The midpoint of the year is an excellent opportunity to take stock of how you’re doing financially. Start by looking at your actual income and expenditure. Are things tracking as planned against the budgets you set at the start of the year? Are you making headway towards the money goals you want to attain?

Your half-yearly budget check-in is like driving a car on a long journey. There are times when you need to step on the gas and times when you need to apply the brakes. It’s about constantly scanning the environment to see where you need to position yourself, so you can be confident you are heading for the right destination – and that you will arrive with some gas in the tank.

Back in January, I diligently worked out a budget for the coming year. Since then, I’ve logged into PocketSmith about once a week, categorizing transactions and watching my pinwheel surge and shrink as the months pass. I have the widgets on my dashboard beautifully set up. They let me instantly see my personal money story for the year so far.

Just like an oil painting, transaction after transaction is being added (all without me needing to do any math I should point out). So, as we near the mid-year point, it’s time to look a little more closely and see if my budget predictions for this entire year were realistic or not.

At this point, it’s entirely within my control to tweak a few levers and make some changes, if that is what’s needed. There is absolutely no point getting to the end of the year and finally checking in with my PocketSmith dashboard only to see my annual budgets are screaming “overspend” at me. Too late to change things then!

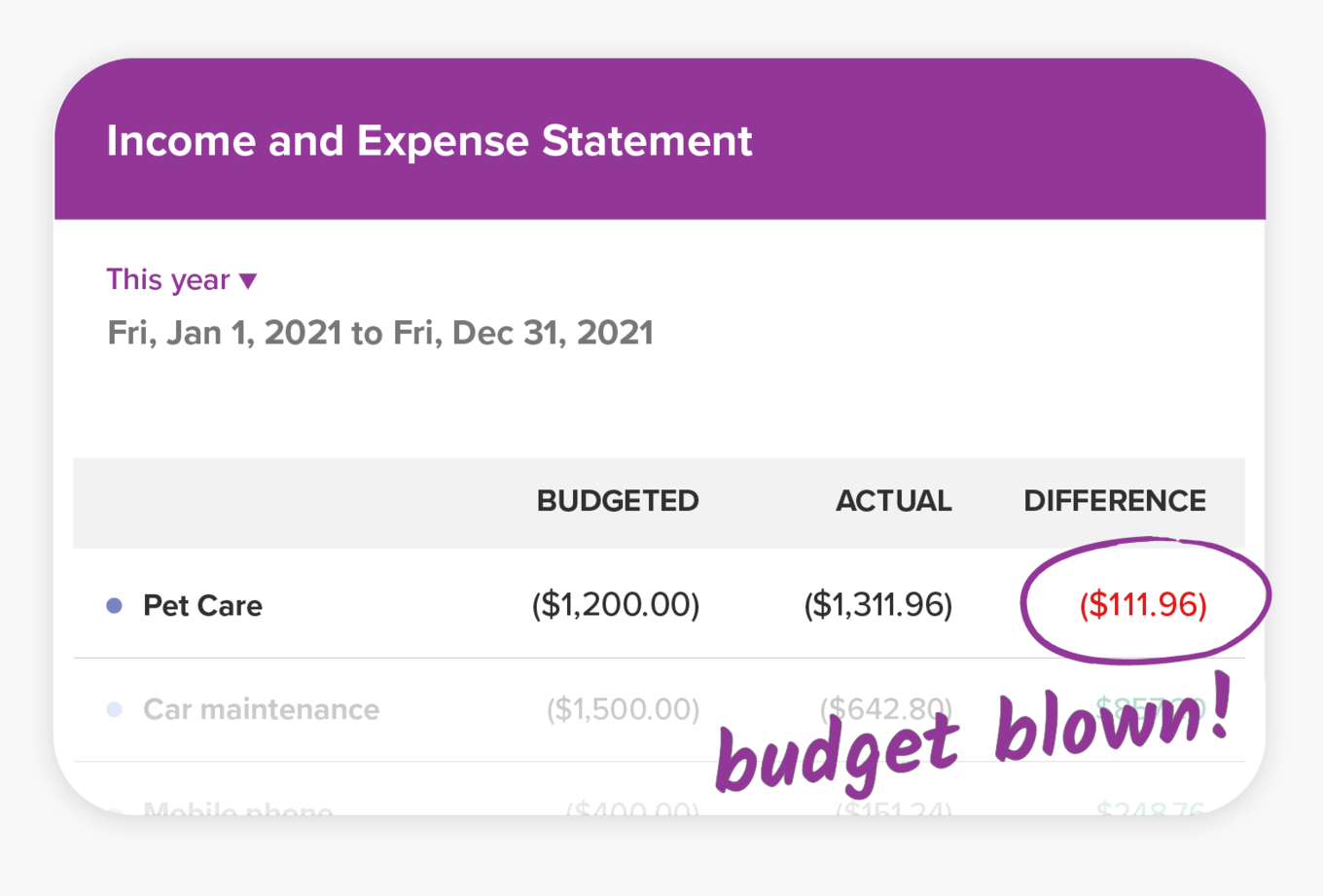

Firstly, I like to pull up my Income & Expense Statement (the Cashflow Statement is also excellent for this) and select “this year”. I can then see at a glance whether any of my expenses have blown the budget yet. For example, in my “Pet Care” category, I can see that they already have!

I originally budgeted to spend $1,200 for the entire year on my cat and dog. In the previous year, I had spent this amount on general veterinary health checks, some boarding while we were on holiday, plus one or two extra trips to the vet, so I felt it would be an appropriate amount for this year too. I keep a bank account specifically for my pets where I set aside $23 a week to build up over the year to a total of $1,200.

An outstanding plan don’t you think?

Well, it was, until it wasn’t! When my big beautiful boy Blue had a terrible toothache, it was off to the vet for a tooth extraction. Once all the final bills were paid, I had exhausted all of the money I had allocated for Pet Care for the entire year and with six months remaining, I am now in deficit by $111.96.

This mid-year check-in is critical because, with another six months to run, I need to adjust my budget just in case there is another expense for a woman’s best friend. To do that, I’m allocating another $500 to this category, a total of $1,700 for the year. At the same time, I will also increase the small weekly payment I make into the bank account for my pets.

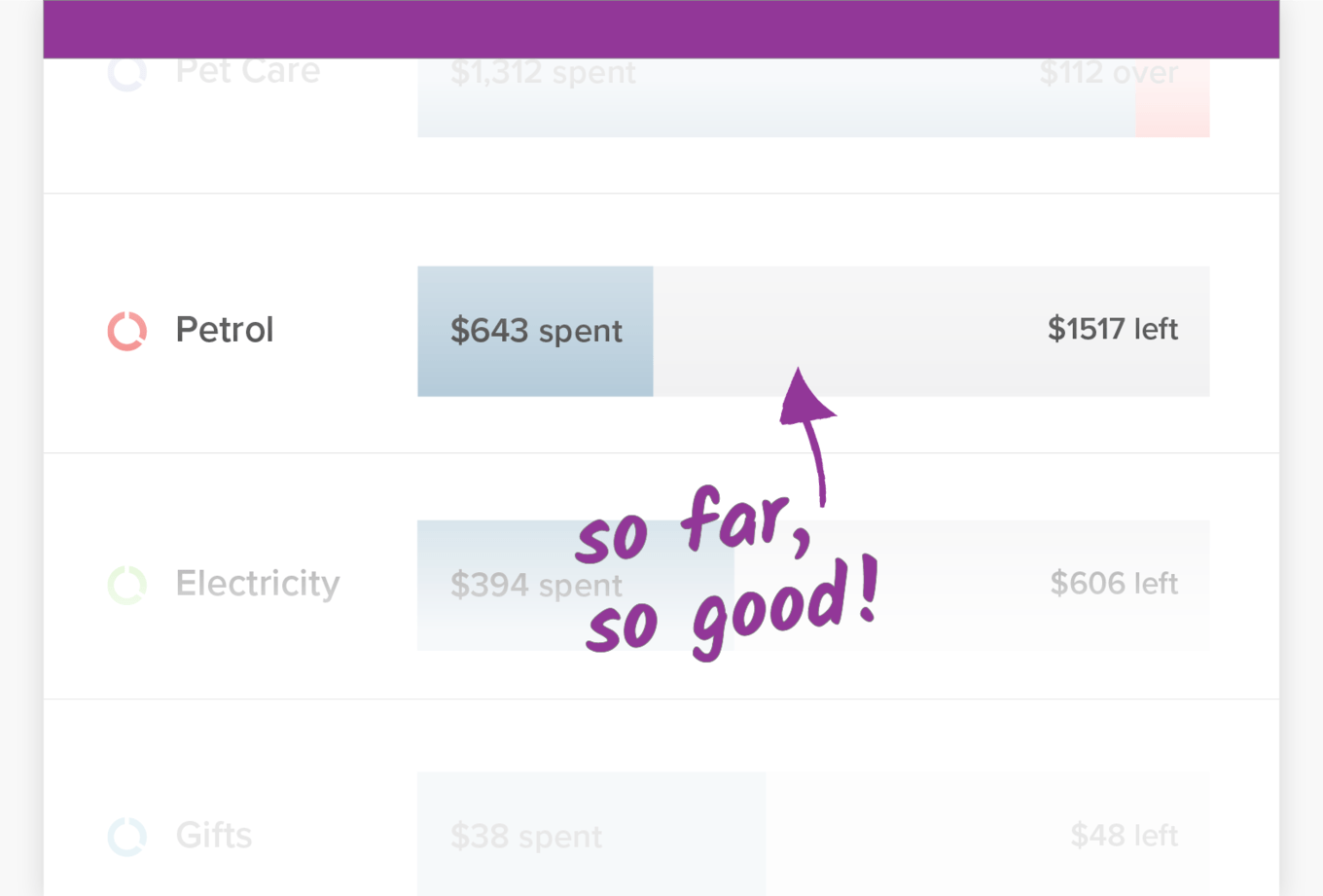

Next, I go to my Budgets (under Budget & Reports) and see how my earning and spending is looking. I need to see that I am on track to spend less than I earn so that I can create as big a surplus as possible. If this is not the case, then I’ve got the next six months to remedy that by either spending less or earning more – preferably both!

I also cast my eyes down my individual categories to see how each is tracking. I like to come here because it provides a great visual picture. For example, I can see that at the midpoint of the year, although I have budgeted to spend $2,160 on petrol, I’ve only spent $643! So, with six months to go, I’m managing to keep well within my budget for this category.

With many categories such as insurance, rates, or mortgage payments you can be pretty confident that they are fixed expenses, but with many other things, like pet care, petrol, health, and dining out, these are very much prone to fluctuation.

A budget is not a fixed thing; it’s a guide and you just have to go with the flow. There are times when we may have blown a budget category due to lack of self-control (hello ‘dining out’ budget category!) and in those cases, our budget is a good reminder to rein in your spending.

Your budget can act as a real wake-up call. But in other cases, as I’ve shown with my pets, life just happens and we need to evolve our budgets to reflect real life.

If you are self-employed, now’s a good time to check that you are setting aside enough money to meet your tax obligations and other costs, so that when those business expenses are due you are financially sorted. It may be that you have been over-saving for tax and you can tweak that, giving yourself more income instead. Or, it might be that you have been under-saving and you now have the next six months to ensure that you are setting enough money aside.

Once I’m comfortable with the adjustments I’ve made to my budgets, I’ll switch to the custom dashboard I’ve created for my family. It’s a much less detailed version of the one I use and it lets me convey a huge amount of information, in a very simple format.

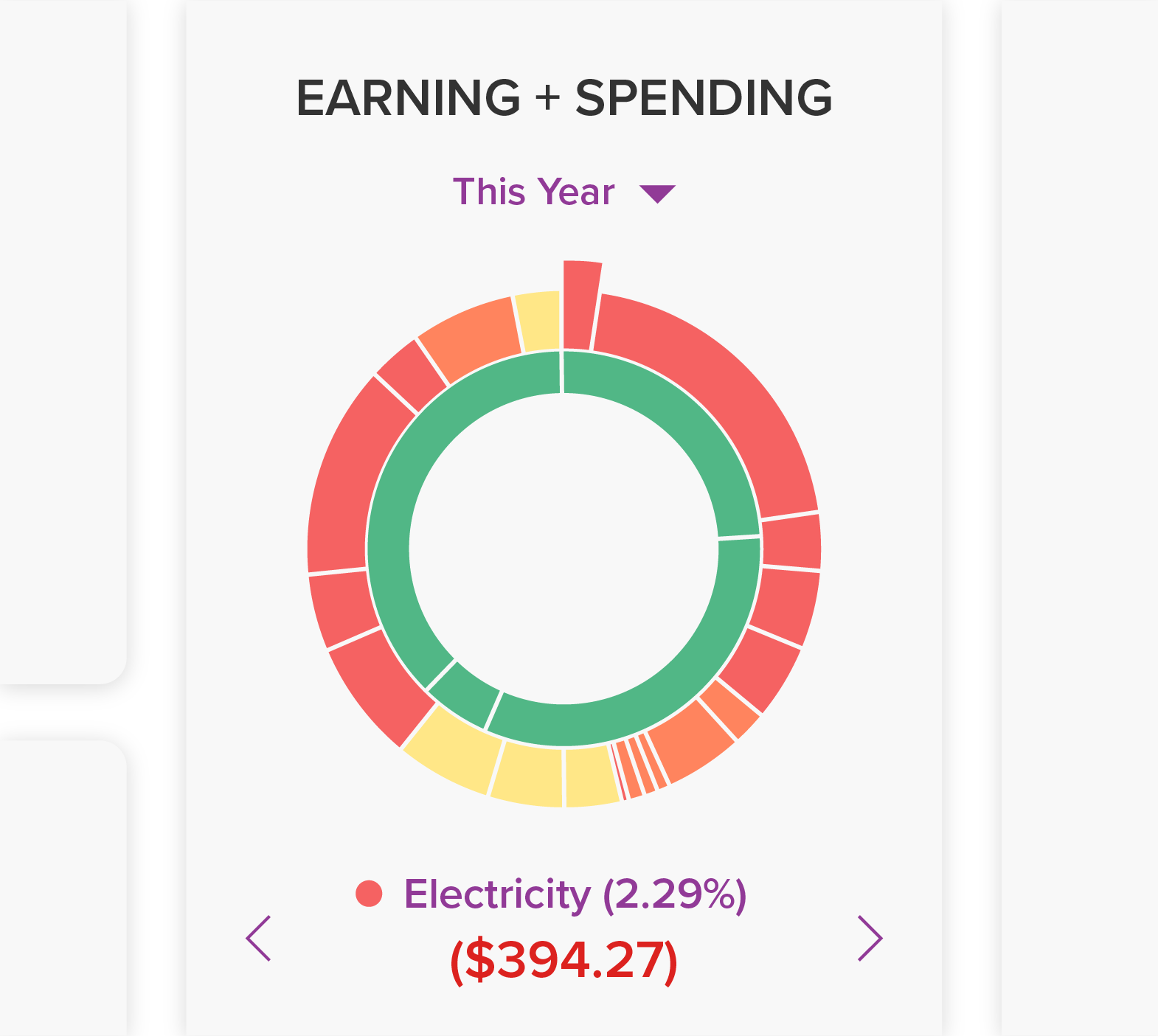

Then, I’ll invite my family to come and have a quick look at our financial position as it sits today and we can chat about areas that we need to cut back in (for us, it’s inevitably too many trips to the supermarket!) and areas that we are doing well in. The Earning and Spending donut widget lets me explain in a very simple graphic that we are spending less than we are earning and what our savings percentage is.

This six-month mark is such an important check-in point to ensure that you are reaching your earning, saving, investing and spending goals. It’s also a good time to check that you’ve organized your budgets in a way that makes sense to you so that they can guide your daily decisions.

When we set up our budgets at the beginning of the year, we do so based on past spending and earning. But because we spend and earn differently each year, budgeting is an inexact science. And that’s beautiful to me because it’s not rigid. There is no right or wrong. Instead budgets shift and evolve as we do and without fuss or fanfare. We just need to evolve with them and adjust our behavior. When we do, we’ll feel a sense of financial freedom and control over our money.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.