We’ve reached that seasonal in-between period here in the Southern Hemisphere, as we transition from summer to winter. Nights are cold, but the days are still warm. My body is confused! I’m sitting here with a hot water bottle on my feet as I think to myself, “is it cold enough to put the heating on yet or will another sweater suffice?”

Of course, for those of you on the other side of the world you are thinking the exact opposite of me as you prepare for summer. “Is it warm enough to turn the cooling on yet or is sitting here in my swimsuit perfectly okay?”

A change in seasons always brings a change in expenses; power, clothing and food just to name a few. But these are expenses that we can plan for, and this is how we do it in my household.

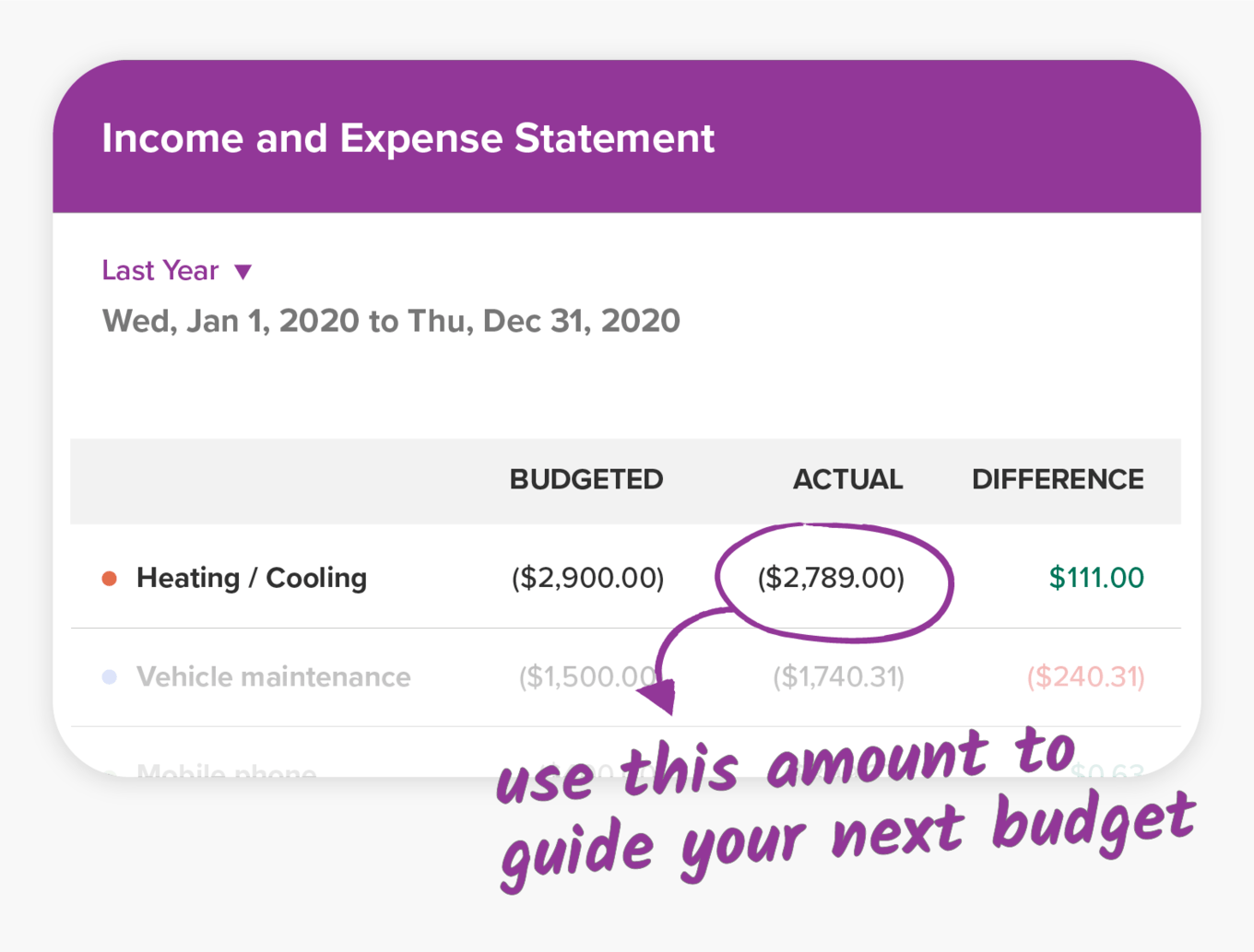

Increased energy bills during winter can be a huge drain on even the best budgeter. I plan for these in PocketSmith by using the Income and Expense Statement for the previous calendar year:

Using this historical information, I’ve budgeted on a similar outlay of $2,789.59 for 2021. It’s just an estimate but is a very sound guide and I can use this information to help me avoid bill shock!

I can choose to pay a set amount to my provider of $232 a month ($2,789÷12) or I can pay as I go, knowing that at the height of summer I may need to pay only $70 but mid-winter I may be paying $250. By knowing this I can set up my budgets accordingly and make sure I’ve got enough money on hand to pay the invoice in full.

Historical data helps with long-term decision-making too. For example, given the cost of what we were previously paying for electricity, we made the decision to fit solar panels to our home. It was an up-front cost that had an immediate impact on reducing our overall energy costs.

There are many energy hacks out there if you look for them. With so many people now working from home, it’s worth asking your employer if they will contribute towards your energy or cooling bills. There are energy providers who allow you to select an hour of free power each day, meaning that if you are organized you can run all the power-intensive appliances at the same time, cutting your overall energy costs. And most providers will give you good breakdowns when you use the most power. This is information that you can apply to your own specific situation to reduce costs.

Winter clothing can be especially expensive. The benefit of living on a round planet is that on the other side of the world, it’s the opposite season. Many times I’ve purchased winter clothes online in huge clothing sales as the US ends its winter. I get the items I need delivered to me at a much cheaper price and in time for MY winter.

And when our winter draws to a close, many people donate winter clothing to recycled clothing boutiques. If you are feeling super organized you can grab yourself a bargain and then store it away for next winter! This is extremely handy if you have children; you can be buying the next size up and have them ready to go when the seasons change.

Finally, I like to pack away the clothes that are not appropriate for the season I’m in. This is a good opportunity to donate or sell items that you didn’t wear and also to declutter your wardrobe. The added benefit is that your clothes are packed away and protected from dust and damage which they would be exposed to in your closet. And I’m not going to lie, as the seasons change and I bring out the clothes that have been stored away, it feels like I’m seeing them for the first time! A great way to get the “I’ve been shopping” vibe, without actually shopping!

Food is another expense to keep an eye on as the seasons change. I LOVE avocados and get them delivered by the box during their growing season. But as that season draws to a close, the price goes up and I have to move on. Even though I’ve not yet reached my avocado-eating limit (is there such thing?), they just get too pricey!

I adjust my eating and my cooking to only fruits and vegetables that are in season. And if I’ve been super organized, I’ve even frozen my favorite home-grown vegetables while they were in season, abundant and cheap.

I’m not a horticultural genius, so I just use my supermarket or my home delivery service to guide me to what’s in season! If you pay attention to price and quality, you will soon work out where the bargains are to be found.

For those who do enjoy getting food delivered to your door, consider reducing costs by buying in bulk and sharing both the produce and costs with your friends and colleagues.

Finally, we all know that eating out is more expensive. And on a cold winter night, the thought of leaving your warm and cozy home to venture out to a restaurant is not a thought you relish. Remember that winter is a wonderful time to instead invite friends to your place, asking them to bring their favorite dishes to share. And when summer rolls around, having the backyard grill on, homemade dishes to share, and a bunch of your favorite people over to enjoy an evening with is hard to beat. It’s kinder on the wallet too.

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.