

PocketSmith has been an innovator in the fintech world since 2008 and is still proudly independent and self-funded. Our only source of revenue is our customer subscriptions, and we are a stable, profitable company with no investors telling us what to do - our customers are at the center of everything we do.

At PocketSmith, we make money from your subscription, not your data. We will never sell your data or advertise to you.

I'm looking for apps like YNAB, how does PocketSmith compare?

PocketSmith offers next level features compared to apps like YNAB. You can check out the feature comparison table above on this page to see why PocketSmith stands out as the best alternatives to YNAB. Of all the possible YNAB alternatives, you will not find one more comprehensive than PocketSmith.

Is PocketSmith the best free alternative to YNAB?

PocketSmith has a free plan that is an excellent alternative to YNAB. To compare the features of our free plan versus our paid plans, have a look at our plans page. Or, you can take advantage of the 50% off deal below to enjoy the full features that PocketSmith has to offer.

Is it worth considering an open source YNAB alternative?

We can totally understand that you would be interested in a community-developed open-source alternative to YNAB, such as GnuCash, for example. While there may be some benefits to trying open-source alternatives to YNAB you should check out the community that looks after PocketSmith. We are a fun-loving bunch of creatives committed to developing top-notch, stable and secure budgeting software to help you manage your money. Unlike open-source alternatives to YNAB, we are here to help when you need us.

What is the best YNAB alternative in Australia?

Look no further! PocketSmith is the best alternative to YNAB in Australia. PocketSmith is fully open banking ready in Australia, we’ve partnered with Australian CDR data provider Basiq to give you open banking access. This means you’ll get access to open banking feeds for all banks in Australia as they come online, and reliable traditional feeds in the interim. Pocketsmith has all the features to help you take your finances to the next level.

I am looking for a YNAB alternative in Europe.

PocketSmith is available worldwide and supports bank feeds to most financial institutions in Europe via Salt Edge, our EU open banking provider, you can search for your bank below.

What is the best YNAB alternative in the UK?

Look no further! PocketSmith is the best alternative to YNAB in the UK. PocketSmith is Connected to open banking via Salt Edge, our UK open banking provider. Pocketsmith has all the features to help you take your finances to the next level.

What is the best YNAB alternative in the United States of America?

PocketSmith offers a flexible and comprehensive budgeting solution that sets us apart as a great alternative to YNAB (You Need A Budget) in the United States. Unlike YNAB's rigid "Every Dollar Has a Job" philosophy, we provide a more customizable approach to financial planning, allowing you to forecast your finances up to 30 years. It also supports multiple currencies and international bank accounts, making it ideal for those with more complex financial situations. You will also love our intuitive calendar feature, which offers a visually engaging way to track income, expenses, and financial goals over time. PocketSmith connects securely to most major banks worldwide with open banking data feeds where available. You can search for your bank below.

Is PocketSmith here to stay?

Yes, PocketSmith is a stable and profitable company, we are only funded by customer subscriptions and have no investors telling us what to do. The customer experience and user privacy is at the center of all our endeavors, we will never sell your data or advertise to you.

Does PocketSmith connect to all YNAB supported banks?

PocketSmith connects securely to most major banks worldwide with open banking data feeds where available. You can search for your bank below.

YNAB vs PocketSmith - how do they stack up?

You can check out the YNAB versus PocketSmith feature comparison table above but you should also know that we are dedicated to continuously developing next-level software to give you the insights you need to plan your future. Additionally you will enjoy our top-rated team of Customer Support champions who will help you out if you get stuck.

PocketSmith is the only product that forecasts each and any of your daily account balances up to 30 years into the future. We have many more value-adds that we’re proud to say are unique to our product, and that are loved by our global userbase. PocketSmith has the features to grow alongside you as you get smarter about your money. PocketSmith is your YNAB upgrade. Take the Tour to explore more.

Do I have to use bank feeds with PocketSmith?

If you prefer not to use automatic bank feeds, you can use our convenient bank file uploader. PocketSmith supports the following file types: OFX, QFX, QIF, and CSV. Export your bank files from your online banking website, then import them straight into PocketSmith! Read our guide to importing bank files.

Can I share PocketSmith with a trusted partner or advisor?

Yes, PocketSmith has a shared access feature where you can choose to share access to your PocketSmith account with a trusted partner, financial advisor, or other financial services of your choice, such as a mortgage broker.

What makes PocketSmith the best budgeting software?

Don’t take it from us, hear what our lovely user community has to say. See how a diverse group of poeple use PocketSmith to supercharge their financial productivity. From keen investor Shay, who tracks his expenses and net worth with PocketSmith, to Sydney-based Daniel, who uses our app to run his busy household of four and manage his investment properties and accounts, and expat Oliver, who consolidates his Australian and UK banking accounts with PocketSmith!

Is PocketSmith a web app, mobile app or both?

Both! PocketSmith can be used at your desk or on your phone so you can manage your money wherever you are! PocketSmith is cloud-based desktop personal finance software with a mobile companion app. Our iOS and Android budgeting app is designed to provide you with the key elements of PocketSmith right there in your pocket. So you can achieve your money goals while you do what you do best — live your life!

What is PocketSmith?

PocketSmith is world-class personal finance software that lets you manage your money, your way. Track your income, expenses, assets and net worth, customize your budgets, forecast your cashflow up to 30 years into the future, and see it all in a nifty calendar view.

Money Under 30 | Advice On Credit Cards, Investing, Student Loans, Mortgages & More