Ellen and Max Parry

We are a recently-married couple in southern California. We’re both under 30, and focused on making smart decisions together for our family’s financial future.

My name is Samm, my day-to- day job is as a consultant at one of the Big 4 accounting firms. My lifetime job is wife to my wonderful husband (sorry, still gushing as we have only been married for 10 months).

About 3 years ago we started our journey towards financial freedom, including budgeting (what a shock!). We started using PocketSmith in October 2014 just to track expenses, but this year we have started to unleash it’s full potential. Even now, we still feel like we are just getting started with its full functionality.

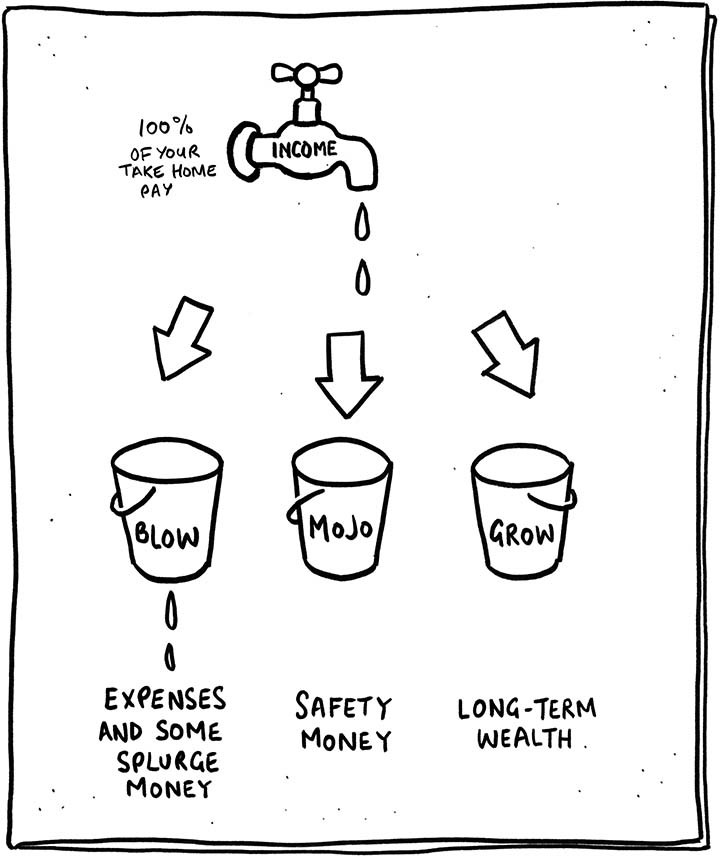

Debt-busting! This is ultimately achieved by tracking expenses and setting budgets in our PocketSmith account. We operate using the following categories:

All of our expenses are grouped into these categories. We found out later that this is similar to the ‘bucket’ idea recommended by the Barefoot Investor.

Fortunately we haven’t had to dip into the emergency fund yet! While we are categorising our expenses, we use Labels to further categorise under the larger categories, i.e. ‘Fuel’ as a subset of ‘Living Expenses’.

PocketSmith has allowed us a lot more freedom in understanding our expenditure. We can see where we are spending too much money (those weekly coffees, or one-off splurges — looking at you, Kmart!). There was also a hidden expense in our budgets: gifts. I had no idea how much we were spending and we now regularly track how much we have spent on those using a gift label. This allows us to plan for the year ahead, based on the previous year.

Ultimately, by understanding our living expenses, we are able to allocate the maximum amount of our money into debt-busting without worrying about running out for anything else. PocketSmith has allowed us review our budgets over a 30 minute coffee date, rather than hours in front of a spreadsheet (my husband is very thankful).

I use the main dashboard the most to see how we are tracking this month in our spending. I love looking at the donut chart to see where we have spent the most and get an overview of what is happening.

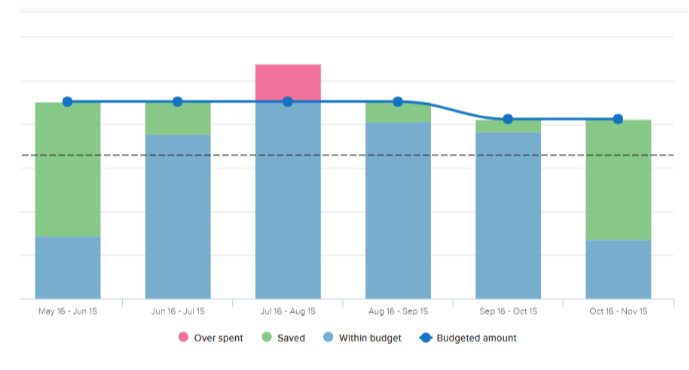

We also use the Trends charts to track how much we have spent against the budgets we have set up. You can see that in September we adjusted our budget as we had allocated too much for living expenses. This small adjustment allowed us to pay an extra $100 per month off our debt!

I log in to the actual site maybe once a month, or twice a month if I am feeling super keen. Otherwise I use the app most of the time (we find it very user-friendly) to categorise the transactions or check on how we are doing with our budget. At first I had to nudge my husband to jump in and categorise transactions, but now he often beats me to it!

Turn off auto categorisation and take the time to set up Filters and categories that are most relevant to your goals. I found this the most helpful thing! Doing this allowed us to make sure that the categories reflected our budgets. By individually categorising each transaction you can make sure your data is accurate. This is particularly important if you have lots of transfer transactions between your accounts.

At the beginning of our marriage we sat down and made some financial goals. Our big goal is to get out of debt by 2020. This means everything from our home loan, personal credit card debt and HECS (Australian student loan).

We then set some smaller goals to keep us on track to achieve that goal. The first one was setting up an emergency fund of 3 months expenses. We achieved this much faster than we expected and we were super stoked! Not only does it give us enormous peace of mind that we are covered against most minor emergencies, but we also keep it in an offset account against our mortgage, allowing us to simultaneously have peace of mind (and not dip into those pesky credit cards) and pay down debt quicker.

We were so excited after we had saved a little more than our emergency fund we purchased something we (or maybe me) had wanted to buy for a long time. A KitchenAid!

As an avid baker, I find it a real pleasure to bake for people; and now I can do it with so much more easy with our KitchenAid!

We are a recently-married couple in southern California. We’re both under 30, and focused on making smart decisions together for our family’s financial future.

We have a 5 year-old son and a 2 year-old Siberian Husky. My family and I currently live in a motorhome and drive around the United States.

I am — first, and foremost — a Dad and Husband, which means I am toy- and house-mender, Lego builder, and head Fort builder. When my busy schedule of fatherhood lets up I am also a cyclist, photographer, IT guy, business builder and Meetup organiser.

Ready to forge your own financial future? Sign up for free and start with our guides.