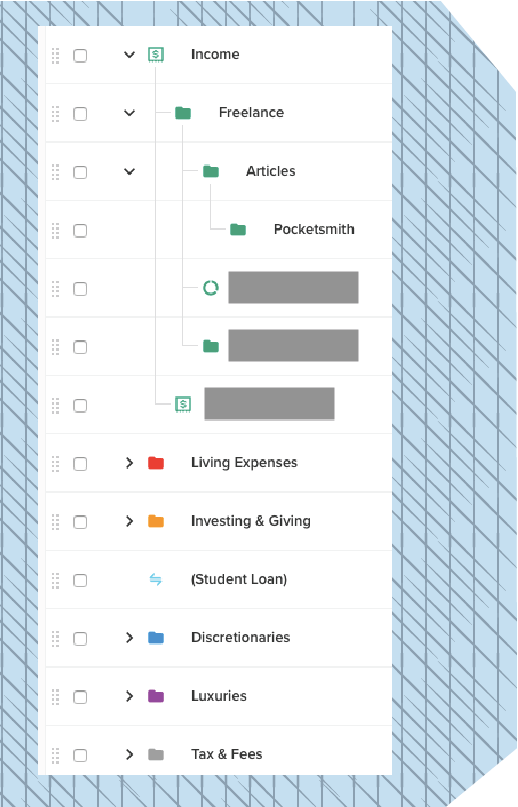

If you’ve read Part One of this Going Global series, you’ll know that a month of chaotic prep and an intense overseas move left my long-established PocketSmith setup in something of a shambles. Offshore service fees, uncategorized transactions, earn/spend budgets that barely resembled the period they were supposed to be tracking — the works.

In New Zealand I’d had, if not regular income (hello, freelancing), at least stable everyday expenses. I knew how much I needed to budget for rent, utilities, and so on. My earnings were predictable enough relative to my client load. It made my color-coded setup easy to handle. Automated rules took care of most of it.

Now, that was out the window. My spending had shot up immensely, thanks to last-minute flights and other travel expenses. My earnings were steady enough for the moment, but who knew how long that would last? And I had a bunch of transactions I simply didn’t know how to classify. I didn’t have a tidy category for them.

Were flights classed as “Transport” or “Travel?” Was clothing bought in the USA “Travel” or “Clothing & Shoes?” Should I put a breakfast run of bagels and coffee under “Groceries”, “Dining Out” or “Travel?” I could feel my brain spinning as I stared at my increasingly overwhelming pile of unorganised budgetry. Heck, maybe I should just shove everything into a “Digital Nomad” category and sort it out later? But that wasn’t a solution. Not long-term.

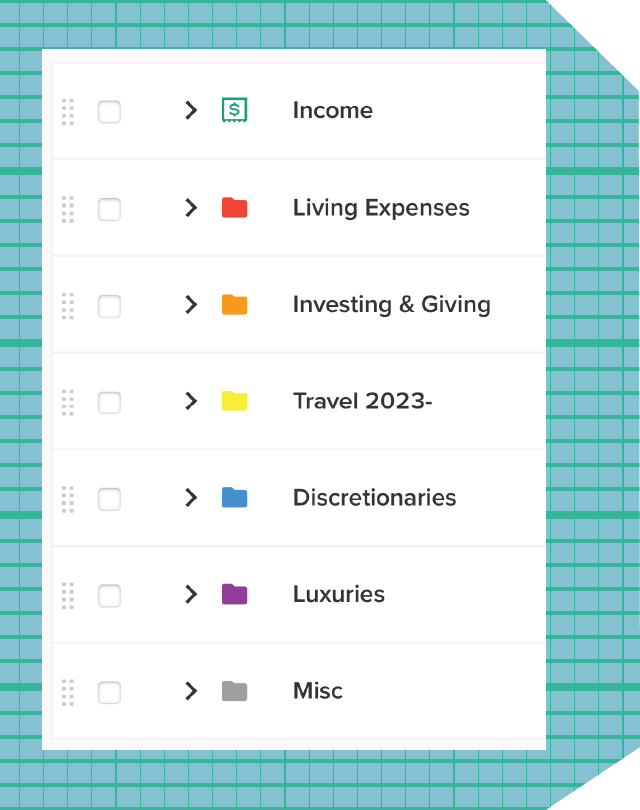

I couldn’t avoid it any longer. The system which had worked so well for me for the last two years… didn’t. Without knowing it, I had designed it for a specific lifestyle: A lifestyle I no longer had. I was on the move, and my budget system needed to move with me.

But how to do that?

I went into every category I no longer needed and stopped their active budgets. This was most of my old life. Rent, internet, household maintenance, houseplants… all the things I didn’t need while I was on the road. I was left with the bare basics: Groceries, clothing, footwear, and a couple of extras like gifts.

The plan, such as it was, was this: From the USA I would bounce to Canada and then on to Scotland. I’d spend a couple of months traveling and visiting friends and family while maintaining a decent level of remote work. At some point, I planned to settle, but I didn’t know what that might look like yet. When? Where? For how long? Who knew?

They were questions I could answer when the time came. I could reactivate those budgets when the time came, too.

I wanted to keep everything contained. That Travel category was a tempting way of doing it. But I couldn’t assign everything for the next few months to that one category. It would balloon out of control in no time.

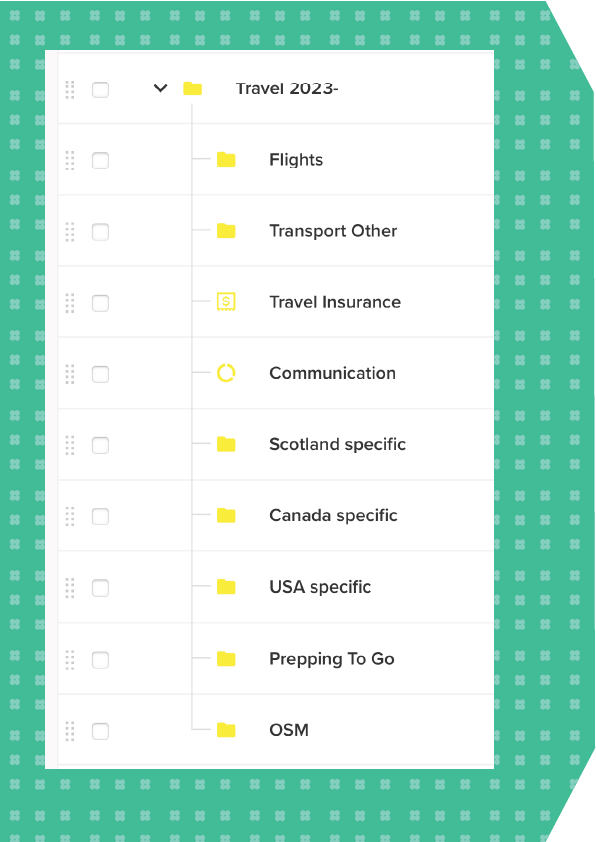

I had been assigning transactions to “Travel” which was an issue. Parent categories are only a shell for the sub-categories they hold; they shouldn’t have active budgets or transactions assigned to them. Easily fixed. I created a new “Prepping To Go” category, nested it under Travel, and moved the relevant transactions across.

Now… what were the essential areas of a new life on the road? Where had I been spending the most money? What was annoying me the most?

Essential categories: Travel insurance and communications

Expenditure: Flights

Annoyance factor: Those offshore service fees

That took me to five sub-categories. “Other Transport”, for things like trains and bike hire, took me to six. But once I’d tidied away as many transactions as I could, I still had unassigned transactions left over. One was an easy fix — the only place to file USD25 in overpriced luxury chocolates was “Regret”, a category I hadn’t used in over a year.

But the rest were frustrating. Erratic. Highly specific to the country I was in at the time. They weren’t everyday expenses like groceries, but they weren’t holiday expenses either. I wasn’t on holiday — but neither was I settled in an everyday life. Like my PocketSmith setup, I was caught in an odd sort of limbo. (More on that another time.)

They were specific to the country, so why not file them as that? One category for “USA specific”, one for “Canada specific”, and one for “Scotland specific”. Done. That gave me seven sub-categories nested under a parent category in bright sunshine yellow.

After tidying up the loose ends of last month’s budgets, I sat back and scrutinized the overall setup.

A budget system reflects its owner. This one certainly did. Like me, it held a dash of the old and a splash of the new. Like me, it was on the move and adapting as best it could. It wasn’t settled or permanent — how could it be? — but it was headed in the right direction. There were things I would change about it once I myself was settled. Once I had some stability for the next six or twelve months.

What does that look like? I’ll let you know when I’m there.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).