We asked our team to share with us how they use PocketSmith to manage their finances and plan ahead. We hope their stories give you ideas and inspiration about how you too, could use PocketSmith to build meaningful relationships with your money. If you have any questions, feel free to ask us — we’re always happy to help!

Meet Ellen, our Head of Support. She loves drinking tea, watching sci-fi, and chowing down on vegan snacks! Ellen spends her workdays making sure PocketSmith’s users are cared for and supported. She and her friendly team of six are always on hand to make it as easy as possible for people to use PocketSmith.

I use PocketSmith to track my flat’s shared rent and expenses.

Living in a big city can be expensive, and Auckland ranks among the highest cost of living in the world! While I would love to own a house of my own someday, in the meantime I have found that sharing the cost of accommodation affords me the lifestyle I desire, at a fraction of the cost of an Auckland mortgage.

Being in charge of my five-person household’s bills isn’t the most straightforward task!

Having PocketSmith has made it so easy to track who has paid their contributions, look out for seasonal Trends in our bills, and know exactly what our future balances will be.

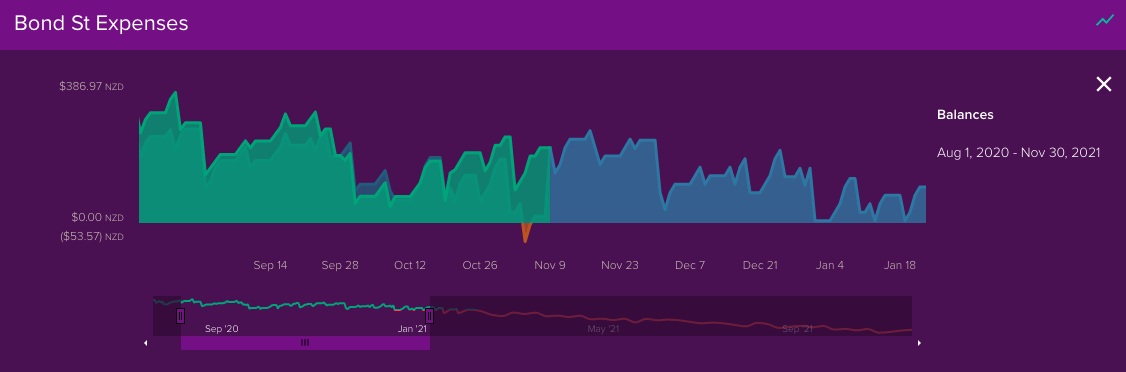

I use a simple two-account system to keep track of our flat’s shared finances; a Rent account where everyone deposits their rent and an automatic payment goes to our landlord, and an Expenses account where everyone contributes a set amount to cover our Power, Gas, Water, and Internet bills, as well as shared consumables.

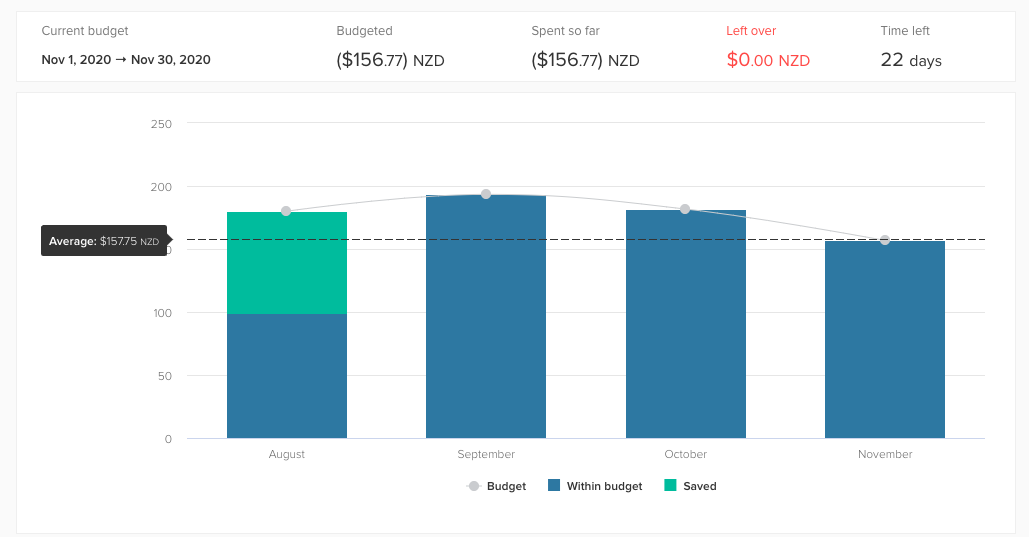

By entering all of our bills into PocketSmith as Budgets, and selecting to view just my flat accounts on the Calendar page, I was able to use the Forecast graph to know exactly how much everyone would need to contribute to the Expenses account each week to cover our costs.

With this, I could see that if we continued to contribute our previous expense contribution estimation, we would end up with a growing surplus sitting around in the Expense account — which wasn’t helping anyone! So, in the end, we could all safely drop our expense contribution by 20% — immediately putting more money into my flatmates’ pockets.

When I first log in, I always go straight to the Awaiting Confirmation section on the Transactions page to confirm that all payments have come in and gone out as expected and that the majority have been categorized automatically by the Category Rules I have created.

I’m also a big fan of the Income & Expense Statement — I love that I can change the time shown, and the report will show all of the budgets expected to occur during that period.

My flatmates each work on their own payment schedules. Those who get paid monthly may pre-pay their rent and expenses in advance, whereas others who are paid weekly may make their transfer the day before its due to go out to our landlord. Being able to set the Income & Expense Statement to an extended timeframe means that, even if the payments come in at irregular times, I don’t have to jump through any mental hoops to figure out who has contributed to each account, and, at the very worst (though it’s never come to it in my house thankfully), who hasn’t paid their rent!

I log in every few days to quickly sync new transactions and confirm all of the categorizing done by my category rules.

Twice a month I will sit down with a cup of tea, reimburse my flatmates for any flat expenses they have paid for (usually boring things like toilet paper and rubbish bin liners). I then log into PocketSmith to double-check that our budgets and forecast are going along as planned and that we will be all set for any upcoming bills.

Having a really good set of categories, and keeping them organized, can be a real game-changer! I love using nested sub-categories to arrange my categories by their purposes, including grouping all my flat categories.

Adding category colors and emojis also make budgeting just a little more fun!