Five Things I Wish I Knew When I First Started Using PocketSmith

You’ve just signed up to PocketSmith and you’re ready to fully harness its money management power — now what? If you’re looking to make the most out of your shiny new PocketSmith account, check out what user Rachel would have told her newbie self now that she’s a pro.

The last couple of years have been messy, haven’t they? Ever-changing pandemic rules, housing bubbles, rising inflation… but we’re here. Summer is roaring (at least here in the Southern hemisphere!), and the season comes with a new warmth and a stubborn hope.

Change is in the air.

We’re also barreling towards my 18-month anniversary of using PocketSmith. I signed up for the Basic plan in late August 2021, lasted a few days, and then upgraded to Premium. As a new user, I had a lot to learn.

Looking back on the past year or so, there are five things I would tell myself.

1. Why pay when I can use it for free?

Oh, me. That’s like asking “Why eat a Fairlie Bakehouse Pork Belly and Apple pie for $7 when I can eat a petrol station gristle-and-gravy pie for $2?”

Sure, the Basic plan is free. It’s a great way to taste what PocketSmith has to offer. You get a tantalizing nibble around the edges. But for the full depth of flavor, it’s worth shelling out for Premium or Super.

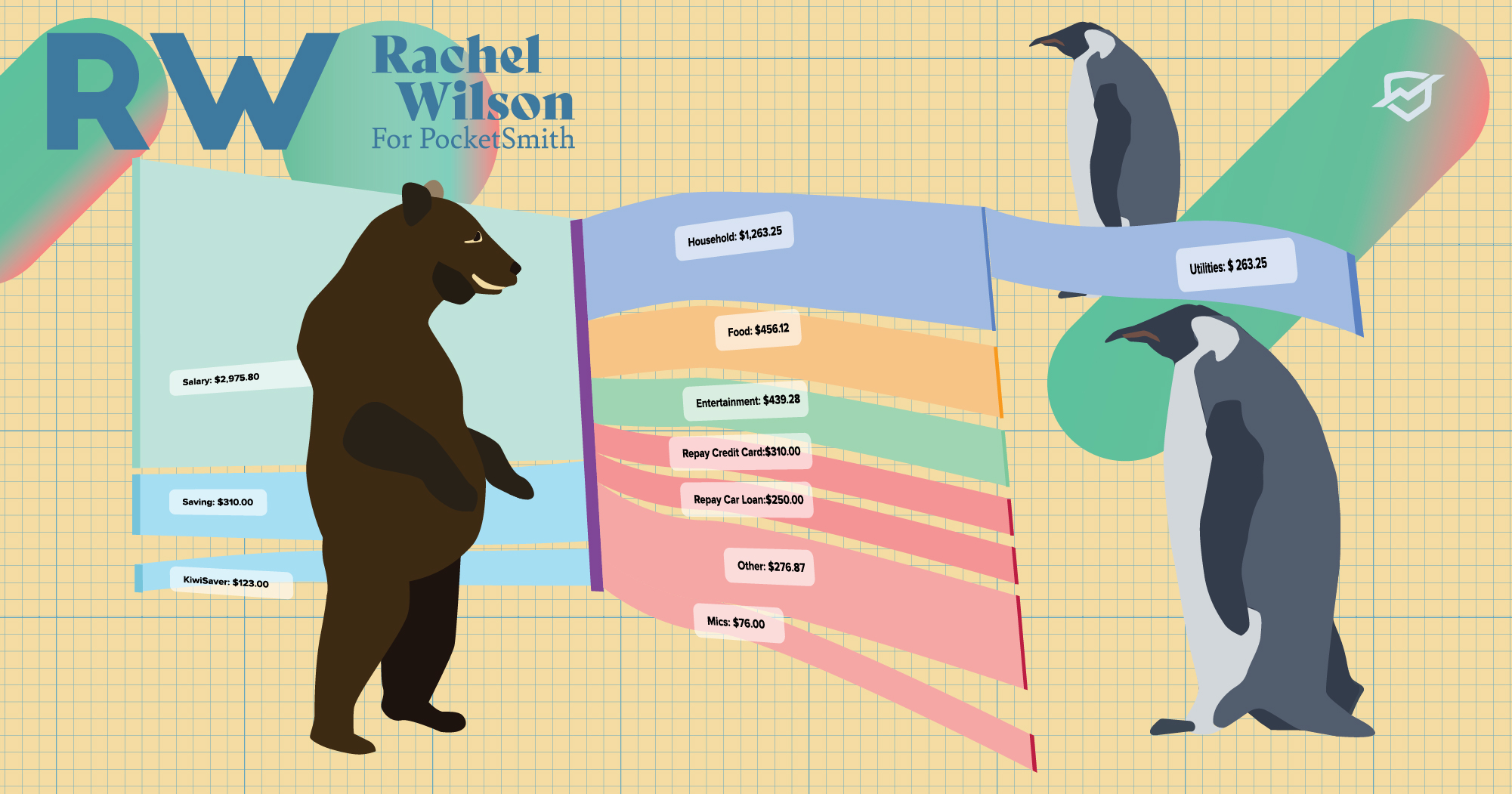

Where the free plan relies on manual imports, the paid plans thrive on automating a ton of functions. Automatic bank feed syncs? Done. Automatic categorization of transactions? Done. Automatic visualization with a Donut or a Sankey diagram? Done!

2. Is it worth $90 a year?

A year ago, I was working full-time in a salaried job and I had a good savings habit. Listening to a Happy Saver podcast, I’d heard about this PocketSmith thing and decided to give it a go. But would it be worth that initial lump payment?

In short: Heck to the yes. I may have spent $90, but seeing what’s happening with my money has saved me that much ten times over.

My advice? Skip Basic and go straight to Premium. The automatic bank feeds alone are a life-saver. I wasted hours importing and categorizing transactions manually, only to move to Premium and find I could do it at the click of a button. Goodbye, frustration. So long, time-wasting. Hello, dozens of useful functions.

3. I want to know everything right now

Okay, calm your farm, friend. I get it. I was impatient too — but I wish I’d taken a step back and let myself breathe.

You don’t have to do it all tonight, or even this weekend. There’s a bit of a learning curve, sure. That’s what the Learn Center is for. Go. Read. Familiarize yourself. If it feels overwhelming, take a break. Or try something — anything — and see for yourself how intuitive it is. You don’t have to do everything now; it’s enough to start with one thing. Connect your bank feeds. Learn how to split a transaction. Create a category. You’ll get there, and before long you’ll be ’Smithing with the best of us.

But know that it’s not a race.

4. Do it for yourself…

When I first signed up for PocketSmith, I dove in head-first with both feet (to quote Adrian Plass): Learning this, trying that, growing more and more excited at this new world of financial functionality. Naturally, I wanted to share it with my friends. I fired off invitation after invitation, and….

Crickets.

Which is fine! As the saying goes: Personal finance is personal.

Your money journey is yours, and your friends’ money journeys are theirs. It’s not a comparison game. It’s not a competition. Everyone moves at different speeds, everyone has different priorities, and that’s fine. Don’t do it for the selfie or the debt-free scream (although they might be bonuses) — do it for your own sense of self.

5. …But be ready to welcome others

Almost a year after that first invitation, a friend read my blog about the Traffic Light Priority System and contacted me.

“Loved your article! That looks really helpful. Hang on, didn’t you send me something about those Pocket people a few months ago…?”

Annoyed? Not a jot. I was thrilled! One, she’d read the article; two, she’d found it useful; and three, she was asking about the next step. That’s everything I ever want my writing to do: Make people feel, make people think, and stir them to action.

The journey is personal, but it’s more fun in a community. Keep an open mind and an open hand. Your friends will learn from you, you’ll learn from them, and who knows? One day you might be the one reaching out to say, “I loved your podcast! Do you have any advice about…?”

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).