We asked staff members how they use PocketSmith to manage their different budgeting needs. They’re short reads, and we hope they give you ideas about how you could use PocketSmith too. Feel free to ask any questions, and we’ll be sure to answer.

Meet Amanda! Brace yourselves, because she’s one of the biggest power users in our team. Amanda’s setup for tracking and paying off debt is pretty crafty — so if you’re looking to do the same, you’re going to want to read this!

I use it for tracking my spending, making sure I’ve got enough money set aside to pay those bills and also to track payments I’m making to pay down debt. PocketSmith is awesome because I can easily see my progress, both graphically and numerically — and this motivates me to try to pay off more, rather than ignore the debt.

It’s definitely made me more aware of what I’m spending money on, and now I’m more strict on myself with treat buying and frivolous expenditure. PocketSmith came along at a time where we had just bought a house (hello, mortgage!), so we’ve had to tighten our belts in other areas to make sure we’re making those payments. PocketSmith has helped us to see how much we have left to spend — so that’s super helpful when making decisions on those larger purchases.

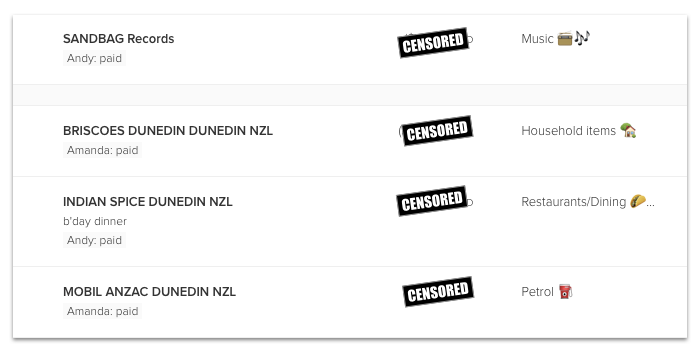

We also just got a joint credit card (I’m a real grown up now!), and I find using Labels in PocketSmith useful for keeping track of who has paid back what. We can then see if either of us have missed anything, and also what remains to be paid from our joint account.

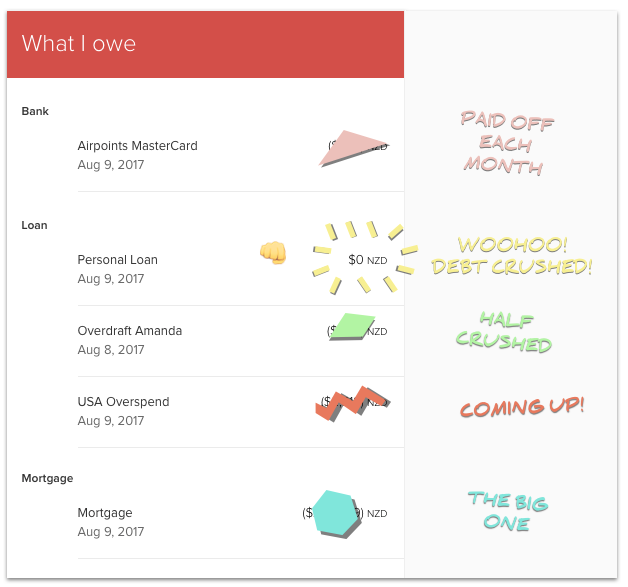

When I signed up with PocketSmith, I had just come back from a three-month trip to the USA, where I had overspent somewhat (to put it mildly!). In addition, my bank notified me they were moving me off the student banking package and therefore my overdraft would start accumulating interest in a year’s time. Dang! Time to address those debts!

Unfortunately, my bank doesn’t allow you to set up regular payments to reduce the limit of an overdraft, so I’ve ended up setting up a separate bank account for this and instead, pay it off in chunks — using PocketSmith to make sure I stick to my repayment goals.

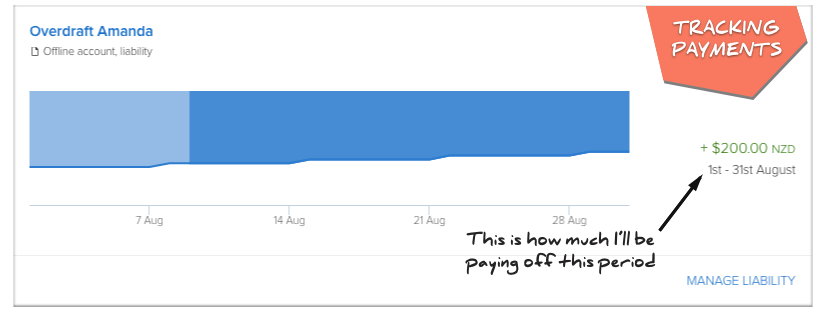

My overdraft and a couple of other personal debts are set up as liabilities on the Net Worth page, and by creating transfer budgets from my main account to the liabilities, the amount owed on the liability automatically decreases with each budget occurrence. That means there’s no need for me to adjust anything manually.

Just recently I paid off a small loan… Now I’m more than halfway to paying off my overdraft! 👊

I like checking out the Earning & Spending chart on the Dashboard for a quick overview of my spending. I’ve added emojis to most of my categories, so it’s satisfyingly fun to look at.

I also use a combination of the Account Summary page, Net Worth page, and the Forecast graph to check out how that debt repayment is tracking.

The Account Summary page shows me how much I’ll be paying off this month, and it’s so satisfying seeing that Forecast graph get closer to $0.00! It’s going to be rad when my debt repayments are finished — in the future I’ll be able to push these payments into savings instead!

I probably log in twice a week — just to catch any transactions that need to be categorised and to make sure we haven’t gone massively over budget anywhere. Once you have your PocketSmith set up and category rules in place it doesn’t require too much maintenance.

Sometimes I’ll tweak a budget or two, and check out the Trends page to see how we’re doing with regards to certain category budgets.

For debt repayments that aren’t associated with a bank loan — e.g. personal loans or perhaps a car loan — set up a transfer budget!

Liabilities in PocketSmith are different to your bank accounts as they don’t have transactions associated with them, so transactions alone won’t affect their balance. A transfer budget tracks your budgeted expenses when paying down a debt and automatically reduces the amount owing on that liability.