We asked our team to share with us how they use PocketSmith to manage their finances and plan ahead. We hope their stories give you ideas and inspiration about how you too, could use PocketSmith to build meaningful relationships with your money. If you have any questions, feel free to ask us – we’re always happy to help!

Meet Mike! He’s the software engineer responsible for the parts of PocketSmith that you can see and interact with. Mike builds new features, fixes bugs, and adds some magic to make PocketSmith a joy to use.

Managing the family budget (good lord, that sounds dull).

Oh wow, where do I even start? Before PocketSmith, my wife and I had shared accounts and no budget whatsoever. We didn’t really watch where our money went, though fortunately we were pretty good at not spending beyond our means. But saving was hard. I would put away whatever I could at the end of each week but it wasn’t a lot.

Nowadays though we also have 3 young kids to provide for. I set up a simple budget on PocketSmith a few years ago and over time I’ve turned it into an incredibly effective household budget. This meant that at times when things were hard, like when my wife wasn’t working and the cost of childcare really started to pinch, we could identify areas where we could cut back our spending while still having enough leftover to go out from time to time or to put away into savings.

Through PocketSmith I also discovered that we could manage our budget even more effectively by using more than one main bank account. We now have separate accounts for things like groceries and bills, along with automatic transfers into those accounts (including the savings account) each week. This means we no longer have to worry about whether there will be enough money left in the account to pay our bills, let alone having money left over for savings — our discretionary funds are in a separate account entirely so it’s nearly impossible to accidentally overspend.

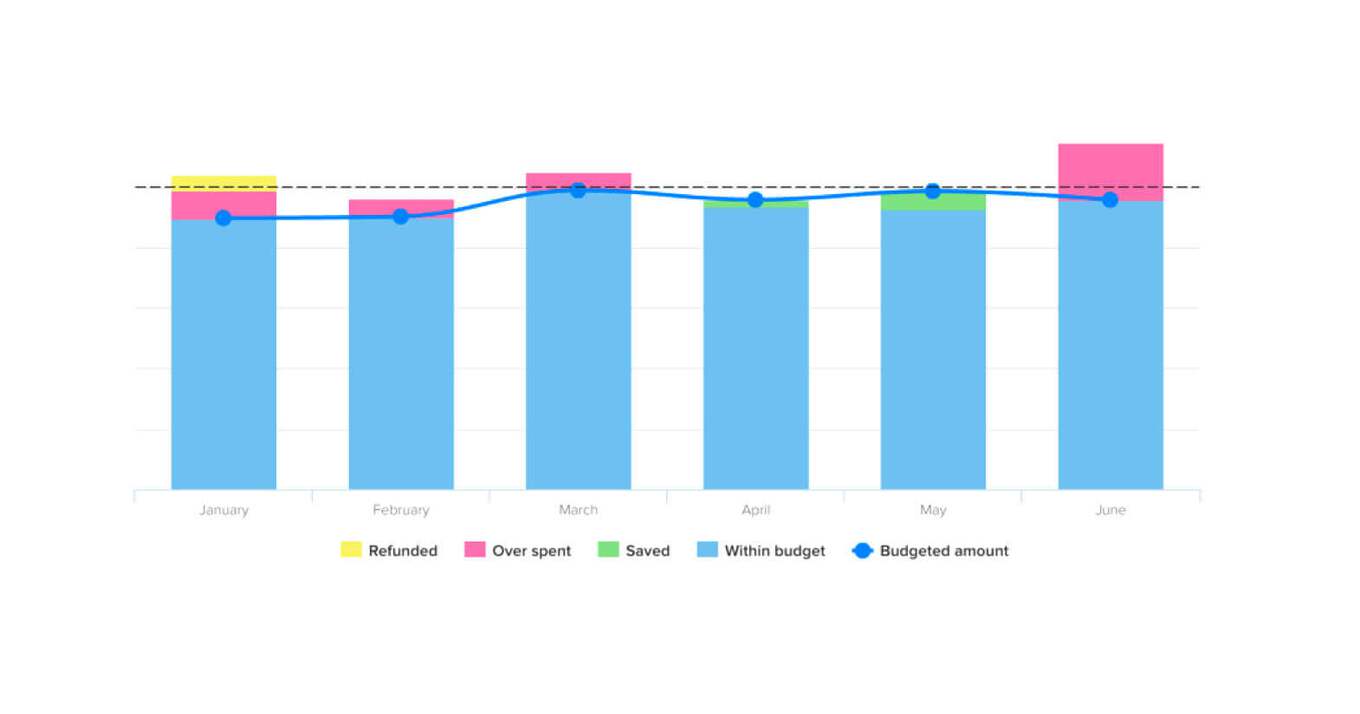

The Budget and Trends pages are where I go to check how our budget is going. From time to time I’ll adjust it a little bit to account for changes in our income or spending habits. I also find the Income & Expense report very helpful to identify areas where we’re overspending, and I use the Digest to compare our progress month-by-month.

About once a week in order to categorize transactions, and roughly once a month to have a more thorough look at our budget.

Having transactions correctly categorized is a crucial first step, and so I highly recommend setting up filters and category rules to apply categories automatically wherever possible.

Second to that, I definitely recommend spending the time to get your budget set up. It took me a little while before I felt that our budget was set up effectively, but once it was budget management suddenly became incredibly easy and I no longer worry about money like I used to.