You think about your finances more than you realize. It’s true. There are a bunch of little moments everyday when you think “how much does that cost?”, or what you might do if you win a million dollars. How often do you think about how much money you need to pay in taxes? If you’re like most people, you’ll put off thinking about tax until the end of the financial year.

Regardless of where in the world you live, tax time can be stressful. It asks us to remember what we did over the course of the year. It’s hard to remember how much you spent on your work uniform nine months ago. It feels like there is no reward for doing your taxes well, but, it’s not that hard. The formula is mostly the same across countries: you need to track your income and expenses, with a breakdown of any deductions you’re eligible for.

As any smart budgeter would tell you, good finances are about spending small nuggets of time with your finances throughout the year. Even more so at tax time, as managing your transactions and keeping your records up to date really pays off. When everything is organized, it’s ready for you to report on. No time wasted guessing or searching for what your deductions could be.

Let’s take a look at how to use PocketSmith to track and report on your taxes:

The key to detailed reporting is good ongoing management of your transactions. PocketSmith gives you control over managing your money. Start by syncing your bank transactions into PocketSmith, either automatically with bank feeds or manually with bank files.

From there it’s still a good idea to group transactions into categories to match your personal budget. Keeping these tidy will save you time when it comes to reporting on your tax form.

“Good categorisation throughout the year means that my tax processing is quick and seamless!”

- Michelle M.

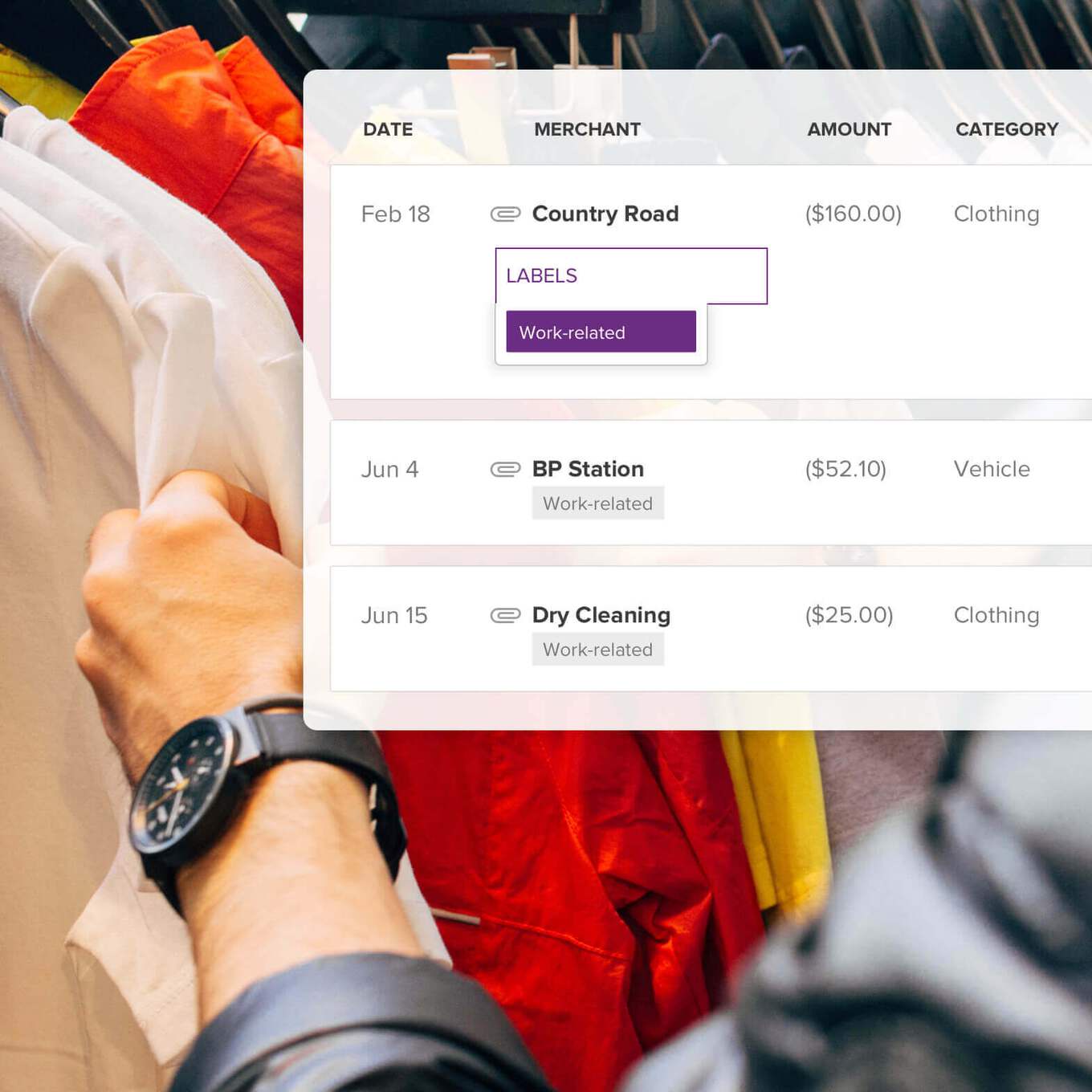

To keep track of transactions that are eligible for deductions use a label to mark them according to their eligibility. Labels are a great way to keep track of transactions across different categories, giving you much more flexibility while keeping the overall information about a category tidy.

Let’s take clothing as an example. You might have spent $1000 on new clothes over the course of the year, but your work-related deductibles are only $300 of that. By labelling the transactions for work-related purchases you can quickly find them, while still understanding the full amount in the category.

Add a label for each deductible that you are eligible for. These will vary depending on where you are doing your tax, so check in with your local state or government requirements to see what you can claim.

The last aspect of managing your taxes is keeping a record of your receipts. In most countries you’re required to keep proof of claimable transactions, like a photo of the receipt.

In PocketSmith you can attach your receipt to the corresponding transaction by adding a photo or file. The attachment will be stored against the labelled transaction, keeping it safe and sound and easy to find. You can quickly add photos of receipts while on the go via the mobile companion app.

If the attachment is already in digital format, like a PDF, you can upload it from your computer, or use the attachment inbox to email receipts and files to your PocketSmith account.

“I use PocketSmith primarily to track and keep on top of my everyday expenses across my different bank accounts… This makes it super easy for me to gather all the necessary information I need when the time comes to file my tax return.”

- Kevin P.

You’ve spent the year managing your categories, labeling your deductions and keeping your records. Now it’s time to fill out your tax forms and you need some figures. Thanks to all the little moments you recorded throughout the year, it’s all in one place.

Use the Transactions page to refine the transactions you want to report on. The graphs and charts at the top will adjust to your selection and display your totals. To filter what you’re looking at, open the Search panel in the top right corner. First, set the date range to the financial year. This will show you your total income and expenses for the period.

To get the details on your deductions, add another filter to the search. This time, select the label for the deduction you want to report on. As you hover over the charts you’ll see groupings of your expenses. The search will also show a list of all relevant transactions, with their attached receipts below for you to review.

Continue to filter out your labels in the search panel until you have the information you need for each of your deductible categories.

If you’re not embarking on filing your taxes on your own but still need to pass on your information to some else, there are a couple of ways to do that in PocketSmith.

You can easily export your transaction search to a CSV spreadsheet file. Open the file in Excel or Google sheets and check that the data is what you’re after. Then pass it on to your tax agent or accountant.

If you have an advisor who is familiar with PocketSmith or is keen to follow this guide, you can grant them Advisor access to your account. Advisors can view and manage your account meaning you won’t need to do the reporting for them.

Even if you’ve just started on your financial management journey, PocketSmith has the tools to give you control over managing your finances, security to store your receipts and the reporting to take the guesswork out of filing your taxes.

Ready to take control of your finances? Get started by choosing a plan that suits you >

Tax reporting is an outcome of good financial management. PocketSmith provides personal finance management software that helps you gain control over money, enabling you to be more productive.