‘Getting out of debt’ is a phrase used often when it comes to discussing personal finance. It’s something almost all of us will have to deal with at some point, in one form or another. Student loans, credit cards, and mortgages are just some of the more common types of debt. While we all have our unique financial situations, there are still some general guidelines that can be used to help anyone get out of debt.

The first step to getting out of debt is figuring out how much debt you actually have. If you’ve only got one or two debts, like a student loan and a credit card to pay off, this step is easy. Personal finances get harder to track when you have multiple debts on top of that, like car payments or hire purchase.

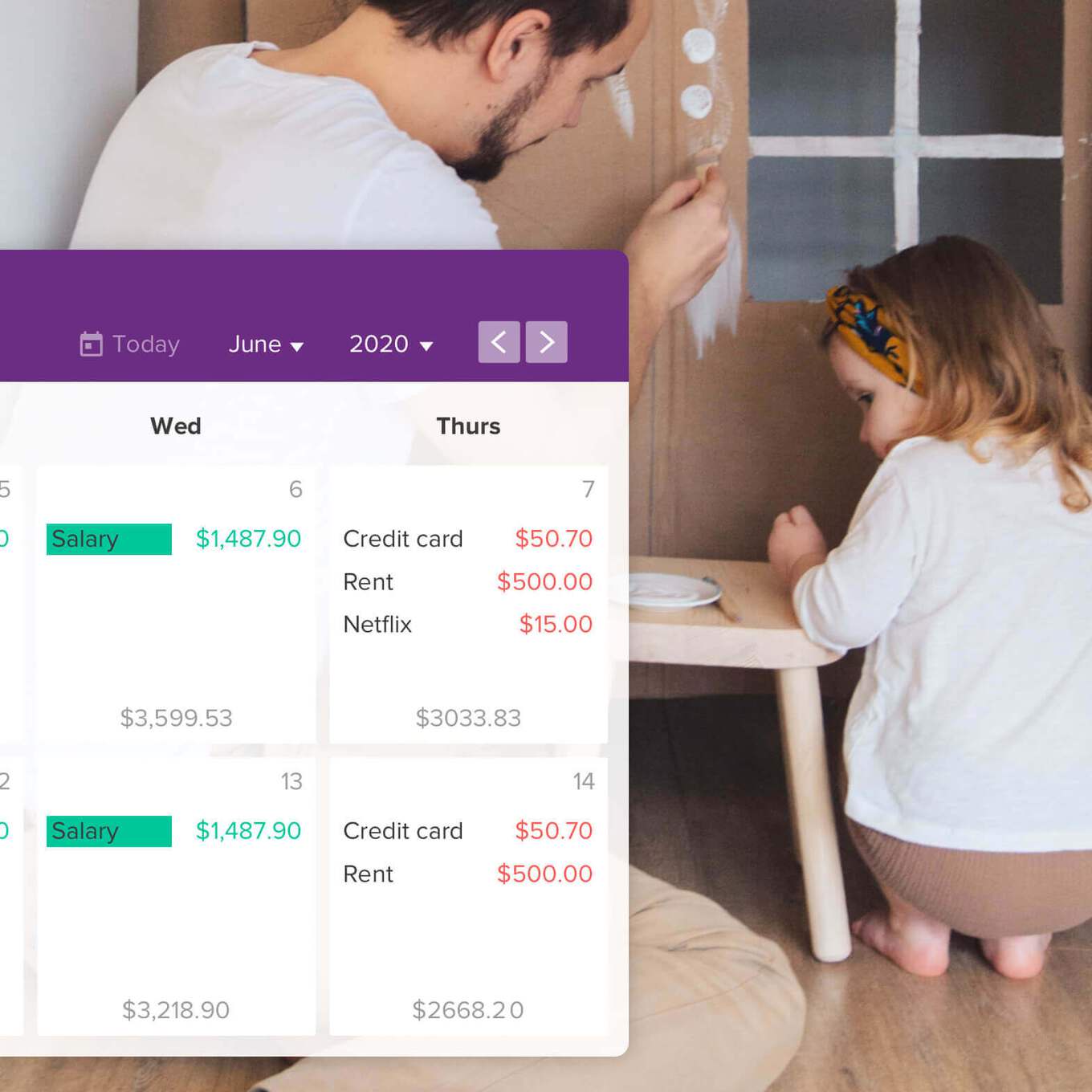

It’s important to start tracking your debt. You can do this with an app on your computer or phone, a basic spreadsheet, or good old-fashioned pen and paper. Whatever your preference, note down each one of your debts with the following information:

Keeping track of all your debts in one place will help getting out of debt seem like a more manageable task. Adding them to your budget calendar will also help you avoid late or missed payments. Once you have a good handle on the debt you want to get rid of, you may want to investigate some debt management strategies.

Read our 3 tips for managing debt >

![]()

There are many strategies and methods that people use to get out of debt. Not all of them will be suitable for your own personal financial situation. The best thing to do is to find out what works best for you. To get you started, here are some common ways that people get out of debt.

Your high-interest debt is going to be your biggest financial gremlin. Often, this will be credit card debt. Take a look at your credit card balances and work on paying them off. If paying them all separately is a struggle, look at getting a balance transfer credit card to have them all under a single card.

The longer this debt continues, the more of your money is wasted paying interest. Paying off your highest interest rate debt first will free up a larger portion of your income that can then be used to pay off other debts — just make sure you’re making your monthly payments on your other debts as well.

When it comes to debt, consolidation means combining all your debts into one. A common way to help yourself get out of debt is through a debt consolidation loan. It may seem counterintuitive to get another loan when you’re already in debt, but debt consolidation loans exist for this exact situation. Many people find that by talking to their bank or lender, they can combine all their debts into one loan, often with a more competitive interest rate. A debt consolidation loan can even save you money in the long run.

Of course, one of the simplest ways to pay off debt is to find ways to increase your income. This is easier said than done, however. Aside from asking your boss for a raise, one of the fastest ways to make some extra cash is to sell possessions that you no longer use or need. Websites like eBay or Trade Me are perfect for listing secondhand items for sale.

Another way to make some extra money is to think about your skillset and how you could potentially leverage this into a marketable product or service. Websites like Fiverr and Upwork exist to support freelancers in offering their services to a global market.

Everyone manages their debt in different ways, but thankfully there are tools available to help you. The most effective tool for managing your debt is a basic budget. Keeping a budget is how you manage the balance between spending and earning. If you can spend less than you earn over a long period of time, you’re on the way to financial freedom.

Read our 3 tips for managing a budget >

PocketSmith exists to help individuals get a handle on their personal finances. It allows you to track debt and manage a budget from any device but is also capable of so much more. With PocketSmith you’ll be able to do things like:

Getting out of debt also means avoiding new debt if possible. Paying off one loan doesn’t mean you now have room for another. If your ultimate goal is getting out of debt completely, you must avoid the temptation to take on more.

There are, of course, exceptions. We’ve mentioned debt consolidation loans already, but there are other forms of debt that aren’t necessarily bad. Credit card debt, for example, is only a problem if it accrues interest. They can be handy tools if you can pay them off each month before the interest is charged. Every individual will need to take different measures to avoid new debt. If you know that your credit card only exists as a temptation, you may be better off cutting it into pieces.

Another exception would be a home loan. The low interest rates in comparison to other forms of debt, combined with the nature of real estate to increase in value, means mortgages are often considered ‘good debt’. If you live in your own home, you’ll also be saving money by not paying rent. If you’re looking at buying a home, having a lot of debt can be a burden on your credit score. Any missed payments will end up on your credit report, which may result in worse lending options for you. This is why it’s so important to manage your debt now. As you take control of your finances and get out of debt, buying a home may become a realistic option. If you find yourself in this situation, we recommend speaking to a registered financial advisor to see if taking on a home loan is the right decision for you.

As you work towards getting out of debt, you may find that you end up with ‘leftover’ money in your budget that hasn’t been assigned to any expenses. Your first reaction may be to consider this as ‘spending money’. Don’t fall into this trap. It’s one thing to get out of debt, but it’s another to stay out of debt.

Instead of spending your extra cash, consider saving it instead. Many people find that having an ‘emergency fund’ provides them with an extra layer of financial security. Consider allocating the money you were using to pay off debt, into an emergency savings account. The amount to save in your emergency fund is completely up to you, but people often quote three to six months of living expenses as a good goal.

Once you’re out of debt, your options are limitless. You now have the financial freedom to decide what to do with your money, instead of being forced to use it to pay off your debts. Spending, saving, or even investing are your new options to consider.

Getting out of debt is not a fleeting desire, it’s a long-term commitment. A tight budget and strictly managed spending is the key to a debt-free future, but try to be smart about it. Empower yourself with a plan that you can stick to and create realistic, achievable goals. People all around the world have used PocketSmith as their pathway to getting out of debt. You can too.