The Best Retirement, Savings, and Nest Egg Calculators

If you’ve ever wanted to find out how much money you need to save for retirement or whether you’re on track to meet a particular savings goal, you might have tried to work it out with a pen and paper. Luckily, there’s usually a calculator available online to figure it out.

- Retirement and nest egg calculators

- Country-specific retirement and nest egg calculators

- Savings calculators

- Investment calculators

We’ve compiled a list of financial calculators you might find helpful — from retirement planning to savings to investments. Just plug in the relevant numbers that apply to your situation and get the answer within minutes.

Retirement and nest egg calculators

- Financial Mentor Ultimate Retirement Calculator

- Key Point Credit Union Nest Egg Calculator

- NestEgg U

- The Retirement Solution Retirement Nest Egg Calculator

- Vanguard Retirement Nest Egg Calculator

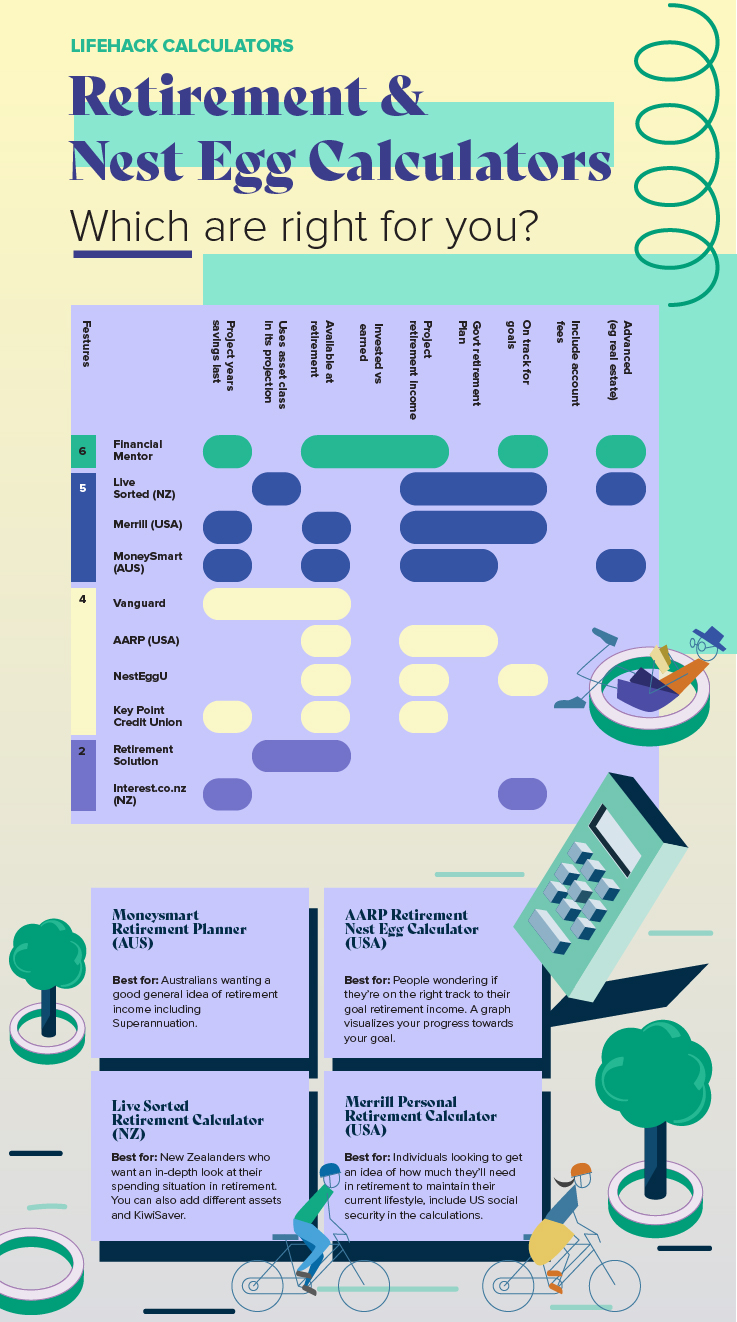

Financial Mentor Ultimate Retirement Calculator

As the name suggests, the Financial Mentor Ultimate Retirement Calculator is one of the most comprehensive. It includes all the regular inputs such as current age, age at retirement, life expectancy, total current savings, monthly savings, desired retirement income, and annual investment return. One feature available here that isn’t found on many other calculators is the ability to increase your monthly savings by an annual percentage — so if you anticipate increasing your savings amount over the course of your career, this can more accurately calculate your final retirement figure.

It also includes a section labeled “Advanced Retirement Planning” that has options to reduce spending throughout retirement, one-time lump sum payments (e.g. an inheritance), or other retirement income sources (i.e. rental properties, pension, business income).

The calculator itself functions very similarly to the others we’ve mentioned here, but the difference comes in the advanced retirement planning section. If you know you may have a more complicated retirement plan than simply your retirement savings, this will likely be much more useful to you than many of the other calculators out there. Having the ability to input inheritance payments or retirement income such as rental properties means that you can more accurately plan for your retirement. Although if you have some more complex finances, you should probably seek professional advice, as this acts merely as a starting point.

Best for: Those looking to do some more complex retirement calculations. The ability to set specific dates for contributions and include any possible lump sum payments (i.e. sale of real estate or business) may give a more accurate picture for individuals with more assets than just their retirement investment account.

Key Point Credit Union Nest Egg Calculator

The Key Point Credit Union Nest Egg Calculator has five main variables: Years until retirement, initial savings, annual investment until retirement, annual withdrawal amount at retirement, and the annual rate of return. Once you input these variables, you’re presented with a total nest egg figure as well as a graph showing how it will change over time depending on the variables you entered.

For our tests, we used 35 years until retirement, initial savings of $20k, an annual investment amount of $10k, annual withdrawal in the retirement of $70k, and an interest rate of 7% annually. This gives us a nest egg of $1,595,900 and estimates us to have a nest egg balance throughout retirement.

Similar to some of the other calculators we’ve discussed, this one gives a good indication of where your financial position and what you may need to do to improve your retirement position. However, if you’d like to include types of investments such as real estate, you’ll need to look at other calculators such as the Sorted one.

Best for: Those who want to see what their nest egg will be at retirement and how long it will last. Like some of the other calculators, it’s limited by the types of assets you can include, thus only giving you a rough idea of the position you’ll be in at retirement.

NestEgg U

NestEgg U is another pretty simple retirement calculator, this only requires your current and retirement ages, your current income, the percentage you contribute towards retirement, your current retirement account balance, the type of investor you are (aggressive/moderate/conservative), expected annual pay increase, retirement income goal, and age expectancy. It then calculates your retirement savings balance at retirement, the retirement income needed, and the annual retirement income generated.

For this calculator, we input the following numbers: Current age of 30, a retirement age of 65, an income of $70,000, a savings rate of 15%, with current retirement savings of $20,000. We also used a moderate investment profile, 2% annual raise, 75% income retirement goal, and a life expectancy of 90 years. This comes out to a balance of $1,710,000 at retirement with an annual retirement income of $96,272.00. The calculator also tells us that this is just 91.69% of the $104,994.00 needed to hit our 75% income retirement goal.

We really like how this calculator presents its results in how full your income bucket is. In our example, it says, “Your bucket is 91.69% full”, thus indicating that more needs to be saved to reach our goal income. The idea of filling the bucket makes it feel more achievable than just “you need to save an extra $X per week to hit your goal.” But it’s not perfect and lacks some of the features that calculators such as Sorted have, such as including your other assets like real estate.

Best for: People who want to see their progress towards being able to retire. Good for a rough idea but limited in the types of assets you can include.

The Retirement Solution Retirement Nest Egg Calculator

The Retirement Solution Retirement Nest Egg Calculator is one of the most simple you’ll come across. You need to enter your current age, retirement age, current retirement savings, the monthly amount invested, and the annual interest rate. Hit enter, and you’ll be greeted with the total amount available at retirement, the number of contributions, the total amount invested, interest earned, and your last deposit date.

Unlike the Vanguard calculator, this just shows you how much you’ll have available to you at your desired retirement age. For our experiments, we entered an age of 30, a retirement age of 65, savings of $50,000, and monthly savings of $1000 at an annual interest rate of 7%. This comes out to $2,560,541.80 by retirement age.

This calculator works great for a quick estimate of where you’ll be financially when you retire. It does fall short when it comes to any nuance within retirement planning. It gives no option to include pensions or real estate, not to mention the fact that you can’t change up the interest rates to reflect what asset classes your retirement portfolio holds.

Best for: Getting a rough idea of what your total retirement investments will be when you retire. Similar to an investment calculator, it’s great if you want to know how much interest you’ll have gained relative to the amount you’ve invested once you retire.

Vanguard Retirement Nest Egg Calculator

Vanguard’s Retirement Nest Egg Calculator is an effective, if somewhat simple, solution to figuring out how long your savings will last and your projected savings balance throughout retirement. All that’s needed to make these projections are four variables: How long your savings should last, your current savings balance, your yearly spending, and how your savings are split between financial instruments (cash, bonds, stock).

For example, if you want your savings to last 30 years, have $1.5 million in savings, an annual spend of $60k, and a 50/30/20 split for your asset types, you have a 91% probability of your savings lasting 30 years. It also gives you a projected savings balance over the course of 30 years.

On the downside, it doesn’t include provisions for pensions or other assets such as real estate that you may own. Converting to a cash equivalent to use the calculator will not take the differing rates of return for different asset classes into account and thus produce inaccurate results.

Best for: Those with relatively simple finances or if you want to get a rough idea of where you’re at.

Country-specific retirement and nest egg calculators

- Moneysmart Retirement Planner (AUS)

- Interest.co.nz Retirement Calculator (NZ)

- Live Sorted Retirement Calculator (NZ)

- AARP Retirement Nest Egg Calculator (USA)

- Merrill Personal Retirement Calculator (USA)

Moneysmart Retirement Planner (AUS)

The Moneysmart Retirement Planner is slightly different from the rest on this list as it focuses on Australian Superannuation for your retirement. The main things you need to input are your current and retirement ages, your current super balance, and the contributions from you and your employer. It then calculates your annual retirement income. You’re able to add in other variables like fees and investment options and homeownership, and other personal assets that you may have.

As a retirement planner, it does the job quite well. Integrating Superannuation is especially useful if you’re from Australia and don’t want to make your super calculation separate from your other assets when you’re retirement planning.

Best for: Australians wanting a good general idea of retirement income, including Superannuation.

Interest.co.nz Retirement Calculator (NZ)

The Interest.co.nz Retirement Calculator calculator offers a different perspective on retirement savings. Rather than calculating the amount of money you’ll have at retirement or the amount you’ll be able to spend whilst in retirement, it calculates how long you’ll be able to live on your current savings trajectory. You’re able to enter in figures such as current and retirement age, your income before and after-tax, expenses while working and retired, current savings and rate of return, as well as superannuation. You can also add your Kiwisaver balance, employee contribution, and rate of return.

Our calculations used a pre-tax salary of $75,000 with approximately $45,000 expenses while working and $40,000 while retired. When we added in $30,00 in savings and $20,000 in Kiwisaver with a 7% rate of return and 2% inflation, the calculator said we’d be able to live to an age of 120 years.

This presents the major hurdle for this calculator — it only calculates how long you’ll be able to live on your funds, and only to a maximum of 120 years. If the only thing you want to know is whether you’ll have enough money saved for retirement, this tool may work for you. On the other hand, if you want some more concrete numbers about your assets or income throughout your retirement, you may want to search for another tool.

Best for: New Zealanders looking to see how long their expected retirement savings will last. The ability to add KiwiSaver makes it easier to get a rounder picture of your retirement.

Live Sorted Retirement Calculator (NZ)

The Live Sorted Retirement Calculator is one of the more in-depth retirement calculators we tested, as it gets into the nuts and bolts of retirement. You’re asked to enter your current and projected retirement age and what your desired weekly ‘allowance’ would be once you retire. Then you enter your retirement funds — these may include your Kiwisaver balance (401k equivalent), savings, investments, home equity, inheritance, sale of a business, or others. From there, you add any other income you may receive and NZ Super.

This calculator is an excellent tool if you already know what you’re likely to have in savings, investments, etc, by the time you retire. It allows you to see what weekly spending amount you can afford and if that’s a relatively high or low amount. The great thing about this calculator is how you can plug in and change all of the different inputs to see how they affect your weekly spending in retirement.

Best for: New Zealanders who want an in-depth look at their spending situation in retirement. The ability to add different assets and KiwiSaver means it’s more helpful than your standard “here’s how much you’ll have when you retire” calculators.

AARP Retirement Nest Egg Calculator (USA)

The AARP Retirement Nest Egg Calculator gives inputs for two major sections: “Retirement plan inputs” and “investment returns, inflation, and social security.” The retirement plan inputs section consists of sliders for your current age, age at retirement, annual household income, current retirement savings, expected annual income increase, the percentage of your pre-retirement income you expect to have in retirement, and the number of years in retirement. The investment returns, inflation, and social security section offer sliders for the rate of return before and during retirement and the expected rate of inflation, marital status, and whether or not to include social security.

When you input all of the numbers, the calculator gives you a total projected nest egg you’ll need for retirement, the amount you have left to save before hitting that target, and the monthly amount you’ll need to save. Using similar numbers to the previous calculators (salary of $75,000 at 30 years old, retiring at 65, etc), we’d need $2,395,557 at retirement and save around $1100 per month.

All in all, this calculator is an effective tool to give you a rough idea of how much you should be trying to save to hit your goals for retirement. Like most calculators, this is just a starting point, but it certainly helps that it gives you a concrete number for both your estimated nest egg and the monthly amount you’ll need to save to get there.

Similar retirement calculators from different websites that use the same format include:

Best for: People trying to see if they’re on the right track to their goal retirement income. The easy-to-use graph shows whether you need to save more to meet your goal or if you’re ahead of where you need to be.

Merrill Personal Retirement Calculator (USA)

The Merrill Personal Retirement Calculator is one of the best-looking calculators we have come across. Its main inputs include your annual income, current savings, monthly savings, investment style (safe/moderate/aggressive), retirement spending, retirement age, and life expectancy.

Using these inputs tells you how much you’ll need total, annually, and monthly to retire. It also allows you to include social security in the calculations. What we found unique to this calculator was its ability to show what your monthly contribution numbers would be in a good vs a poor market. It also has excellent information text bubbles to help you understand what all the different numbers actually mean.

Best for: Individuals looking to get an idea of how much they’ll need in retirement to maintain their current lifestyle (total, annually, monthly). Specifically for individuals from the USA, as it can include social security in the calculations.

Savings calculators

- Calculator Soup Savings Calculator

- CalcXML “How long will my money last” calculator

- Investor.Gov Savings Goal Calculator

Calculator Soup Savings Calculator

As far as financial calculators go, this one has it in the name of the website. Calculator Soup Savings Calculator offers many useful tools to help with your finances.

The savings account calculator is probably the easiest to use on this entire list. All you have to enter is the starting amount, the amount you’re going to deposit (weekly/monthly/annually), the interest rate, the length of time, and the compounding interval. This can help you figure out how much you’ll have saved in the future (including interest) if you make consistent deposits over a period of time. For example, with an initial amount of $1000 and monthly deposits of $500 for 10 years, compounding 7% annually, the final total comes out to be $87,976.59.

Best for: Figuring out how much your savings will grow over time. It’s a very simple calculator but does its job well.

CalcXML “How long will my money last” calculator

The CalcXML How long will my money last calculator estimates how long your money will last when you systematically withdraw money each month. It can act similar to a retirement calculator as it’ll show you what happens to the principle after you take out your retirement income.

We used $1 million in savings with $5000 in monthly withdrawals as an example. This calculator allows you to adjust assumptions, so we chose to increase the annual withdrawals by 2% to match inflation, an annual before-tax return of 8%, and a marginal tax rate of 22%. The resulting graph shows that our savings will last approximately 29 years before running out.

Although this calculator will not tell you how much you need for retirement, it is useful for approximating how long the money you currently have will last. Using this in conjunction with other calculators may be helpful to plan your retirement or any other long-term expenses.

Best for: Those wanting to figure out how long their savings would last given consistent withdrawals, e.g. someone facing unemployment and needing to survive on their savings.

Investor.Gov Savings Goal Calculator

The Investor.Gov Savings Goal Calculator from the US Securities and Exchange Commission is for calculating your savings goals rather than retirement. Entering your goal, initial savings, years to grow, and estimated interest rate calculates how much you should aim to save on a monthly basis.

We aimed for $100,000 in 10 years at a 7% annual interest rate for our test. According to the calculator, we’d need to save $484.50 each month to reach our goal. This can be a great tool if you have a set goal in mind for something you need to save for.

Alternatively, Investor.Gov also has a compound interest calculator that shows how much your savings/investments will increase over time, depending on how much you put away each month. For example, with an initial sum of $10,000, if we save $500 per month for 10 years at 7% the total would come out to $102,570.20.

Both tools are great at what they do. Still, they are inherently limited and probably shouldn’t be used for retirement planning as they lack some of the features that other calculators have — things such as your retirement draw rate and inclusion of other assets like real estate.

Best for: Great for understanding how your savings will grow with regular deposits/investments. Would be useful for someone looking to save for a specific goal (purchasing a house) or simply wanting to see what their savings/investments may look like in the future.

Investment calculators

Calculator Soup Investment Account Calculator

The Calculator Soup Investment Account Calculator helps you somewhat accurately forecast how much money you’ll have in your investment account in the future.

By entering your initial balance, start date, interest rate, monthly deposits, monthly withdrawals, and account fees, you’ll quickly figure out how much you’ll have in your investment account. This can even be used for your retirement accounts as you can schedule when you want the withdrawals to start - they can coincide with your retirement.

Best for: People who want to figure out their total investments after deposits/withdrawals/fees. The inclusion of fees makes it unique from the other calculators on this list.

Calculator.net Investment Calculator

When it comes to calculating your investments, there are many different things you may want to find out. Calculator.net Investment Calculator uses multiple different calculators to help you with your investing journey.

To find your total investment after a period of time, all you need to do is enter your starting amount, time frame, return rate, compounding period, and contribution amount. For example, if you start with $20,000 and invest $1000 a month for 10 years at a 6% return annually, you’ll end up with $198,290.40. This figure is broken down into the amount invested, and interest gained.

The other investment calculators use similar formats to find out:

- How much you’d need to invest each month/year to get a certain return. You can enter your target investment, the initial amount invested, rate of return, time frame, and when the interest will compound.

- What return rate you’ll need to hit your target investment. Enter your initial investment, target, additional contribution amounts, and time frame to find out your required rate of return.

- The starting amount you need to reach your investment goal. Enter your target, rate of return, additional contribution amounts, and time frame.

- Your investment time frame. You’ll need to enter your initial investment, investment goal, rate of return, compounding period, and additional contribution amount.

Best for: People looking to play around with different investing variables. If you’ve got a target investment total in mind but are unsure about the other metrics, this is the calculator for you.

Anton is PocketSmith’s Marketing Coordinator and is currently completing his BComSci degree in Marketing and Ecology alongside working at PocketSmith. Anton started his investing journey in high school and hasn’t looked back since. He’s a strong proponent of index investing, although he still likes the thrill of individual stocks on the side.