If you’ve come here to learn about an easy way to get your maximum account values for your FBARs, we can cut to the chase: PocketSmith has just the feature for you.

For the uninitiated, here’s a quick run-down.

An FBAR is a Foreign Bank Account Report, also known as FinCEN Form 114. Briefly, you need to file one of these if you are:

The requirement to file an FBAR was first enacted as part of the Bank Secrecy Act of 1970 as a tool to prevent financial crimes like money laundering, terrorist financing, and other illicit activity.

FinCEN even has a brief instruction guide on how to launder money, just so you don’t accidentally open a financial laundromat:

*Typically, it involves three steps: placement, layering and integration. First, the illegitimate funds are furtively introduced into the legitimate financial system. Then, the money is moved around to create confusion, sometimes by wiring or transferring through numerous accounts. Finally, it is integrated into the financial system through additional transactions until the “dirty money” appears “clean.” *

More information about FBAR can be found on the IRS website. The filing date for most years is April 15, with various extensions possible through to October 15.

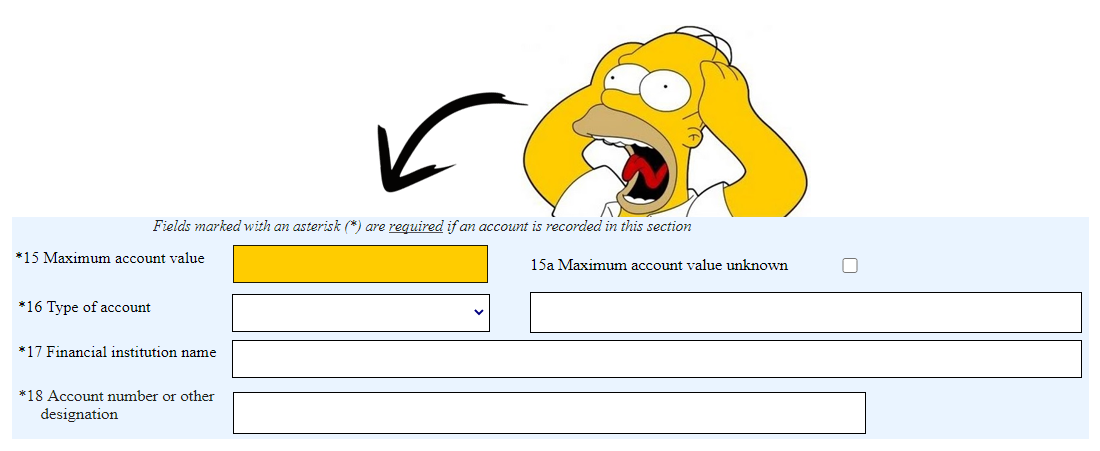

The FBAR is fairly straightforward to file when you know which accounts to declare, however one detail that can be complicated to determine is the maximum account value for each account:

This is because a running tally of an account’s closing balances over the year isn’t immediately visible on most online banking websites or apps, nor in the files you download from your bank.

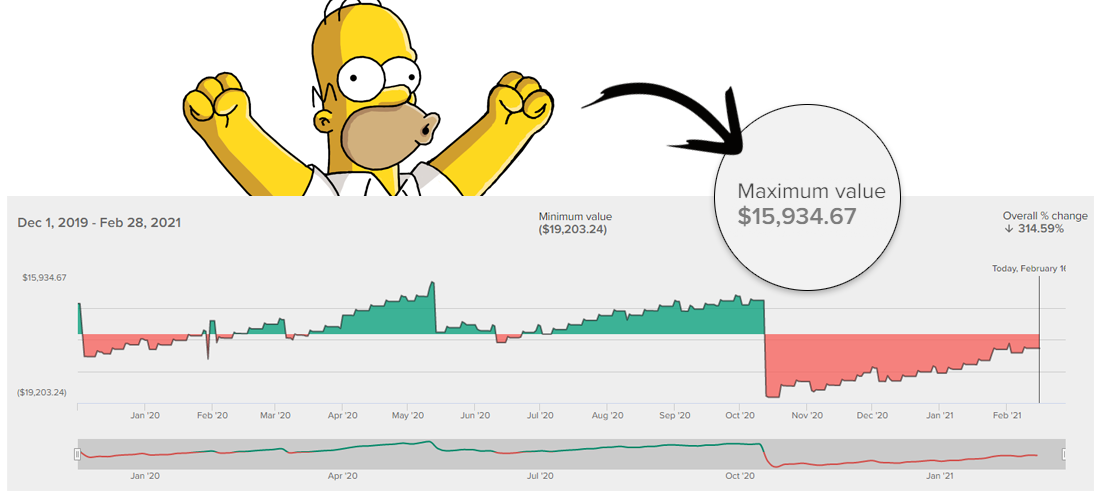

In PocketSmith, you can get this information in under a minute with a few clicks on the new Dashboard, just by adding a Balance Graph Widget for the accounts you need the values for.

Widgets are little reports that you can configure and add to your Dashboard. The example above shows a Balance Graph Widget for one of the accounts tracked by PocketSmith.

The interactive graph shows the balance of the account over time, and the maximum account value for the date range selected is right there at the top. Job done!

You can make a stand-alone Dashboard with widgets just for accounts that require FBAR reporting, so the maximum values for all accounts are visible on one page.

Use Automatic Bank Feeds so the data will be kept up-to-date for you – and next year, all you need to do is sail back to your FBAR Dashboard to get those values! PocketSmith connects to over 12,000 banks in 49 countries, so we should have you covered.

A Balance Widget can also aggregate values for multiple accounts, which could come in handy if you need to know whether the aggregate maximum value of all your foreign accounts exceeds the required threshold of USD10,000 before filing.

Do remember that the values need to be converted to USD for FBAR filing, so bear this in mind when reading the widgets and combining account values. FinCEN advises using the Treasury’s Financial Management Service rate for the last day of the calendar year.

PocketSmith has multi-currency support for budgets, reports and transactions with automatic currency conversion based on daily rates.

Find out more about the Dashboard’s other new capabilities in our feature preview article.

If you’re new to PocketSmith, the automatic bank feed system may only be able to get up to 90 days’ history for you, depending on your bank.

This is not a problem, however, as you can back-fill the data by importing your transaction files into PocketSmith. We also have Express Importers if your data is on popular apps like Mint, Quicken and YNAB. The process just takes a couple of minutes, and here are some articles that will be helpful:

This is just a small example of what PocketSmith can do for you, but we hope that this has the potential to save you some time and money in filing your FBAR for the years to come.

Ready to save some time and get your FBAR sorted? Sign up here.

If you have any questions about this article, please feel free to drop us a line at [email protected].

Homer Simpson images owned by The Walt Disney Company, sourced from Pikpng.com. Used under the Creative Commons 2.0.

Jason is the CEO and co-founder here at PocketSmith. He is fascinated by our unique relationships with our money, and is passionate about making peoples’ lives better through the technologies we craft. He’s been a sneakerhead since the 80’s, and loves gardening on sunny days while listening to Planet Money.