I’m from the US and grew up in California and Utah. For work, I’m a Product Designer for Degreed. My wife is a real estate investor and is from Samoa (formerly Western Samoa). We have a 5 year-old son and a 2 year-old Siberian Husky. My family and I currently live in a motorhome and drive around the United States.

At the time of writing, we’re near Yellowstone National Park. Besides traveling, our favorite family activity is taking our Jeep off-roading (while our dog follows us for exercise).

We use PocketSmith most frequently as a budgeting tool. We use it to track and categorize where our money has been spent. We set budgets for quite a few spending categories, and monitor whether we are staying within our budgets. My wife and I have been budgeting to some degree for almost as long as we’ve been married. We’ve found that even though we don’t always manage to stay within our budgets, budgeting has always helped us reduce our spending. PocketSmith is now helping us stay on top of that more easily.

I’ve really enjoyed the scenarios feature. Scenarios allow us to experiment with hypothetical changes to our financial plan, and then see how it impacts our financial outlook.

Looking at our forecast, we were disappointed with the slow growth of our savings account. We wondered if trimming some of our budgets would make a significant impact on our savings growth. I created a scenario that reflected a smaller budget, and we were surprised how big of a difference it made. We permanently incorporated the smaller budget and hope our savings growth follows the projection.

We’ve also wanted to buy solar panels for our motorhome for a while, but we were concerned the purchase may negatively impact our ability to purchase another rental property in the near future. So, I input the solar panel purchase as a Scenario in PocketSmith. When we then looked at our cash projection for the quarter in which we hoped to acquire a rental property, we realized the solar panels didn’t make a significant impact on our real estate goals. We bought the solar panels! We never would have had the confidence to make the purchase without Scenarios.

When it comes to showing me the future of my money, no product comes close to PocketSmith. We make wiser financial decisions when we can see how a purchase or investment will play out over time.

Seeing future balances is extremely motivating. Sometimes forecasts give you a taste of fear, and other times they entice you with a reward (i.e. a bigger savings/discretionary spending account).

I spend the most time on the Transactions page, which is where I categorize our transactions. I filter the page by transactions needing confirmation. This allows me to see transactions that were automatically categorized, as well as those that weren’t categorized.

The second most used page is the Budget page. We check this frequently so we can avoid overspending. I like that the Budget page overlays the current spending with the amount of time left in the month. This helps us identify when our spending velocity is too aggressive.

We check the reports and forecasts on a monthly basis as we do our financial planning. While those features are critical parts of our process, they get used far less frequently than the budget and transaction pages.

Last year I set a goal to check our budget every 3 days. If I wait any longer than that, we sometimes have trouble categorizing our transactions. It’s remarkable how quickly you can forget the purchases you make.

We try to scan our receipts, but sometimes we forget. By checking our budget frequently, we avoid forgetting how our transactions should be categorized, even if we lose the receipt. In addition to my 3 day routine, we try to log in before shopping. Sometimes this means we’re checking PocketSmith every day.

I think people should spend more time getting categorization right. Getting the categories right makes budgeting far more powerful and actionable. I’ve driven my wife crazy with all the different approaches I’ve tried!

I used to think that fewer categories was better because it’s simpler. However, when you are trying to identify why you overspent in a category, I’ve found it’s easier when the categories are more specific (and therefore have fewer transactions in them). Setting more categories also forces you to be more knowledgeable about how your money is spent, and I believe that encourages you to spend less. Since PocketSmith allows category nesting (sub-categories) and rolling up of budgets, there really isn’t any reason to limit the number of categories you create.

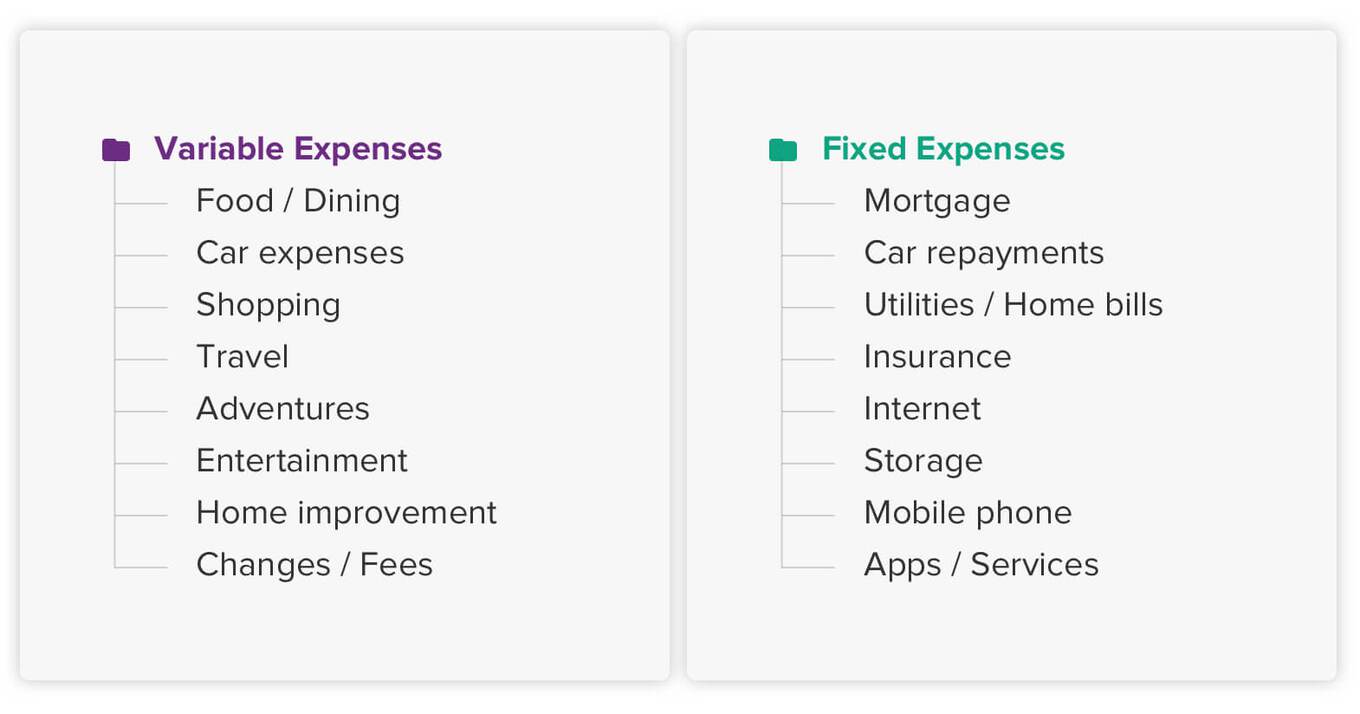

When you have lots of categories, grouping them wisely is critical. I try to group categories I can control separate to expenses that I don’t have control over. We’ve been calling these buckets “Variable Expenses” and “Fixed Expenses” respectively, although admittedly those aren’t great names.

Fixed Expenses are ones like mortgage payments, car payments, insurance, phone bill, and others that don’t change month to month. When we were living in a house, we also chose to include utilities in “Fixed”. Our most predictable expenses go in “Fixed”.

Variable Expenses are those which we have control over. These include groceries, eating out, shopping, gas/fuel, etc. We also include things like car repairs and medical expenses. Although we can’t always control them, they are not predictable and therefore not a good fit for our “Fixed” bucket.

We’ve seen several benefits to doing it this way. First, we generally don’t have to even think about the Fixed Expenses. Most of the time, the entire category only fluctuates by $100 or less. This means there’s a ton of items I just don’t have to worry about.

Second, having Variable Expenses separated helps give us a big picture view of our discretionary spending and forces us to remember we have control over those expenses. If we overspend in one budget, we can make up for it in another. We can track our overall “Variable Expenses” bucket and see that even though we spent too much on groceries this month, overall our discretionary spending was lower for the month and we’re actually saving more. Without this big picture perspective, overspending a single budget can feel like a total failure.

In 2017, we essentially sold everything we owned and began a completely new lifestyle. On top of that, we made some major investment decisions. Frankly, it’s too early to see which of our many decisions was the smartest and we probably won’t be able to objectively say which decision benefited us most for a few more years.

If I had to guess which decision will end up being the smartest, I’d predict it being one of our investment decisions. We’re hoping these investments will open the door to us being able to have a source of revenue that isn’t dependent on whether or not we’re doing any work.

👉 Follow Devin and his family on their epic motorhome adventure on Instagram

This interview is part of New Zealand Money Week (NZMW) 2017. NZMW is led by the Commission For Financial Capability, and it involves events all around the country to encourage New Zealanders to talk about money and develop greater financial capability. To further the conversation about money we got in touch with some of our favourite Kiwis to get their perspectives on their finances.