Has a child ever asked you, “How much money do you have?”

You could simply open your wallet and quickly add up the cash inside and tell them the total, “Today I have $21.”

We all know that this does not accurately answer the bigger question: what is your personal net worth? It’s unlikely that you have all of your money in your wallet, right? Of course, not! Most of us keep our money securely in a bank and access it via some type of electronic card. Besides, you can’t fit all the things you own in a wallet, and luckily, you don’t carry all your debt around in your pockets either.

To answer the question “How much money do you have?”, you need to know what your personal net worth is. Here are four steps to get started:

Your personal net worth tells you your exact financial position. Knowing what it is helps you reach your financial and life goals much faster. Net worth is simply the difference between your assets, that is everything you own, and your liabilities, the sum of everything you owe.

Everyone’s net worth is unique. Its true purpose is to act as a benchmark which shows you where you are today, and it then helps you plan where you want to go in the future. Whether you’re trying to create a retirement plan, or trying just trying to figure out what your current financial position is beyond what’s in your bank account, calculating your net worth can be incredibly valuable.

Do you have a “feeling” for how you are doing in monetary terms? By calculating your personal net worth it lets you replace feeling with fact. It lets you see how financially fit you are and for most people, calculating their net worth for the very first time is a real eye-opener—some will realize they are doing better than they thought, while others will realize that they have a bit of work to do to get ahead.

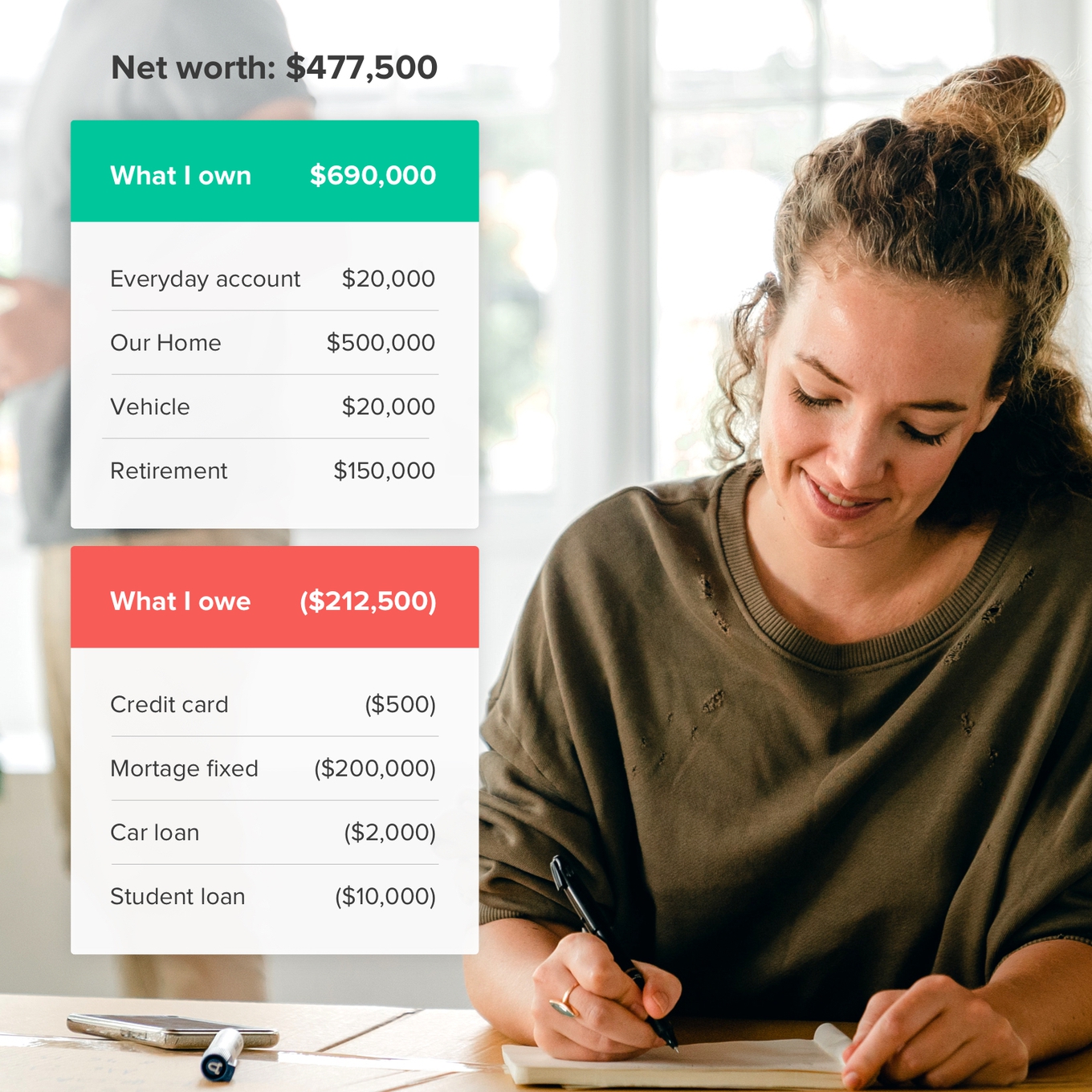

To quickly calculate your net worth, all you really need is a pen and paper. Start with two headings: “What I own” and “What I owe”. Under each heading, note down all of your assets and liabilities — these should include both your long-term assets and your short-term assets. Some things you may know the exact value of, but others you may need to estimate and that’s quite okay! I’ve used some numbers to give you an idea:

Total assets = $690,000

Total liabilities = $212,500

So let’s use our Personal Net Worth formulae: $690,000 (Assets) - $212,500 (Liabilities) = $477,500 (Your Personal Net Worth)

You can get as detailed as you like, adding all of the various assets and liabilities that you have. Now that you have a basic list and a total for each, you just subtract one from the other and you have created your personal net worth statement which is entirely unique to YOU!

We each lead busy lives and we each have a wide range of assets and liabilities to keep track of. We each use different banks, have different investments and many have interests spread around the world in different countries, using different currencies.

You can start with pen and paper, but over time, money management software such as PocketSmith can be used to help you easily and accurately calculate and track your ever-changing net worth. Personal finance software can also be useful to track spending and making sure your finances are staying on the right track.

Now that you have your total net worth figure, you can choose when and how often to review this information. You have now created a starting point from which you can grow your personal net worth. Your total net worth figure ebbs and flows throughout the month and you will see it rise when your income comes into your account but then you will see it fall again as your expenses go out.

On a monthly, quarterly or annual basis, take a minute to update your assets and liabilities as their values change and note down your new total net worth figure. Start to keep a record of the total figure and the date each time you calculate it. By choosing to check in on a consistent basis, such as the first day of each month, you will have a more accurate comparison of how you are tracking.

You can now use your net worth to influence many of the daily decisions you make around money. You may start questioning your spending decisions. Depending on your situation, you might decide that things like eating out aren’t financially worth it.

Once you start making these daily micro-decisions, you will see them reflected in your total net worth over time. For example, as you pay more money towards a credit card debt, you will see the remaining balance drop each month and your total net worth grow. These decisions may help you in other areas of your financial life such as improving your credit score.

Once I started to track my own net worth, it motivated me to wipe out all of my debts as fast as possible and become net worth positive. By keeping a record of my changing net worth, it gave me a baseline for comparison and I could monitor my success (or failure) on a monthly and yearly basis. With years of data, it becomes easy to see how much progress you’ve made.

I began to take notice of my income and expenses and it fired me up to do better! On the other hand, it allowed me to relax. Knowing as each year passes by, I am heading in the right direction and that when I pay attention to my assets and liabilities, I can grow my wealth in just a few short years. If I had not tracked it, I never would have known!

Knowing your net worth may motivate you to seek a better interest rate on your mortgage, or clear that lingering credit card balance, save up for a holiday or divert more money to investments. It may even prompt you to seek a pay rise or a career change and get you looking for ways to reach your goals faster. It can also encourage you to work on ways to increase your net worth. You might try and find new income streams such as rental property or side hustles to keep your net worth trending up.

Calculating your net worth means no more guessing and wondering if you are on the right track financially. It gives you a simple strategy for managing your money. So, the next time a small child innocently asks you that very direct question, “How much money do you have?”, you can say with confidence exactly how much.

Although, it’s up to you whether you actually tell them or not!

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.