As the Chief Financial Officer of the family, I make it my responsibility to financially plan for the year ahead. It’s a New Year’s Eve money ritual that I look forward to each year!

This is the time when predictions become facts and I get to see how those budgets I set myself 12 months ago actually played out. The longer I have used PocketSmith, the closer my best guess gets to what actually happened. It’s common to see goal-setting on social media but there is a huge satisfaction to be found in setting a realistic budget with the help of PocketSmith, monitoring it throughout the year and then actually achieving it.

Every new year’s eve, I take a little time to reflect on the year just gone and think ahead to the coming year with a sense of purpose and control. That’s so important when it comes to handling your money. I’ll think about what specific goals we were striving to achieve and if we have met them or are on track to meet them.

I also set some new goals like:

It’s also a good time to make sure that long-term goals such as retirement savings are on track. Keeping an eye on big goals such as these, as well as your short-term goals, can help make sure that nothing’s gone awry.

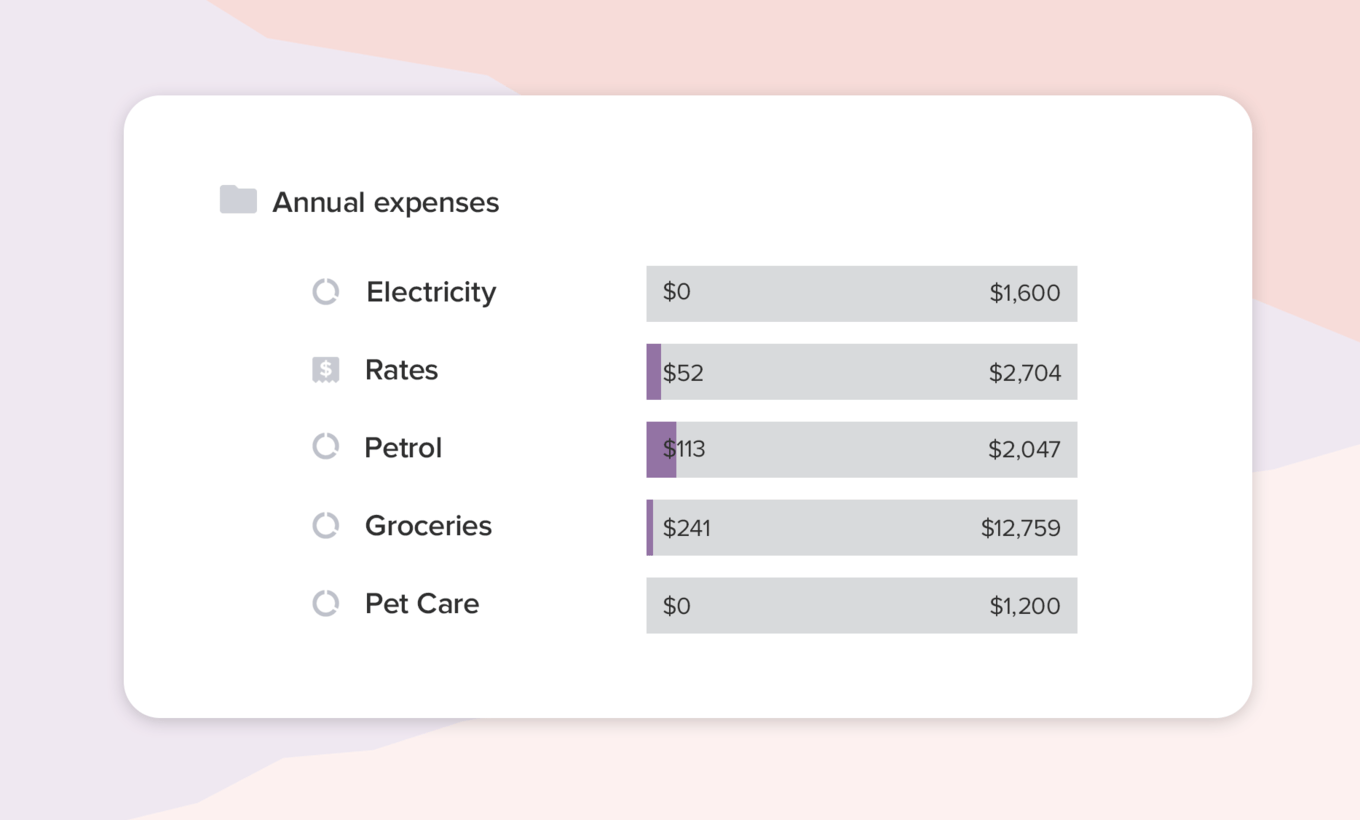

I specifically use a few key PocketSmith features to close out the year and plan for next year. It never takes me long and it’s a time to reflect on our personal finances and talk as a family about what we spent last year and what we anticipate spending in the coming year.

PocketSmith helps my family feel completely in control of our money for all 52 weeks of the year.

This generally involves me at my computer ‘enlightening’ the family and playing a few guessing games along the lines of “guess what we spent on clothes last year” or “guess how much we spent on holiday in June”? It’s actually a fun experience as we get the chance to reminisce about our experiences throughout the year.

Then, once they have inevitably lost interest I start to focus in on four key areas:

If you have good intentions, yet no budget, it is impossible to track your progress. I find that those who are budgeting for the first time always get quite a surprise at what they actually spent, compared to what they think they were spending.

Using PocketSmith to plan my year ahead gives me guide rails for the coming 12 months. I can regularly check-in to make sure we are sticking to our resolutions. It is THE best way I have found to help my family feel completely in control of our money for all 52 weeks of the year, no matter what the year might throw at us, whether it be wonderful opportunities or big obstacles.

That, in my mind, is the definition of financial freedom.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.