One of the biggest lessons I learned from a career in sales was to use your ears twice as much as your mouth.

When a client was objecting to a price or a product feature, instead of butting in to fix the problem, I zipped my mouth and doubled down on listening to them instead. What was the real cause of their objections, I wondered?

Today I use that same process to talk to my husband Jonny about money. Conversations happen frequently, and they are useful and effective. Money doesn’t cause us angst, stress or anxiety.

Having a financial conversation doesn’t have to be difficult and it’s certainly better than financial stress becoming a pain point in your relationship. About a third of adults with partners say that money issues are a major source of conflict in their relationship, but I’m relieved that money is not a pain point in our home. I want this for everyone, so I’ve written a guide on how to talk to your partner about money!

Jonny and I didn’t reach our zen state by accident. We started talking about money early, and accepted the awkwardness that came with those early conversations.

Let’s start with how different we are. We’re chalk and cheese when it comes to:

With our differences, conversations were bound to be challenging at first!

But, remember how early in a relationship, sex could be this incredibly awkward thing, but the more you ‘did it’ the less awkward you felt?

I don’t mean to be crass, but it’s the same with money!

The more chats about money that you have, the less awkward you will feel and the more natural it becomes.

Jonny and I started talking about money very early on and we have never really stopped. He recalls an ‘awkward conversation’ we had soon after we met. I had asked him — in public no less — how much he earned.

In my memories, it was an excellent conversation! I was fascinated to learn what he earned and what he did for a career.

So, here’s the truth. He felt awkward. I was fascinated. But we both listened to each other with kindness, and pretty quickly, we found common ground.

Since then, nothing is off-limits when it comes to money.

No matter what outlandish financial idea one of us might come up with, the other will patiently listen and hear the other out. Then the discussion can begin. We don’t always agree but we do always find a compromise that both are happy with.

It’s about listening well, with kindness and being honest. From there, building trust and shared goals will come.

Let’s face it. In a relationship, one person - let’s call them the Family Chief Financial Officer, or CFO for short - is usually more ‘into’ money than the other.

That is absolutely fine.

But it’s important that even if the Family CFO is doing all the day-to-day budgeting and bill paying, that both partners have an understanding of what’s going on.

To do that you have to discuss money and you may have to set aside time to do it. What that looks like differs from family to family. It could be:

Choose a time that works for you. The key is that you both have to come into the conversation ready to chat.

I’m a real morning person and I used to spring a conversation about money on Jonny just as he was waking up, or even worse, when he was still in bed. To say he was unprepared for the conversation was a gross understatement!

Pick a distraction-free meeting place that you both agree on.

Writing a list of what you want to chat about also helps keep the conversation on track.

Here’s a sample agenda:

All this day-to-day life admin is worth chatting about, because you will each bring your perspective to the table. This can only help you both make better decisions.

I’ve spoken to many people from all walks of life about money. And every single one of them credits their upbringing for shaping their money habits, both good and bad.

Recognizing each other’s perspectives around money will really help you understand the ‘why’ behind your partner’s actions and words.

I recall many of my own “oh, so that’s why you think that way” moments in my own relationship.

But it’s equally important to acknowledge any negative money behaviors and address these. The beauty of being an adult is that you get to write the script.

Keep what you find useful, be excited for your future, but let the rest go.

There are few people who go on holiday without knowing where they are going. Yet with money, we often amble along with no clear idea of where we are headed, making it very easy to get lost along the way.

It might be that you both really want your mortgage gone as quickly as possible, yet you have signed a 30-year mortgage with your bank which will prevent that from happening. By discussing this and setting a goal together you can make extra payments and become debt-free far sooner.

Or maybe you’re thinking of starting a family and know that you would like to be a stay-home parent. By discussing this and financially planning for it in the years leading up to parenthood, you can make this a reality. But only if you set it down as a goal. For example, you might want to start investing together to make sure you can fund your children’s tertiary studies.

A quick and useful exercise I learned from Playing With Fire by Scott Rieckens, is for each person to write a list of the top 10 things that bring them joy. Then compare your lists and make sure that you are structuring your money and setting goals in a way that reflects your values and desires.

The key is to think and work as a team, even if you have some goals that are different to each other. Think about your long-term goals and short-term goals. Just talk them through and compromise, reach an agreement and make a plan.

You will notice that I have barely mentioned the word that can sometimes cause the most angst, budgeting!

To me, it’s last on the list for how to talk to your partner about money. You need to get the communication flowing first.

Once you can see each other’s position, motivations and goals, then setting a budget should flow quite easily.

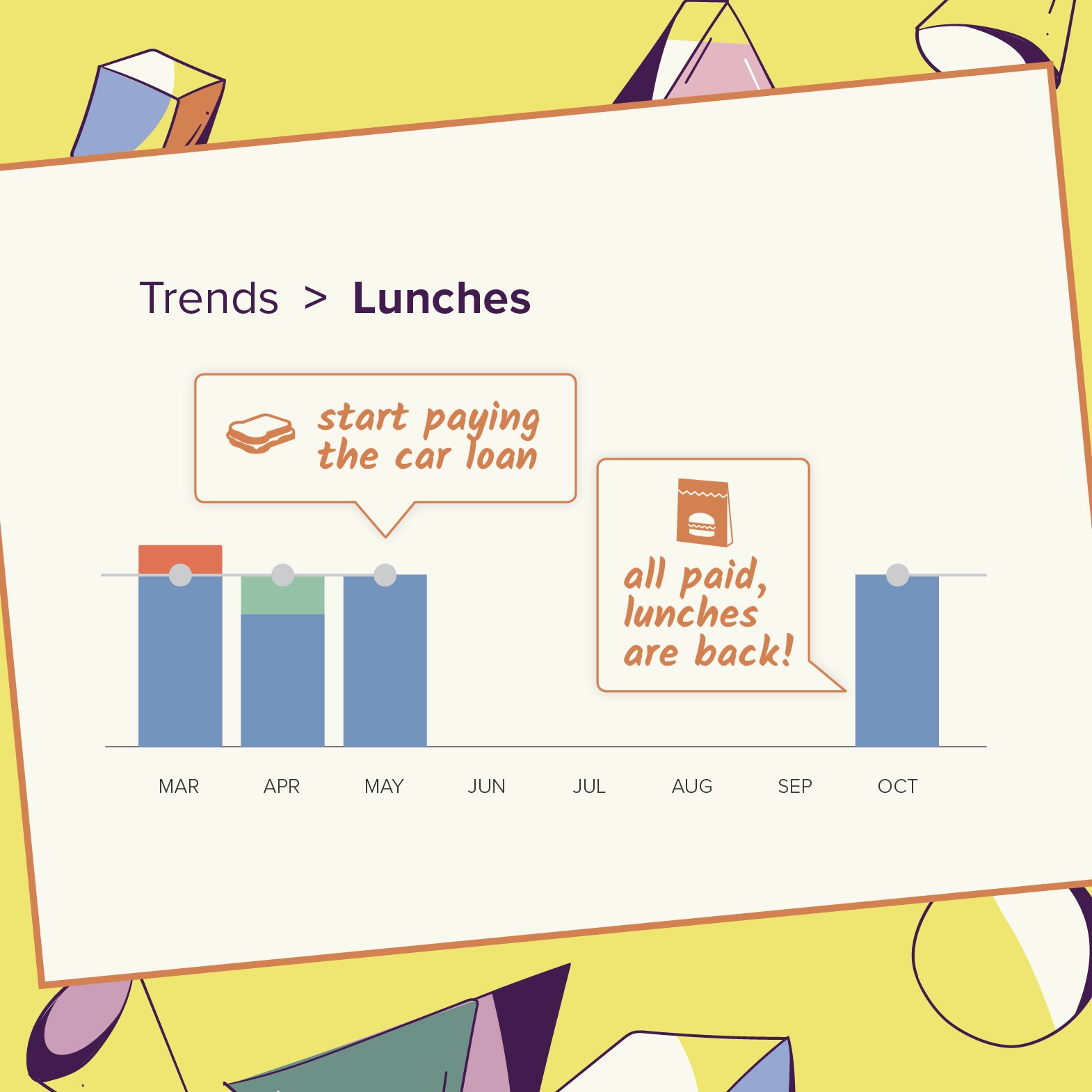

For example, if you are spending $75 on lunch a week, but as a couple you have decided to pay off your car loan quickly, then it becomes a relatively obvious choice for you to start bringing your lunch from home. You’d then divert what you would’ve spent buying lunch to the car payment instead. You will feel far happier with your homemade lunch when you can then track the progress of your shared goal, to pay off the car.

A budget isn’t a restriction. I see it as spending on the things that make you, as a couple or family, collectively happy.

At your regular money catch-ups, remember to keep asking questions, and reviewing the status quo.

Tweaking and changing is all part of a healthy process. It will take time before you see the strengths and weaknesses in your plan, as well as your behaviors around money.

Keep discussing your finances by talking through these strengths and weaknesses, and before long I can guarantee that any stress and anxiety you feel around money will start to leave you.

Take it from me, having a partner on board, working as a team toward attaining a common goal truly is one of the keys to a happy relationship.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.