Mint's Budgets page

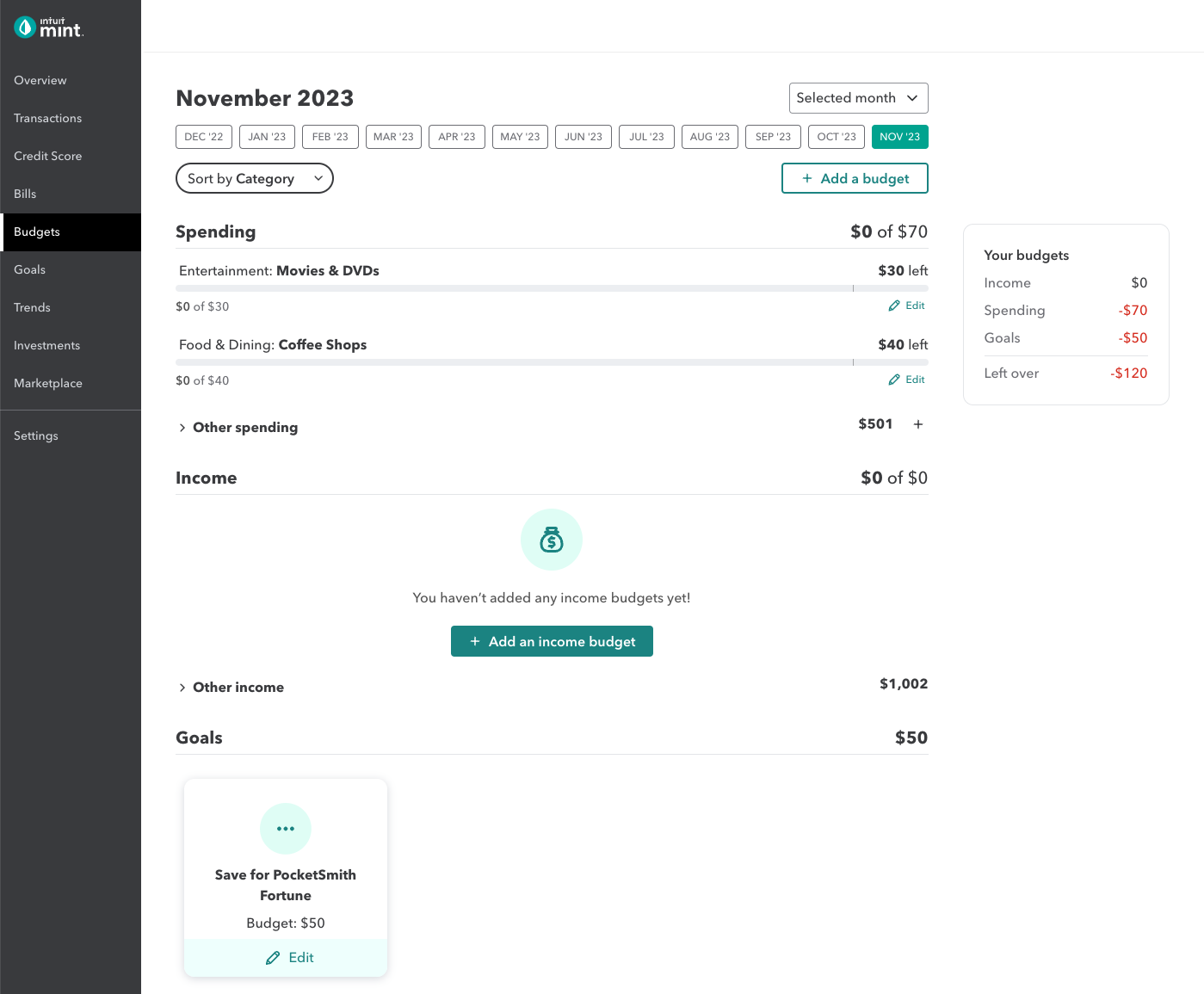

The ability to set a budget is a big reason for monitoring our spending transactions. Mint’s Budgets feature was a simple and effective tool that let us set spending limits for each category and see how we were tracking against it.

via Tenor

While it may be hard to say goodbye to a familiar feature you’ve relied on for a long time, here’s what you can look forward to in PocketSmith.

We’re continuing to craft an elegant budgeting experience that grows with you based on years of customer feedback. We’re confident you’ll be surprised and delighted at what we have in store.

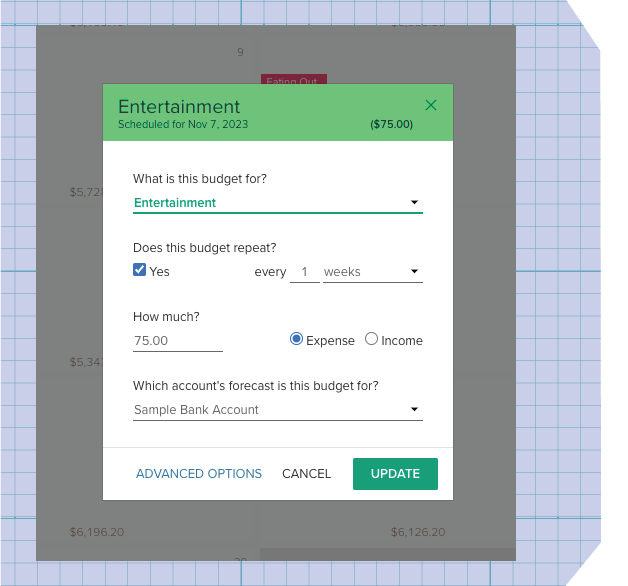

Where Mint’s budgets are limited to one-off, one-month, or a few months, PocketSmith lets you set budgets in common configurations you can find in a calendar:

Budgets can be started on any date you wish — not just at the beginning of a month.

You can also set advanced options, like when you would like a budget to permanently end, or if it’s a transfer to another account, or a bill, and more.

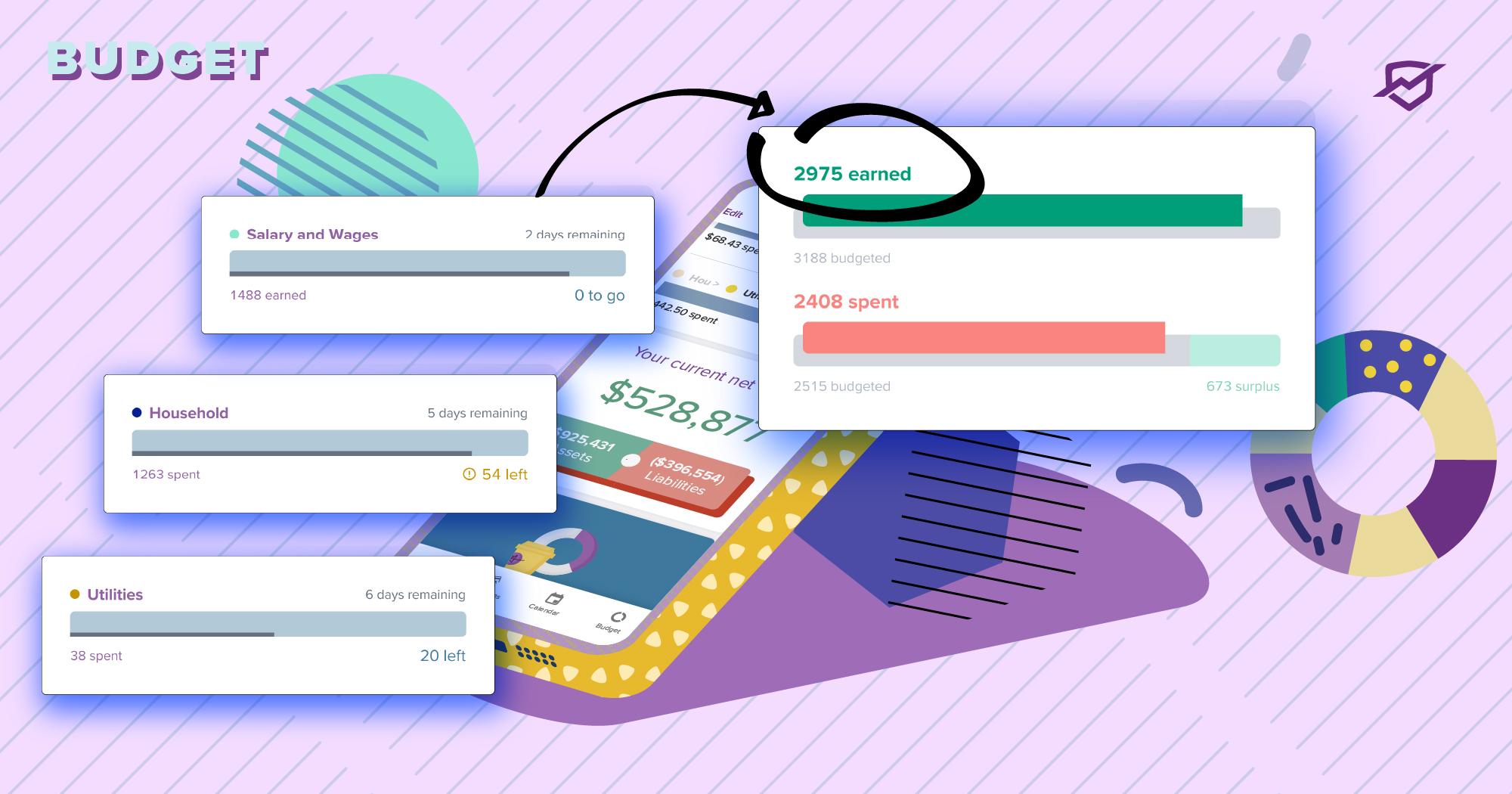

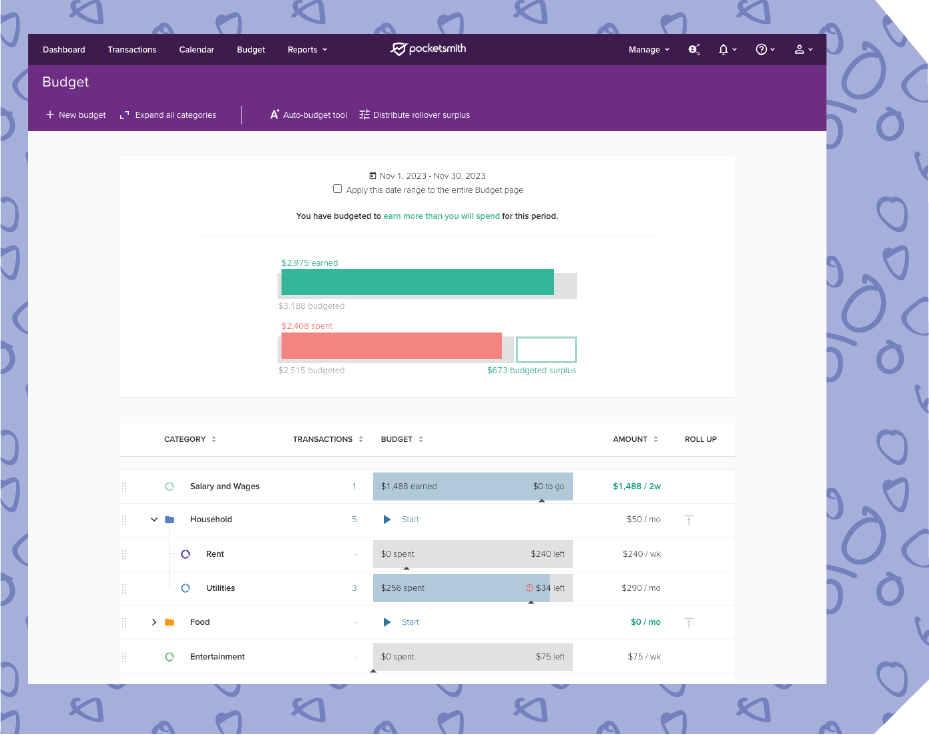

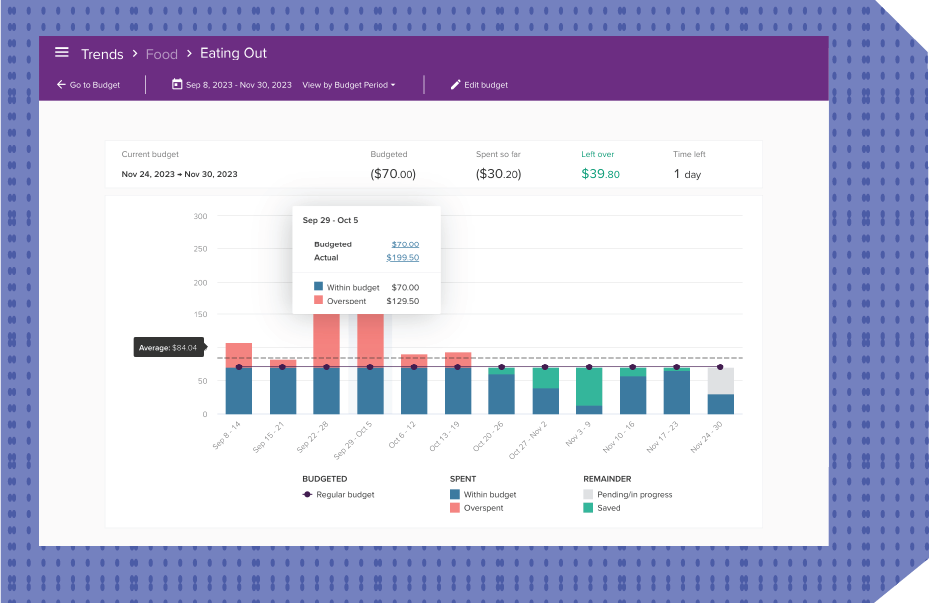

We make the information as clear as possible so you can quickly see what’s going on, with:

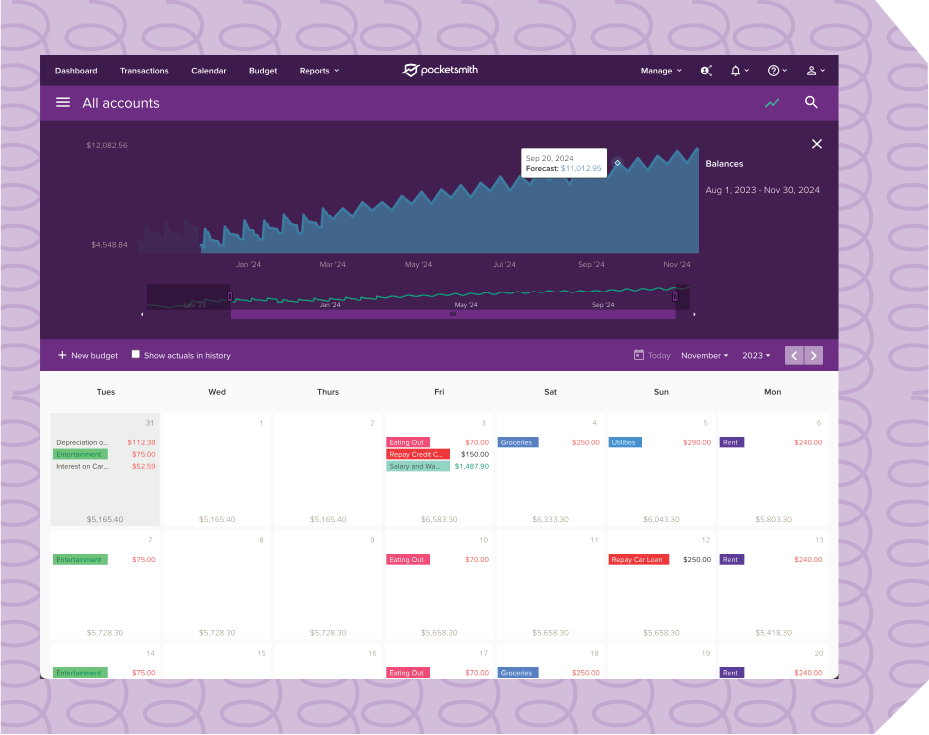

PocketSmith can show you your budgets in a calendar because it treats budgets like calendar events.

This view makes it easy to see when:

Adding, editing, or deleting a budget from here is as simple as clicking on it, just like on a regular calendar.

Another cool thing about PocketSmith’s event-style budgeting is that it will make a forecast for you based on your recurring budgets.

You’ll see a daily predicted balance at the bottom of every day in the calendar, and this can go as far as 60 years into the future, depending on your plan.

You can make multiple forecasts comprised of different budgets and budget amounts in separate scenarios. By switching scenarios, combining them, and turning them on and off, you can quickly model the outcomes of different decisions on your future bank balances, like:

If you’d like to get set up quickly, you can use the Auto-budget Tool to get PocketSmith to make budgets based on your categories and average spending.

This tool also creates your forecast, giving you an idea of how you’ve performed historically against your averages and what your potential future would look like.

PocketSmith will automatically set your budgets based on the information it has from your transactions. If there’s not much data, please remember that a large purchase or income may skew your averages.

Auto-budgets can be easily deleted, however, so you can quickly undo this step and go on to refine your budgets as you see fit.

Okay, so you’ve gone over or under budget — but how did this happen?

We love saving our users time, so we’ve made it easy for you to refine the information you’re looking for.

PocketSmith lists the number of transactions belonging to a budget for the period, and you can see them in a pop-up simply by clicking on the number.

You can then dig in deeper within the pop-up by:

And for more heavy-duty work, just click “View on transactions page” to be taken there, where you can rename, recategorize, edit, add notes and attachments, delete and more.

Just click on a budget, and voilà:

Our friend, the Transactions Pop-up, also works here. The pop-up appears when you click on any total value of your actuals that appears as a link.

You’ll be able to see the reason for the red spikes in the past with just a couple of clicks.

Mint’s top-level categories are fixed, whereas in PocketSmith, you can choose your category names across all levels to budget in a way that suits you best.

I’ll clue you in on a pro feature here. You can quickly create entire category structures on the Manage Category page in one click.

Click “Add new categories”, and boom! You’ve just created all your categories in one shot.

Like in Mint, you can also nest your budgets in PocketSmith. We offer a couple of advanced features here, though:

This is the most feature-rich aspect of PocketSmith’s Budgets. Simply put, for each budget period:

While the concept is relatively straightforward, we’ve worked hard to represent this phenomenon as clearly as possible for:

There are also multiple configuration options for budgeters who use this system:

You also have control over when you would like to roll a budget over and can choose to save the underspent amount instead of making the next period’s budget bigger.

Last but not least, you can use the distribute rollover surpluses feature if you have accumulated rollover surpluses in some categories and want to lock in this surplus or distribute this surplus to another category’s budget.

We know that the right tool at the right time can give you the valuable insights you need to make the best decisions without a ton of effort. This is why we’ve spent years refining our budgeting system in response to the needs of our customers.

We don’t expect you to use everything here, but rest assured, the tools are ready when you are.

So keep it simple, or get geeky. We’re here to help you be more productive with your money, your way. If our attention to detail resonates with you, you may have found your new home.

Jason is the CEO and co-founder here at PocketSmith. He is fascinated by our unique relationships with our money, and is passionate about making peoples’ lives better through the technologies we craft. He’s been a sneakerhead since the 80’s, and loves gardening on sunny days while listening to Planet Money.