Advance Australia Fair: Open Banking Access Incoming With Basiq

The march of progress is upon us! We're very happy to announce that we're currently integrating with new data provider Basiq in Australia. Through them, we'll be getting access to open banking feeds for all banks in Australia as they come online, and reliable traditional feeds in the interim.

We’ll discuss a bit of background around open banking access in Australia in this post, and provide context around our decision to go with Basiq as our chosen CDR data provider. But let’s frontload the most important information: When?

Cutting to the chase: When can you get access?

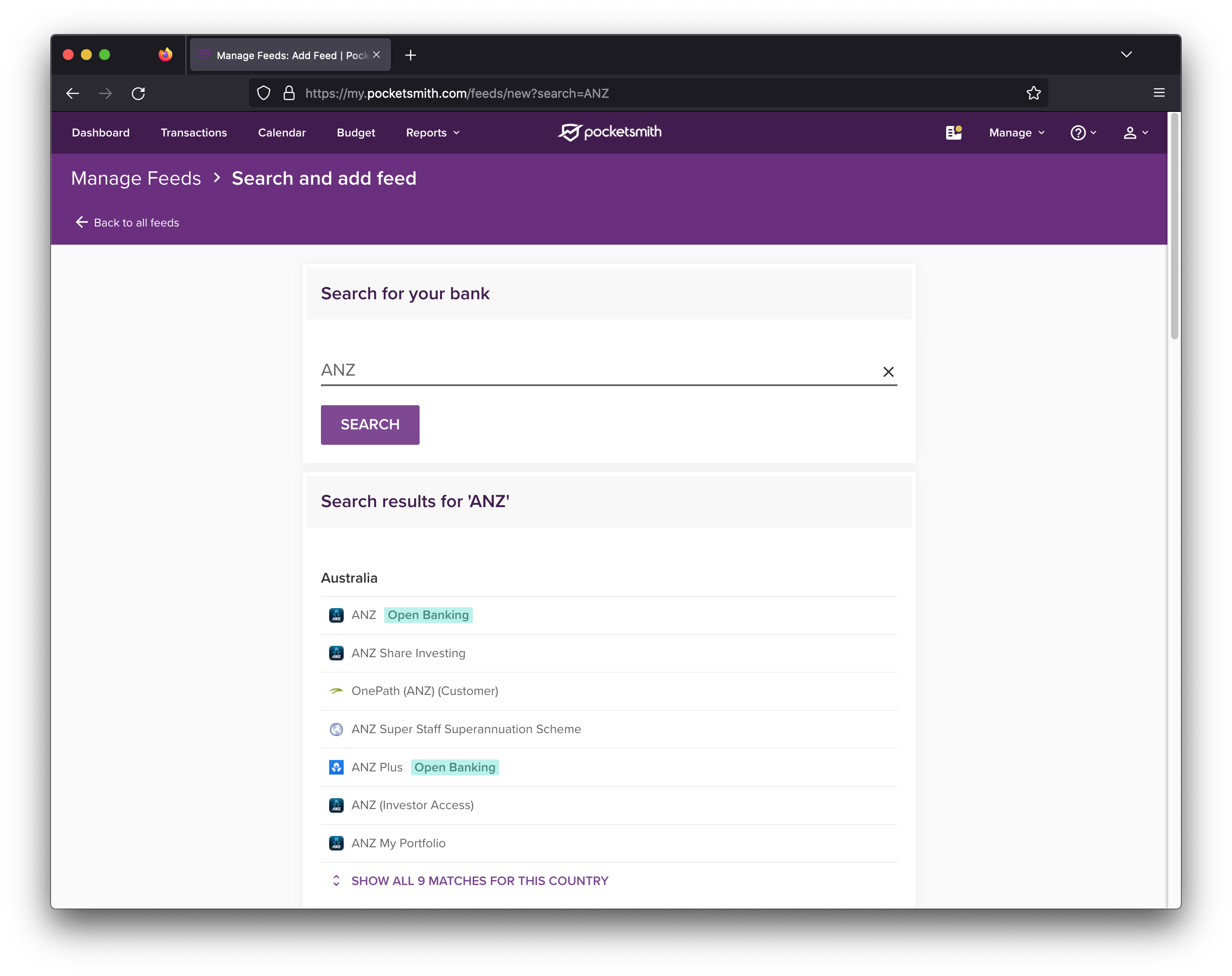

Right now! All Basiq feeds are now available to search and add within PocketSmith. Just look for the “Open Banking” tag next to your Australian bank feed in your feed search results to identify which feeds are provided via Basiq, as a CDR open banking data sharing feed.

Look for the Open Banking tag to identify Basiq feeds

Everything is working well, however as CDR open banking data sharing is a fairly new concept, some banks are still struggling to supply data reliably and completely. If you experience any issues, please send us an email and we’ll be happy to look into the problem.

(No further updates will be provided here; last updated October 28, 2022).

Our background on Australian open banking

Australian banks have been rolling out their open banking implementations since the official launch in July 2020, allowing customers to share their banking data with accredited data recipients. As of the end of 2021, a total of 16 banks had come online with their access models.

Since the official launch, the picture has been murky for non-Australian companies with Australian customers, like PocketSmith. At first, there was no way to even start the application process without an Australian Business Number.

Additionally, the original legislation also left little room for the lesser access requirements of PocketSmith. The same accreditation requirements were applied for organizations enacting payments, and for those who just allowed users to access their account and transaction data automatically, like PocketSmith.

At the end of September 2021, this changed with new rules for tiered accreditation being published by the Australian Treasury. This finally meant there was hope for PocketSmith’s users to access Australian open banking feeds. The hunt started!

Choosing Basiq

While open banking promises a level of ease to connect to banks individually, it’s not pragmatic for PocketSmith to take this path. Aside from the fact that we’re already supporting bank feeds in many countries outside of Australia via a myriad of data providers, the individual quirks and differences between how banks interpret the open banking requirements are best dealt with by experts in the field.

Once we were settled on using an aggregator, we decided that we want to use someone local to Australia. We’ve had an excellent experience with our local New Zealand bank feed aggregator, Akahu. We also knew, based on our experience of how things shook out with the introduction of the PSD2 in Europe in 2019, that we needed someone with local knowledge of the legislation coming into effect.

Basiq came to the fore. They have support for over 130 Australian institutions, and offer both open banking feeds alongside their own methods of maintaining a bank feed. This dual approach means we can better choose the best feed type for the individual bank, based on the data that they provide via open banking APIs, versus other access methods.

What enamored us even more is that they have a public status page for their connections to Australian banks at https://status.basiq.io. This sort of visibility is something we know that both ourselves and our customers appreciate. And look at all those 100% uptime statistics!

Next steps

As mentioned at the start, we’re moving ahead as fast as we can, in order to get Australian customers connected via Basiq. We’re beyond excited about being able to offer truly reliable, open banking feeds for all Australian financial institutions. Can’t wait for you to all hopefully experience that 100% uptime!

James is the CTO and co-founder at PocketSmith. He loves tech from software to hardware to music, and is passionate about technology being a net-positive in people’s lives. He lives off-grid with two humans, two axolotls, two rabbits, one dog, and too many possums.