The people who have achieved Financial Independence, Retire Early (FIRE) are an adventurous bunch, coming from all walks of life, each pursuing financial independence for their own reasons and in their own way.

One specific common trait is a burning motivation to have enough money so that, somewhat ironically, money no longer becomes their main motivator.

Once they have hit their FIRE number - a number that is entirely unique to them - they fill their days, which they had formerly spent working, with pursuits that bring them happiness. And happiness, as we all know, can be found in many forms.

If you want to understand more about the FIRE movement, here’s the first article in this series: What is FIRE?

For those of you wondering how different people have achieved FIRE, read on, I’m about to show you how it’s done!

One of the most well-known early retirees is Pete Adeney, who blogs under the name Mr Money Mustache. He retired at the age of just 30 by working hard, saving a high proportion of his income and only spending a very small percentage of his income for daily living.

At the time of retiring, he and his family-owned their own home and had an investment portfolio of around $600,000 USD. This was enough for him to apply the 4% Rule, where each year they could withdraw up to 4% of their portfolio to cover their expenses, yet never run out of money.

Since stopping work in 2005, he has lived an incredibly full life, only doing things that will increase his happiness. He is clear that it was the initial investment amount that still provides all he needs to live on today.

When you are free of financial constraints, you find yourself being able to give back to others, with no expectation of financial gain, so Pete has become a key advocate of the FIRE lifestyle and is an inspiration to many.

There are many people living right here in our community who have quietly gone about pursuing FIRE, never bringing it to the attention of others. Many FIRE adherents practice mindful spending and reduce their annual expenses to the minimum in order to achieve their goals. I have met a woman who discovered the concept in her 30s and set herself the goal to retire by her mid-40s.

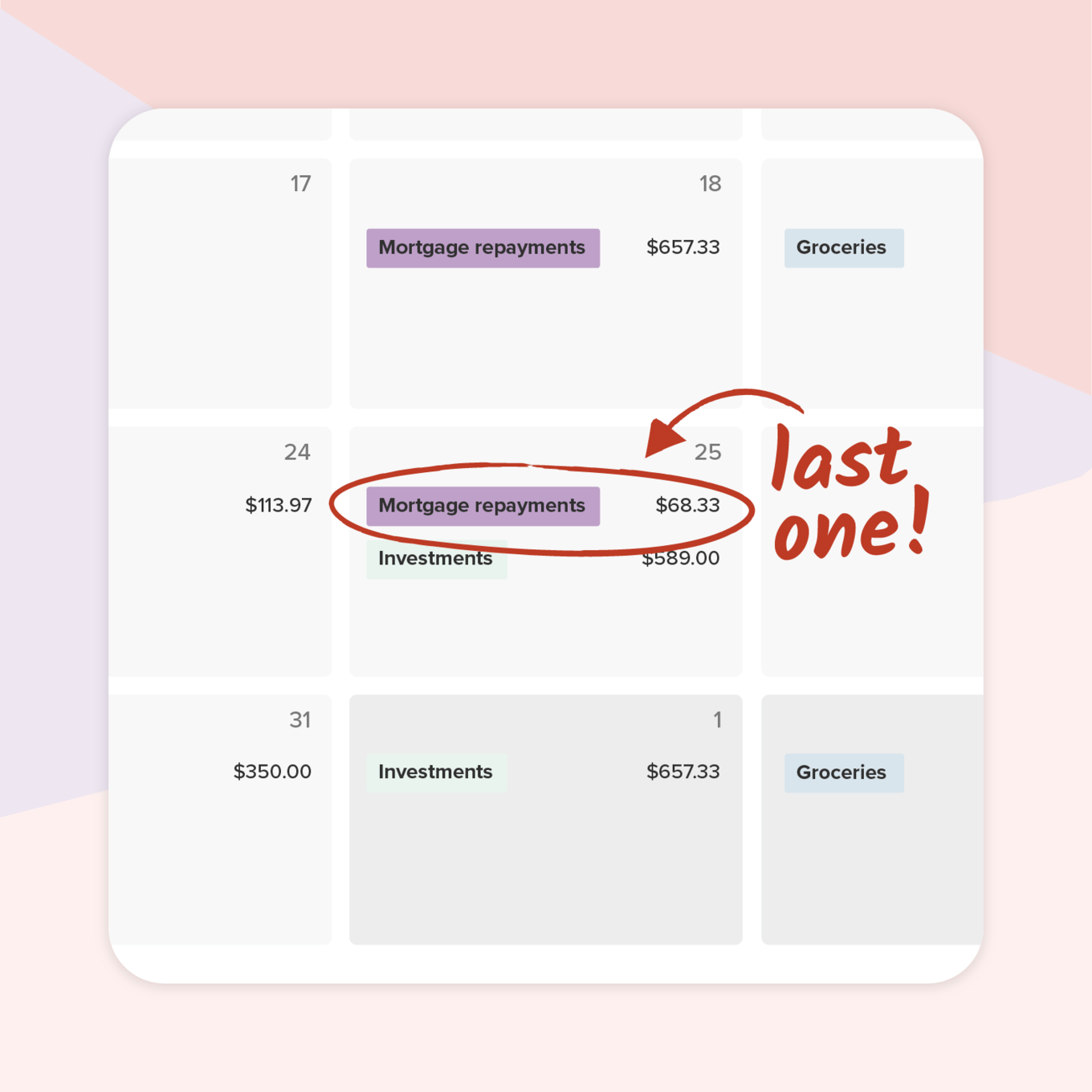

To reach her goal she worked hard at her profession to bring in as much income as she could, she cleared all debt and kept her expenses extremely low by careful budgeting and mindful spending which freed up cash for her to invest. She paid off her own home and then immediately channeled that mortgage payment into her investments, which like many in the FIRE community are predominantly into index funds and retirement accounts, while also keeping an emergency fund and cash on hand.

Use PocketSmith’s Calendar to create financial projections up to 30 years in the future in minutes >

Her final move was to sell her home which had appreciated in value and buy a cheaper house for cash in a cheaper city. This bold move let her reach her FIRE number. And, right on cue at the age of 45, she quit her job and started the next chapter of her life!

If you struggle to find examples of how to FIRE in your friend group, then head to Instagram (or other social media) as it is full of people from all over the world documenting their journey in detail.

I follow A Purple Life on Instagram. She recently handed in her notice at work and retired early, after just 5.75 years of saving, 3,376 days of working, 3 jobs and 1 career change. She was done at the age of just 30! She has a net worth of about $540,000 US and is debt-free. To get there she had doubled her salary, cut her living costs by half (she currently lives in AirBnBs) and traveled to live and work in places with a lower cost of living (known as geo-arbitrage).

People who FIRE think outside the box and are not afraid to do things a little differently to most. They are disciplined, dedicated and focussed over a long period of time, knowing in their heart that the end goal will be more than worth it.

Earning as much as you possibly can is a key strategy for achieving FIRE. Some do this as an employee, while others take the next step and become the employer. They strategically build up a company and get it to a point where they have a big enough asset that they can sell.

To hold onto an income-producing business is technically not part of the FIRE strategy, because that business still relies on you to be present and the key to FIRE is that you shouldn’t have to work.

I spoke with a New Zealand-based couple (with six children no less!) who did just that. Starting from $0 they built up a company at the same time as they used debt to buy several apartments. The sale of their company paid off all of their housing debt, meaning they get to collect the rent to provide them with an income in the years ahead.

Using the profit from the sale of the company, they also invested in the share market and receive a passive income from that via dividends and capital gains.

Their final move was the sale of their large family home and a move into a smaller and cheaper home that they own outright. This freed up more cash that they were able to invest. Having started with $0 in their 30s and now aged in their early 50s, they are able to spend all the time they want, doing what they love.

You can’t just wake up one morning and decide to FIRE today, but you can wake up one morning and decide to make a plan to start your journey towards financial independence, so you can retire early on some specific date in the future! Whether you’re building your own small business or side hustle online, or you’re changing your spending habits to meet your goals, it’s never too late to start.

Remember that the sooner you start, the younger you will be when you reach your goal. Your pursuit of FIRE is entirely in your own hands and to get there quickly you will need to make deep cuts into your lifestyle to free up money to invest. You will need to work hard and earn the highest income possible and you will need to remain focused for a long period of time.

The key to FIRE is also contentment and learning to keep your living expenses low, living well below your means because what that means is that you will need a smaller amount of money to retire.

Here is a simple yet powerful example of what living on less can add up to:

For every $100 you can reduce your expenses by each month, you need $30,000 less to FIRE.

$100 x 12 = $1,200. $1,200 x 25 = $30,000

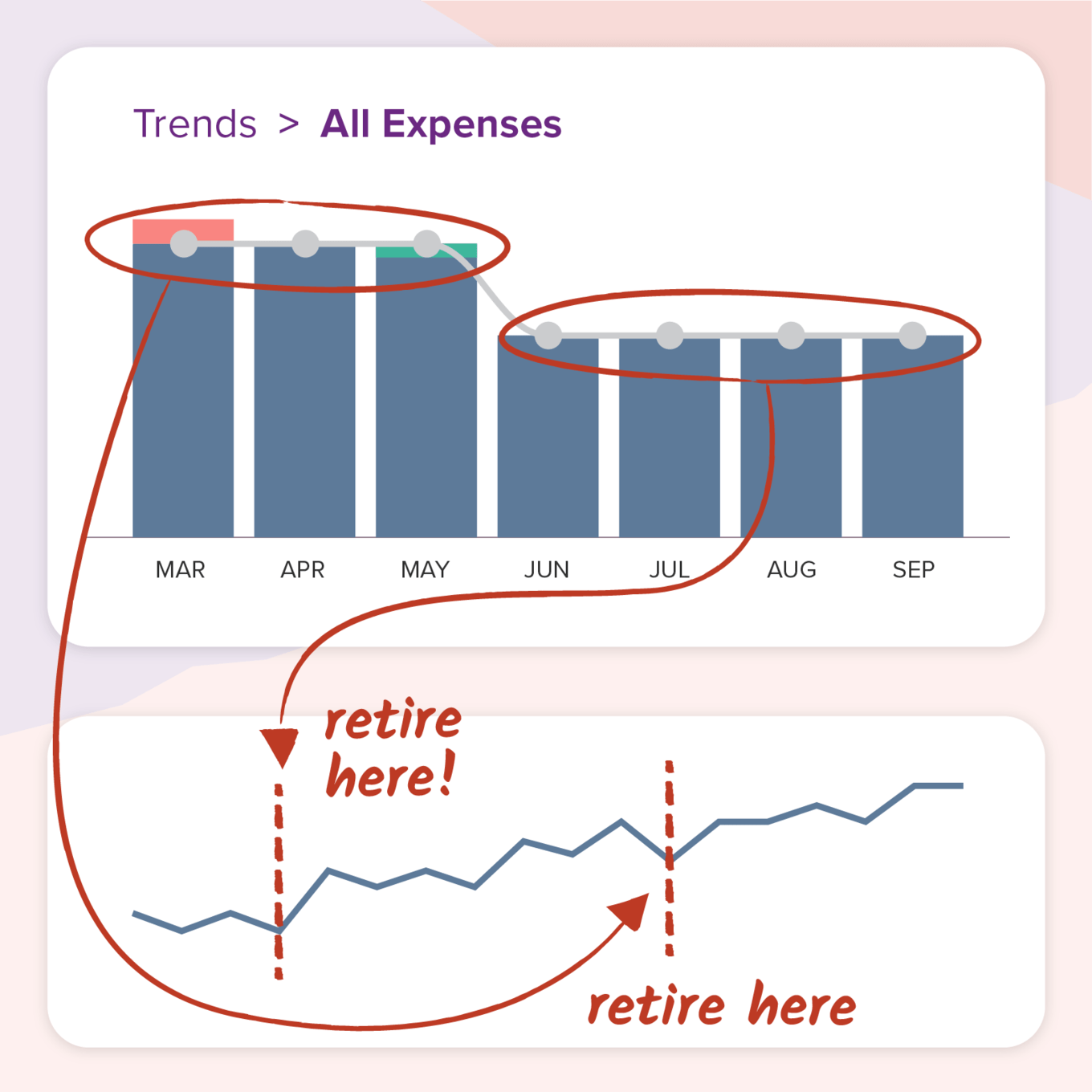

See how PocketSmith’s Trends page allows you to quickly compare your spending over time >

A major strategy for achieving FIRE is financial forecasting. If you take your current financial statements and look at your income and expenses, you can forecast your finances well into the future. While this may seem like a complicated task, tools like PocketSmith can help you do this automatically.

The FIRE community has learned many hacks along the way to get them to their goal faster and there is a welcoming community waiting to help you do the same. Just google “financial independence retire early” to see what I mean!

Those who put in the effort and swim against the tide certainly do reap the rewards and enjoy a life lived differently to most. In my experience I find these people to be generous with their time and their energy because they now have plenty of both.

People who FIRE want others to do the same yet each does it for their own reasons. Their retirement years may look different from the next person, but the point is that they get to structure their day on their own terms, and that is a very powerful way to live your life.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.