With the cost of living rising higher and higher, financial stress can easily take hold. You are not alone. The most common cause of stress is money-related and living paycheck to paycheck is a reality for many. Will I have enough money for the rent/mortgage this month? Can I continue these car payments? Will the increased winter electricity bill push me over the edge?

Stress can negatively affect your health and even contribute to chronic health problems such as diabetes and heart disease. Are you looking to become more financially secure? Learning how to manage your money properly can help to relieve day-to-day stress and benefit your future self.

Managing your money doesn’t have to be a scary concept. It’s not as hard as you may think to make positive changes that will improve your financial situation. Forget the old paper-filled filing cabinet. We live in a time when your personal finances can be handled online.

Money management means making a commitment. Financial security, like any goal, takes practice and routine. Here are five steps to get you started.

For many people, their personal financial situation affects others around them as well. Whether this is a partner, family member, or flatmate, there should be an open discussion around money management. Talk about your financial goals and consider how you can help each other establish and reach these goals. Make it a team effort.

Outline your financial goals and in return gain an understanding of theirs. Is the goal simply to become more financially stable? Perhaps you want to travel, buy a new vehicle, or renovate the home. Everyone has their own ideas about how they’d like to spend their money. The intention here is to come to an agreement and create a shared goal (or goals). You don’t want to be in a position where you’re working against each other. Make a commitment to chat about money every month, share updates, and celebrate achievements when goals are reached.

If you’ve only got yourself to worry about, this step should be over quite quickly. You probably already have an idea of your personal financial goals, and can move on to analyzing your current situation.

Do you know exactly how your last paycheck was spent? Did you manage to cover all your expenses or is there still money owing on your credit card? Did you spend more money than you made, or make more than you spent?

Managing your money can be boiled down to a simple formula: money earned - money spent = money saved. The idea is to spend less than you make, which leaves room to save, invest, or treat yourself. Actively tracking your income versus expenses is key to managing your money effectively. Successful money management starts with 100% of your finances being accounted for.

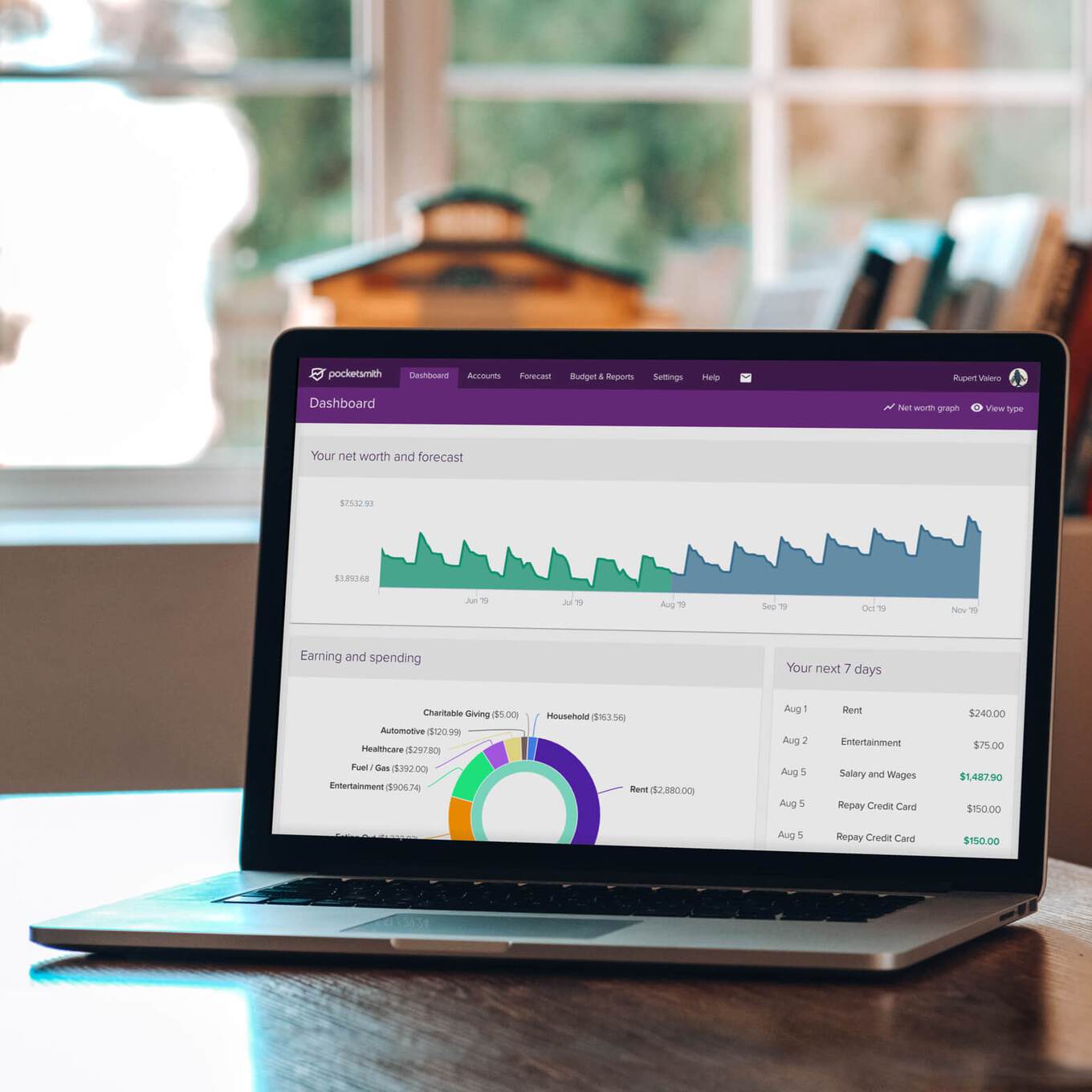

Implementing expense tracking is beneficial for all financial situations, not just those working on a tight budget. Personal finance software like PocketSmith can help, with live bank feeds showing all transactions and accounts in one place. Categorization allows you to identify where your money is being spent, and where it could be saved. You don’t need to worry about saving receipts or spending hours manually tracking your transactions on paper or in a spreadsheet.

Once you know how much money is coming in and exactly where it’s going out, it’s time to create a budget.

Creating a budget can be the most impactful step you can take toward better money management. Budgets are used to track and forecast your income and expenses — it’s an essential tool for financial decision-making.

Learn how to create a budget with PocketSmith >

There are many benefits to be discovered when working to an effective budget. Your credit rating may improve, making you less of a risk for bank loans or mortgages. You may be able to handle your debt more efficiently, increasing your preparedness for unexpected costs. Generally speaking, you’ll make better financial decisions with a budget in place.

A great starting point is to focus on the small, regular expenses which can easily be avoided. This might be those morning coffees, or buying lunch every day. $5 or $10 is easy to justify as a one-off payment, but as a daily expense it adds up to hundreds a month. It’s a simple change and a small sacrifice to make your food at home. If you can’t bear to go without your barista-made coffees, look for something you are willing to give up. Changing your daily expenses into daily savings may net you hundreds or even thousands of dollars per year.

Once you’ve got a handle on your smaller expenses, start looking at the larger costs in your budget. These are often your month-to-month fixed expenses such as bills. How much are you spending on your grocery shops? Are you getting the best mortgage rate? Is there a better deal out there for utilities like electricity and internet? Can these regular costs be reduced in any way? Utility providers often offer special deals, so keep an eye out for these and consider switching providers if a better deal is available.

Note: Special offers often come with a fixed-term contract. Make sure to read the fine print when researching new service providers.

Within your budget, be sure to include a portion for unplanned spending (things like catching up with a friend over coffee, or replacing a broken phone screen). You’ll also need to cover any larger savings you may need for those longer-term financial goals like holidays or home renovations. When you start saving, put the money into high-interest savings accounts to maximize what you earn by leaving it in the bank. You could even set aside money for investing.

Creating a budget puts you in control of your money, but don’t forget to tailor your budget to your individual situation. A family of five will have a very different budget than a young couple with no kids.

Remember, money management is about allocating your finances to make every cent count. Revisit your budget regularly to optimize your money management.

Debt isn’t exactly a delightful discussion point. It is a reality, however, that most adults have debt in some form. Mortgages, car loans, student loans and credit cards are the most common. Debt isn’t always a bad thing, but it should be strictly managed.

Successful management of your money includes outlining all current debts and repaying them as efficiently as possible. Sometimes people find it helpful to consolidate all their debts into one with a debt consolidation loan. It may seem counter-intuitive to take out another loan to reduce debt, but you may be able to find a better interest rate and save money in the long run. Research reputable lenders and facilitate a plan to consolidate and eliminate your debt.

Poorly maintained debt can have some serious consequences when it comes to your credit score. Obtaining a credit report can help you determine if further steps are needed to repair your credit score.

Learn how PocketSmith can help you destroy your debt >

No matter how good you get at managing your money, there will be a time where you run into unexpected expenses. Vehicles often need repairing and appliances eventually need replacing. Successful money management includes being prepared to cover these expenses without a huge effect on your day-to-day finances.

Regular automatic transfers into an ‘emergency’ account will help you retain money that can be used to cover any unexpected costs. Even an amount as small as $20 a week will accumulate to over $1,000 a year. As you settle into your budgeting routine you may find you are able to increase your contribution to this account. A general rule of thumb is to try and save up enough in your emergency fund to cover three to six months of expenses.

When you need to access your emergency fund, make a point of replacing what you took out as quickly as possible. Consider reducing other expenses to increase your automatic payments for a short while. There’s no way to forecast the frequency of unexpected expenses, so it will pay to be prepared for anything.

Having an emergency fund is there to ease your mind and reduce financial stress, but it’s up to you to save it for emergencies. Many banks have account types with higher interest rates that penalize you for regular withdrawals. These make perfect emergency accounts if the penalty is enough to dissuade you from accessing it. Speak to your bank about the best way to manage your emergency account.

When it comes to managing money, knowledge is power. Don’t ignore your accounts or avoid investigating your financial position. Managing your money is about taking all of your financial information, good or bad, and implementing a plan and budget that will work best for you.

Money management software like PocketSmith can be used to help you stay on top of your finances more easily. Empower yourself by taking control of your money. Manage it well and your future self will thank you for it.