Actively managing your money may not carry the same thrilling risk of owning a wild animal but it’s an essential part of reaching your financial goals.

You don’t have to earn big money to remove financial stress, you need to spend less than you earn. Keeping a budget is how you manage that balance. Here are three budgeting tips to help you along the way:

If you share certain accounts with a partner, family member, or friend, you need to share the budget as well. Anyone with access to the account/s must all agree to put in the effort to follow the budget or it simply won’t work.

Sharing your budget with others who rely on it is an excellent way to stay on track. You all become accountable to each other and will all benefit. A monthly budget discussion is also a great way to educate your kids (or roommates!) about the benefits of personal financial management.

Only having to worry about your own spending can be a blessing and a curse. On one hand, you only have to worry about one person spending money - you. On the other hand, the only person watching your spending is you… and it can be easy to justify frivolous purchases to yourself, can’t it? Some individuals find it helpful to share their budget with a trusted friend. This way they can be held accountable in the same way as a family or couple might.

Learn how to create a budget with PocketSmith >

It’s important to realize when you start keeping a budget that every month is going to be different. Some months you’ll have to budget for things like car maintenance or appliance repair. Other months you’ll be saving for things like vacations and birthday gifts. Make sure you account for these expenses when keeping your budget updated each month.

While many expenses can be planned for, others cannot. Be budget-flexible and make sure you adjust your budget each month as things change. Putting money towards a separate emergency fund will also help you save for unexpected expenses.

Another way to stay flexible is to discuss and define which expenses are essential, and which are not. Some months you may need to make cuts to keep the budget in check. If you’ve already decided which expenses are non-essential, it’s easy to decide what to cut. If the car gets a flat tire, you might just need to skip eating out once or twice this month. Check your budget or PocketSmith dashboard to make an informed decision.

You may have heard the term ‘budgeting to zero’ or ‘zero-based budget.’ This means that before the month even starts, you’ve got a plan and have assigned every dollar of your income to a certain expense.

Most people know exactly how much they will earn in the coming month. Be as accurate as possible when assigning this in your budget. If you’re not sure, round your income down and your expenses up.

Some expenses may overlap into different categories; be careful not to count them twice. If you’ve included your car insurance in a ‘vehicles’ category, don’t include it again under insurance.

Setting up automatic payments for routine expenses is a great way to efficiently manage your money. Automatic payments are most effective when you withdraw the money on the same day you get paid. If you never see this money in your account, there’s no temptation to spend it. You’ll be able to avoid being in a position where payments sneak up on you after you’ve already spent the money. This is one of the ways you can make sure you have enough room in your budget to save. Set up automatic payments to your savings account at the beginning of each accounting period to ensure that you don’t overspend and undersave.

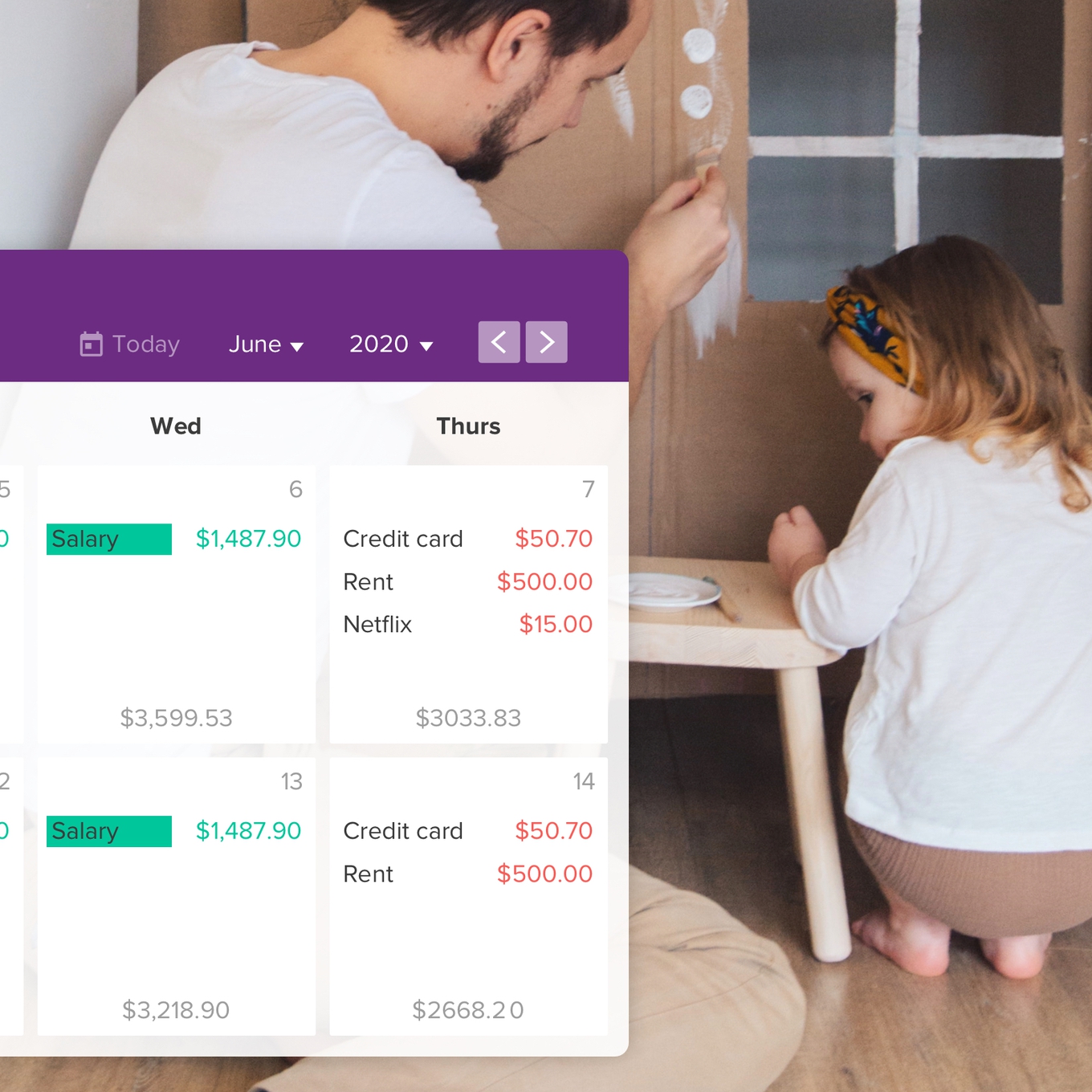

Set up multiple automated payments to cover all your regular expenses. This could include your mortgage/rent, insurances, utilities, loan repayments, and even savings or investment contributions. A budget calendar will help you keep track of payments and avoid any surprises.

It usually takes a few months to get used to keeping a budget. It might not be perfect in the first month, or the second. Keep going and you’ll get there.

If paper and spreadsheets put you to sleep, consider personal finance management software like PocketSmith. Keep your budget convenient on your computer or smartphone with a budgeting app.