If you’re neurodivergent, you might struggle with traditional budgeting advice and software. Most of it is written for neurotypical brains, and in the past, that may have left you feeling like a budget failure.

Here at PocketSmith, we don’t believe in one-size-fits-all advice. Our budgeting software is all about customisation so our users can build a budgeting system that works for their own, unique process. Most of all, we don’t believe you’re bad at money. We just think you need a software option that plays to your strengths while also supporting you in areas that may be more challenging.

Today, we’ll take a look at some PocketSmith features that can take your neurospicy mind from budget-adverse to financially empowered.

There are oh-so-many reasons your executive function may be offline. Maybe you frequently procrastinate non-preferred tasks. Maybe you’re in an anxiety spiral that’s got you frozen. Or maybe you’re so busy with everything else going on in your life that it’s difficult to make budgeting a regular routine.

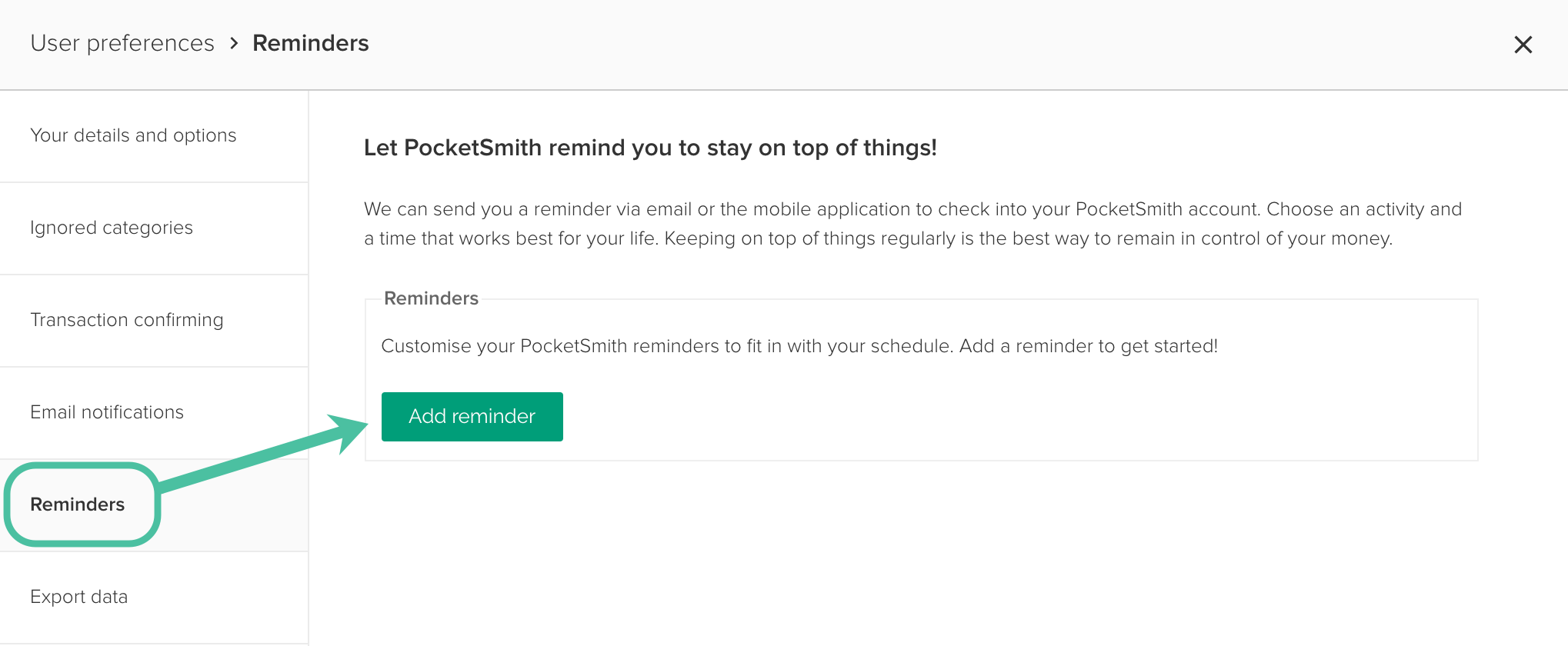

Whatever the reason, PocketSmith can help nudge you in the right direction with the Reminders feature. This is what’s known as an environmental support. Environmental supports can go a long way towards helping you keep your money habits on track.

You can use PocketSmith reminders to prompt you to do something simple, like categorise your expenses or simply sit down to do your weekly budgeting sessions. Reminder notifications can be sent to your phone or your email.

Here’s how to set them up:

For a lot of people, automating bill payments is a great way to ensure everything gets paid on time. If you’re lower-income or you have irregular income, though, the thought of automation may add to your anxiety rather than alleviating it. If a bill is scheduled to come out and the money’s not in your account, that could mean dealing with overdraft fees. In these instances, you might feel more in control when you manually pay your bills.

In either scenario, it can be helpful to receive reminders about when your bills are due — whether that’s because you need to manually pay them, or because it’s good to remember when hundreds of dollars will be automatically withdrawn from your checking account.

Here’s how to set up bill reminders in PocketSmith:

One of the many PocketSmith features we’re really proud of is our customisable categorisation. While there are lots of default options for categorisation of each line item in your budget, we appreciate that every user has their own way of thinking about and organising their expenses. That’s why we’ve given you the added option of customising your categories for however works best for your brain.

You can add and delete categories by selecting Manage and then Categories. To delete a category, click on the three dots on the right of the screen. Then it’s as simple as clicking delete.

You have a couple of options when it comes to adding new categories. From the category management page, all you have to do is click + Add new in the toolbar. But if you find yourself in the thick of budgeting, you don’t even have to leave the transaction page. You’ll notice a drop-down menu for categories. Type your new category name into that box, and you’ll see a box pop up in the drop-down menu that says Create category: (your category name here). Simply select it, and PocketSmith’s software will handle the rest for you!

Not every line item is created equally. Some of your spending is going to be on bills that occur every month or every week, like your utilities or rent. You pay these all at once in one lump sum. Other categories are going to be spending that you do throughout your budgeting period, like the money you spend at the grocery store or the cash you drop on clothes. Still others are going to be once-per-year expenses, like your vehicle registration.

Organising all of that on your own can be super overwhelming, even for the biggest Type A math nerds. That’s why PocketSmith comes with different types of categories so your budget will automatically populate the right expenses at the right time, allowing you to plan your financial year with far less effort.

Here are the types of categories you can designate in PocketSmith on the Categorisation management page:

Just because you’re neurodivergent doesn’t necessarily mean numbers aren’t your love language. But if you do have dyscalculia or are otherwise a visual learner, you’ll likely love that PocketSmith gives you the option to view your spending, savings goals, and budgeting projections in pretty charts rather than straight spreadsheets. You can do this using the Dashboard feature.

You can get as customised with your Dashboards as you like. Whether you want to view your entire financial picture all at once or a single aspect of your financial life, like your spending vs income over the past month, we’ve got you covered. We have 15 different Dashboard widgets to choose from including:

You can add or delete any of these options from your main, big-picture Dashboard. But you can also create multiple, separate Dashboards for any category you so choose. We have some templates to get you started, or you can build everything custom from scratch.

Spontaneity and generosity are beautiful traits some of our neurodivergent users have in spades, but when these traits lead you into impulse spending or over-giving, they can wreak havoc on your budget. PocketSmith has you covered with even more environmental supports so you can still be spontaneous and generous — just with some built-in guardrails.

You can build these guardrails in by setting a limit on each category of your budget. For example, maybe your entertainment budget is $200 per month. Go to the Budgets section of PocketSmith and select the Entertainment category. From there, you’ll be able to enter the amount you want to spend and how frequently you want to spend it. In this case, it would be $200 every month.

When you start getting close to this limit, PocketSmith will send you a notification. These reminders can help you rein in your spending (or giving) before things get out of hand.

Budgeting doesn’t have to be all drudgery and responsibility! It can be a liberating practice that allows you to set goals for your special interests or other things that you’re excited about. For example, let’s say you caught word that Taylor Swift is going on tour next year. Your $200-per-month entertainment budget probably won’t cut it when it’s finally time to buy tickets. Instead, you decide you want to save up $1,000 so you’re prepared for Ticketmaster’s worst.

The easiest way to do that is to set up a separate savings account for your goal. Use PocketSmith to name your savings account so you can keep your focus on your goal. For our example, you might name the account ‘Taylor Swift tickets’. You want to be prepared for the day tickets go on sale, so you’re trying to save up your $1,000 over the course of five months — or $200 per month.

On the Categories page, set up a transfer category and name it after Taylor. Set your budget up as $200 per month (or $100 per fortnight, whatever works best for your pay schedule). Because your goal is to save this money in five months, you’d set an end date five months out from today. You’ll then be able to see a chart projecting your progress towards this savings goal in your Dashboard.

Your brain is wired differently, and that’s a beautiful thing. We think you deserve a beautiful budget that supports your lived experience and helps you reach your financial goals. With endless customisation options, bill and budgeting reminders, and automated budgeting visualisations, PocketSmith is a great fit for neurodivergent budgeters who want to achieve financial success.

Brynne Conroy is an award-winning personal finance writer, creator of the popular women’s finance site, Femme Frugality, and author of The Feminist Financial Handbook, which was an Amazon #1 New Release across multiple categories including Poverty and LGBTQ Demographic Studies. Her work has been cited in academic texts, and she’s spoken at venues such as Vanderbilt University, the Financial Planning Association and the 529 Conference. Here at PocketSmith, Brynne covers personal finance within American financial systems.