Last July, I booked flights from Christchurch, New Zealand, to Atlanta, Georgia, USA. Then I gave notice on my flat. I sold all my family and hugged my stuff goodbye —

Wait. Strike that last sentence. Reverse it.

Via Gifer

The United States of America was never my permanent destination. It was a safe transition zone, that’s all. A stepping stone to keep my feet dry while crossing a few wild oceans. One month later, I had spent two weeks in the USA; six days in Canada; three hours in Amsterdam; and I wrote this from a kitchen table in Scotland. Working remote and adjusting to digital nomad life, I’ve relied on PocketSmith more than ever — and found features I never had a use for before.

So what are the best PocketSmith features for global travelers?

I’ve moved through four different countries in a single month, which means I’ve dealt in four different currencies. But I don’t want to (and can’t) open a bank account in each new country. And I don’t want to (and won’t) suffer the offshore service margins incurred by using my NZ bank card.

So what’s a girl to do when she’s deprived of live bank feeds?

The answer is simple: Four offline accounts and one multi-currency debit card.

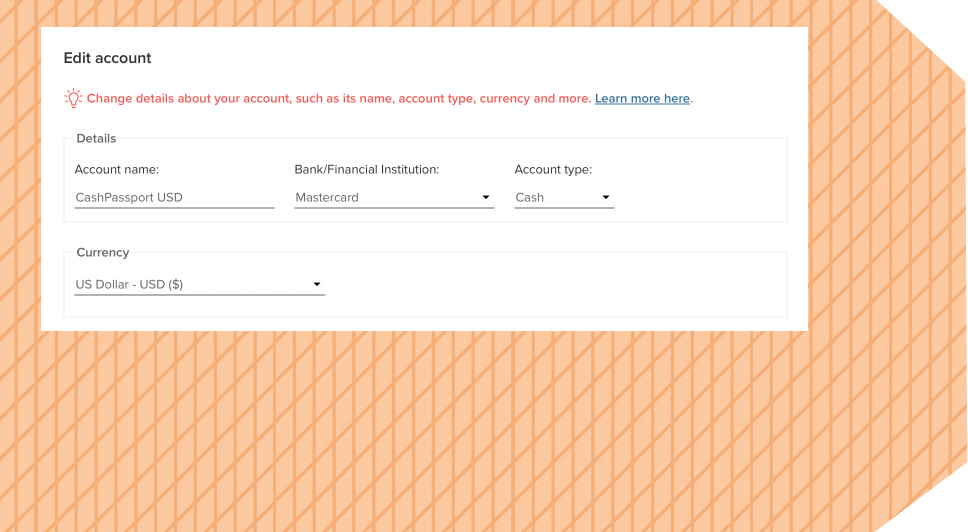

My preloaded debit card currently holds four currencies (NZD, USD, CAN, GBP) and can hold up to ten. The exchange rate is locked in at the time of loading, so you always know what you’re getting. I created an offline account for each currency in PocketSmith. Once a month, I export the month’s transactions from the card portal, import them into PocketSmith, and let category rules do their thing. Done.

Offline accounts work just as well to track cash in multiple currencies! A lot of places simply don’t have card facilities and only accept local cash. Besides, I’m not the first person to find a spare NZD$20 note in my wallet as I step off the plane in Aberdeen… right?

Until I left New Zealand, 100% of my PocketSmith usage was in a single currency. My bank accounts were in NZD. My bills were in NZD. Even when I invoiced clients in AUD or CAD, my tax agent handled the conversion and paid the balance through in NZD.

Looking back, it was all a bit too simple.

Which meant I got a wee surprise when I created an offline account, scrolled down, and set the account currency to USD. *boop* Something changed. Everywhere. On my PocketSmith screen. Suddenly every account, every transaction, and every balance had a little three-letter code beside it.

NZD. NZD. USD. NZD. USD.

More codes were added when I created my second and third offline accounts.

USD. USD. NZD. CAD. GBP. GBP.

I won’t lie. Going from decades of working in a single currency to abruptly dealing in four at once was a significant mindset shift. But it’s a natural one. PocketSmith eased the transition for me and made it easy.

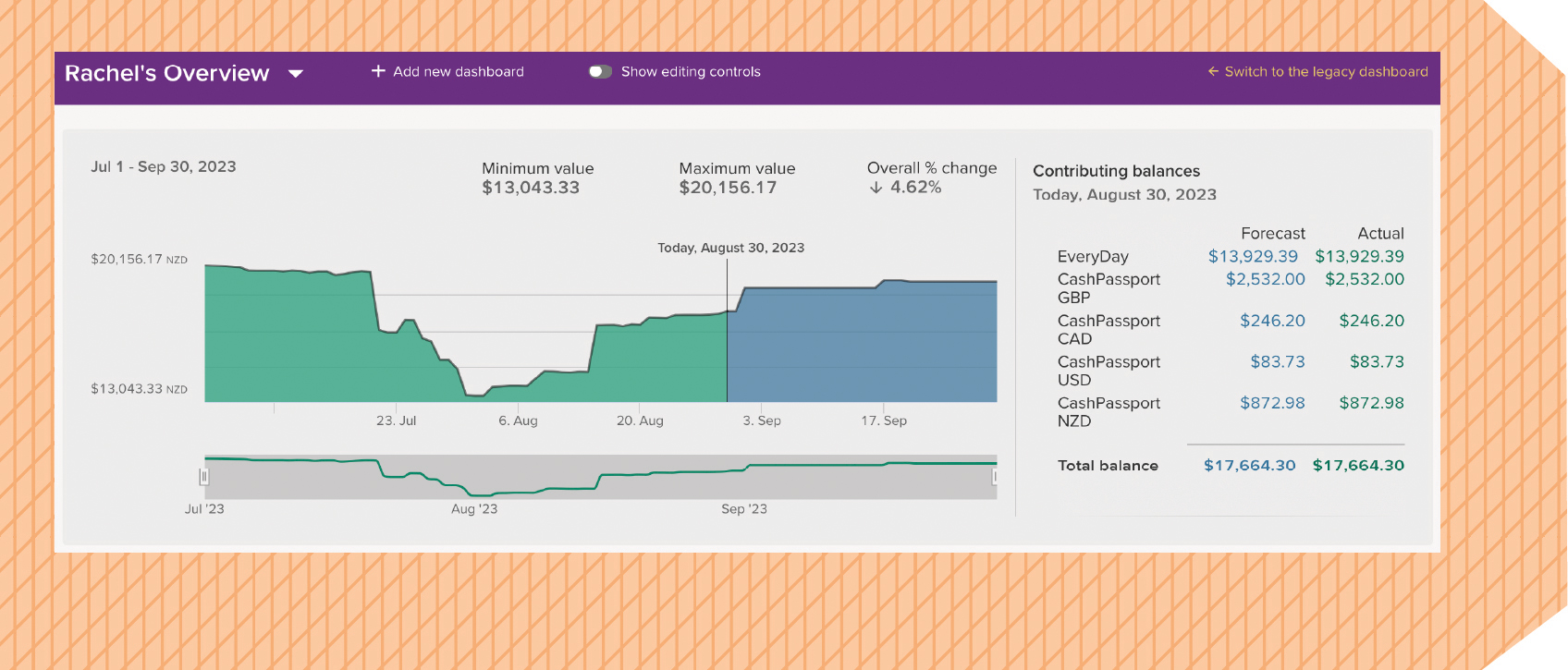

Creating accounts in multiple currencies opened up swathes of features I didn’t know existed, or if I did know, they were an afterthought grouped under “multi-currency support.” A cool afterthought, a nice-to-have, but an afterthought.

Not anymore. Now they were front and center because I was dealing with them all. the. time.

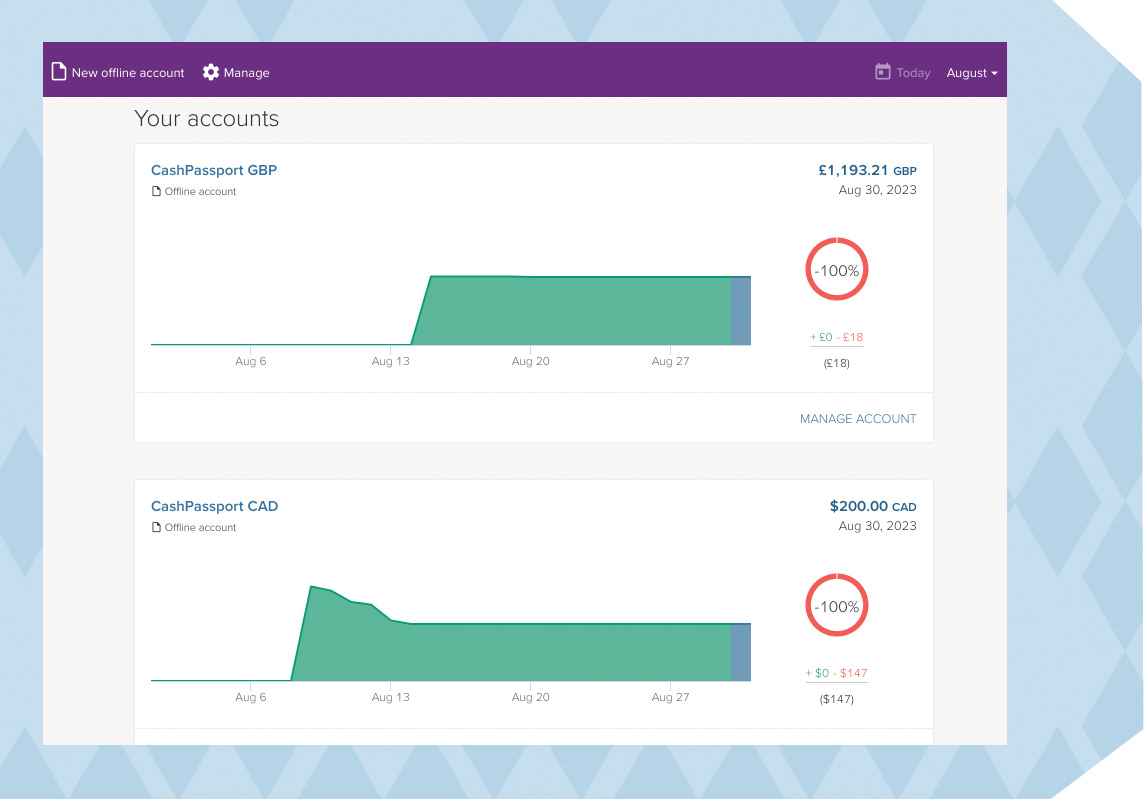

Like the balance graph at the top of my dashboard. It’s one of those stalwart features we take for granted, innit? Sturdy. Dependable. Until I looked at the balance for my CashPassport GBP account, expecting to see 1,190, and I saw… 2,500.

Cue miniature freak-out. I knew I hadn’t loaded that much onto the card.

After some frenzied clicking, I realized the obvious: Of course PocketSmith can’t calculate a total on selected accounts when they’re in different currencies. So the amounts are converted into your native currency, whatever you’ve set that as. In my case, it’s NZD.

Which showed me the danger of only seeing what you expected to see. Expecting £1,190, I’d read the total as £2,500 — pounds sterling. But on second glance, it was really $2,500 — New Zealand dollars.

The transactions column widget has always been in my top five favorite dashboard widgets. With its hard work over the last few months, it has firmly cemented its place and earned a gold star for good behavior.

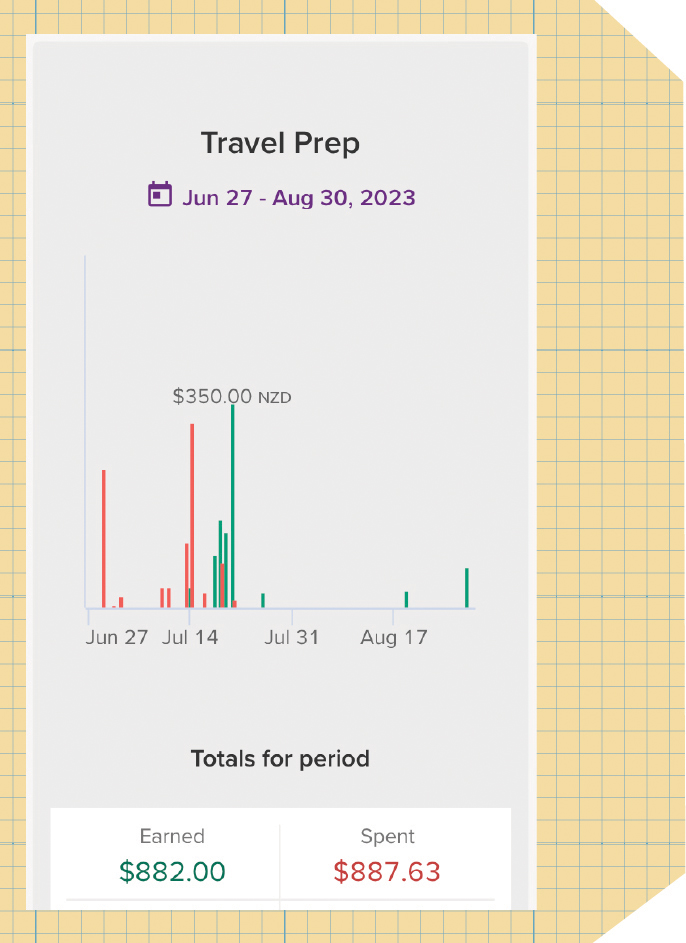

When I started prepping to move overseas, I needed a way of tracking the ins and outs of my travel finances. I won’t go into my full PocketSmith overhaul — that’s a story for another time — but in the meantime, I created a category called “Prepping To Go.” Anything, and I mean anything, to do with the upcoming move went in there. Houseplant sales? Prepping To Go. Buying a travel pack? Prepping To Go. Selling my beloved Doc Martens because they wouldn’t fit in my carry-on? Prepping To Go.

I tracked it all in a transactions column widget. ‘No account filtering’ + ‘Include only selected categories’ + ‘Prepping To Go.’ That gave me a daily update on how much I had spent or earned for that category and whether it was even close to balancing out*.

Spoiler alert! By some miracle and despite all my expectations to the contrary… it did.

*Not factoring in flights and insurance because they’re a different category and a whole other kettle of fish.

My favorite. Okay, one of my favorites. They’re all intertwined and interconnected, frankly. I can’t talk about offline bank accounts without mentioning setting the bank balance in your chosen currency. Likewise, I can’t talk about currency conversion in one place without following that through to other places.

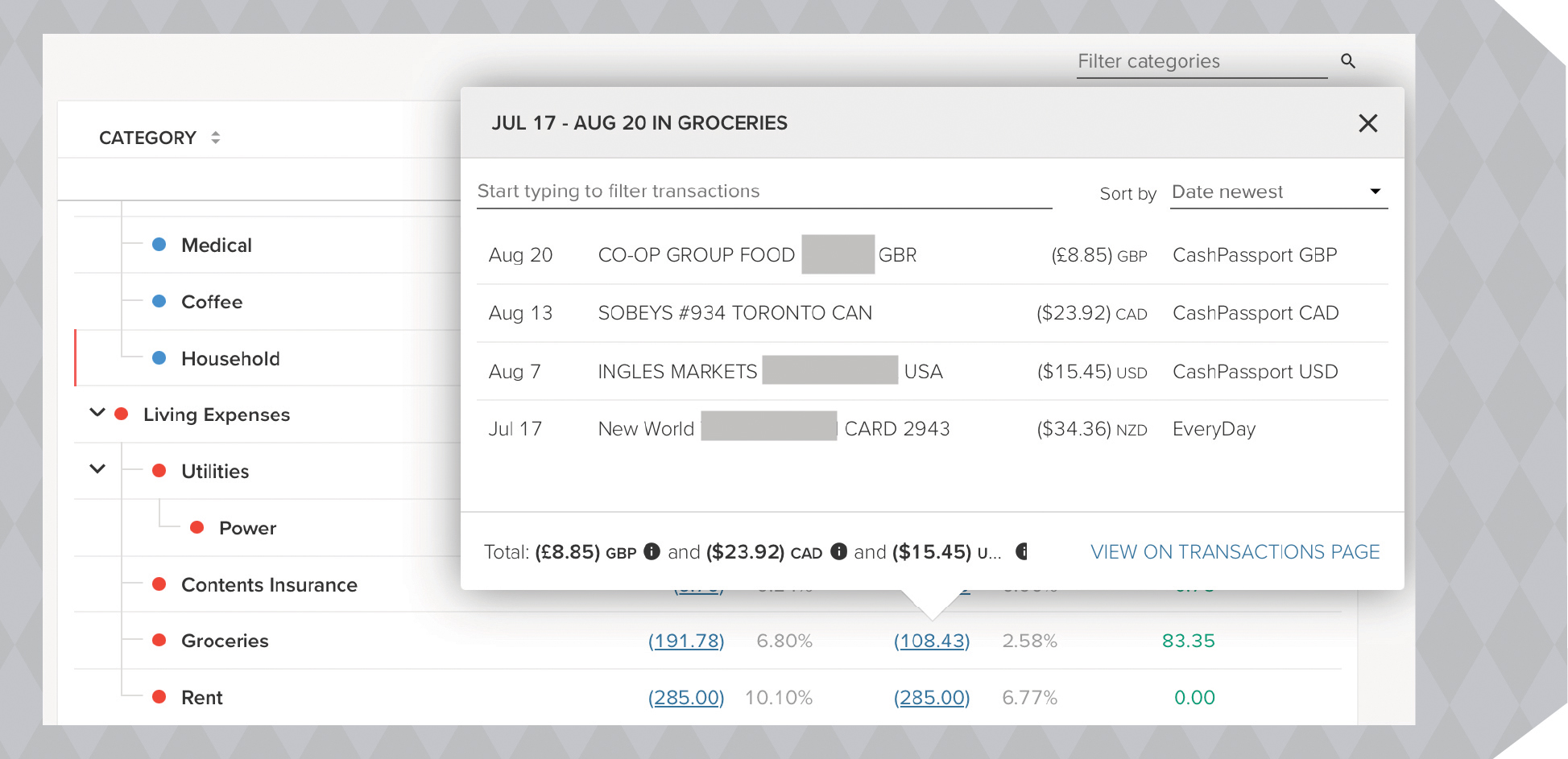

So, aye, the currency conversion carries through to the Transactions page. But it doesn’t stop at glancing over the Transactions page and seeing four different currency codes. On the Calendar, you’ll see individual transactions in their own currency and an overall total converted to your native currency. On the Income & Expense report, a category will roll up to show an overall total; but click into it, and you get the breakdown of transactions in each individual currency.

It’s the first time in my life that I’ve done something as mundane as buying groceries — in four currencies, in four countries, in the space of four weeks. PocketSmith lets me see that. All of it.

And it is awesome.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).