Updated June 2025

The end of the Australian financial year is fast approaching. For investors, that means getting on top of your investments, understanding your tax liabilities, and identifying the opportunities in your investment situation.

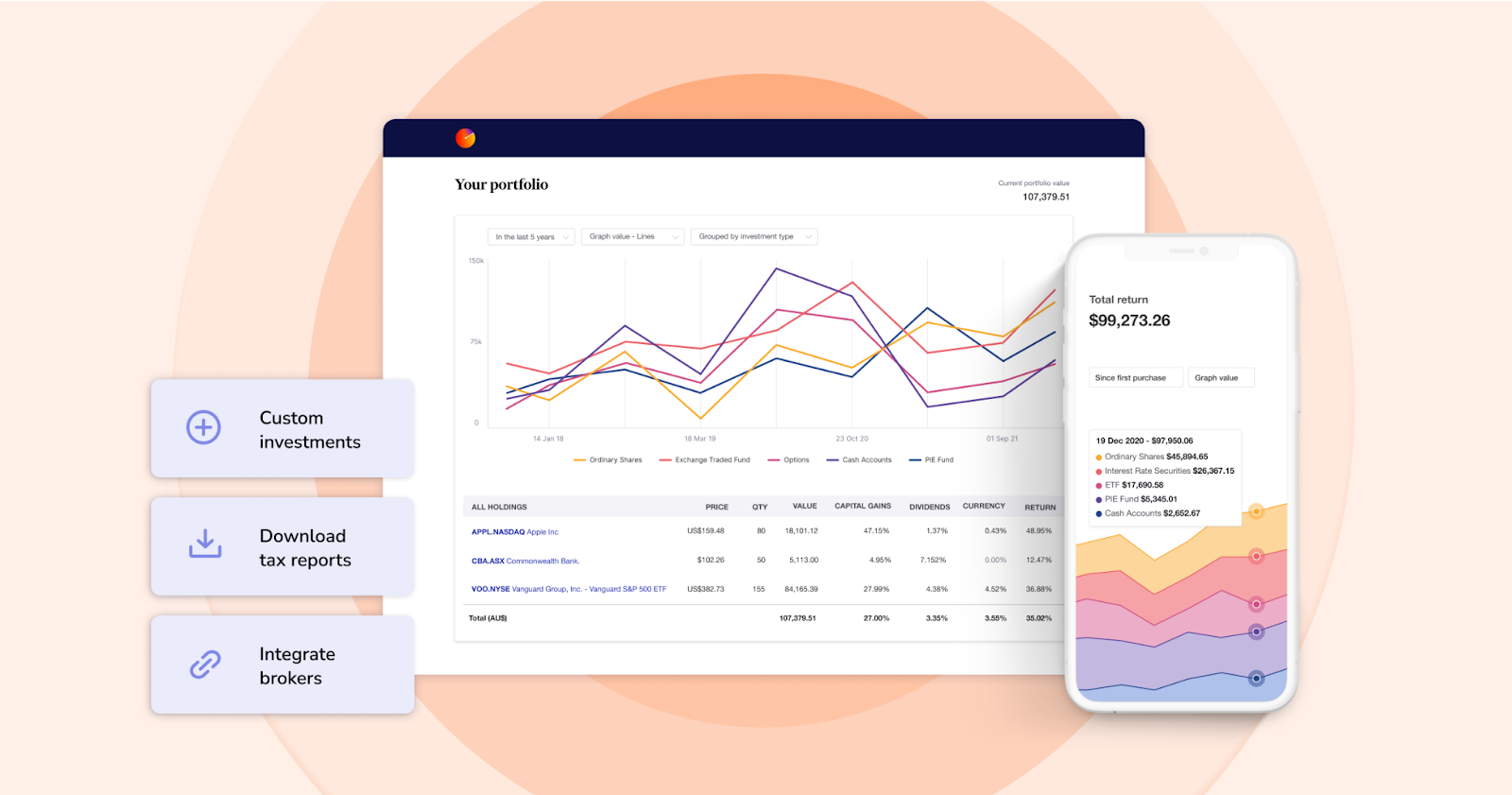

Enter PocketSmith’s Data Connections partner, Sharesight. Sharesight is a global portfolio management software that gives DIY investors all the information they need to prepare for the tax season. From tracking investments in one place to benchmarking your portfolios, learn how Sharesight’s Australian-specific tax features can help you complete your tax return and save you time and money.

Keen to understand more? We’ve rounded-up six Sharesight articles that explain its Australian-specific tax features.

Find out more about Sharesight’s valuable tax reports, all built according to Australian Tax Office (ATO) rules, that can help you save time and money during tax time. Five ways Sharesight helps Australian investors at tax time outlines the key features aimed at Australian investors, including:

Tax loss selling is a strategy that investors can leverage to minimize their net capital gains during a financial year for tax purposes. Tax loss selling for Australian investors demystifies the concept, provides a clear example of how it works, explains how to model tax loss selling opportunities with Sharesight, and how investors can avoid wash sales.

Who doesn’t love a solid checklist? Sharesight has pulled together a handy EOFY checklist for Australian investors to get you ship-shape heading into June. Read on if you want to be a prepared investor and understand the full picture of your investments and make the most of the opportunities it presents this financial year. The checklist covers taking stock of your stocks (and unlisted investments), painting your financial picture, and putting yourself in the best tax position.

If you’re a Self-Managed Super Fund (SMSF) trustee, the end of the financial year is a good time to take stock of your assets and get your records in order for the tax portion of your annual return. Read How SMSF trustees can get EOFY-ready to understand the strict requirements for SMSFs at tax time, and how a portfolio tracking tool like Sharesight can eliminate tedious portfolio admin, and save you time and money. The article covers how Sharesight can help SMSF trustees take stock of their investments, calculate investment income, and prepare annual accounts after the end of the financial year.

Look no further if you need to calculate your CGT. The article Capital Gains Tax Calculator for Australian Investors provides easy-to-follow steps to use the powerful Australian Capital Gains Tax Report to take care of the math so you don’t have to struggle with complex spreadsheets. It also covers how to use the report, which can be run at any time, over any time period, to optimize your tax position.

Last but certainly not least, explore how Sharesight’s Taxable Income Report can help you calculate your investment income and complete your tax return with confidence. Designed to align with ATO requirements, the report breaks down dividends, distributions, and interest income over any selected time period.

Connecting your Sharesight account to PocketSmith means you’ll automatically be able to pull in the total value of all your holdings in Sharesight. This consolidated balance can then be tracked alongside all the other financial information you store in PocketSmith, so you can automatically see your accurate daily net worth figure.

You may already be tracking your bank and credit card accounts, mortgages, personal loans, property, vehicles, and cash assets in PocketSmith. Adding the total value of your Sharesight holdings will give you a truer picture of your exact financial position. And when it comes to charting a path to financial independence, knowing exactly what you own and owe is key.

Read our step-by-step guide for more information on how to add your Sharesight feed to PocketSmith, and other handy tips!

If you’re not already using Sharesight, sign up for a free account so you can get started tracking your performance and tax today. Plus, gain access to a suite of powerful reporting tools designed to give you all the insights you need to make smarter investing decisions.

Bonus: If you are an Australian tax resident and you derive income from the share market, your subscription may be tax-deductible. Check with your accountant.