How PocketSmith Helps Me Pay Off My Student Loan Faster

“However you want to do it, PocketSmith makes tracking your loan payments easy.” Paying off your student loan — the perennial monkey on the back of many Millennials and Gen Zers. Rachel shares how she’s using PocketSmith to tackle her student loan repayments, and the peace of mind that comes with it.

“Student loans,” said my hairdresser. “Teenagers borrowing thousands of dollars. What’s with that?”

“Right?” I agreed.

“I know a guy who moved to Australia when he graduated med school. He’s been there a year, working in some tiny outback village, and he’s paid his loan off already.”

I digested that news in (slightly jealous) silence. “Wow. Good on him.”

I admit, I’m still paying my student loan off — maybe because I didn’t move to the outback for work straight after university. But then, because I live in New Zealand, I don’t pay interest on my loan. Those 2.8% rates kicking in around the six-month mark must bite.

In NZ, we don’t deal with exorbitant interest rates like our American friends, or rely on student loan forgiveness programs. But we still have to pay it back. Past a low-income threshold ($22,828 a year or $439 a week, before tax), 12% of every pay goes on student loan repayment.

When I tell people I’m using PocketSmith to pay my loan off early, I get a blank look.

“Why?” is the most common response, followed by “How?”

Fair enough. It’s an interest-free loan: Why pay it back early if you’re not being penalized for having it?

Reason #1: It’s the right thing to do

Yeah, the 12% trickle would take care of it over time. But that’s the bare minimum. This was my decision, right? I signed up for this. I borrowed the money. I agreed to repay it. So, as a decent human being, it’s my obligation to pay it back.

Reason #2: Get that 12% pay rise, baby!

The thing is, we are being penalized for having that student loan. Penalized to the tune of 12% in mandatory repayments.

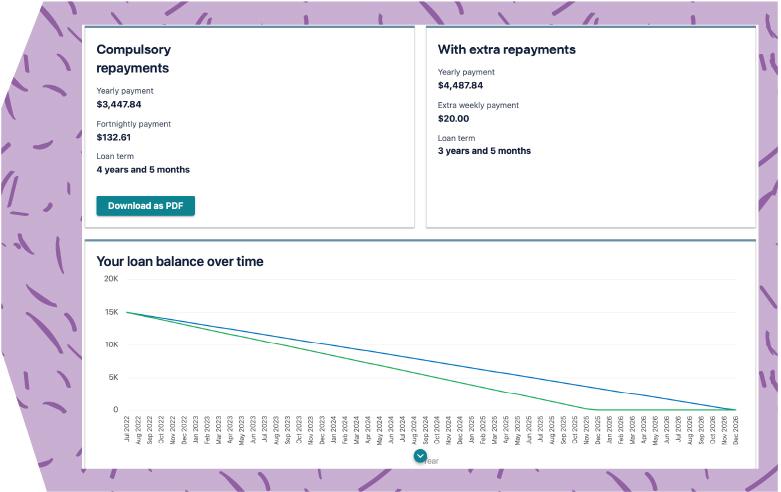

My last PAYE job offered a 3% annual pay rise. At that rate, a 12% pay rise would take around 4 years. Want that 12% sooner? Try the student loan repayment calculator and add, say, $20 a week extra towards a $15k loan. Instead of December 2026, you’ve paid off your loan in November 2025 — which gives you a 12% bump in take-home pay a whole year earlier.

Reason #3: Net worth — every dollar down is a dollar up

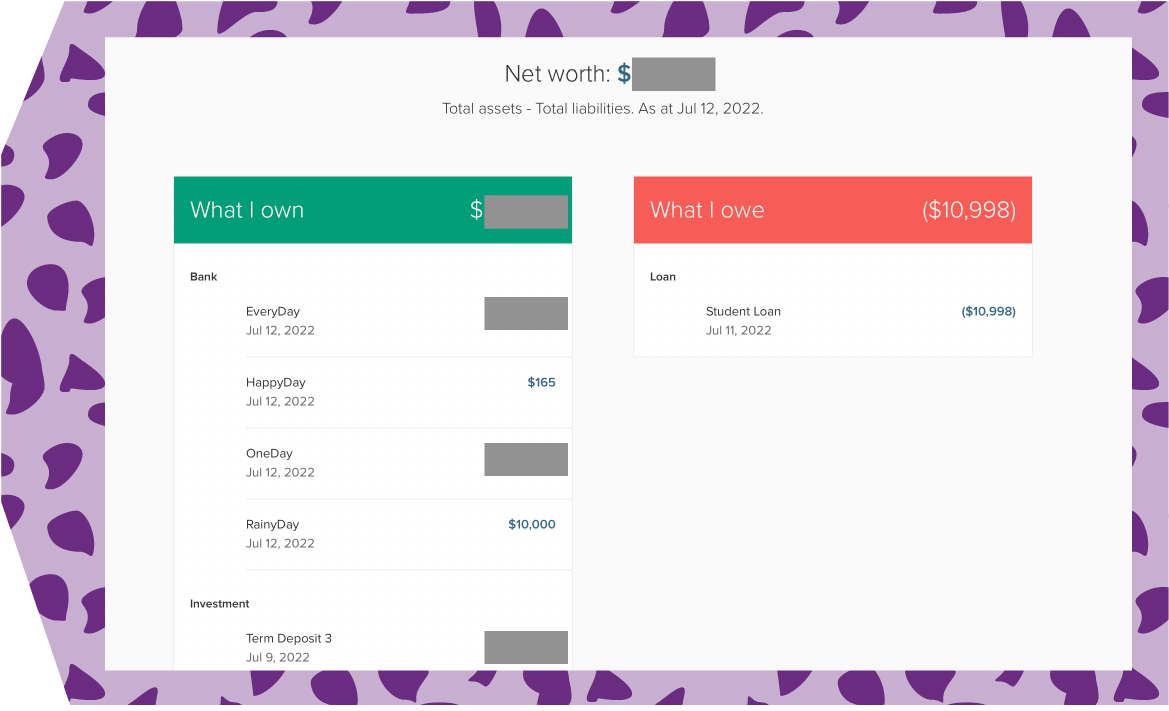

I love PocketSmith’s Net Worth page. Net worth is simply what you own minus what you owe. PocketSmith provides these in two handy columns with a total in the header — and as you can see, I have exactly one liability.

My old nemesis, the student loan.

I hate being in debt. I hate that one item under What I Owe. What I love is seeing my net worth slowly growing over time. Every dollar I pay off my student loan is another dollar that gets added to the header total, because it’s money I no longer owe to anyone.

To put it another way, every dollar down is a dollar up: A dollar paid down on the student loan is a dollar paid up to my net worth.

Now, there are different ways you can set this up, and also ways you can track it.

Set it up

- Make one-off payments direct from your bank account. Just look for the “IRD” or “Pay Tax” option and then select “Student Loan.” Alternatively, IRD payment options are here.

- Make regular automatic payments directly from your bank account. Instead of a single payment, set it to once a month. Set and forget, it’s that simple!

- Set up a weekly auto-payment directly through MyIR for a set period — say, 12 months. The IRD’s systems can be a little messy to work with, so I’d recommend looking at the other options first.

Track it

Tracking it in PocketSmith couldn’t be easier.

- I use an Offline Liabilities account with a scheduled weekly transfer from my everyday account. This is great for Basic users or if your loan institution isn’t yet supported by PocketSmith.

- For Kiwis, you could manage this directly through Bank Feeds. Just sync your feed directly with the IRD and it’s taken care of for you. No worries!

However you want to do it, PocketSmith makes tracking your loan payments easy. I love the peace of mind that comes with watching that balance tick down over time. It’s such a relief knowing that I can be debt free an entire year sooner than I otherwise would be — all for the price of a few coffees or a lunch out.

And I don’t even have to move to Australia to do it.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).