Traffic lights are pretty simple, right? Green for go, orange means slow, and if it’s red you’d better Stop Right Now. It’s not a hard system to understand — which is why I use an adapted version for my finances.

A year ago, I was using a boring but adequate spreadsheet for my budgeting. Problem was, it wasn’t doing the one thing I really wanted: traffic light color-coding. I had the system in my head, but I couldn’t see it on my screen.

Then I found PocketSmith.

See, I’ve always had variable income year-to-year which means I’ve grown used to trimming or growing my budget accordingly. The system is simple: red for bare-bones essentials, Stop, Do Not Pass Go; orange for investing and giving, Slow And Steady; and the all-important income, Green For Go.

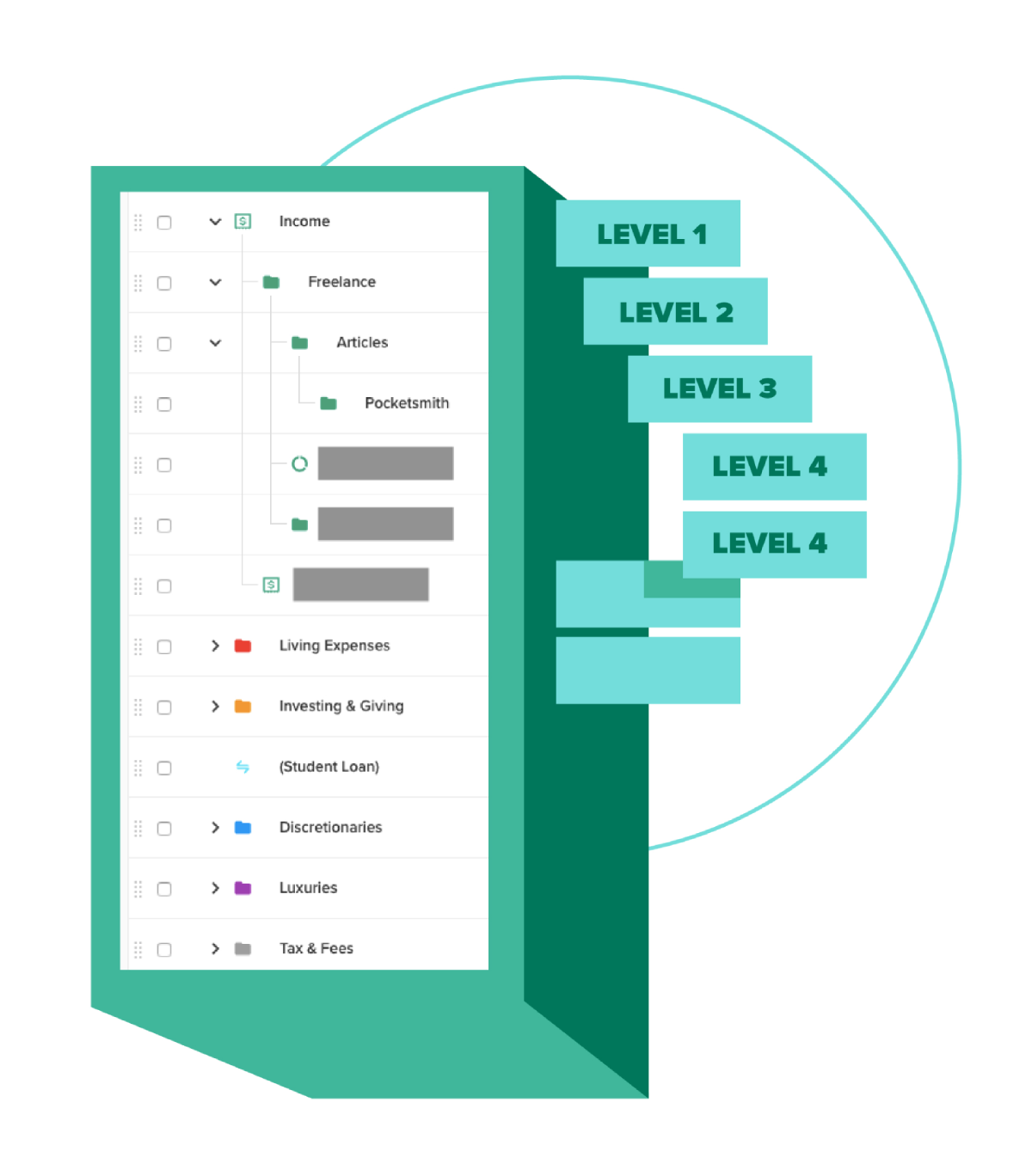

When I was unemployed, I stopped spending and investing, and dropped back to the red category of essential living expenses. When I’m in stable work, I can budget from red through orange to the whole dang rainbow. Nested color-coded categories make it easy to see where my priorities are. If I have a drop in income, it’s easy to pause budgets for all categories in that color.

I start with income because it’s easy. This is what I base all my other colors around. If the light isn’t green, I stop on red. If the light is green, I budget based on how much money is coming in and what my needs are at the time.

Even with a decent income, I try to keep my spending contained, which means the red category sits around the 50% mark of my monthly finances. This is my ‘survival number’ — the minimum I need to keep my head above water. It includes rent, groceries, transport, and utilities, with sub-categories for phone, power, and internet.

I find the Dashboard Donut a fantastic way to see this at a glance.

Ah, orange. This is my slow-growth-for-the-future category.

It’s evolved over the years. Once it was the beginnings of a house deposit stashed in the bank. (Remember when term deposits would give you more than 3% p.a.?)

But who can afford a house, right? Now it’s a bit of that, a bit of Kernel’s index funds, and a steady 10% tithe to give something back to the community.

This is where I branch out from ‘basic traffic light’ to ‘full rainbow’, but only when I have a level of income that lets me.

Light blue is any voluntary debt repayments — not minimum payments, they’d be in red, but over-and-above. For me, it’s my student loan.

The next bite on my donut is discretionary spending. This is anything that isn’t essential but isn’t quite at the level of ‘complete lavish luxury’ either. It looks different for everyone. Think regular haircuts, new shoes, going for coffee with friends… that sort of thing.

To be honest, a dentist appointment might fall under this. But I digress.

This isn’t just any purple. This is PocketSmith Purple, for all your most luxurious, splash-out-y expenses… like your finance app subscription. Or shouting your best friends dinner out at a restaurant. Or splurging on a new houseplant or three (No? Is that just me?) I even have a Regret category here, but that’s another story!

It’s a lesser-priority category, so I make my spending proportionately less. If you look at the Earning and Spending Donut, you’ll notice I put about half into red, then progressively smaller amounts into each of the other categories.

Incidentally, this makes it super easy to tell if my spending is a little out of control one month. The focus should be on the traffic lights. Green, red, orange: income, essentials, slow growth for the future. If purple takes up a full quarter of the donut, then Houston, we have a problem!

The traffic light system might be simple, but simple is good. It cuts down on decision fatigue. It makes slashing expenses during tough times a breeze. And once you’re on your feet again, it opens out into a whole world of brightly-colored possibilities.

Just do me a favor and never run the red light.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).