David and Julia have very generously offered us a glimpse into the depths of their PocketSmith account. Read how PocketSmith helped them move from rough guesses to precise timelines for their mortgage and bigger financial goals.

For many households, money management is something we intend to get on top of “one day.” For us, that changed the moment we started using PocketSmith. What began as a budgeting app quickly became the backbone of our financial planning — shaping how we spend, how we save, and how confidently we make major life decisions.

We are both busy professionals, and PocketSmith has been indispensable. Below are the five biggest ways PocketSmith transformed our financial life. These are the features we now rely on so deeply that we can’t imagine running our household without them.

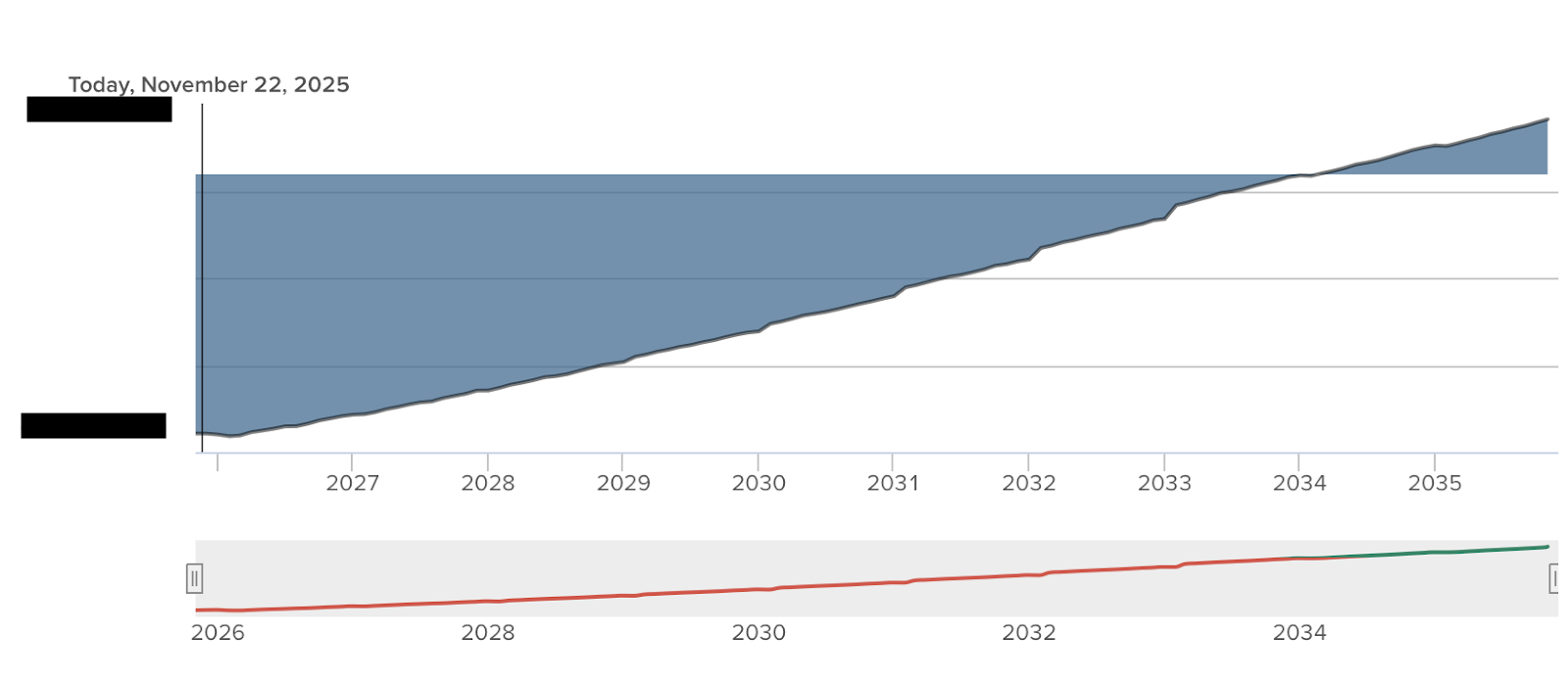

The single greatest benefit PocketSmith gave us was clarity around our mortgage.

Before using it, we had a rough idea of when the mortgage might be paid off — based loosely on guesswork, bank calculators, and hope. This gave us considerable stress, not knowing how long it would take us to pay it down, as we have a large mortgage.

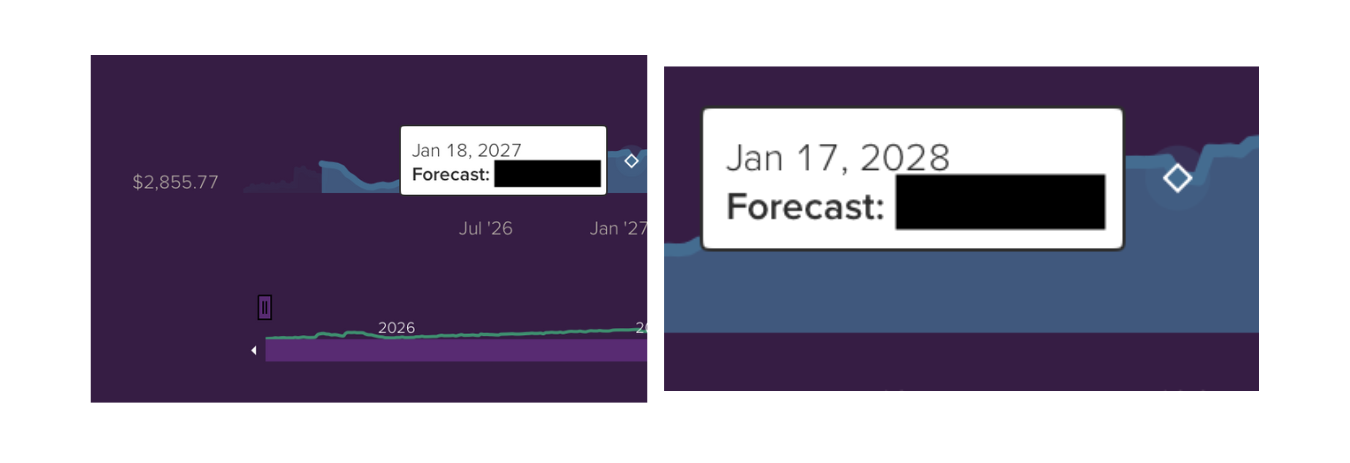

With PocketSmith, we finally had a precise, dynamic timeline.

This gave us a feeling we didn’t have before: peace of mind.

There is something powerfully motivating to see how a few more dollars directed to the mortgage helps you save so much interest later. PocketSmith helps you see the ripples of what you do now, well into the future. If you would like to live a good life and have plenty of spare cash later, it just makes sense to figure out where you can divert the extra funds to the mortgage.

Some professional financial advisors (who have also published a book) had told us, after paying them $4000, that it would take us 15 years to pay off our mortgage. But we can accurately see that if we continued with our current trajectory, it would take us only slightly more than half that time frame.

It gave us tremendous peace of mind, but also encouragement and motivation, knowing we could pay off our mortgage in 9 years, especially with such a large mortgage.

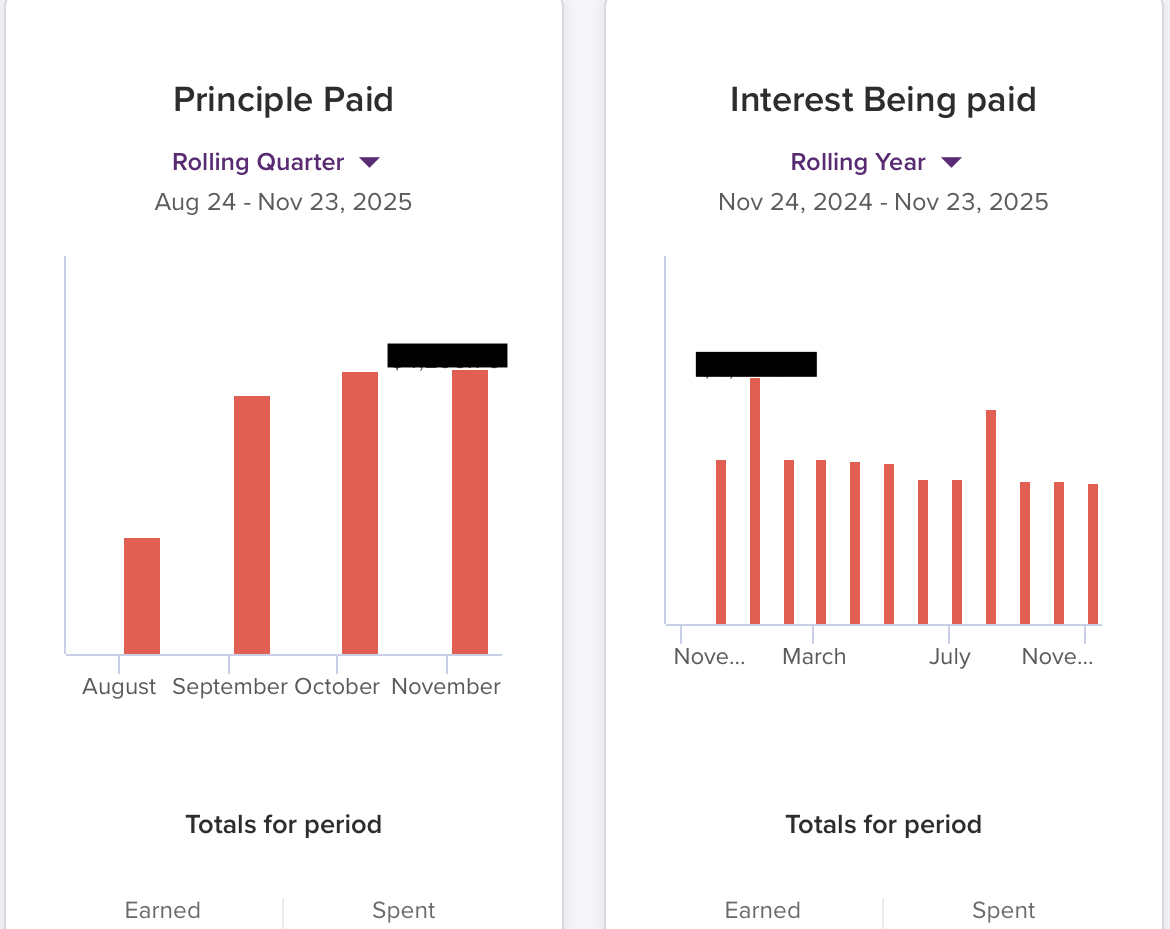

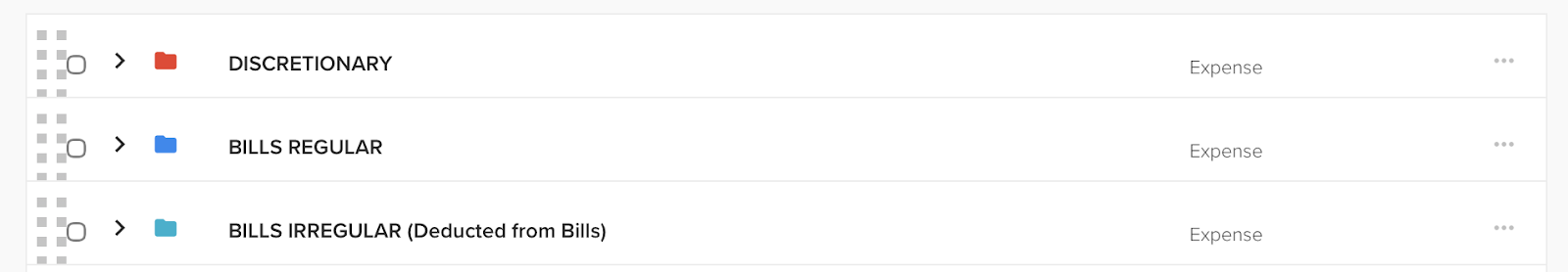

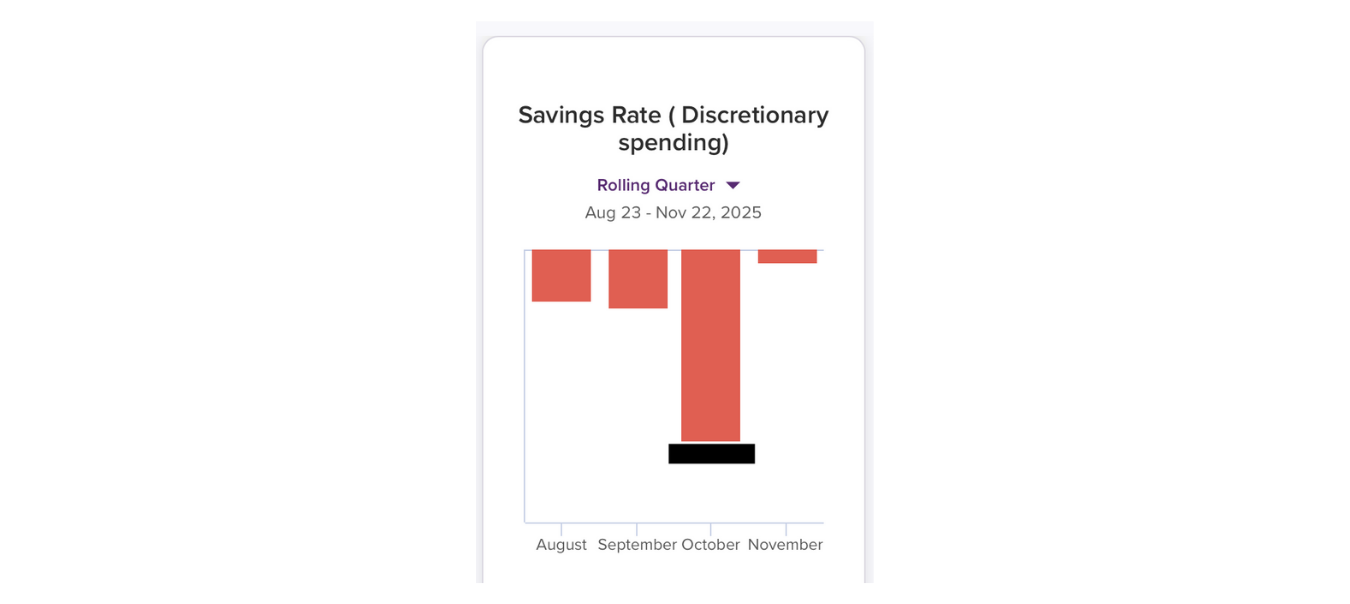

The second major breakthrough was learning how much of our income was disappearing into fritter — those discretionary purchases that don’t improve happiness. To make this visible, we set up our banking and PocketSmith in a deliberate way:

Seeing discretionary spending isolated so clearly was eye-opening. Once we knew the number, we were able to redirect that wasted money straight into our mortgage. It’s been one of the most powerful habits we’ve ever created.

We know exactly each month how much we spent on fritter. That is money that was not spent on any essential things, that did not improve our happiness.

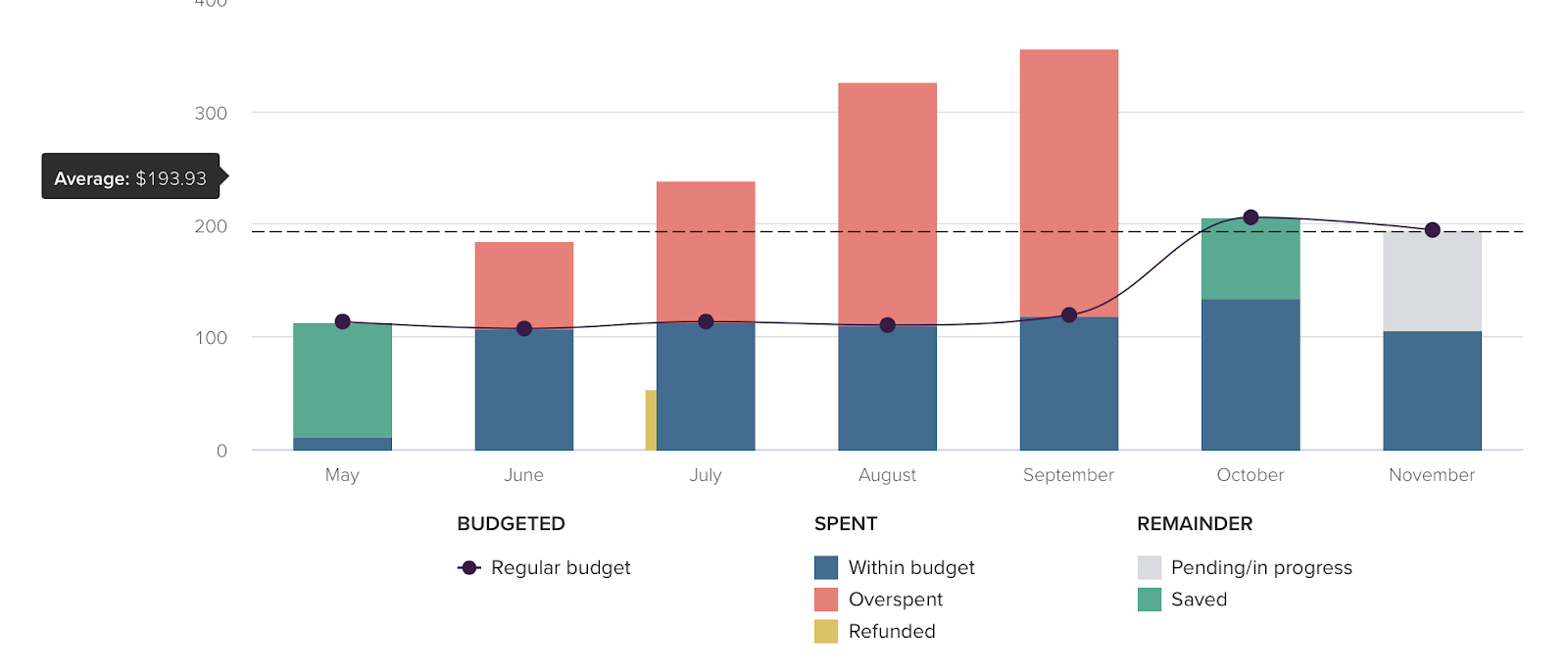

For example, we overspent in October, so we cut back in November.

PocketSmith made it incredibly easy to identify how much “surplus” income we actually had available for additional mortgage payments.

Using the Income & Expense Statement or Calendar View, we could instantly see:

This clarity allowed us to use one of the most effective payoff strategies: increasing mortgage repayments whenever possible.

Our bank (ASB) allows repayment increases up to three times per year. By monitoring our surplus income in PocketSmith, it became effortless to push more into the mortgage at the right times — saving substantial interest and accelerating our payoff date.

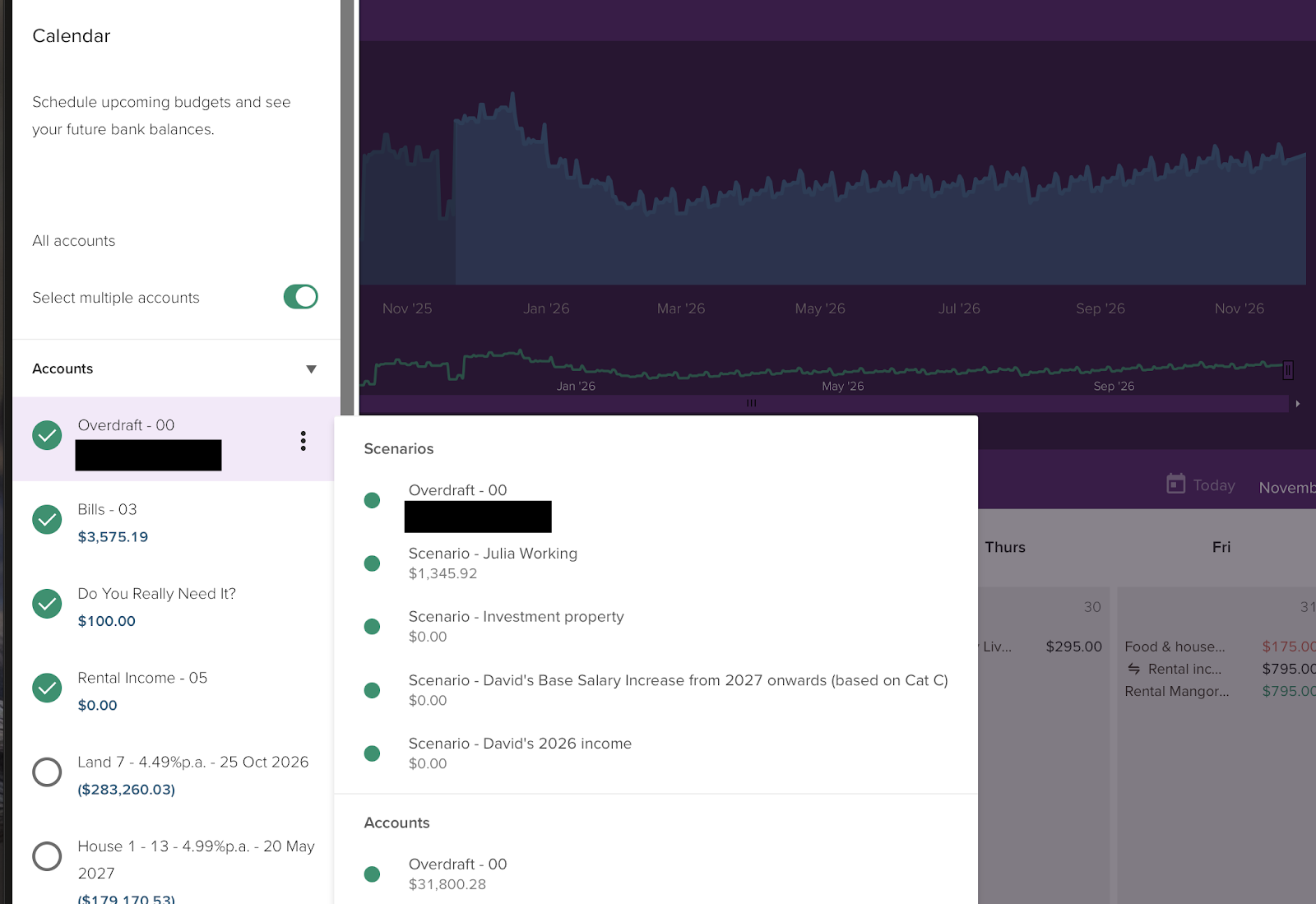

Perhaps the most surprising feature we came to rely on was Scenarios.

When we considered buying an investment property at the same time as planning for a child (with my wife potentially off work for a couple of years), it looked financially overwhelming — at least on paper. But using PocketSmith’s scenarios, we could:

This analysis gave us the confidence to proceed with an investment property — something we simply would not have done without the assurance the modelling provided.

And because PocketSmith uses our real, accurately categorised data, the projections felt trustworthy and realistic.

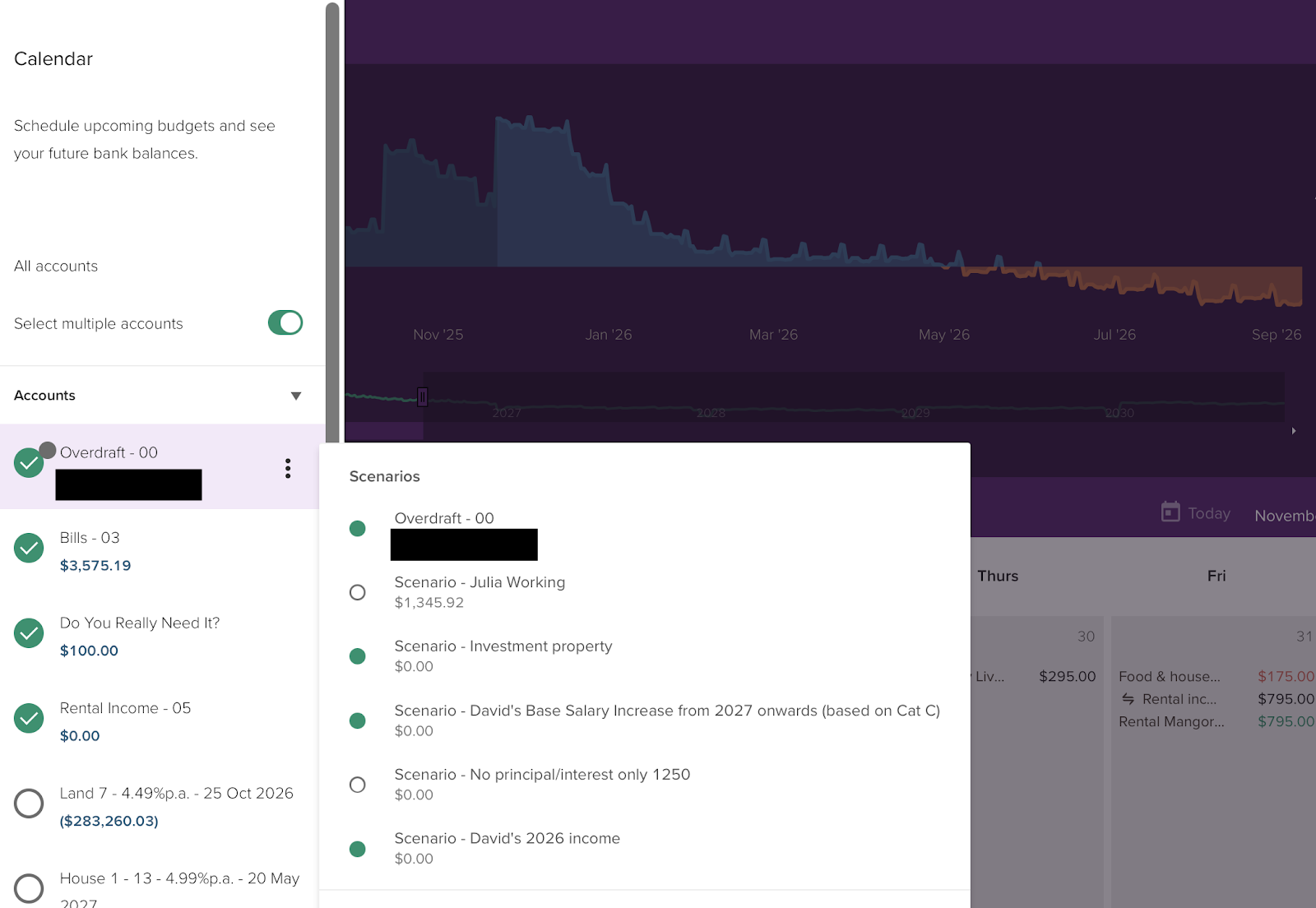

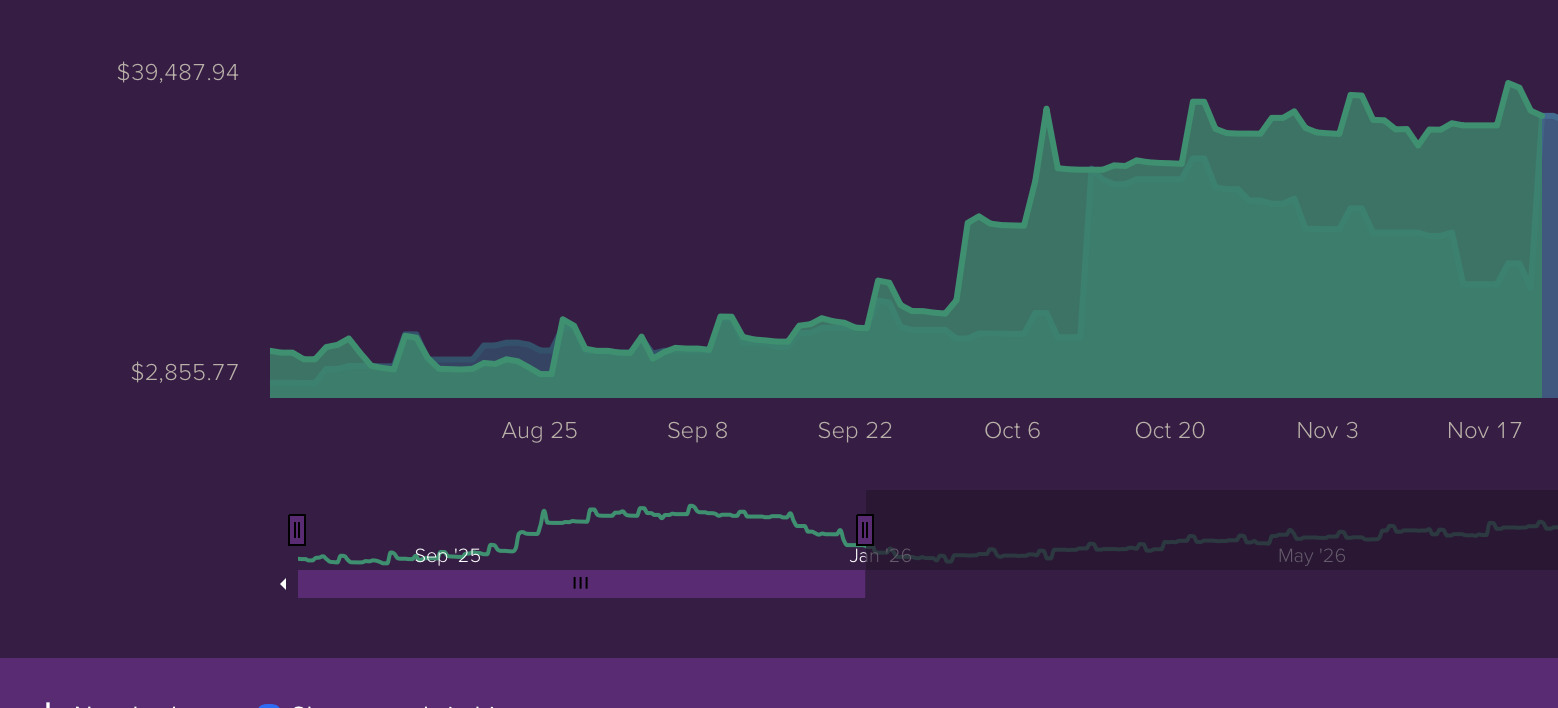

For example, if my wife did not work and we continued paying principal + interest, we would soon be in a negative cash flow:

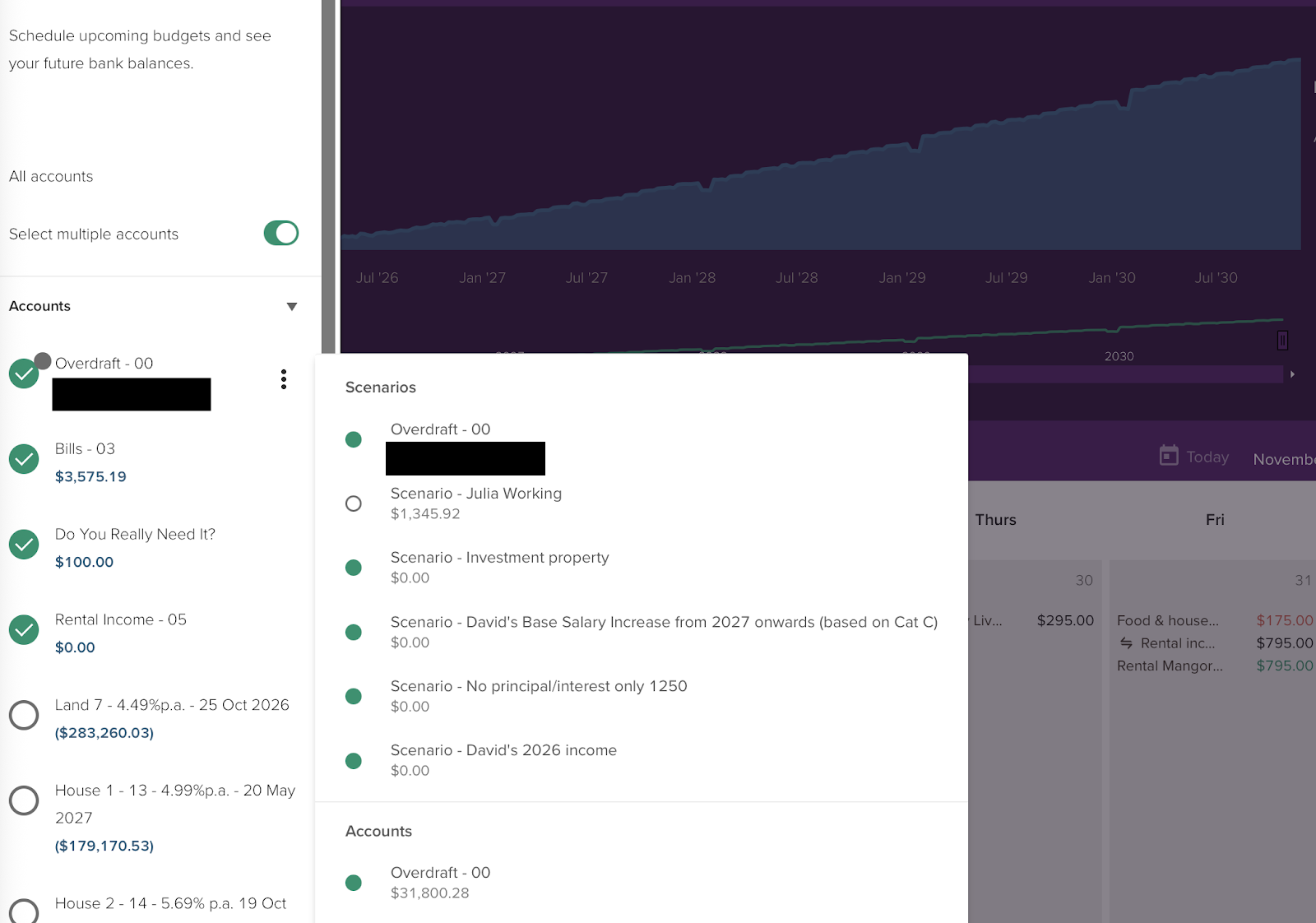

And so, playing with scenarios, we ran the scenario of what if we spent less on principal? Would that help us get a positive cash flow to tide us over the period we are on a single income while having a baby?

This can be viewed below, under the scenario of paying less Principal, we see that we do have a positive cash flow if we do interest only, during this time of single income.

And by subtracting the difference of the cashflow over an interval of time, we were able to predict how much extra cashflow we could have that may be directed to the mortgage or act as a buffer:

So, on a single income after one year with an investment property, we would have an extra positive income buffer in 2027-2028.

Finally, PocketSmith has helped us set more realistic budgets.

Through the Dashboard and the Trends page, we can track:

In the budget above for Electricity and Gas, the average we spent is way higher than the budgeted amount, and so I would adjust the budget based on this new average.

How current spending compares with historical forecasts:

Want to check if you are on target? Look at the calendar and how your historical forecast compares to your actual costs. This lets us course-correct early rather than being blindsided later.

The result is a budgeting system that feels effortless and proactive — exactly how personal finance should feel.

At this point, PocketSmith is more than a budgeting tool for us. It’s a foundation for making intelligent financial decisions:

In simple terms, our lives have never been the same since using PocketSmith.

And we wouldn’t go without it again.