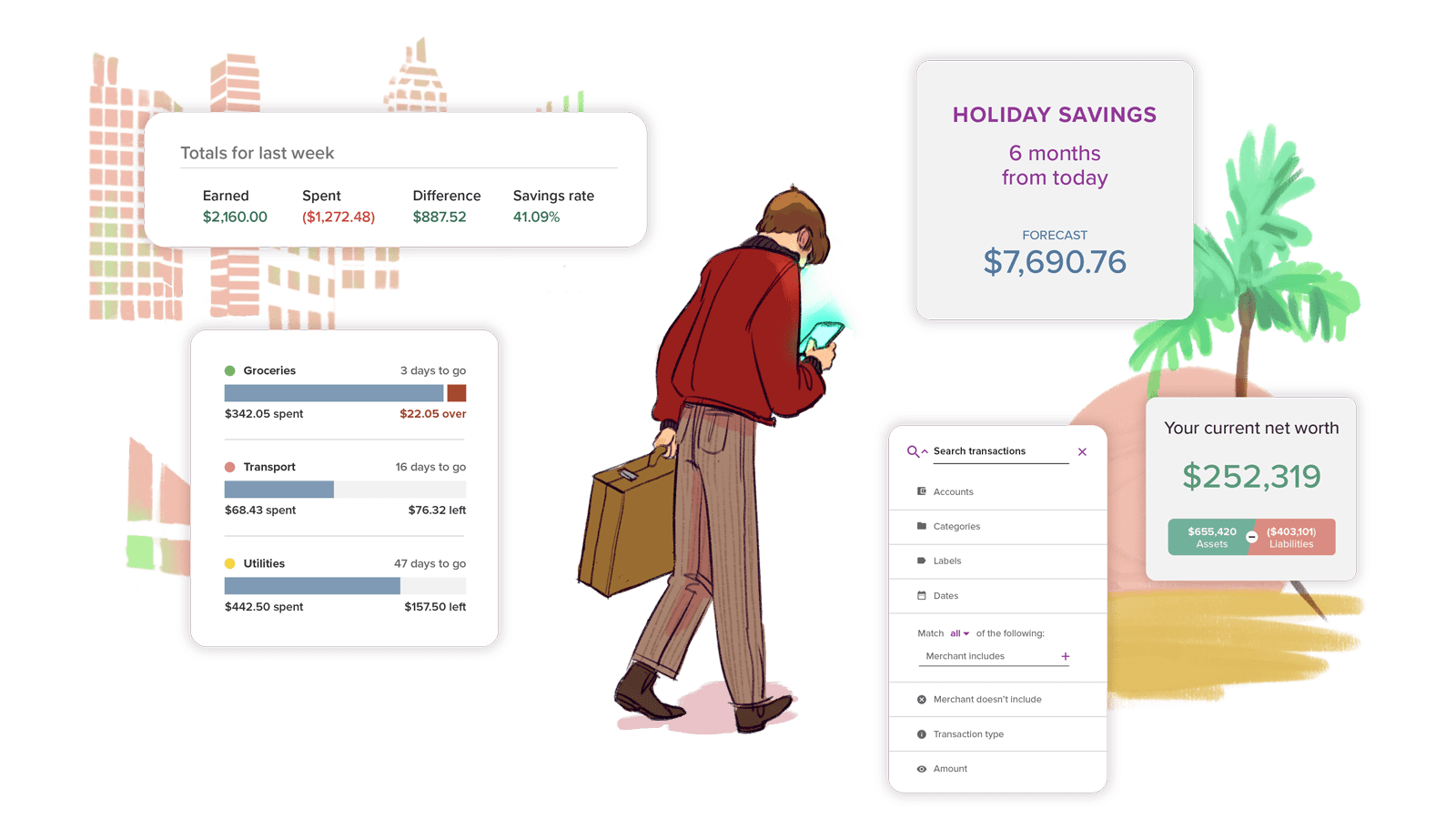

You'll find many of the features you know and love from the Money Dashboard app, but with so much more. Project your finances up to 60 years into the future with our powerful cashflow forecasting engine. Track your financial journey with unlimited custom dashboards. Gain clarity with spending trends, income and expense statements, calendar budgeting, net worth reports, and support for multiple currencies.

Safely store essential documents like insurance policies, warranties, receipts, and photos with PocketSmith. Rest easy, knowing all your household records are accessible when you need them.

We’re a team of hardworking people who are committed to looking after all Money Dashboard users. Come try us out and take your money journey to the next level!

Our dedicated Money Dashboard importer helps you make the switch with ease. Seamlessly transfer data from your accounts, transactions, budgets and categories, and set it up in PocketSmith within minutes.

PocketSmith is privately owned and funded only by customer subscriptions so you are the centre of our world. PocketSmith is stable, profitable and here to stay. Here’s a bit more about us.

We're highly responsive and care about helping you be in control of your money. If you need a little help or just want to learn more, please get in touch — we’ll get right back to you.

We've partnered with data provider Salt Edge to connect you with PSD2-compliant open banking feeds for all major institutions across England, Scotland, Wales, Northern Ireland and the EU.

Since 2008, we've been working on creating the world's best personal finance tool. We pride ourselves on constant improvement and iteration. You won't see any stagnation around here. Check out our product history.

Some free personal finance apps in the UK advertise to you, making you their product. The PocketSmith experience is about you and your money, you will not be sold other products along the way.

“I can do everything on PocketSmith and no longer need to use spreadsheets. Just takes five minutes a day.” Read more reviews.

PocketSmith has all the features you adored in Money Dashboard, but it also takes your financial planning to new heights.

Visualisation: Craft custom dashboards tailored to your financial journey, from versatile graphs to calendar-based planning. See the insights that matter to you and block out the noise.

Reporting: Get a snapshot of your finances with your personal income and expense statement. Keep track of your net worth, and monitor international accounts with real-time currency conversions.

Transactions: Organise transactions intuitively, with custom nestable categories, labels, notes and attachments. Finding and filtering have never been easier with the Transactions page's super powerful Search bar.

Budgeting: Exercise the control you want with flexible budgeting periods and activating rollover budgeting. Share your journey with a family member or financial advisor with Advisor Access.

PocketSmith has been an innovator in the fintech world since 2008 and is still proudly independent and self-funded. Our only source of revenue is our customer subscriptions, and we are a stable, profitable company with no investors telling us what to do — our customers are at the centre of everything we do.

At PocketSmith, we make money from your subscription, not your data. We will never sell your data or advertise to you.

Free apps like Money Dashboard have made the user their product, selling real-time information to their market research clients. That doesn't vibe with our values — our users' data is sacred to us.

How do I transfer my data from Money Dashboard to PocketSmith?

Transferring your Money Dashboard data to PocketSmith is straightforward. First, export your data from Money Dashboard. Then, in PocketSmith, use our dedicated importer to upload and seamlessly integrate your financial data. Our step-by-step guide in our Learn Center provides detailed instructions to ensure a smooth transition.

What banks are supported by PocketSmith compared to Money Dashboard?

PocketSmith provides extensive support for banks globally, covering major financial institutions in the UK, EU and beyond. While Money Dashboard focused primarily on UK banks, PocketSmith's reach is broader, catering to international users. Check out our complete list of supported banks to see if your specific bank is included.

What sets PocketSmith apart as the best alternative to Money Dashboard?

Don’t take it from us, hear what our lovely user community has to say. See how diverse households around the world use PocketSmith to get financial peace of mind. From self-employed expat mental health nurse Nicole, who uses PocketSmith to conquer her taxes, to London-based Kevin, who uses our app to track his everyday expenses and pay off his debts, and to Jimmy, a Kiwi who fast-tracked his way to a house deposit with PocketSmith.

How does Money Dashboard vs PocketSmith stack up?

PocketSmith has all the functionality, plus so much more, compared to apps like Money Dashboard or any other free expense tracker apps in the UK. Of the Money Dashboard alternatives in the UK, you won’t find one more comprehensive than PocketSmith. Take the Tour to explore.

Can I share PocketSmith with my financial advisor or family member?

Yes, PocketSmith has a shared access feature where you can choose to share access to your PocketSmith account with a trusted partner, financial advisor, or other financial services of your choice, such as a mortgage broker.

Is PocketSmith a blend of web and mobile applications?

Absolutely! PocketSmith primarily is a cloud-based desktop household financial software, complemented by a mobile companion app. Our iOS and Android versions ensure your financial insights are always a tap away.

Are there any fees associated with using PocketSmith, unlike the free Money Dashboard?

Yes, while PocketSmith offers a free plan, our premium features have a cost. These fees support an ad-free experience and ensure we don't sell user data. By choosing our premium plans, you unlock automatic open-banking sanctioned feeds, as well as advanced financial tools. Read more about our plans and pricing.

Why don't you offer a trial?

We prioritise our customers' needs and the sustainability of PocketSmith. With the significant costs associated with bank feeds, our resources are dedicated to supporting our paying users. Rather than courting potential users with short-term trials, we concentrate on delivering consistent value to our committed user base. This approach ensures the longevity and quality of our services.

What other tools and features does PocketSmith offer that Money Dashboard doesn't?

While Money Dashboard provides a comprehensive view of your finances, PocketSmith takes it a step further with a suite of advanced features:

These features, along with PocketSmith's commitment to user privacy and focus on user-centric design, make it one of the best alternatives to Money Dashboard.

Money Under 30 | Advice On Credit Cards, Investing, Student Loans, Mortgages & More