Your side hustle is gratifying for many reasons. The extra income can make a material difference to your financial goals – be it paying down debt, topping up to make ends meet, or making a bit more money to spend, save, or invest. But possibly most rewarding is the opportunity to bring a passion project to life.

You can also count yourself a member of a fast-growing global community of everyday entrepreneurs. Side hustling is on an upward trend all over the world, with 43% of households in the US, 25% of Australians, and 25% of British people now reporting as having side gigs.

Here at PocketSmith, we celebrate side hustlers and are committed to crafting the best tools to help in their unique journeys. Nearly 20% of our users now use PocketSmith primarily to manage multiple streams of income, and we expect this to continue to grow over the coming years.

We live in a time where people are seeking greater fulfilment and meaning from their lives outside of regular jobs, and we believe in the movement because side hustles are proving to be a valuable avenue in helping us preserve our independence and further develop our identities.

But gosh, handling the finances will be a drag if you don’t have a system that works for you.

So your passion project is now making some money, you’re feeling a strong sense of satisfaction, and your customers are happy.

The voice at the back of your mind tells you that you’re now responsible for somehow organizing this new financial activity. But hold up, you think – you shouldn’t have to, because you didn’t set out to start a business. Or did you?

Well a side hustle is essentially a micro-business, which means that some basic financial principles apply. Without financial tracking, the biggest risks you run include committing accidental tax fraud, over/underestimating your expenses, or running at a loss instead of a profit.

If this starts to sound stressful – and stress sounds like an all-too-familiar drone of joy being slurped from an endeavor – don’t worry. PocketSmith makes it easy and delightful to get those finances straightened up, meaningful, and presentable. Here are our tips for how to keep your side hustle on the straight and narrow, anxiety-free.

The first thing to do is seek advice that is specific to your situation. Are you making enough money to declare to the tax authorities? Do you need to register a business yet, or not at all?

Knowing your obligations at the outset will help you understand how much financial tracking is needed, and what you need to do with the data.

Engaging an accountant is worth the money, and many will be able to help with your taxes for a reasonable fee if you keep good records for them. This is where PocketSmith can help, because it keeps your information in one place, online, and easily accessible. You can also share your insights securely with a trusted advisor or friend with Advisor Access.

What you don’t want to do is turn up to an accountant at the eleventh hour, with a stack of bank statements and a plastic bag of receipts, smelling of stale sweat and desperation. This is not good for anyone, and it will cost you.

The good news is you don’t need to spend a lot of time as a bookkeeper – unless of course, your side hustle is about running an awesome bookkeeping service (and if so, please take PocketSmith to your clients).

We’re here to do the heavy lifting while you focus on being an awesome yoga instructor/jam maker/board game illustrator/fanfic writer/Airbnb host for puppies.

We need to build a record of the incomes and expenses incurred by your side hustle, and to do this you can link your relevant bank accounts to PocketSmith, and have your transactions automatically synced without a scrap of manual data entry.

PocketSmith links to popular payment services like Paypal and Payoneer, as well as accounts and credit cards from banks worldwide. This takes just a few minutes to set up. When done, you’ll have a continuous, up-to-date record of your transactions in PocketSmith that is easily accessible, and from which you can make reports.

It’s generally advisable to keep your side hustle transactions in their own account and on a separate credit card, but if your incomes and expenses are in your regular day-to-day account and you’re trading in low amounts or just getting started, you can still use PocketSmith to easily split out business transactions from your personal ones without making any changes.

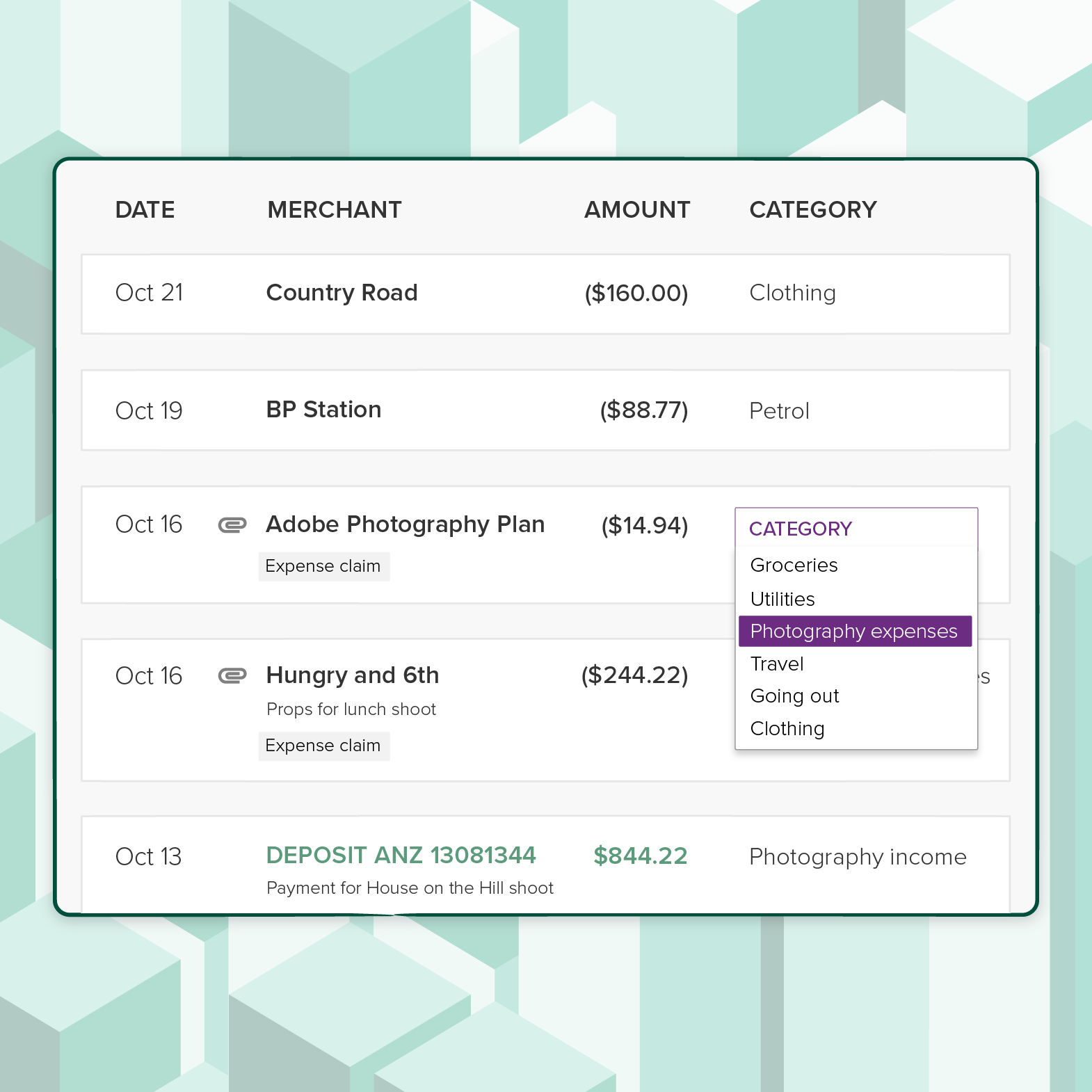

Now this record of incomes and expenses needs to be filed into categories, which will help you find out:

PocketSmith will automatically categorize your transactions as they come in so all you need to do is check and change any categories to better suit your needs. You can also make rules to assign categories to merchants so the work is automatically done for you in the future.

Income transactions in PocketSmith are easy to spot as they’re indicated in green. If you have incomes from multiple sources (personal income vs. side hustle income as an example), categorize them appropriately so they’re easy to split out in your reports.

If you already have a PocketSmith account for your personal finances, you may consider making a separate one just for your side hustle. This helps keep your records easier to manage, and yes, you can write-off the very reasonable subscription fee as a business expense.

It’s highly recommended to check your work with your accountant or advisor while you’re setting up so that you’re confident the records are appropriately documented.

A stitch in time saves nine. Set a regular reminder to check in on your PocketSmith account to follow up on categorization! By doing just a few minutes’ bookkeeping each week, you’ll be rewarded with up-to-date information on how your side hustle is performing, as well as a welling sense of pride in knowing you’ve got everything under control.

If you need any more motivation, remember that you’re saving money whenever you claim any eligible expenses against your side hustle income. Make those expenses count!

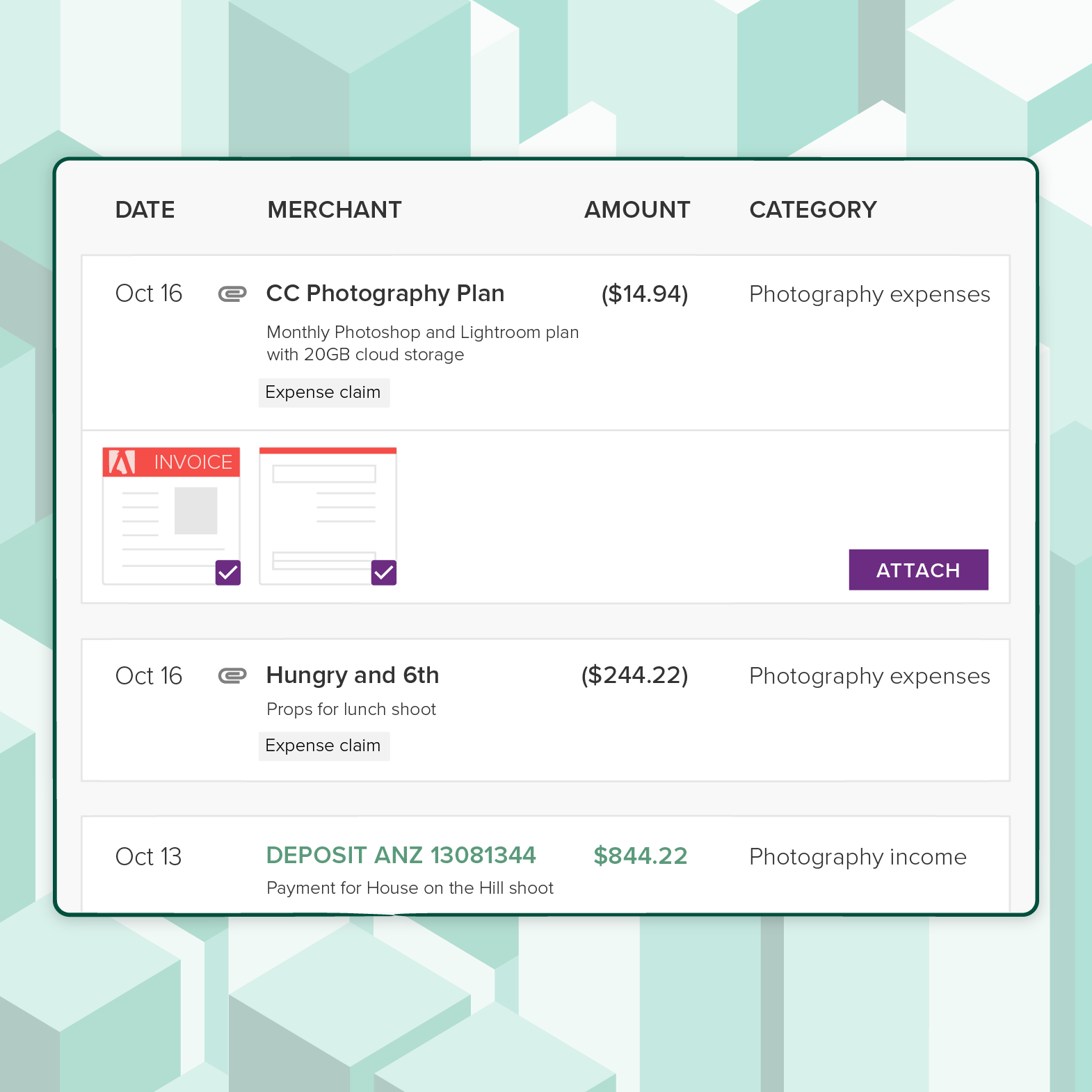

Attach all your receipts to their relevant transactions as soon as they come in so they’re safely stored, and you can also add a description to the transaction while your memory is fresh.

Good, descriptive records will also help you dig up old incomes and expenses in the future, as you’ll be able to easily search for them.

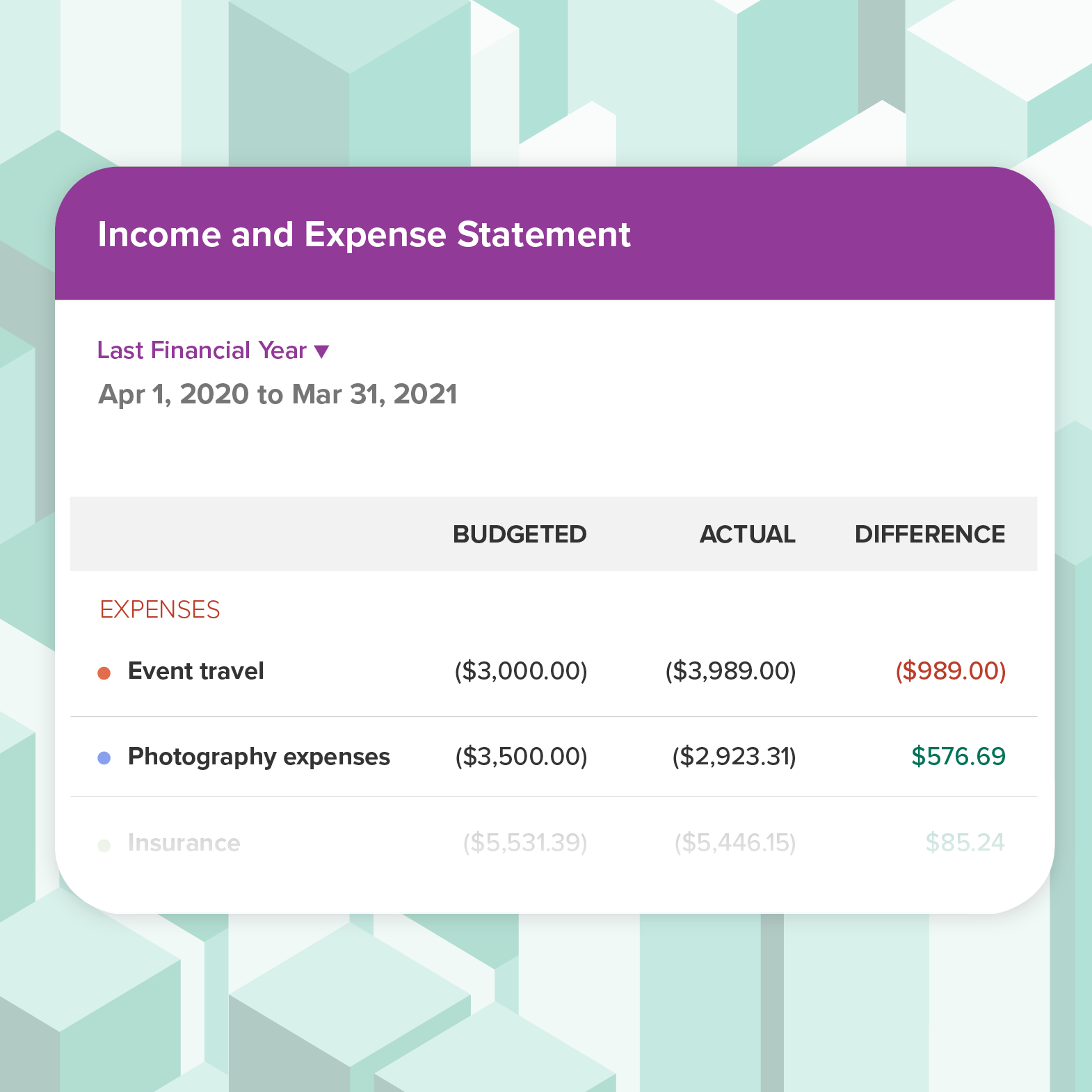

An elegant run-down of your side hustles’ finances is now just a click away. The Income & Expense report, or I&E (a cousin to the Profit & Loss statement), shows you the totals earned and spent by the categories you’ve determined. This is kept automatically up-to-date as new transactions are synced.

You can also click on the amounts in the table to drill into the transactions making up the total – for example, everything you spent on insurance for the period.

The I&E lets you choose which categories to feature in your report and will calculate the totals relative to what is shown. This means that you can isolate just the relevant categories in your report so that you can:

You’ll also have the bonus of your reports being always ready for tax time. Getting a report for your accountant or an advisor is a breeze. Click to export a copy of your I&E, or an expanded report that includes all the transactions belonging to each category.

Nothing can be certain, as the saying goes, except death and taxes. And you can always count on either to kill the buzz when they turn up to your party.

While PocketSmith can’t (yet) help with the former, it will give you an on-going indication of what you may need to set aside for taxes, particularly if your taxes are calculated as a percentage of your profits for a period.

Once you have a reasonable idea of what your regular tax obligations are, you can use PocketSmith to set a budget to put aside some of your earnings on a recurring basis to cover them.

With a little planning, you can set up an automated system with PocketSmith that takes most of the work out of financially managing your side hustle. While the bulk of the responsibility relates to your tax obligations, PocketSmith also lets you keep tabs on the health of your passion project, which is arguably more important to do on a continual basis.

We’d love to profile some of your side hustles for a future article, so if you’d like to share your stories with us, please reach out to us via email or on social media!

Jason is the CEO and co-founder here at PocketSmith. He is fascinated by our unique relationships with our money, and is passionate about making peoples’ lives better through the technologies we craft. He’s been a sneakerhead since the 80’s, and loves gardening on sunny days while listening to Planet Money.