A side hustle is an interesting thing. Going by the accepted definition of “a part-time job or piece of work that a person does as well as their regular job,” I’ve been hustling ever since I finished university. But here’s the rub: If someone is working three part-time jobs simultaneously… which one, if any, is the side hustle?

For me, these extra sources of income are usually related to writing. I’ve had novels published under a pen name, I’ve done regular transcribing for a local historian, and I’ve picked up bits and pieces of editing work. In April 2022 I finished a fixed-term contract at a full-time office job. Instead of launching into the next traditional-employee job, I sat back and took a breath.

I looked at my most consistent hobbies and side jobs over the last ten years. There was a common thread, and it was a thread I could use to venture out on my own: Freelance writing.

It’s early days yet. I enjoy the work and I’m building a good client base, but as living costs skyrocket, I may get a part-time day job. If there’s anything we’ve learned in these uncertain days, it’s that multiple income sources are a good thing. And boy, has PocketSmith been a massive help there.

Let me show you my old system, the change in April, and my new system.

I’ll always sing the praises of the category nesting and color coding that PocketSmith excels in. I used a “Freelance” sub-category under the “Income” parent category to keep freelance income separated from day job income. Business expenses weren’t really a thing; the beauty of freelance writing is it doesn’t need specialized equipment. Any side jobs were less than five hours a week total. The hassle of claiming power and internet expenses wasn’t worth it.

In terms of tax obligations, I kept a sinking fund bank account and a “Freelance Tax” budget category. Anytime I was paid for freelance work, I manually took 30% of the payment and set it aside in that bank account, ready for the end of the tax year.

Side note: Don’t be afraid to query the official numbers if they seem wrong. Once I was landed with an unexpected ACC bill for more than my total freelance income for that year! I queried it and it turned out they’d mistakenly allocated my “total annual part-time” freelance income to “monthly full-time”. It got cleared up and the bill was canceled in full.

When I decided to expand my freelancing, I knew I needed a systems change. The way I’d been doing things was fine for a side hobby, not so much for a growing business. As a result, Hnry now handles all my invoicing, business expensing, pay-as-you-go tax obligations, and more.

With the new system, I’d love to say my business admin is cut in half. It’s not. But it’s a lot more efficient, and I have far greater peace of mind.

As Hnry handles my tax, I no longer have a need for that “Freelance Tax” sinking fund, which means any money that lands in my accounts is really mine to keep. I now file any business expenses, down to my internet plan and my website domain. Given I needed to buy a new laptop within a month of going freelance, this was impeccable timing. With work-specific purchases, I categorize these in PocketSmith as “Business Expenses” and keep an eye on the trend lines to track them over time.

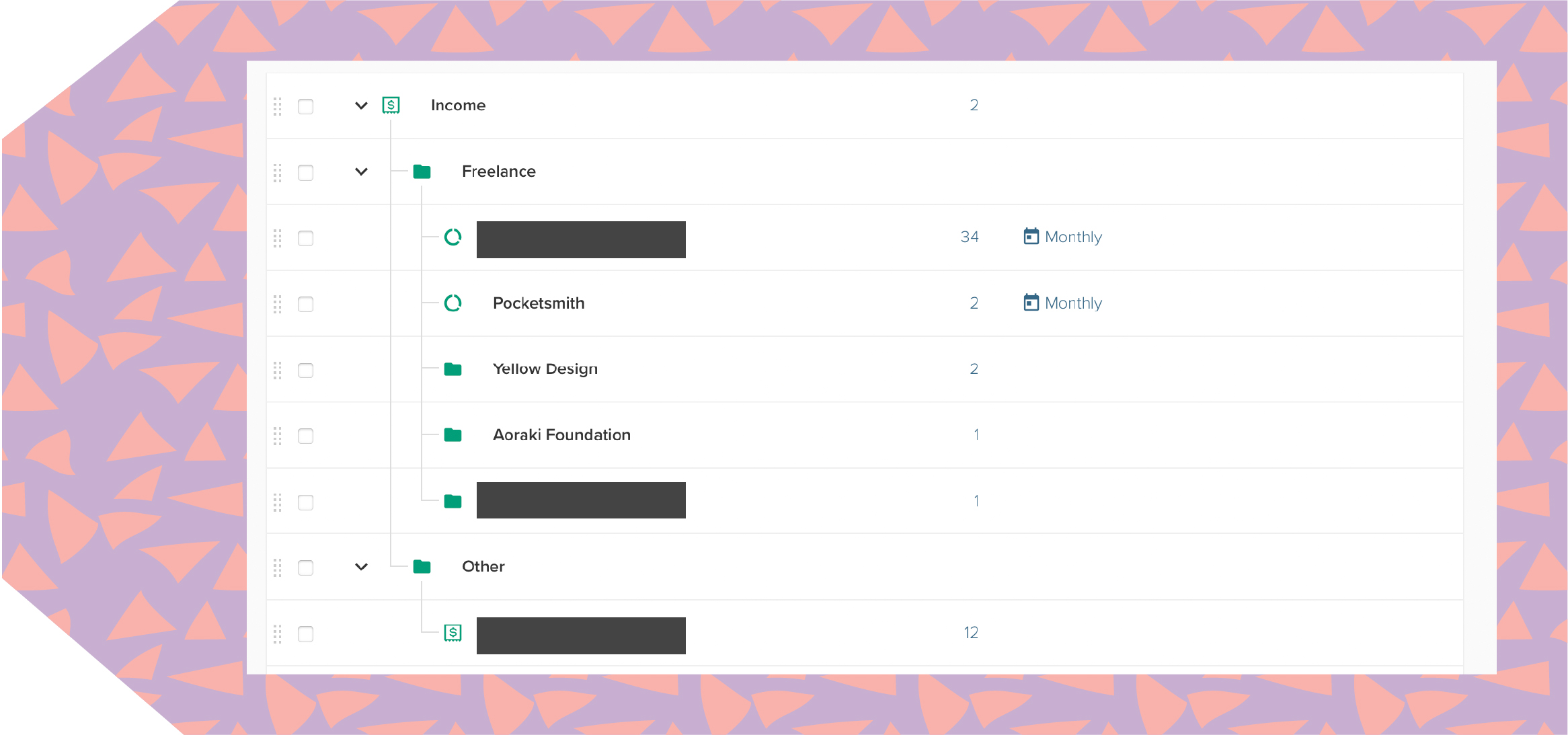

The biggest change is in my Income sub-categories. One overall “Freelance” category didn’t cut it anymore. Thank goodness for three-layer nesting! My “Income” parent category drops down to “Freelance” and “Other” categories. The “Freelance” category then drops down again to show my individual clients. If they’re regular clients, I set a recurring budget based on their average rate. This might be hours-per-week or piece-rate-per-month. And for irregular clients, if I want to, I can set a non-recurring budget based on the specific invoice dates for that job.

I also use the Income & Expense report for a quick, easy overview of my financial breakdown. I tend to check this monthly. It’s a great way to see the ins and out of each category as part of the bigger picture.

So that’s the system — for now. I can almost guarantee it won’t be a forever system. That’s the great thing about life: It changes. Thankfully, PocketSmith gives me the flexibility to change with it.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).