If recent world events have taught us anything, it’s that as humans and as a society, we’re incredibly resilient and adaptable. We’ve all had to learn to operate in this post-COVID normal. It got us thinking — are there any lessons we can apply from this to how we manage money?

Managing your money can sometimes be a bit complicated so here are some bad habits that you can start overcoming today!

Hands up who knew that there would be a global pandemic this year? And that it would derail so many of our money habits? I didn’t. But I did know that something would come along to stress test my financial plan. Which is why I have taken a bit of time over the years to plan for that something. It’s absolutely worth planning for. That way you won’t be blindsided when something does happen.

You aren’t doing yourself any favors by pretending that something won’t come along. So trust me when I say you will feel immense freedom when you know that you have planned for them in advance.

You can plan for all sorts of somethings:

Your car is failing its warrant of fitness (WOF) because it needs four new tires at a cost of $1,000. You can plan for that by setting money aside in the months leading up to your next WOF.

You can plan for that by working out how much you spend each month, how much the government will pay you in superannuation and how much you will need to have invested in a savings scheme to make up the difference and supplement your income in retirement.

You can plan for this by opening a savings account that has enough funds for at least three months of expenses. This is called an emergency fund and should only be touched in the case of emergencies such as a loss of income or unexpected expenses like vehicle maintenance. Saving money and creating an emergency fund allows you to have access to immediate funds if you lose your income. This will give you breathing room to cover all your expenses whilst you job hunt.

It’s hard to plan for something we can’t see. But by just spending a bit of time thinking about the situations that have surprised you over the years, you will become far better at predicting something.

It’s easy to make your life more complicated than it needs to be by getting bogged down in the details. In my family, we refer to making a simple decision into a complicated one as “putting it through the complicator”. We are experts at this habit!

It takes up unnecessary time and it generally makes one member of the family unhappy! When it comes to money habits, it’s easy to put a simple process of tracking your earnings and spending “through the complicator”. Here’s an example:

I travel around by car quite a bit, meaning I fuel up in different towns using a range of fuel suppliers. Should I track them all separately in PocketSmith: Caltex, Z, Gull, NPD, BP? Would that be any use to me (NO) or am I just getting bogged down in the details and making a simple transaction like fueling my car more complicated than it needs to be (YES)?

They are all in one category named ‘Fuel’ and at a glance, I can see what I’ve spent across a month which is a detail that would be lost if I categorized them individually.

Keep it simple!

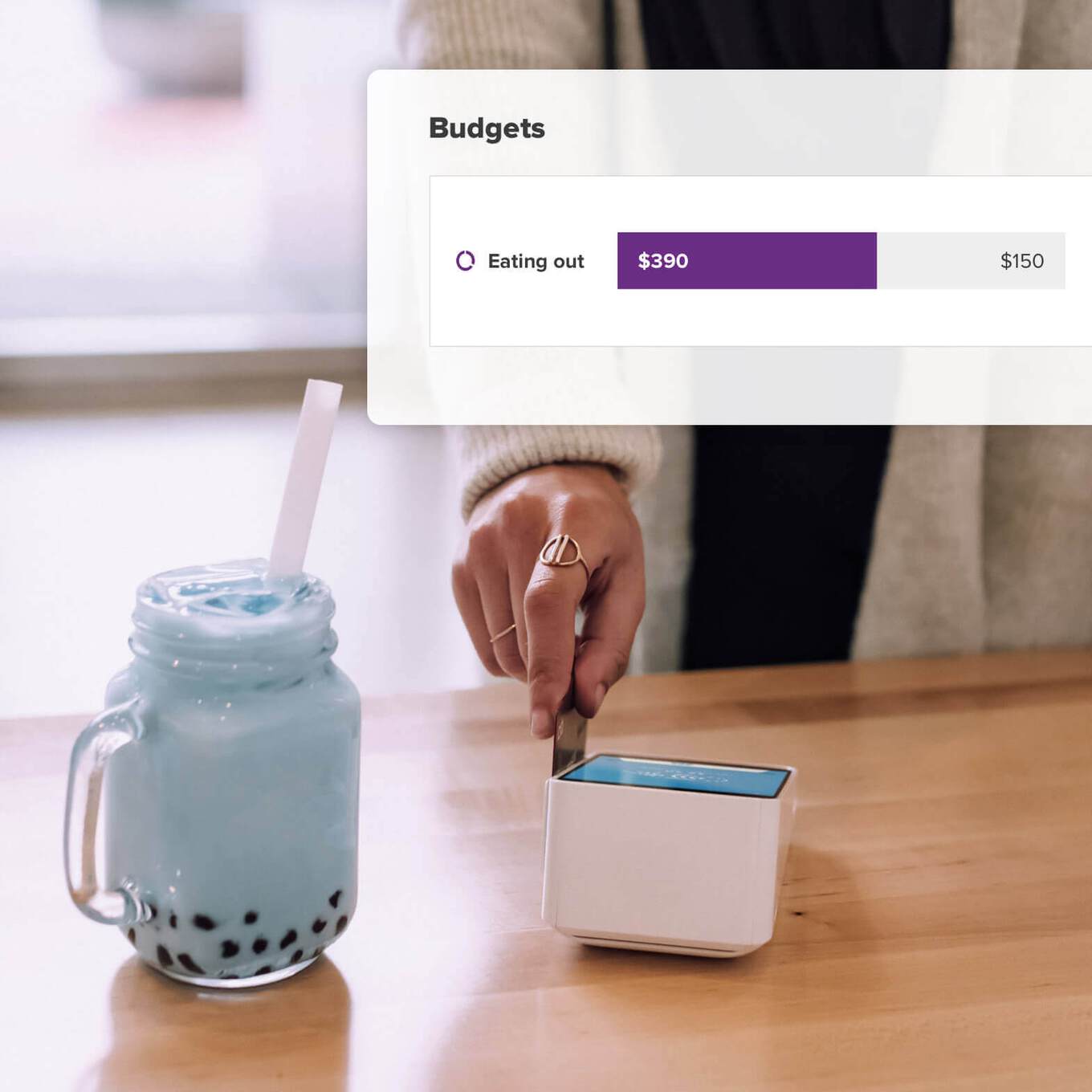

There are many moments throughout the week where money can just disappear. If you just keep a budget in your head, as many do, then you will never capture these expenses because you don’t notice them while you are actually doing them.

It wasn’t until I started tracking my spending that I noticed the times I wasted away my money. Here are two examples that I found:

Another bad money habit is one I like to call the “fritter factor”. Reducing the “fritter factor” is an important step in taking control of your spending. It’s my biggest weakness and happens when I’m wandering around the shops after collecting my daughter from school. To counter this “fritter factor”, I simply leave my wallet at home! We still enjoy some shopping time and if there is something that we feel we do really need, it can wait for us to return to the store the next day to buy it. Chances are we have forgotten about it by then anyway!

This can be extra important if your impulse buys tend to be bought with a credit card. Keeping your credit card debt under control is vital, especially when you take into account the next habit.

Bank fees, credit card fees, investment fees. Ignoring these is a bad money habit, yet often a lot more covert. You might look at your financial statements at the end of each accounting period and think that these fees aren’t a big deal. Many services we use have little fish hooks attached — a small fee here, a small fee there — if you don’t pay attention, they soon add up.

I encourage you to seek these out and cancel them or question them. You will be surprised at how often a company will waive a fee if you ask.

In most relationships, there tends to be one person who leads the finances. They might look after the budget and keep all the paperwork tidy. For it to work well, there needs to be good communication. Or else one person ends up running away with the spending, leaving the other to carry the load.

When your partner comes to you and tells you they are worried about the family finances take the time to listen. It’s likely that they have done some calculations, read some books, gained some awareness and they feel in their heart (and in the math) that you are both on a bad path financially. Staying on your course won’t end well, so for goodness sake, please listen to them!

Remember that it’s more than just sharing the financial load, there is also hidden anxiety and stress involved. So please listen, and if you’re not sure you are listening enough, check in regularly with your partner.

I often hear from people who are experimenting with different money approaches. They’re reading every blog and book they can find on FIRE (financial independence retire early) or personal finance and they are absorbing podcasts on double-speed whilst completely reimagining their entire financial life. Their partner may not even notice, or they might be a bit nervous that something is up.

The best way to introduce new money habits to your partner is to bring them along with you on the journey. Share what you are learning, whether that may be by sending them the books/blogs/links you are using, or if they have zero interest in reading screeds of text on money, then paraphrase the key points into bullet points.

Your current financial position, whether good or bad is made up of hundreds of decisions made up over a joint lifetime. Therefore, changing direction can take a bit of time too and it’s no point doing it in a rush, or alone. Every good adventure is better with a friend by your side.

I used to work in the housing industry where I helped clients design beautiful homes. One request that I always got was to add more insulation so that the family would be warm and comfortable. Unfortunately, sometimes the design would be over budget and cuts had to be made. Too often clients would ask me to “remove the extra insulation because I can’t see it anyway”! Possibly the shortest term thinking I have ever witnessed!

Insurance is like insulation: you can’t see it, but it’s there when you need it. Making sure you have an adequate level of insurance is crucial to a comfortable life. Unlike insulation, your insurance situation changes often and you need to adjust and review it regularly.

There are many valuable types of insurance, including renters insurance and auto insurance, that may be offered by your insurance company. Keep in mind that you may get a more favorable deal by shopping around different companies.

You don’t know what you don’t know. So the decisions you made in the past should be left in your past - despite the fact that you may still be paying for them today. It’s normal to make mistakes. Be kind to yourself, focus on your growth and not repeating the same bad money habits over again.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.