I overheard an illogical conversation the other day. A couple were working out how much to spend on a friend’s Christmas gift, using the value of the gift they’d been given by that friend previously. They then shortlisted gifts that were in a similar price range.

Interestingly, they also noted that year after year, their gifts were never to be seen again. Their friend didn’t seem to cherish their gift.

I had to wonder, when did Christmas become more about the price of the gift than the person it was meant for?

So, here is a quick dose of common sense for you. I wanted to share a few tips, to save money for Christmas before the silly season takes over to help curb and control your spending. Here are a few things you need to do before you hit the shops:

A trip to the landfill or recycling center will bring it all home. Take in the magnitude of stuff people have discarded. It’s possible that some unwanted Christmas gifts end up there! Make a pinky promise that you will not add to the waste.

Our tummies can only hold so much. So, talk to the people you will be spending Christmas with. Sort out a shopping list with everyone before you hit the supermarket. This will avoid doubling up, overspending, wasting food and money.

Consider how much fridge and freezer space you have, and plan accordingly. That way, you won’t be caught out when people try to wedge hams and chickens, rounds of gourmet cheese and bottles of wine into a too-tight space.

This is a well-worn phrase in our house. Gift lists are awesome, especially if you are busy or have a less-than-stellar memory! You might ask yourself, “Have I bought second cousin Brittany a gift yet?”. Well, let’s refer to the list to find out, shall we? This method helps you stop spending money and stick to your savings goals while you’re holiday budgeting because there certainly are some things that you may want to spend extra money on this Christmas.

Without a list I’m known to double-shop for gifts and when it comes time to wrap things up on Christmas Eve I find out I’ve bought one person two gifts, yet missed someone else entirely. Which results in a frantic last-minute costly run to the shops.

A list doesn’t just stop your wasteful spending - it also helps avoid awkward conversations on Christmas morning. Just ask my daughter who was distraught when Granny forgot to buy her a gift last year! Oops.

Hands up if you have a pile of items stored away for “regifting”. These could be gifts from people who don’t know you that well, to double-ups of items you already own.

While the money spent on gifts might keep the economy running, it also represents wasted resources and time. How much easier would it be to ask your friends and family what they would like? And, within reason, try to give them what they want!

On that note, if you have someone who says, “Honestly, I don’t want anything”, please take them at their word! I never used to believe people when they said that to me, but now that I’m that person, I’m being completely honest when I say “I’d love your presence, not presents, thanks!”

Instead of a physical gift, how about writing a card with a loving message? Or bring them out for a coffee. Or help with a chore, or spend some time with them. If you’re really lost, you could take a look at these Christmas gift ideas.

The last time I checked, Christmas will be held on December 25. No surprises there. It’ll fall on the same day next year too!

So, here’s the thing to do on December 26.

So by the time Christmas rolls around again, you would have $520, $1,040 or $1,560 set aside. How much you set aside depends on how much you have budgeted to spend of course, but the point is that staying on a budget takes planning.

The key to staying on budget for Christmas is boring yet effective. Start putting aside money early, start shopping early and then stick to your budget and gift list.

If you have thought ahead of time and have taken the time to write a list of what you would like to get for people, then you can make an early start on your shopping, using the money that you have been saving throughout the year.

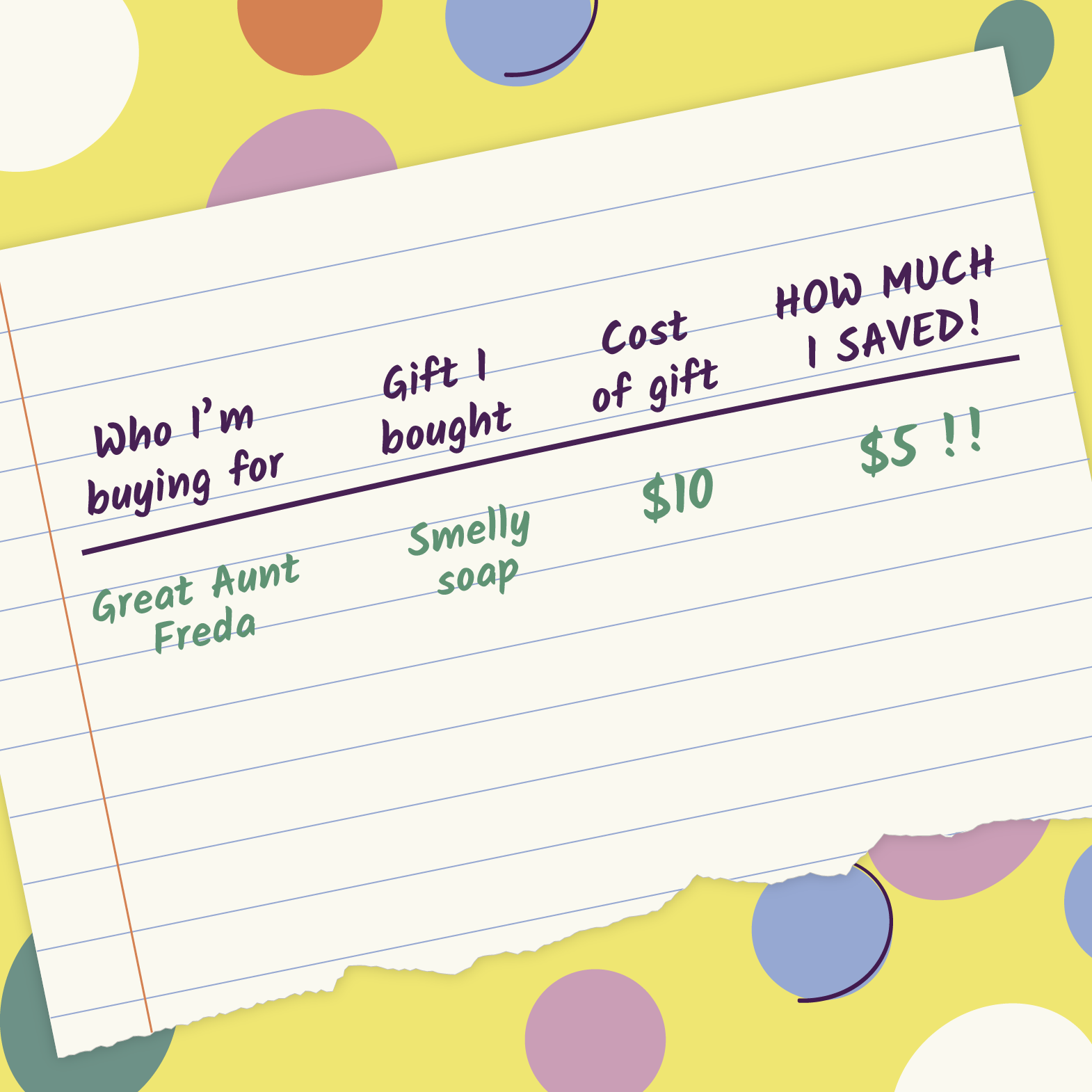

And when you see something you want on sale, grab it! Heck, for the sheer fun of it, you could even add an extra column to your Christmas list:

There’s just one last thing I want you to do for me.

Think back to last Christmas. What gifts did you receive? Can’t remember exactly?

Now think about who you spent Christmas with. I bet you can recall that. This simple exercise should remind you that people are what’s important, not expensive presents.

Gift carefully, gift thoughtfully, gift with love. And if none of that is possible, give no gift at all. Instead, just buy yourself something nice and that way you will at least end up with one gift that you actually wanted!

Merry Christmas!

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.