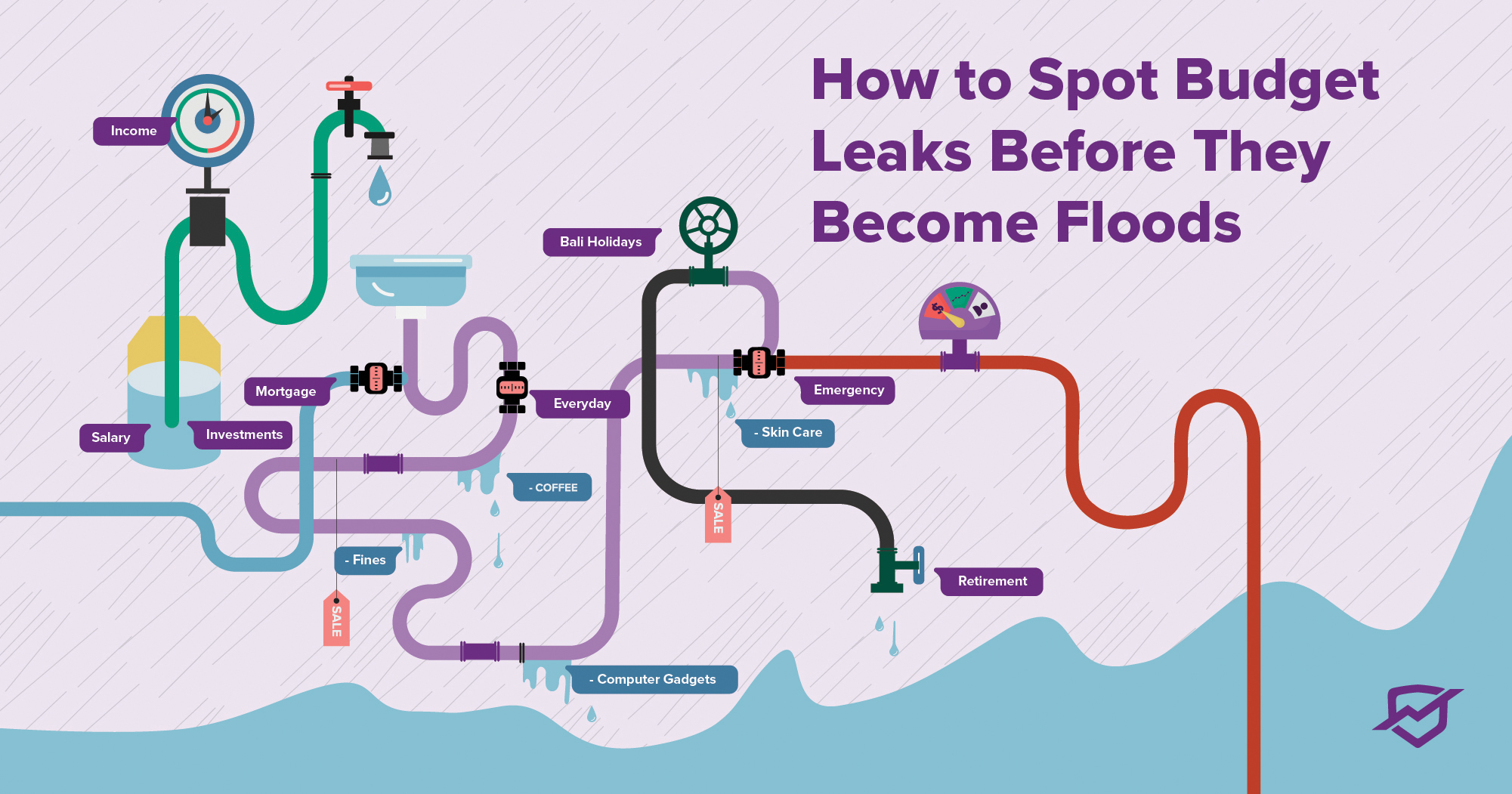

How To Spot Budget Leaks Before They Become Floods

Mind the leak! It’s pretty normal to experience hairline cracks in your budget from the day-to-day stresses of life, but it’s important to keep them in check. Emma shares how you can spot those leaks and plug them up before they become an absolute deluge.

There’s an old saying that goes something like “small leaks sink big ships”, and when it comes to knowing how to budget, this phrase has never been more accurate. In your budget, leaks tend to show up in the form of unsuspecting expenses that go almost unnoticed, but over time compound to have a much greater impact on your overall financial situation than you might think. In this article, we’re showing you how to spot budget leaks early on, so you can plug them before they become floods.

What is a budget leak?

Okay, first of all, what can a budget leak actually be? Leaking money can look different for everyone depending on your lifestyle and how you spend, but in almost all cases, it’s an expense or series of transactions that don’t provide the same amount of value that they’re taking away from your bank account. When we spend money, we’re trading our financial capacity for the goods or services we’re paying for. If they’re not adding value to our lives, they can feel like money leaks.

A budget leak isn’t that one splurge you made once, or the accidental “treat yo’self” moment you had after a big week. Leaks tend to be repeated habitual expenditures that go almost unnoticed or seem insignificant to your broader financial reality at first glance. This might be a sneaky habit of a second coffee creeping into your weekly work routine, or the takeaway you always seem to end up ordering on the night you work late that you don’t really enjoy all that much, or maybe you’re putting your hand up to foot the bill for more rounds than your mates at Friday night drinks.

via GIPHY

How do you spot a budget leak?

Identifying budget leaks is all about keeping your finger on the pulse of where your money is going. If you suspect you might be leaking money in areas you’re unaware of, sit down and embark upon a full money audit.

Open up your accounts — or your PocketSmith dashboard! — and go through every transaction with a fine-tooth comb. We don’t just mean broad categories and amounts. Nope, we want you to go deeper than that. If it was a trip to the supermarket, what exactly did you buy? If it’s the coffee shop, what were you getting, who for, and why?

Looking at the context behind each of your transactions can uncover patterns of behavior that add up to become these money leaks.

As an example, lots of us leak money because of poor meal planning. We end up popping into the supermarket three or four times a week to get ingredients we didn’t plan for, and end up picking up a few extra things here and there that add up to far more than we intended to spend. Instant money leak!

What to do if you uncover a budget leak?

If you’ve uncovered a budget leak, don’t stress. It’s super easy to rectify. What you need to do next is take direct action steps to plug that leak. The exact action you take will depend on what the leak is and what’s causing it, but try and find ways to respond to the intent behind that behavior with a free or lower-cost solution.

Looking at our supermarket example, if you’re leaking money picking up bits and pieces from the supermarket on your way home every night, try planning ahead with greater detail, and make a proper list so you get all your ingredients in one shop, once a week. Minimizing the number of times you need to enter a store instantly reduces the chance of a money leak, because you won’t be surrounded by temptation on the ends of aisles or with special offers in the checkout queue.

How to prevent budget leaks

Preventing budget leaks is a huge part of knowing how to budget better. Here are some of our top tips to prevent leaks from starting in the first place:

- Use PocketSmith’s Trends report to identify areas of overspending or anomalies in your usual routine. Making this part of a weekly money review can be a great way to have clear visibility over exactly where your money is going.

- Track your expenses closely, and rank your transactions at the end of each week by how much joy they brought you or how much value they added to your life. Sometimes leaks can present in the form of money you spend for the sake of it, or on things that don’t really add to your life. If you’re frequently getting low numbers on your joy rankings, it’s a clear sign that you’re not getting much value for your money.

- Identify your financial values. When you know what matters to you, you can spend in a way that honors that, and instantly feel like you’re getting more value out of your money. Think about what’s really important to you, what adds value to your life, and what makes you feel good about spending money, and allocate your money towards those categories.

Compartmentalize your money. Sometimes money leaks can occur when we have too much freedom or autonomy in our budget. If you struggle to keep track of your money, split it up into different categories, buckets or accounts, so you allocate a set amount for various different things. Adding more structure to your budget can help you connect to where your money is going and stop leaks from happening in the first place.

Emma Edwards is a finance copywriter and blogger, on a mission to humanize the financial services industry by creating meaningful content that’s accessible and empowering. You’ll find her penning money tips at her blog, The Broke Generation, sharing financial insights on Instagram, or injecting life into content for her business clients.