Ahhh, Christmas. The season of giving, gratitude, family time, twinkly lights, terrible shop music, and stuffing yourself with trifle and that third slice of pavlova until all you can do for the afternoon is lie on the floor groaning. Here in New Zealand, December is in our summer. Christmas is less “snow and sleigh bells” and more “sandy beaches and the slap-slap-slap of jandals on searingly-hot tar seal”.

It can be a time of financial stress for many people, too. The seasonal obligations add up. There’s the workplace Secret Santa gift, the company lunch out, the kids clamoring for the latest whatsit that all their friends are getting, the mountain of grocery bills, the Christmas shop sales, the time off work… and of course the togs (swimsuits) that no longer fit and need replacing. Whew!

But as they say: Christmas happens every year. Don’t let it be a surprise.

With that in mind, here’s how I’m prepping for December 25th with PocketSmith.

Some people love ‘em, some don’t, but what are they? A sinking fund is somewhere to set aside money regularly so you’re not caught out by a sudden big expense. For predictable costs, it’s a great way to even out a big mountain into a number of smaller, more manageable lumps.

Create a new bank account. Label it “Christmas”. While you’re at it, create a new category in PocketSmith called “Christmas” and assign it a budget. There are 52 weeks in the year — but you want some prep time, right? Okay, call it 48 weeks.

If you automatically transfer $12.50 a week for 48 weeks into the Christmas sinking fund, you’ll have $600 set aside for Christmas expenses by the time December rolls around. That’s worth gold for your peace of mind — and at the price of a Big Mac combo!

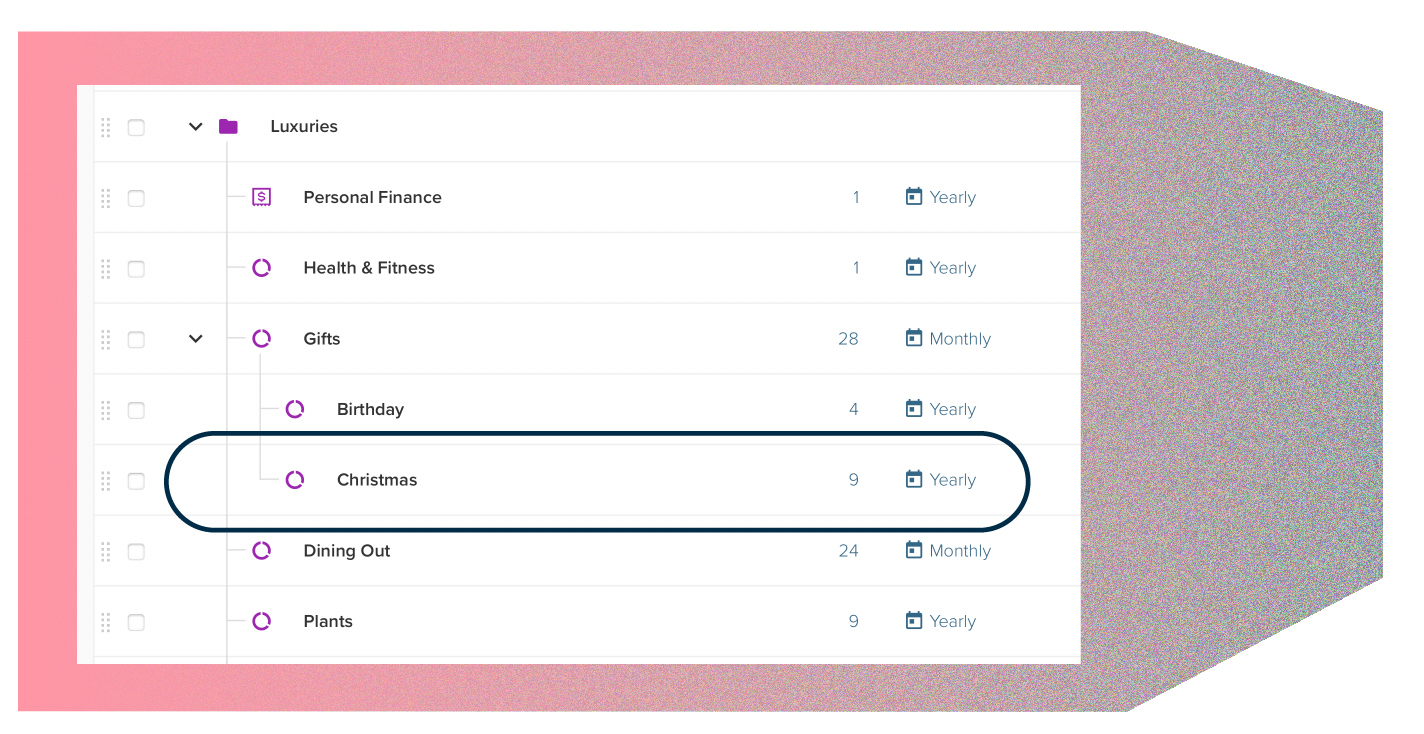

In my traffic light system, I have a parent category called “Luxuries”. Under this, I have a “Gifts” category. Under this, I have a “Christmas” category. Aren’t you glad PocketSmith offers three layers of nesting categories? I sure am!

Now, I tend to set an annual budget for Christmas rather than a weekly one. I always go back into my Income and Expense Statement and look at what I spent the previous years, and then adjust this year’s budget accordingly. The neat thing with PocketSmith? I assign an annual budget, then PocketSmith tells me what it averages out to per week — and how much of the total I’ve already spent.

Being able to categorize Christmas transactions throughout the year is fantastic, particularly for those pesky “I know I bought something in advance for Brother 2 back in June… but what was it?” moments. Unfortunately, PocketSmith can’t tell you which spot you stashed it in so your brother wouldn’t find it!

You know that envelope your uncle slipped you with a crisp $50 note in it? Or the bank transfer that arrived from Auntie Maia in Peru on December 23rd? Can you remember what you spent that money on?

Yeah. Me neither.

Gifts of money are a great way to offset the costs of the season — if you know where it’s going. As soon as I receive cash gifts for Christmas, I trot down to the nearest ATM and deposit it. In PocketSmith, I file the deposit under “Christmas”, just like I would with an expense. This then shows up as a refund against expenses for that Christmas period.

I like to label these transactions with the person’s name, so I can send them a personal thank-you later. For example, a photo of the whanau with an email saying “Check out the waterfalls! Your gift helped us have a week-long family holiday in the Catlins — thank you!”

I’m always fine-tuning my systems. Some years I budget a set amount, then my work situation changes and I have to adjust accordingly. Some years I don’t leave enough wiggle room, and I have to pull savings from my emergency fund, then make a note to top it back up as soon as I can.

Every year, I look at how I handled Christmas last year and I think, how can I do it better next time?

This year, I’m starting by reminding myself not to go back for that third slice of pavlova.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).