When you're self-employed, your finances do double duty. You need proper reporting for your business and clear visibility for your household. Accounting software covers the compliance side. PocketSmith helps you plan, forecast and stay in control of real life. Used together, they make a powerful pair.

Money tips

Money tips

The end of the financial year can feel like an arduous and admin-heavy time, especially if you earn secondary income through something like a side hustle or investment portfolio. Follow Emma’s checklist to get your finances ready for the end of the fiscal year and keep the tax man happy.

Money tips

Money tips

Oh to be young and have the freedom of your entire life ahead of you. But you aren’t a teenager anymore and it could be the right time to start thinking about your future finances — how do you want to spend your retirement? Lavishly or pinching pennies? Starting early can put you on the right path.

Money tips

Money tips

From YouTube to TikTok, young people have never been exposed to as much financial information as they are now. But with more teens gaining interest in a subject as nuanced as investing, it’s important that they’re equipped to confidently make the most of it. We’re sharing how the next generation can develop a strong foundation to start their investing journey.

Product feature

Product feature

Recent changes to the CCCFA legislation in New Zealand have made borrowing more difficult, and it mirrors a tightening of the mortgage market worldwide. See how you can use PocketSmith’s tools to reduce the stress and increase the success of your mortgage application.

Money tips

Money tips

It seems like every other day that you see a headline about some company pledging to go net-zero emissions by 2050. The primary method they use is carbon offsetting. You might have even purchased carbon offsets yourself. But what are they, and are they actually a viable solution for solving our emission problems?

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Sam crunches the numbers of his family’s finances with PocketSmith’s powerful reporting and helpful visualization features.

Money tips

Money tips

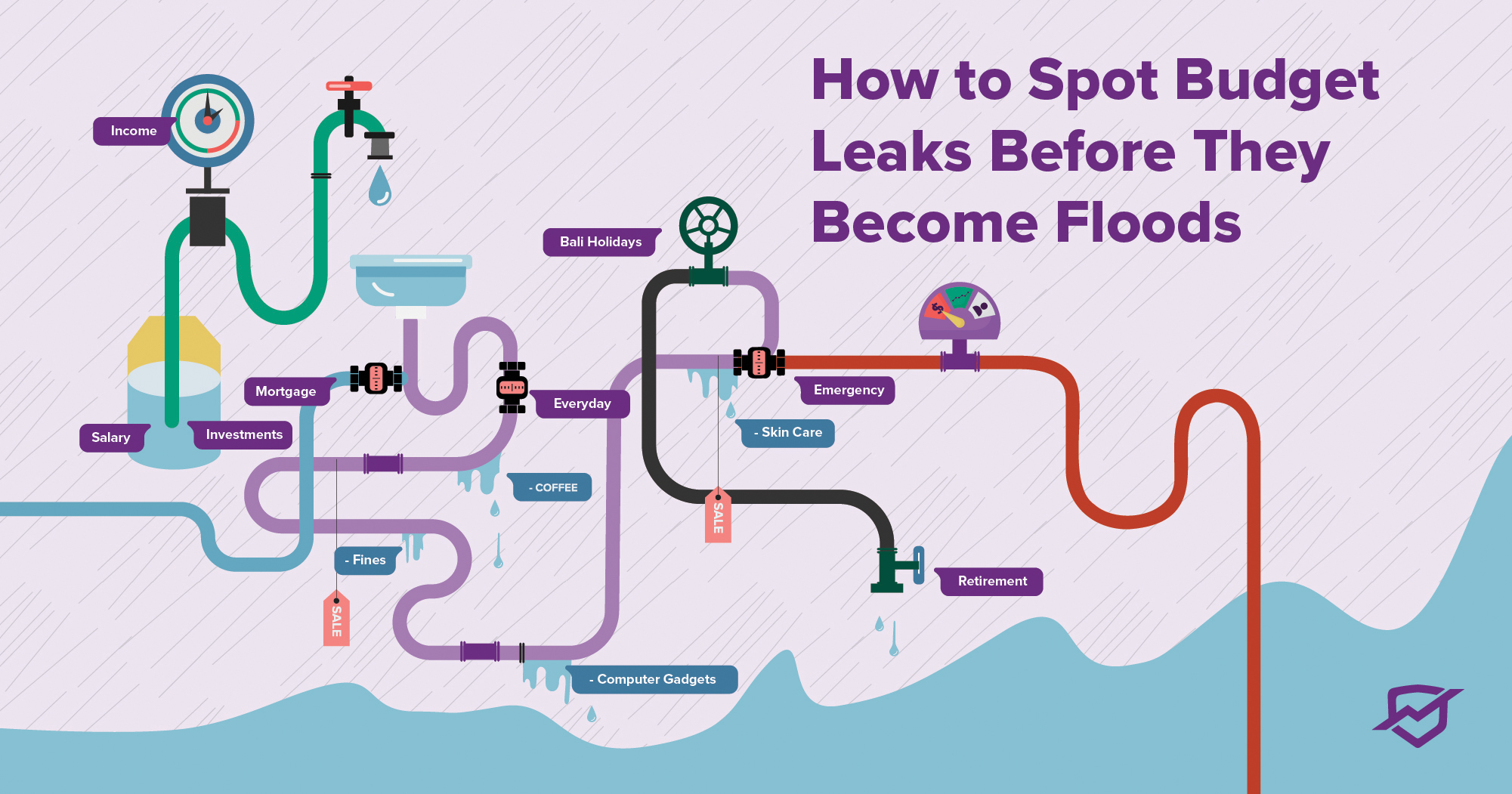

Mind the leak! It’s pretty normal to experience hairline cracks in your budget from the day-to-day stresses of life, but it’s important to keep them in check. Emma shares how you can spot those leaks and plug them up before they become an absolute deluge.

Money tips

Money tips

Side hustles aren’t just a hobby, they’re a job and they can make an excellent addition to your resume for demonstrating your skills to further your career. Hiration co-founder Aditya Sharma shares how you can add your side hustles to your CV and put your expertise on full display.

Money tips

Money tips

Whether it’s due to economic uncertainty or self-imposed for movements like the Great Resignation, the average worker will experience unemployment at least once or twice. Ruth The Happy Saver reminisces about her own experiences with unemployment, and shares what you can do during this period to keep moving forward to your next stage in life.

Money tips

Money tips

In late 2021, the NZ government introduced legislative changes aimed at protecting Kiwis from high-cost loans and unaffordable debt. One unintended result is that banks now closely scrutinize your spending habits when you apply for finance. Mortgage Lab CEO Rupert Gough explains how using PocketSmith to track your expenses can make all the difference to your application.

Money tips

Money tips

Many people get calls regarding the debt they don’t own, but you’ve got some tools up your sleeve to dispute your debt and deal with such creditors. Lyle Solomon from Oak View Law Group breaks down the recourse available to our friends in the USA if you’re being hounded by pushy debt collectors.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Tara uses PocketSmith to track her spending and stay accountable to her budget to meet her savings goals!

Money tips

Money tips

So your account has been hacked or there’s been suspicious transactions in your bank account — now what? In the final part of our fraud series, Emma from The Broke Generation shares the steps you can take if you ever fall victim to a scam so your money stays intact.

Company

Company

As the sun rose on a brand new year, co-founder and CEO Jason found himself ruminating on the ‘what’, ‘when’ and ‘how’ of 2021. As for the ‘why’? That’s going to be PocketSmith’s focus for the year ahead, and it can be yours too. Read on for Jason’s thoughts about approaching your ‘why’ with intent to help you reach your goals.

Money tips

Money tips

As the saying goes, “tidy house, tidy mind”. Keeping a tidy wallet can have a similar effect on your well-being. But it can be easier said than done keeping something as complex as your finances organized and effective. Ruth The Happy Saver channels her inner Marie Kondo and shares how she’s decluttered her financial life.

Money tips

Money tips

“The real voyage of discovery consists not in seeking new lands but in seeing with new eyes.” In the spirit of Proustian self-discovery, Head of Marketing Dora asked her 13-year-old son, Jordan, to pen some observations about common ways he thinks adults waste money. What she received was surprisingly pragmatic insight with a few truth bombs thrown in! Read on to see what he had to say.

Money tips

Money tips

Goodbye 2021, hello 2022. After another year of ups and downs, a new year offers the opportunity to reset and reboot. If you want to leave questionable spending habits and bygone goals in the past, now’s the perfect chance. Emma from The Broke Generation shares the actions you can take to make sure you start off this year on the right financial footing.

Money tips

Money tips

As a part-time employee with her own blog and podcast side business, Ruth Henderson has a more complex tax-life than the average person. That said, she decided from the outset to manage her freelance income the same way she runs her household finances: simply and fuss-free! Read on to see how she organizes her taxes.

Company

Company

It’s that time of year to look back on the past 12 months and ruminate on all of your choices made. We asked some of the PocketSmith team to do just that and reveal their purchases of delight and disappointment in 2021. From video games, mops, stock and new beds, it’s been quite the year of retail therapy!

Money tips

Money tips

Amidst fancy hors d'oeuvres and a chorus of ‘new year, new me’, a celebration of glitz and glamoring could have you clamoring to save your bank account in the morning. Emma Edwards shares her best tips for making sure you keep your budget intact over the new year period — because New Year’s Eve is one night, but financial confidence is forever!

Product feature

Product feature

While reflecting on the changes released during 2021, we ended up striking upon a couple of new features that will make a lot of users' lives easier. Read on for details on how you can now perform math operations in key number fields in the application, and also filter through your financial events in the Calendar. But first, a quick recap.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Wellingtonian couple Renee and Jamie use PocketSmith to track their finances and identify their money leakages!

Money tips

Money tips

Christmas is mere days, minutes, seconds away. If your gift list is looking woefully empty this close to December 25th, fear not! The Broke Generation’s Emma has been a helpful little elf for us and gathered up some easy, low-cost options for last minute Christmas presents. You’ve still got time, so get cracking!

Money tips

Money tips

Do you have a secure password? And are your devices secure? There are plenty of actions you can take to ensure your money and related data are protected. In the second part of our fraud series, Emma from The Broke Generation shares ten ways you can defend yourself from would-be hackers and scammers.