Those who are actively pursuing FIRE (Financial Independence, Retire Early) have an intricate knowledge of their personal finances. It is one of the main tools in their toolbox, outside of cutting their costs, maximizing their income and ramping up their investments.

Some people love the systematic tracking of their every financial move, but the reality is that others groan at the very thought of it! But that’s OK, you can still aim to FIRE. It’s all about finding the balance that works for you.

I’ve mentioned in my previous blog posts What is FIRE and How to achieve FIRE that everyone’s journey to financial independence and retiring early looks different. Thankfully, PocketSmith can easily give you the level of detail you need to be able to easily track your journey to FIRE.

Those pursuing FIRE generally have a bit going on. By nature, they are adventurous types who live life a little differently and they may have multiple streams of income coming in.

PocketSmith easily takes care of this by importing ALL of your banking transactions and categorizing them into the areas you set up which will, of course, be unique to you.

Let’s take a look at how you can use PocketSmith to track your FIRE journey!

Your FIRE goal is to spend as small a percentage of your annual income as possible.

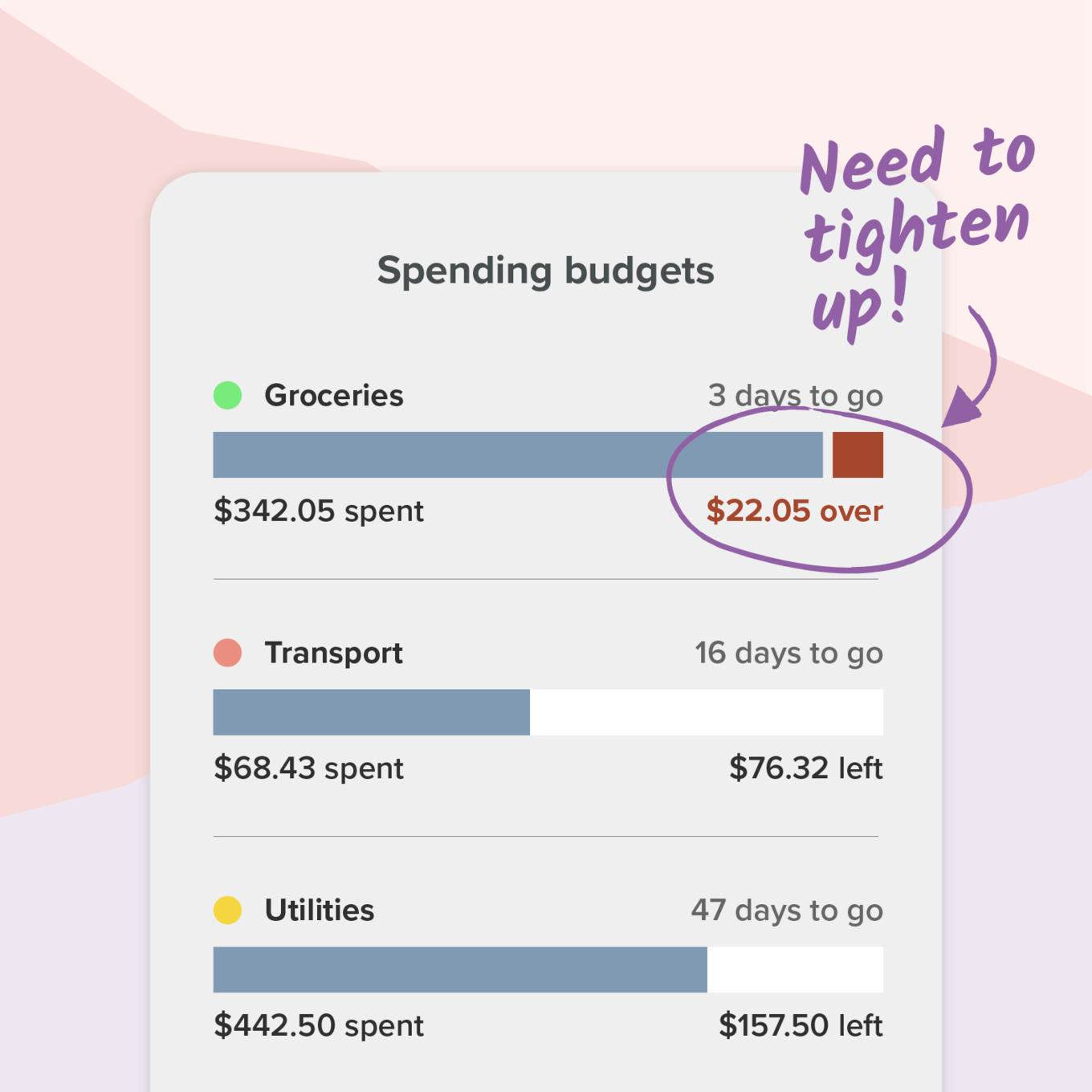

You can control your spending by using Budgets in PocketSmith. Those wanting to retire early will set themselves strict budgets for different categories like:

They will drive the cost of each category as low as possible. Then, using actual data from previous transactions that they have tracked in PocketSmith, they will set a fixed budget using this figure.

PocketSmith will then show how you are tracking within that budget category.

They hold themselves to this strict budget. Whereas other people may overspend and not worry too much about it, those in the FIRE community will do no such thing, telling themselves that when they have spent their allocated money, then that’s it. Spending stops!

If they do take their eye off the prize, PocketSmith will alert them to spending overruns and help to get them get quickly back on track.

They combine their PocketSmith budget with their own willpower to do everything within their power to stick to it. You don’t wander into FIRE - it’s regular and consistent attention to detail over a number of years!

It may sound restrictive, to be constantly checking in on every dollar spent, where is the fun in that?

Many say that the opposite is in fact true. Knowing in advance where their money will be allocated actually gives immense freedom and ability to relax and enjoy daily life, knowing that their goal is always firmly in sight.

PocketSmith creates firm guard rails to live their life within and over time, a reduced spending habit becomes just that, a habit and not something that you actually have to think about too much.

Having created budgets for each category, those chasing FIRE will check in regularly to the Earning and Spending pinwheel on their home screen to check their progress throughout the month/year. They use this information to guide their spending habits.

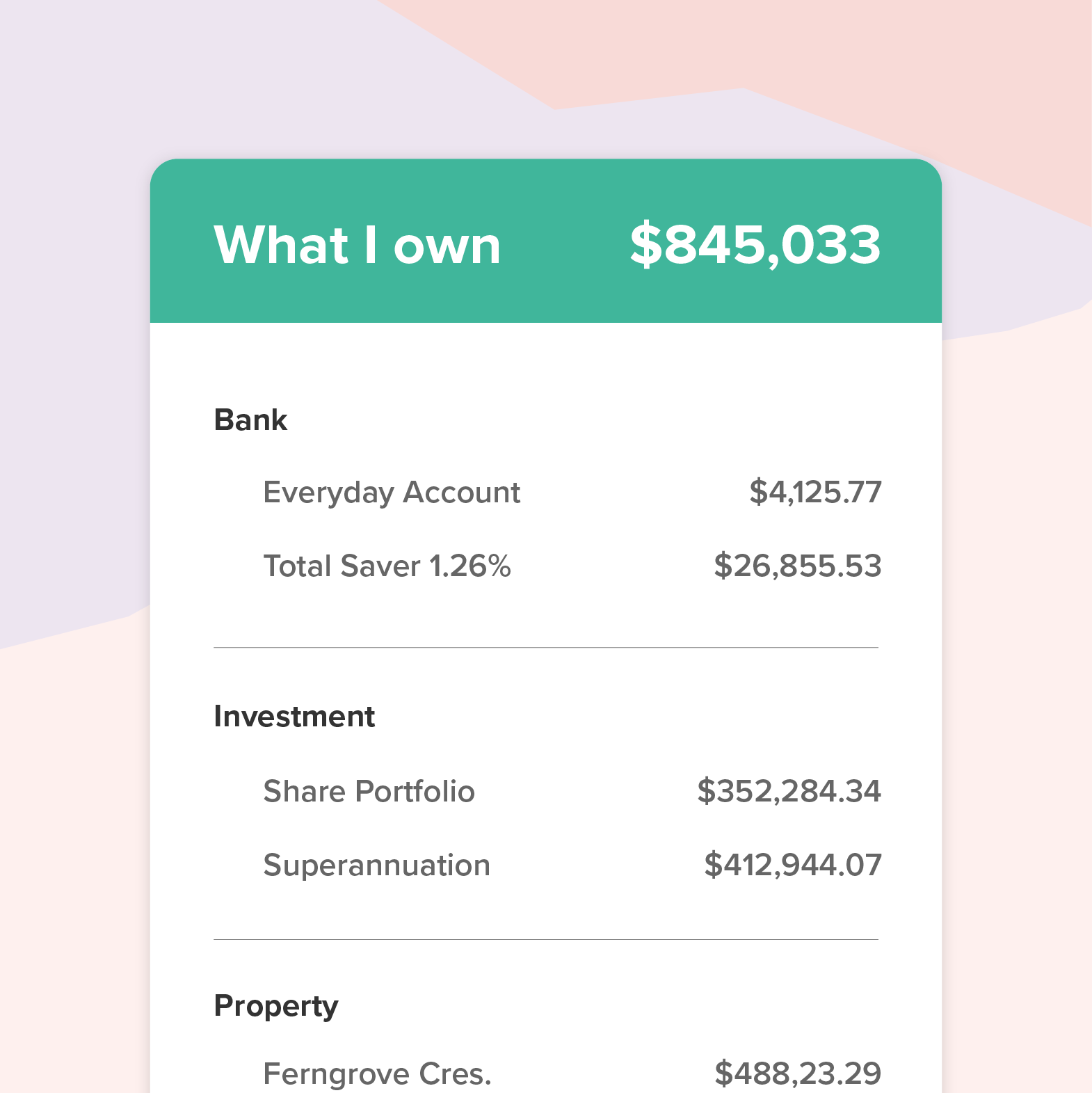

Perhaps the most joyful screen for FIRE advocates is the Net Worth page, which is found under Budgets & Reports. This gives you a real-time measure of how you are tracking towards your FIRE number. It’s a huge source of motivation for many because this is where you get to see your frugal efforts paying off as you watch your net worth grow year on year.

PocketSmith’s Calendar features can project up to 30 years in advance to show how you’ll be tracking financially. This information is gold as you work towards your early retirement date. With this you can see the amount of money you will have saved in the future and whether you’re on track to achieve financial independence before retirement age.

We all have “what if” discussions where we try to weigh up the financial pros and cons of a decision, but it’s a difficult calculation to make in real numbers.

What if I moved into shared accommodation, instead of renting my own apartment. How much could I save?

What if I instead invested the money I was intending to use to take a holiday?

Using PocketSmith’s Scenarios feature, you can actually plan these hypothetical situations out. This is hugely useful if you are trying to work out the financial implications of a decision, something that is critical for those aiming to FIRE.

Here is a simple yet powerful example of what living on less can add up to:

For every $100 you reduce your expenses by each month you need $30,000 less to FIRE.

By creating scenarios in PocketSmith, you can get some hard numbers around the savings you can make, and the corresponding changes to your FIRE number. That is a powerful tool to have at your disposal.

A big part of FIRE is regularly investing into assets like shares and property. In PocketSmith, these investments will show as regular withdrawals from your bank, as you send money out to investments that will grow in value and produce that passive income you are looking for in your early retirement.

PocketSmith lets you track the value of these non-banking investments alongside your daily banking, which is crucial to giving you a complete picture of your entire financial situation in one place.

For years, I looked for a comprehensive personal finance tool to enable me to do that. I found it in PocketSmith — it just makes so much sense to have all of your financial data available in one location.

No matter when you plan to retire, there are a few key things that you need to have at the heart of all you do because reaching FIRE - and retiring 10, 20, 30 or even 40 years before your peers — will never happen by accident.

You need to find your WHY. Understanding your reason to swim against the tide will help you aggressively cut costs out of your life so you can build up your net worth as fast as possible. Without an adequate WHY, you won’t be able to last the distance to FIRE and I think that the stronger emphasis is best put on the first two letters: FI (financial independence).

The ultimate goal may not be to quit your job at 30. You may actually like your job and have a lot to contribute, but it may give you the peace of mind to know that the day you no longer want to work, then you can stop and continue to maintain the lifestyle you enjoy. That is financial independence.

Keeping an eye on your spending is key. The lower your expenses, the sooner you can theoretically retire. With every dollar you cut from your lifestyle, the less you have to save for retirement. And in a time when so much is outside of our control, controlling our spending is something we can all do. We can pull levers to reduce our grocery bill, find a cheaper home, a cheaper city to live in and a better paying job.

There is no perfect way to achieve FIRE. Although we can each learn from each other and embrace tools like PocketSmith to guide us there, at the end of the day, we each have to decide how pursuing it fits in within our own goals.

Reaching FIRE takes many years to achieve, so it’s important that we enjoy the process. I see no point living a life of dull deprivation for 5 to 10 years while we try to hit our retirement goals.

Think about it this way, when you get to FIRE you want to still have some friends around to enjoy it with!

With social media to fuel the flames, the FIRE community is global and diverse. We are each working to find the delicate balance between living well while also living without. A high income obviously helps. But you can reach FI on a lower income too. The secret is to get your spending down and your saving rate up, squeezing the most out of each dollar you earn, because every dollar wasted adds up to a huge amount over a lifetime.

I’ll give the final word to Mr Money Mustache: “Financial independence may not mean the end of your working career, instead it means complete freedom to be the best, most powerful, energetic, happiest and most generous version of You that you can possibly be”.

And to me, that is something worth aiming for.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.