As The Happy Saver, I operate in two tax worlds. I work part-time as a PAYE (pay as you earn) employee, meaning the tax I pay is all sorted by my employer. But with my blog and podcast, it’s all on me to keep track of my freelance earnings and expenses and then calculate the tax I must pay.

When self-employed, we are obligated to pay our taxes. I prefer to be meticulous about declaring all income because complete honesty with the tax department makes life much easier!

I manage my freelance income the same way I run my family finances, keeping it extremely simple.

When I first started blogging, I made a tiny income. Because I had visions of greatness for my venture, I knew that my income would grow over time and that I wanted sound accounting principles to handle that growth. I spent half an hour with an accountant, seeking their wisdom about setting myself up correctly from the very beginning. They advised me to set up separate bank accounts, keep good invoicing records and significantly, set aside tax each month. With the help of PocketSmith, that’s what I’ve done ever since.

You may not need an accountant to file your taxes as a freelancer. You can do it yourself quite easily, they tell me, but professional help is there (at a cost) if you need it, and I recommend at least an initial consultation as a good investment in your fledgling business. You don’t need fancy and expensive accounting software to start your business. Keep it simple.

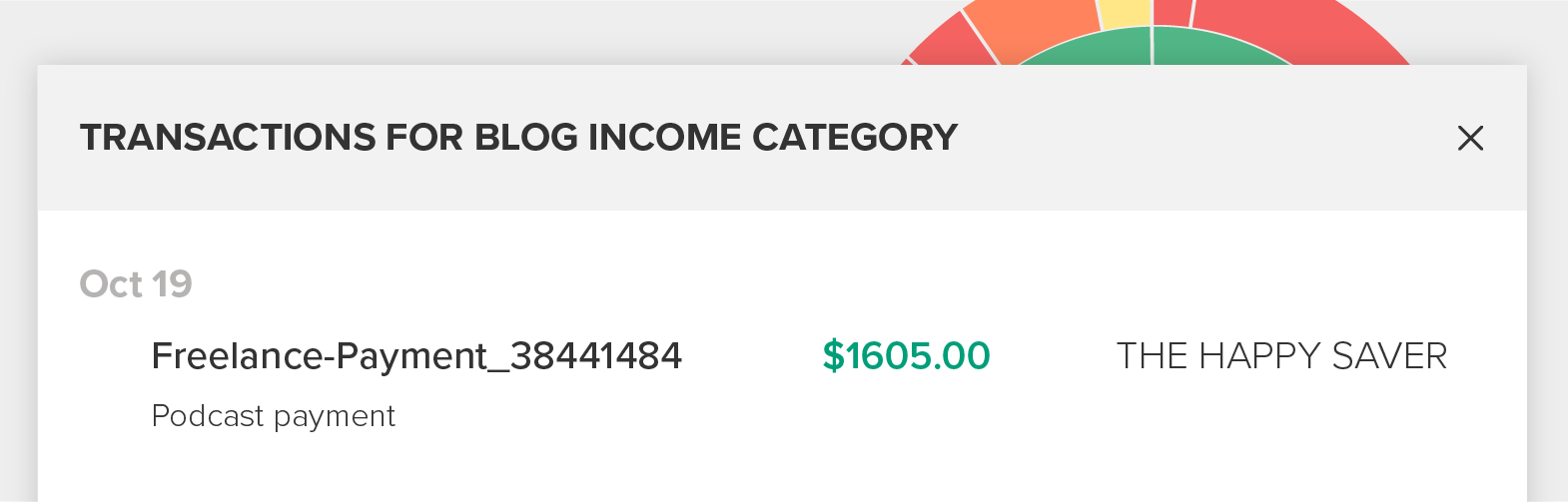

Throughout the month, I work and create income. I issue invoices, and these accounts get paid in due course and entered as ‘Blog Income’ into PocketSmith.

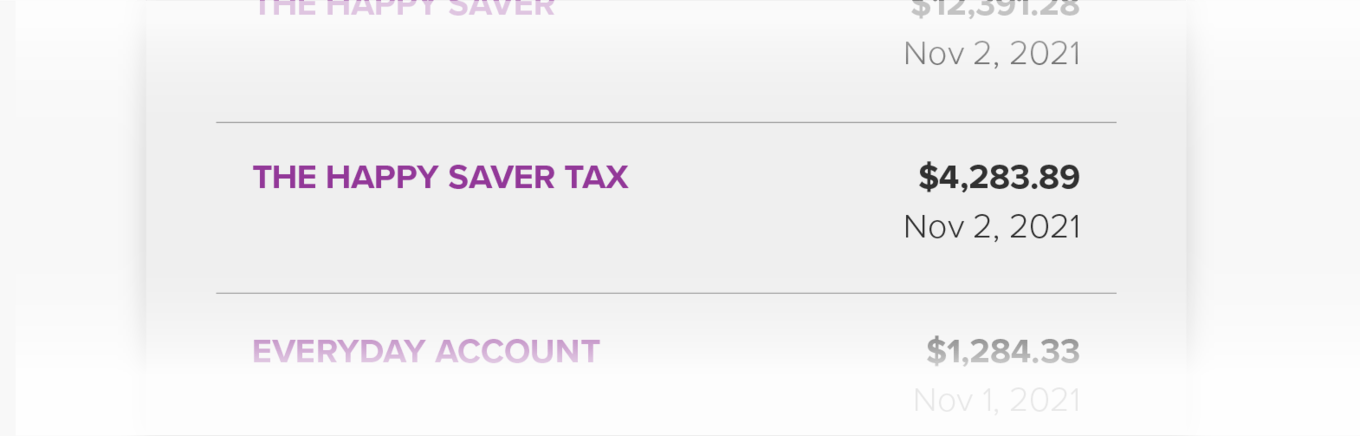

I let the income build up in my bank account, and then on the first day of the new month, using PocketSmith, I go back and calculate what I earned in the month prior. I then take 17.5% of that total income, and I put it in a separate ‘sinking fund’ bank account called The Happy Saver Tax.

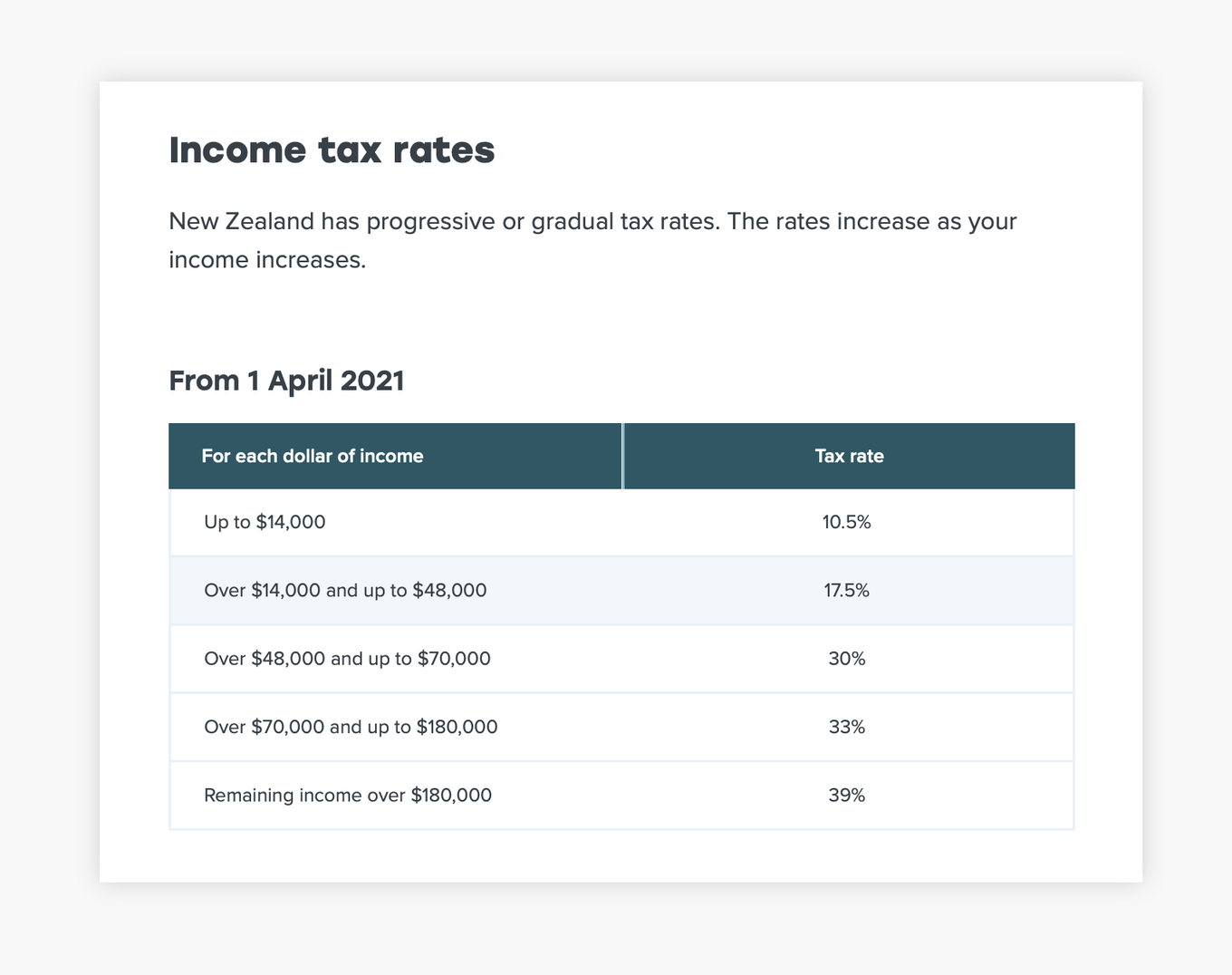

In New Zealand, we have specific tax rates that increase as your income increases. There is no particular freelancer tax rate. Instead, all income from any source is taxed using this structure:

I know that The Happy Saver income is between $0 and $48,000 each year. Although the first $14,000 is taxed at 10.5%, anything over that amount is taxed at 17.5%. So that is what I prefer to set aside, and I would far rather over-save for my tax than under-save.

Over-saving came to my rescue recently when a $465 unexpected tax bill (an ACC payment) turned up. Not only was it surprising, but it was also OVERDUE! I simply reached into my tax account and paid it in full, causing what could have been a financial emergency to become a mere inconvenience.

When the financial year ends on the 31st of March, I gather up all of my paperwork and present it to my accountant for processing. They then tell me how much tax I have to pay and when to pay it. I reach into my bank account and pay the invoice in full.

Once a tax sinking fund is set in motion, it never stops growing, and I am constantly saving up in advance for the future tax I need to pay. Under no circumstances would I ever access this money for any purpose other than tax payments. I might be solving an urgent financial need by doing so, but I’m creating a tax headache for myself down the track.

As my freelance income grows, I may become eligible to pay my tax in advance, known in New Zealand as Provisional Tax. If and when this becomes my reality, I’ll still use this sinking fundto save up in advance and plan for this. There are key dates in New Zealand for paying provisional tax, and payments are spread across the year, giving a lot of warning as to how much and when tax is due. My strategy of always setting aside a little more than needed will set me up well if this happens.

I’ve spoken with many freelancers and small business owners who use this straightforward strategy to pay their tax, and the longer they are in business, the more of a feel they get for their future income and the tax they need to set aside. Over time they settle into a pattern of always staying one step ahead of their tax bill! It becomes an easy part of their business to manage and brings them considerable peace of mind to have planned ahead.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.