Battling Cost of Living Increases With Small Actions

“I decided some time ago to make changes before I feel the financial squeeze upon my family, which, if I don't take my foot off the spending gas pedal now, it will inevitably do.” Ruth shares how she’s using PocketSmith to support her sustainable changes to her finances in the face of the current rise in the cost of living.

Due to the cost of living increases, I have been cutting back in some areas and redistributing money to things that have increased in price. You are probably doing the same. I think it is best to cut back spending before we run out of money, not because we have run out of money.

It’s been a tough couple of years, and in another blow, prices of everyday goods and services are creeping (or jumping in some cases) ever higher. I’m confident it will settle down at some point, but like everyone else, I don’t know when that point will be. So I decided some time ago to make changes before I feel the financial squeeze upon my family, which, if I don’t take my foot off the spending gas pedal now, it will inevitably do.

Remain present in your finances

Pre-dawn is my time to sit uninterrupted with PocketSmith and review our spending in each category. This is my first tip for you. You must set aside some quiet time to take a strategic look at your money and fully understand its ebbs and flows.

If instead, you decide to act in the moment, the attention you give your money will be sporadic. If you think, “Right, that’s it, I’m cutting costs today”, chances are your willpower and attention to detail will probably only last that one day, two at most. So many transactions happen behind the scenes, with automatic payments flying out of your account monthly and yearly. You will have at some point set up payments and transactions to save time, but unless you check in on them, money that you have simply forgotten you organized is flying out the door. PocketSmith will do a fantastic job of categorizing all this data for you, but it’s still your job to actually look at it and learn from it.

As arduous as it seems, taking the time to regularly check in and concentrate on what is going where is going to cut your costs more than returning that $6 head of broccoli to the supermarket shelf.

I’ve been making a more regular effort to make month-to-month, year-to-year, and category comparisons in PocketSmith to confirm whether my hunch of a price increase is correct. That way, I look at factual information and can actively choose to do something about it.

Look at the big picture…

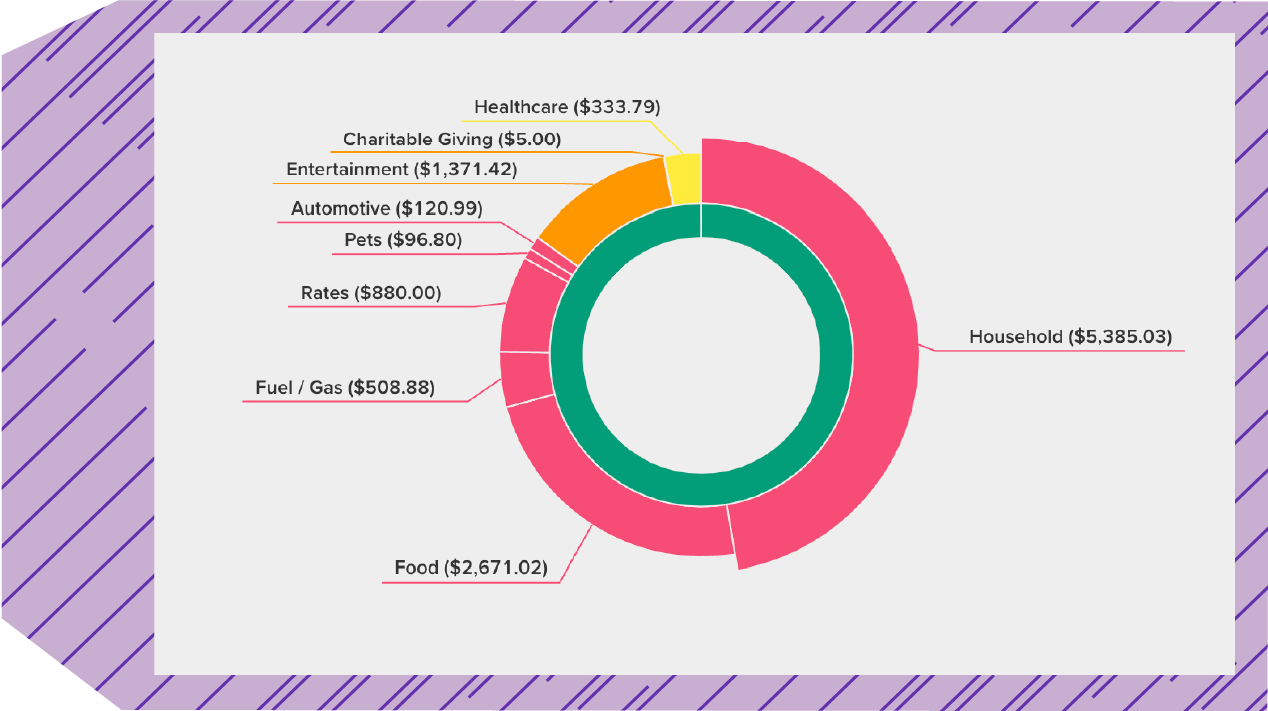

Firstly, I take a high-level look. To help me do this at a glance, I’ve color-coded my pinwheel using the following:

- Green - Income

- Red - Essential spending

- Orange - Nice to have spending

- Yellow - Insurance

Because we are trying to tighten our belts, I aim to see as little of the color orange in my pinwheel as possible, meaning that the majority of my spending is on essentials and insurance.

…then examine everything closely

Then I will drill down into some key categories and make some comparisons with the previous year. If possible, I’ll adjust our lifestyle to bring the costs down. For example:

Fuel per month

2022: $243

2023: $156

I committed to walking to work as much as possible. I’m saving $87 per month, an annual saving of $1,044.

Dining out per month

2022: $207

2023: $145

You guessed it — we are packing our lunches and cooking at home more, saving $62 per month and $744 annually.

Monthly house maintenance

2022: $585

2023: $281

We have stopped any big projects and are instead just doing what we need to do to keep our house well-maintained, saving $304 per month and $3,648 annually.

Monthly grocery spend

2022: $1156

2023: $1040

We are shopping smarter, adjusting our recipes and cutting back on luxuries, and have reduced the amount we are paying by $116 monthly, saving us about $1,392 annually.

We are simply trying to spend our money smarter. In the past, if I saved money in one area, I could spend it on a financial goal I had planned — now these savings are simply being redirected to all the areas that have had price increases.

I think of it as redistributing our spending towards areas currently sucking up more money than before. When I look at our total outgoings year to date, we are on track to spend less than last year, showing me that we are spending our money quite differently from previous years.

Keep it super simple

There is another layer to our cost cutting, one that I think is having the greatest impact on reducing our costs, and I’m taking a leaf out of an elderly person’s book to do it. Why an older person’s point of view? Because they lived in a simpler time, they often have a very simple answer for what can be a complex problem.

Behavior change is a key factor in keeping our outlays from growing any higher than they have to. I have an apple tree in my yard. In previous years, I’ve enjoyed picking an apple a day straight from the tree, loving that autumn flavor. During the weekends, I’d pick up the windfall from the ground and put them into my compost bin, completing the cycle of life. This time, I’ve added one more step in the process. I have turned every apple that hit the ground this year into applesauce and stored it in recycled jars. It is not only delicious, but it is 100% free. To me, this is a new thing; to my grandmother, this would have been the obvious thing to do! The very reason she would have planted the tree was so that she could pick the apples and preserve their goodness for year-round use.

It won’t hurt us to simplify our lives for a time, and there are benefits beyond what I’ve touched on here. Throughout this week, when you are looking at your spending, ask yourself what your grandparents would think of your choices. What would they have done in the same situation? I know that I have surprised myself that I can really make some big savings and some big changes just by trying something new.

Nothing lasts forever, this time will pass, and we may be able to return to our hedonistic ways, and who knows, maybe when we look back at this time, we will tell our grandchildren how back in 2023 the prices got so high we had to stay home on the weekend and eat porridge for breakfast, instead of visiting our favorite cafe for eggs benedict, with a side of bacon and a large flat white. Times were indeed tough in our day!

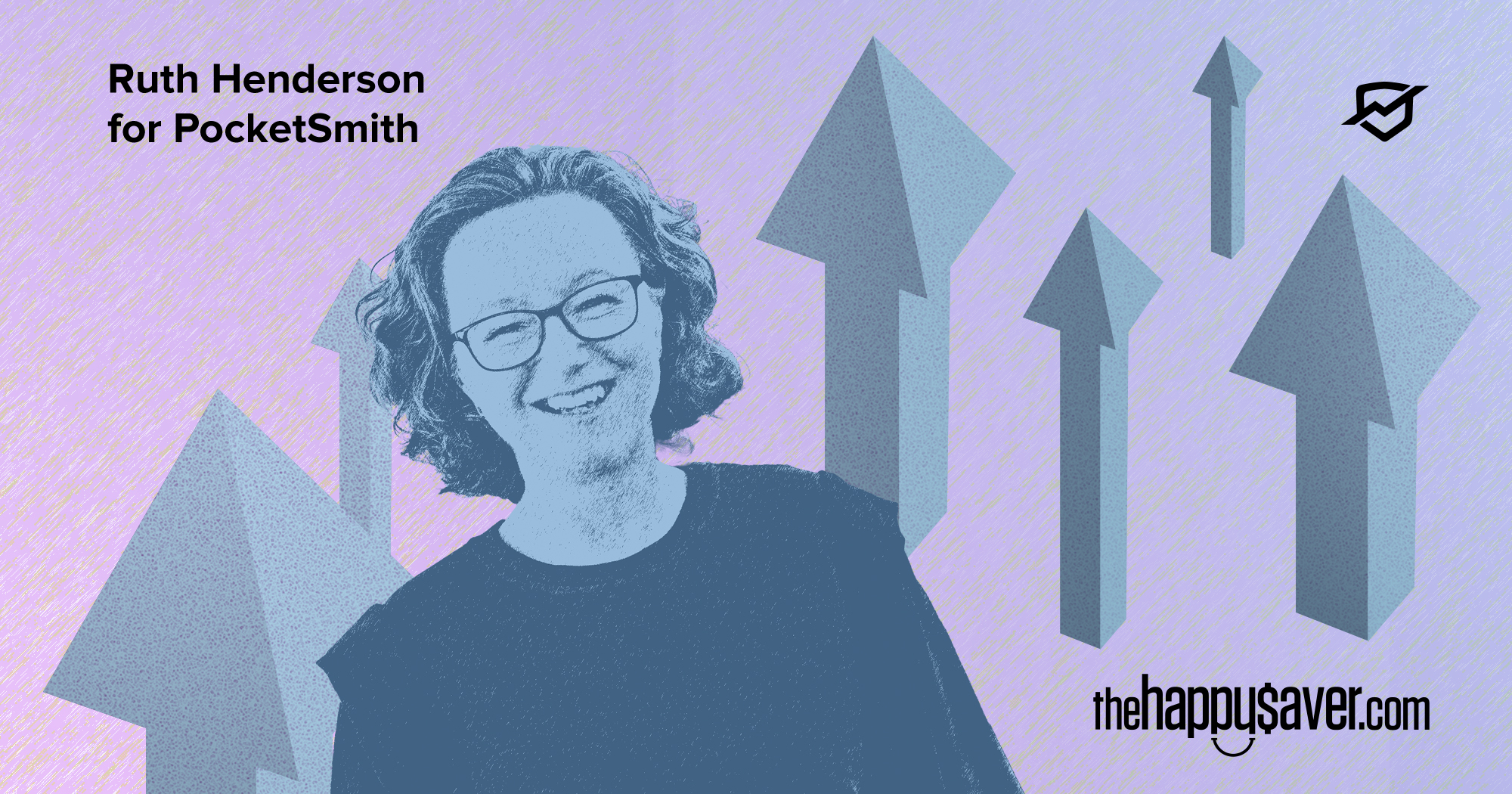

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.