You’ve nearly made it to the end of the month. Just two more days to go, so why not treat yourself to a takeaway lunch? Just a little something, maybe some sushi. You should have room for one more small expense before your next paycheck, right?

As you check your money situation, you find that your account doesn’t have enough for lunch. Maybe it’s even snuck over into the negative… oh dear. Where did all your money go?

Do you remember a time when you had to wait for your bank statements to arrive in the mail? Usually a few days after month-end. You might have gone through the printed statements with different highlighters, grouping transactions and doing the odd sum in the margins. Only to find out that you’d already bought plenty of sushi.

Luckily today, you can use online banking anytime. No more highlighters, no more written sums in the margins. What’s more, you can securely connect your bank accounts to PocketSmith to reveal more about your spending than you ever knew. Control starts with understanding your spending habits, and making adjustments to be effective with your money.

Let’s take a closer look at how to track your spending in PocketSmith and what you can learn about your money habits.

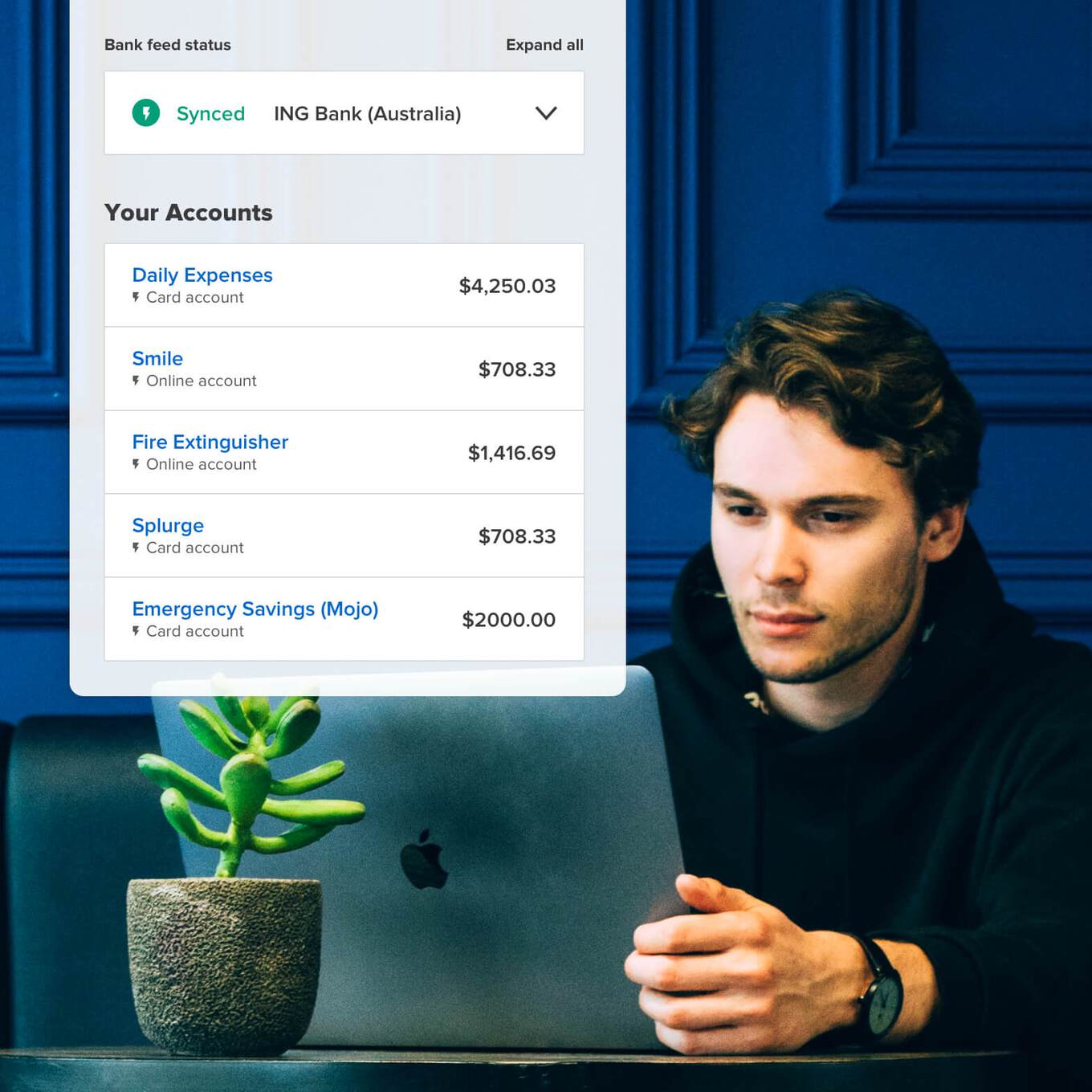

While your bank account holds a wealth of details about where your money is, online banking isn’t the most dynamic place to work with your information. So the first step is to get your data from your bank account into PocketSmith. You can do this by connecting the two with bank feeds, manually importing a file or migrating your data from another app.

Bank feeds are the most convenient way to connect your accounts. Once connected, they will automatically fetch your transactions and import them for you. Meaning whatever shows up in your bank account will automatically be shared with PocketSmith.

Our bank feeds securely connect with over 14,000 banks globally. The feature is available on our paid plans and they’re a great way to ensure you’re working with up-to-date and accurate transactions.

Bank files work mostly in the same way as a bank feed except you’ll need to fetch the files from the bank yourself. In your online banking, look for where you can export your bank account statement. With this file in hand, import it into PocketSmith, sort your details and your data is ready to use.

Because bank files are manually imported you’ll need to grab a freshly exported file from your online banking every so often. Be sure to check your dates - you wouldn’t want to miss a few days!

If you’re transitioning to PocketSmith from another money management app, you can also import files from another personal finance manager into PocketSmith. Most apps allow you to export your data to a file which you can add in the same way as manual bank files.

We also have custom migration tools for Mint.com, Microsoft Money, Quicken, YNAB, Buxfer, Pocketbook or MoneyWiz. If your app isn’t listed or you’re unsure of the best way to approach your import, get in touch with our team and we’ll advise on the best way.

With your bank transactions added to PocketSmith the next step is to group them by what they have in common. This task of sorting your income and expenses into categories is where you’ll find the interesting details of your spending habits.

To understand where your money is going, it’s good to start off with a set of categories that suits you. We recommend at least eight. If you’re really unsure, then you can use our ready-to-go set of categories as a place to start. You can change, delete, edit or add new categories at any time.

Over time you’ll extend your categories out to match your spending. Don’t worry about this too much right now. You don’t want to get bogged down setting up 40 categories. Instead, expand your categories as you learn more about what they contain. Meaningful categories are the foundation of a good budget.

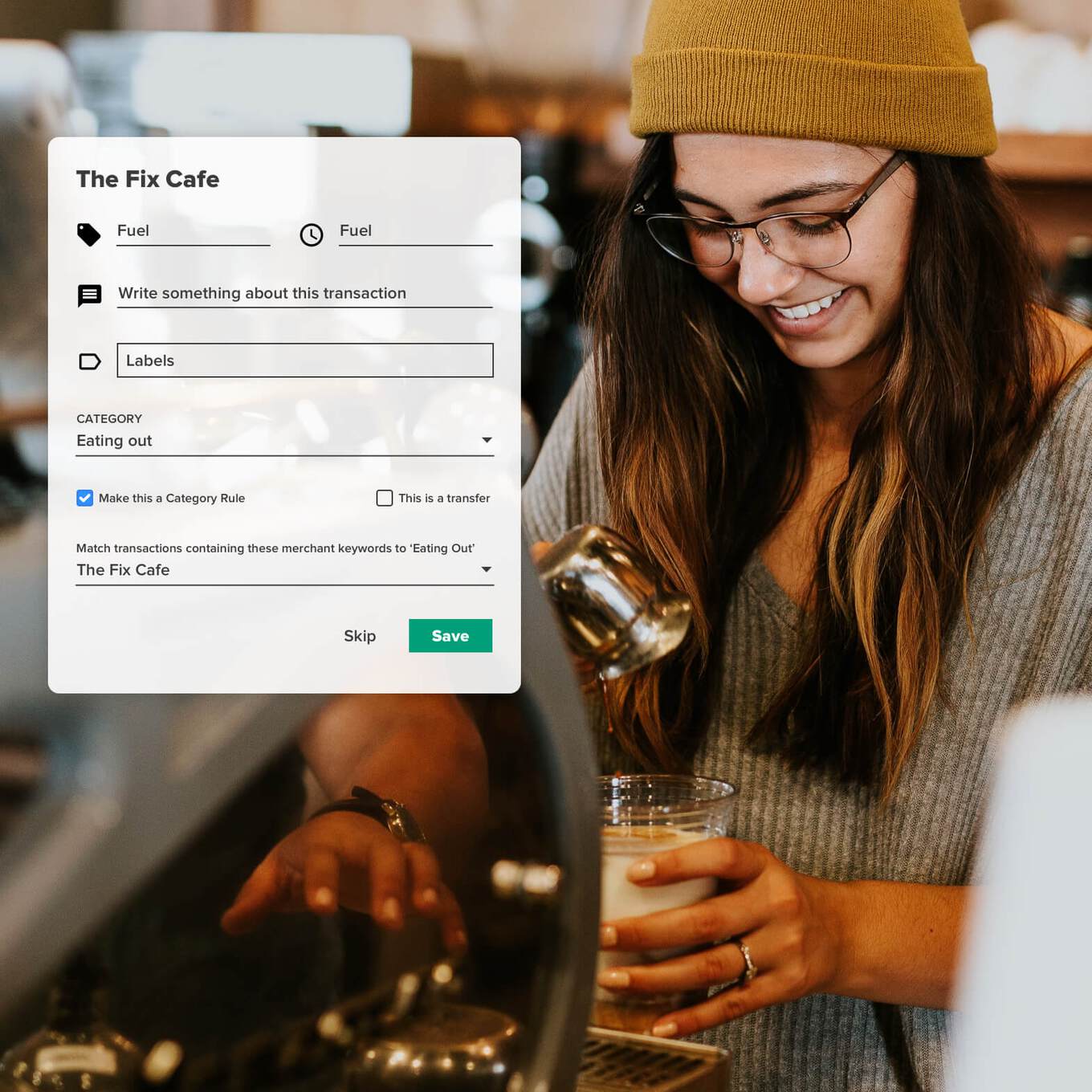

The best option to learn about your spending habits is by using the Categorize Items page. Head over to Accounts > Categories items to begin sorting your transactions. Select a transaction and choose the appropriate category from the drop-down list. If you’d like to include all similar transactions in the same group then choose the ‘Make this a category rule’ before saving.

These category rules are a great way to ease the load and they’ll automatically categorize the majority of your transactions. Then, you’ll just need to check in once a week or so to catch any stray transactions that don’t yet fall into a category rule.

There are four other ways to categorize your transactions in PocketSmith: on the Transactions page; using automatic Category rules; automatic Filters; and automatic categorization from your bank feed. Phew, that’s a lot of options! We recommend using the Categorize Items page as you’ll get a good sense of your transactions at the same time.

With your spending sorted into categories, it’s time to explore them. The great thing about being connected to PocketSmith is that you can get a nice overview of your activity with visual dashboards, and the finer details with reports. Let’s see what we can use:

Your newly populated Dashboard will give you a great overview of your money. At the very top you’ll spot your net worth and forecast graph. It’s showing you the total balances of all of your accounts, assets, and liabilities for the last three months, and projecting it forward for the next three months. Ideally you want to have this projecting upwards over time.

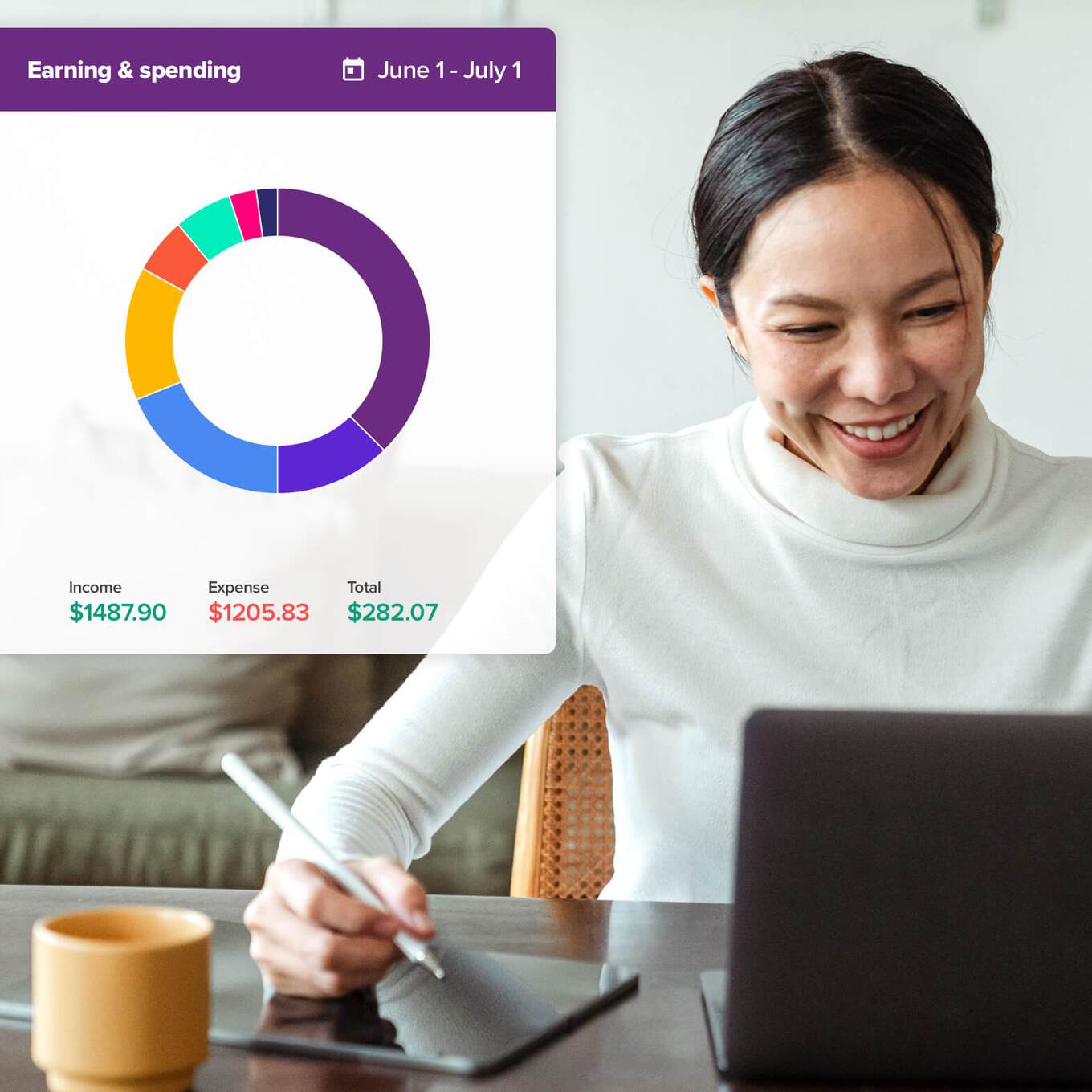

You’ll also see summaries of your accounts and recent activity. Next you’ll see the aptly named Earning and spending donut chart to the right. Here you’ll find your expenses split into segments that match your categories. To see a figure for each, simply hover over it. This is a great way to see how your spending is split up and find anything that is proportionally too big.

The rest of the dashboard holds information about your budgets. If you haven’t set any up yet, this may be empty for now.

With a broad idea of your spending in mind, it’s time to get even deeper insights by looking at a few of PocketSmith’s reports. These will break down your spending by various time periods, depending on what you want to look at.

If you’re not sure where to start, or what to look for, try checking your Digest first. Think of your Digest like an infographic for your money. Your data is presented in a series of charts and illustrated snapshots that answer simple questions such as “Have you earned more than you’ve spent?”

With your Digest you can also view your top spending categories and easily identify where you’ve spent too much. This is a great place to find little insights on your earning and spending over various time periods if you’re looking for areas to curb your spending.

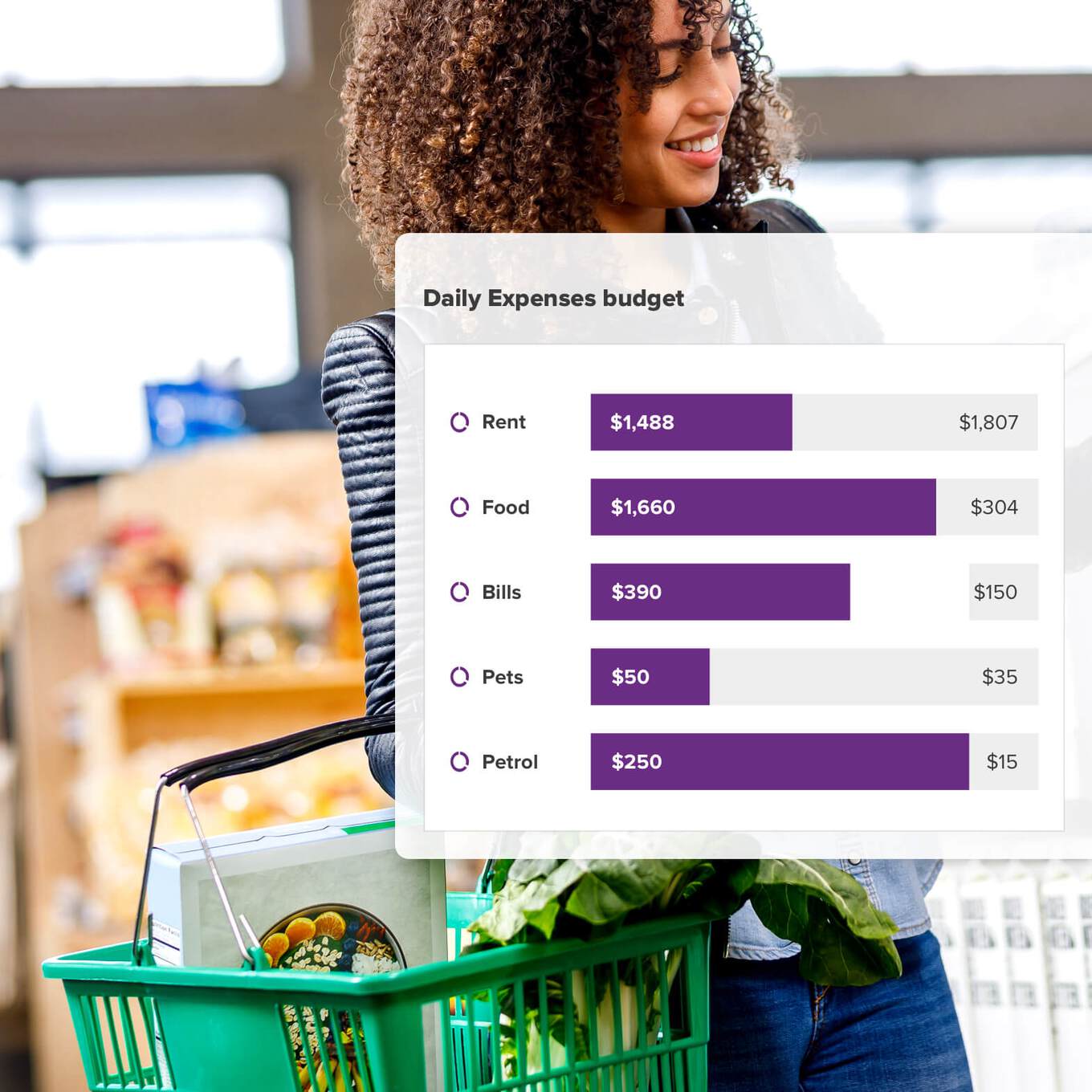

Let’s say your account emptied faster than usual three weekends ago and you want to see what you spent over your categories. You can use the Income & Expense statement to see your expenses, broken down by their categories over any date range. You can also choose to view all accounts, a single account, or a selection of accounts.

The Income & Expense report becomes even more useful once you’ve set up your budgets and you’ll see your budgeted figure next to your actual figure. Allowing you to find where you blew your budget.

If you’ve looked at any of the above reports you should have an idea of which category is blowing out your expenses. Now’s a good time to look at the trend in that category over a few months.

The Trends page allows you to quickly drill down and spot patterns in your spending. You can analyze your categories and budgets and view them broken down into weeks, months, years or budget periods. Best of all, you can compare your actual spending over time to see how you track each month, including what your average is and comparing it to previous periods.

The trends page is particularly good at measuring the accuracy of your budgets over time. You will see how much you have left to spend and quickly detect overspending, which you can use to readjust your future budgets.

Controlling your spending is about changing your habits. The best way to achieve that is to plan your money to a budget. Before you can begin to plan effectively you need to track your expenses. It’s the best place to start and it will clearly show you where you can make things better.

With the automated tools in PocketSmith, tracking your expenses is easy. Make the most of Dashboards and Reports to dig deeper and get a real understanding of your money.