While this blog post focuses primarily on the New Zealand financial system, there may still be valuable insights and strategies that readers from other countries can adapt to their own financial situations.

Last week, after church, my friend and I were chatting when she frowned into the distance and abruptly turned to me. “I’m glad freelancing is going so well for you,” she said, “but what are you doing about KiwiSaver?”

It’s a fair question, especially coming from the woman who first introduced me to The Barefoot Investor. As a freelancer, I don’t have the security of a steady paycheque every fortnight. I don’t get a minimum of 3% deducted from those paycheques towards my retirement fund. I also don’t get a 3% match from my employer.

What was I doing about KiwiSaver? My thinking around it, as I explained to her, sort of went in three stages…

Retirement contributions are an easy, mindless tick-box exercise when you’re an employee. It goes like this:

(Note: If you are an employee, I am begging you — check that match rate. I was nine months into a twelve-month contract when I found out HR had misinformed me, and the company match rate was in fact 4%, not 3%. I’d been essentially throwing away free money for nine months. It hurt.)

As a freelancer, it’s a bit more complicated. Where KiwiSaver for employees is opt-out, meaning you’re automatically enrolled unless you choose otherwise, KiwiSaver for the self-employed is opt-in. If I want to make contributions, it’s up to me to make them happen.

But when I don’t have an employer matching my contributions, is there really any advantage to locking away my hard-earned money somewhere I can’t access it until I either:

Well. Yes. There’s still an advantage… to a point.

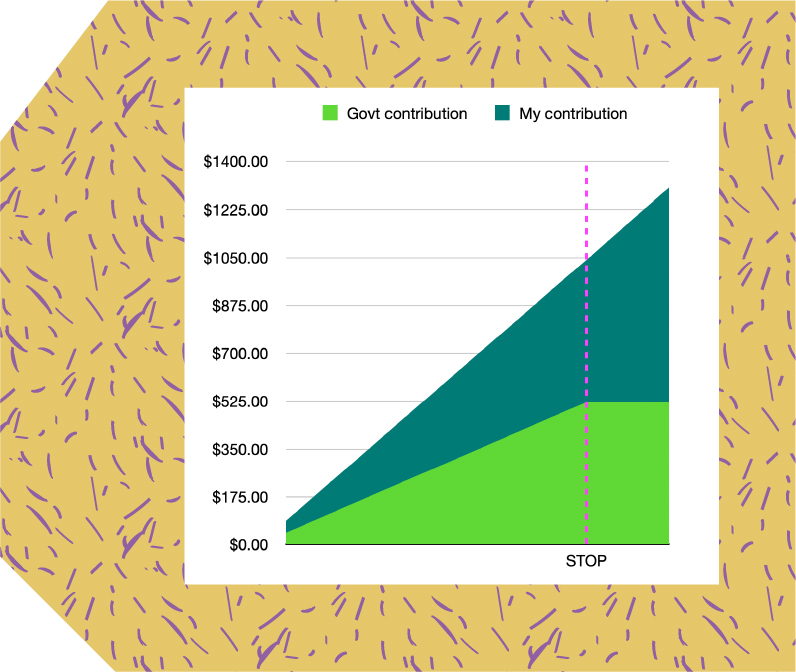

See, even if you don’t get employer contributions, you still get government contributions. These aren’t the steady 3% match that an employer makes. Instead, they’re a whopping 50%.

Yep, the government will match you 50 cents for every dollar you contribute to KiwiSaver… to a limit. Government contributions are capped at $521.43, which means your threshold for getting that sweet, sweet government-matched money is $1,042.86 of your own money. Anything beyond that point is no longer matched by the government. It’s all your own money.

So, when you can’t access KiwiSaver until you’re 65 or with the government’s permission, why would you keep contributing beyond the match point?

But that doesn’t mean you should stop altogether.

I contribute $1,042.86 a year to my KiwiSaver, which is currently in Kernel’s excellent High Growth Fund. This doesn’t mean contributing the same amount every month: It rises and falls in line with my monthly income, which I track in colour-coded categories on my PocketSmith dashboard. Then I look elsewhere.

Many people, when they think “retirement,” think of:

The truth is, there are so many more options than these. You don’t need to be a millionaire to enjoy a good retirement — but you do need to start thinking about it.

So you’ve got KiwiSaver. Great. You might have savings or a term deposit in the bank. Good. They’ll be earning stuff-all in the way of interest, but it’s better than nothing. And let’s presume you don’t own a rental property. I certainly don’t.

Now. A savings account might net you around 2% in interest. A term deposit? 4-4.5%. Investing in a broad-base index fund returns, on average, 8-9% over a ten-year period.

So 8-9% a year, averaged out, is a darn sight better than that measly 2% back in the savings account. It’s also easier than dealing with rotating term deposits and far more passive than the so-called ‘passive’ income from rental property. I mean, have you talked to a landlord recently?

As a freelancer, I want to make saving for retirement as easy and automatic as it ever was when I was an employee. Simplicity is the name of the game — no, not that Simplicity, although I did have my KiwiSaver with them previously. What I mean is I want it to be simple. There are endless options: Sharesies, Hatch, InvestNow… but my KiwiSaver is already with Kernel. Why not have my index funds with them as well?

So I do. My KiwiSaver is in the Kernel High Growth Fund. Past that magical $1,042.86 mark, I switch to investing in my own independently-held funds. Currently, these are a 50/50 mix of the NZ 50 ESG Tilted fund and the Global 100 fund, with a minuscule less-than-1% dropped into the S&P Kensho Moonshots Innovation fund for fun.

This gives me the freedom to move my money around as I see fit. With an eye to ethical investing, and a general dislike of industries such as tobacco, I can pull money out of one fund and drop it into another whenever I want. Most importantly, I can access the entirety of that money when I need to — without waiting until I’m 65 or asking the government for permission.

There you have it: My three-step freelancing plan for retirement. 65 is a long way away for me personally. I’m sure the plan will change again before I get there. But the fun is in the journey, don’t you agree?

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).